Download a Slide Explaining Fixed Income Weekly

The Fed wants to start shrinking its $4.5 trillion balance sheet later ... Your Update on the FOMC March Meeting Minutes ECB Meeting Comes at a Precarious Time for Markets ECB unlikely to signal stimulus end, despite French optimism Bank of Japan March meeting summary: Policy will remain easy for ... 1st Round of French Elections, ECB & BoJ Meetings, Key Data in ... Praise handed out at St. C BOE meeting TUESDAY: Four Board of Education Seats Up For Election China's yuan weakens slightly, market monitors N. Korea PBOC Raises Interest Rates on Standing Lending Facility Loans Banco do Brasil ratings affirmed, outlook still negative Banks announce reduction of interest rates after Selic cut Positive real rates, rupee and reserves adequacy Normal rains to prop rural India; RBI rate cut on cards: BofAML Russia's Sberbank cuts mortgage rate to below 9% for selected ... CBR likely to continue cutting key interest rate CBT likely to keep policy rates unchanged, inflation may peak in April Forex News – Turkey's economic outlook depends on referendum ... South Africa Central Bank Governor Says Rate Cuts Are 'Off the Table' South African central bank keeps rates on hold, warns on political ... South Korea central bank chief says April rate decision was ... DIARY-Emerging Markets Economic Events to June 20

Top 20 GEM Sovereign Bonds Yields Climbs Change USD Eurobonds (Losers) Weekly

BondVENEZUELA (BOLVARIAN REPUBLIC OF) RegS 19VENEZUELA (BOLVARIAN REPUBLIC OF) RegS 20VENEZUELA BOLIVARIAN REPUBLIC OF RegS 22PETROLEOS DE VENEZUELA SA RegS 22

Top 20 GEM Sovereign Bonds Yields Drops Week Change USD Eurobonds (Winners)

BondPETROLEOS DE VENEZUELA SA RegS 26PETROLEOS DE VENEZUELA SA RegS 27PETROLEOS DE VENEZUELA SA RegS 37ARGENTINA REPUBLIC OF 33

Top 10 GEM Corporate Bonds Yields Climbs Week Change USD Eurobonds (Losers)

BondPETROLEOS DE VENEZUELA SA RegS 22CSN RESOURCES SA RegS 20PETROLEOS DE VENEZUELA SA RegS 20ODEBRECHT FINANCE LTD RegS 25

Top 10 GEM Corporate Bonds Yields Drops USD Eurobonds (Winners) Weekly

BondODEBRECHT OFFSHORE DRILLING FINANC RegS 22ODEBRECHT DRILL VIII/IX RegS 21DIGICEL LTD RegS 21YPF SA RegS 21

Country Average Sovereign Yield Change USD Eurobonds Weekly

CountryEcuadorVenezuelaEl SalvadorZambiaTrinidad and Tobago

Country Average Corporate Yield Change USD Eurobonds Weekly

CountrySouth AfricaKazakhstanKuwaitTaiwanUnited States

Top 30 GEM Souvereign Eurobonds by Yield

NameVENEZUELA (BOLVARIAN REPUBLIC OF) RegSPETROLEOS DE VENEZUELA SA MTN RegSPETROLEOS DE VENEZUELA SA RegS

Top 30 GEM Corporate Eurobonds by Yield

NamePETROLEOS DE VENEZUELA SA MTN RegSPETROLEOS DE VENEZUELA SA RegSPETROLEOS DE VENEZUELA SA RegS

Top 30 GEM Local (reasonably rated) Currency Bonds by Yield

NameTURKEY (REPUBLIC OF)TURKEY (REPUBLIC OF)TURKEY (REPUBLIC OF)

Big Country Table - Stance, Ratings and Datamine

Top 20 Developed Markets Sovereign Bonds Yields Climbs Change USD Eurobonds (Losers) Weekly

BondITALY (REPUBLIC OF) 17AUSTRIA (REPUBLIC OF) MTN 17CANADA (GOVERNMENT OF) 17SPAIN (KINGDOM OF) 17

Top 20 Developed Markets Sovereign Bonds Yields Drops Change USD Eurobonds (Winners) Weekly

BondPORTUGAL (REPUBLIC OF) 23PORTUGAL (REPUBLIC OF) 45PORTUGAL (REPUBLIC OF) 20PORTUGAL (REPUBLIC OF) 24

Top 10 Developed Markets Corporate Bonds Yields Climbs Week Change USD Eurobonds (Losers)

BondCountryYieldYield Change %ptsGRUPO ISOLUX CORSAN SA 21Spain399.4699.99GRUPO ISOLUX CORSAN SA 21Spain148.3773.39CONCORDIA HEALTHCARE CORP 144A 23Canada59.437.01CONCORDIA HEALTHCARE CORP 144A 22Canada66.816.31ALGECO SCOTSMAN GLOBAL FINANCE PLC 144A 18United Kingdom14.082.05

Top 10 Developed Markets Corporate Bonds Yields Drops Week Change USD Eurobonds (Winners)

BondCountryYieldYield Change %ptsBANCA POPOLARE DI VICENZA MTN RegS 18Italy13.42-7.78CLAIRES STORES INC 144A 19United States62.84-7.32T-MOBILE USA INC 17United States0.00-5.90VENETO BANCA SCPA MTN RegS 19Italy11.00-5.61PACIFIC DRILLING SA 144A 20United States34.19-2.60

Top 30 DM Souvereign Eurobonds by Yield

NameISINcountryMaturityCouponYTWPORTUGAL (REPUBLIC OF)PTOTEBOE0020PortugalFeb 15, 20454.104.47PORTUGAL (REPUBLIC OF)PTOTE5OE0007PortugalApr 15, 20374.104.28PORTUGAL (REPUBLIC OF)PTOTEROE0014PortugalFeb 15, 20303.884.17

Top 30 DM Corporate Eurobonds by Yield

NameISINcountryMaturityCouponYTWGRUPO ISOLUX CORSAN SAXS1542318388SpainDec 30, 20210.25399.46GRUPO ISOLUX CORSAN SAXS1527710963SpainDec 30, 20213.00148.37CONCORDIA HEALTHCARE CORP 144AUS206519AB61CanadaOct 21, 20229.5066.81

Country Average Sovereign+Corporate USD Yields Ordered by Weekly Change

| country | Yield | YieldChange |

| Ecuador | 9.27 | 0.61 |

| El Salvador | 8.41 | 0.58 |

| Venezuela | 24.48 | 0.45 |

| Zambia | 8.23 | 0.28 |

| South Africa | 5.17 | 0.25 |

| Gabon | 7.12 | 0.13 |

| Bolivia | 4.84 | 0.12 |

| Iraq | 8.19 | 0.10 |

| Hong Kong | 8.47 | 0.09 |

| Canada | 8.47 | 0.03 |

| Kuwait | 4.05 | 0.02 |

| Kazakhstan | 4.95 | 0.01 |

| Taiwan | 3.62 | 0.01 |

| Angola | 9.01 | -0.02 |

| Croatia (Hrvatska) | 3.53 | -0.03 |

| India | 4.23 | -0.03 |

| Poland | 2.80 | -0.04 |

| China | 3.79 | -0.04 |

| Spain | 4.34 | -0.04 |

| Malaysia | 3.17 | -0.05 |

| Slovak Republic | 2.50 | -0.05 |

| Paraguay | 5.60 | -0.05 |

| Romania | 3.61 | -0.06 |

| Egypt | 5.99 | -0.06 |

| Ukraine | 8.56 | -0.06 |

| Bahrain | 5.34 | -0.06 |

| Australia | 6.10 | -0.06 |

| Panama | 3.56 | -0.07 |

| Morocco | 4.05 | -0.07 |

| Indonesia | 4.18 | -0.07 |

| Vietnam | 4.20 | -0.07 |

| Qatar | 3.15 | -0.07 |

| Russian Federation | 3.92 | -0.08 |

| Peru | 3.79 | -0.08 |

| Korea (South) | 3.01 | -0.08 |

| France | 6.42 | -0.08 |

| Philippines | 3.16 | -0.09 |

| United Arab Emirates | 3.24 | -0.09 |

| Nigeria | 5.00 | -0.10 |

| Finland | 2.59 | -0.12 |

| Uruguay | 4.28 | -0.14 |

| Lithuania | 2.50 | -0.14 |

| Thailand | 3.32 | -0.14 |

| Senegal | 5.00 | -0.15 |

| Chile | 3.66 | -0.16 |

| Mexico | 4.68 | -0.16 |

| Mongolia | 6.27 | -0.16 |

| United Kingdom | 5.38 | -0.16 |

| Colombia | 4.46 | -0.17 |

| Azerbaijan | 5.28 | -0.17 |

| Hungary | 3.32 | -0.18 |

| Lebanon | 5.78 | -0.18 |

| Costa Rica | 6.04 | -0.18 |

| Pakistan | 5.37 | -0.18 |

| Israel | 3.55 | -0.18 |

| Dominican Republic | 5.21 | -0.19 |

| Guatemala | 4.15 | -0.20 |

| Serbia | 3.38 | -0.21 |

| Turkey | 5.09 | -0.21 |

| Ghana | 8.11 | -0.22 |

| Germany | 3.77 | -0.22 |

| Oman | 4.64 | -0.23 |

| Sri Lanka | 5.10 | -0.23 |

| Italy | 4.65 | -0.24 |

| Trinidad and Tobago | 6.01 | -0.26 |

| Kenya | 6.87 | -0.27 |

| United States | 5.58 | -0.28 |

| Jordan | 5.89 | -0.29 |

| Netherlands | 4.57 | -0.29 |

| Ireland | 5.06 | -0.29 |

| New Zealand | 5.13 | -0.29 |

| Luxembourg | 6.84 | -0.31 |

| Cote D'Ivoire (Ivory Coast) | 6.42 | -0.33 |

| Tunisia | 6.18 | -0.33 |

| Barbados | 5.34 | -0.34 |

| Ethiopia | 7.12 | -0.37 |

| Jamaica | 8.00 | -0.56 |

| Japan | 3.41 | -0.56 |

| Argentina | 5.97 | -0.61 |

| Brazil | 5.66 | -0.64 |

| Singapore | 18.38 | -0.85 |

Country Average Sovereign+Corporate USD Yields Ordered By YTD Yield Chance

| country | Yield | YieldChange |

| Canada | 8.69 | 0.86 |

| Venezuela | 24.57 | 0.64 |

| Ecuador | 9.13 | 0.51 |

| El Salvador | 8.41 | 0.50 |

| Australia | 6.10 | 0.04 |

| Ukraine | 8.56 | -0.02 |

| France | 6.42 | -0.11 |

| Finland | 2.59 | -0.13 |

| United States | 5.57 | -0.18 |

| Ghana | 8.16 | -0.18 |

| Germany | 3.83 | -0.19 |

| United Kingdom | 5.50 | -0.22 |

| Slovak Republic | 2.50 | -0.23 |

| Cote D'Ivoire (Ivory Coast) | 6.42 | -0.24 |

| Spain | 4.34 | -0.25 |

| Philippines | 3.13 | -0.29 |

| Korea (South) | 3.02 | -0.29 |

| Qatar | 3.14 | -0.31 |

| Ireland | 6.07 | -0.31 |

| Azerbaijan | 5.32 | -0.34 |

| Barbados | 5.34 | -0.35 |

| New Zealand | 5.13 | -0.35 |

| Poland | 2.80 | -0.36 |

| China | 3.74 | -0.36 |

| Netherlands | 4.31 | -0.37 |

| Peru | 3.86 | -0.38 |

| South Africa | 5.17 | -0.38 |

| Morocco | 4.05 | -0.39 |

| Trinidad and Tobago | 6.01 | -0.39 |

| United Arab Emirates | 3.38 | -0.39 |

| Japan | 3.41 | -0.41 |

| Malaysia | 3.20 | -0.42 |

| Italy | 4.49 | -0.42 |

| Thailand | 3.00 | -0.45 |

| Bahrain | 5.34 | -0.45 |

| Jordan | 5.87 | -0.46 |

| Israel | 3.55 | -0.48 |

| Oman | 4.43 | -0.50 |

| Paraguay | 5.60 | -0.50 |

| Colombia | 4.53 | -0.51 |

| Lithuania | 2.50 | -0.52 |

| Pakistan | 5.25 | -0.52 |

| Taiwan | 3.62 | -0.52 |

| Russian Federation | 3.88 | -0.53 |

| Panama | 3.56 | -0.54 |

| Hungary | 3.32 | -0.55 |

| Uruguay | 4.28 | -0.57 |

| Romania | 3.61 | -0.58 |

| Luxembourg | 7.11 | -0.58 |

| Jamaica | 8.00 | -0.59 |

| Vietnam | 4.20 | -0.60 |

| Kuwait | 3.95 | -0.60 |

| Nigeria | 5.00 | -0.61 |

| Gabon | 7.12 | -0.62 |

| Chile | 3.57 | -0.64 |

| Croatia (Hrvatska) | 3.53 | -0.64 |

| Indonesia | 4.18 | -0.64 |

| Mexico | 4.65 | -0.71 |

| Tunisia | 6.18 | -0.71 |

| Senegal | 5.00 | -0.71 |

| India | 4.19 | -0.72 |

| Guatemala | 4.15 | -0.75 |

| Kazakhstan | 4.78 | -0.81 |

| Zambia | 8.23 | -0.87 |

| Ethiopia | 7.12 | -0.90 |

| Turkey | 5.03 | -0.95 |

| Kenya | 6.87 | -0.97 |

| Serbia | 3.38 | -0.98 |

| Iraq | 8.19 | -1.06 |

| Lebanon | 5.81 | -1.06 |

| Costa Rica | 6.02 | -1.08 |

| Dominican Republic | 5.20 | -1.11 |

| Angola | 9.01 | -1.11 |

| Sri Lanka | 5.15 | -1.12 |

| Egypt | 5.23 | -1.26 |

| Argentina | 5.97 | -1.28 |

| Brazil | 5.69 | -1.32 |

| Mongolia | 6.27 | -2.05 |

| Hong Kong | 8.47 | -4.63 |

Country Average Sovereign+Corporate USD Yields Ordered by Current YTM

| country | Yield | YieldChange |

| Venezuela | 24.48 | 0.45 |

| Singapore | 18.38 | -0.85 |

| Ecuador | 9.27 | 0.61 |

| Angola | 9.01 | -0.02 |

| Ukraine | 8.56 | -0.06 |

| Canada | 8.47 | 0.03 |

| Hong Kong | 8.47 | 0.09 |

| El Salvador | 8.41 | 0.58 |

| Zambia | 8.23 | 0.28 |

| Iraq | 8.19 | 0.10 |

| Ghana | 8.11 | -0.22 |

| Jamaica | 8.00 | -0.56 |

| Gabon | 7.12 | 0.13 |

| Ethiopia | 7.12 | -0.37 |

| Kenya | 6.87 | -0.27 |

| Luxembourg | 6.84 | -0.31 |

| Cote D'Ivoire (Ivory Coast) | 6.42 | -0.33 |

| France | 6.42 | -0.08 |

| Mongolia | 6.27 | -0.16 |

| Tunisia | 6.18 | -0.33 |

| Australia | 6.10 | -0.06 |

| Costa Rica | 6.04 | -0.18 |

| Trinidad and Tobago | 6.01 | -0.26 |

| Egypt | 5.99 | -0.06 |

| Argentina | 5.97 | -0.61 |

| Jordan | 5.89 | -0.29 |

| Lebanon | 5.78 | -0.18 |

| Brazil | 5.66 | -0.64 |

| Paraguay | 5.60 | -0.05 |

| United States | 5.58 | -0.28 |

| United Kingdom | 5.38 | -0.16 |

| Pakistan | 5.37 | -0.18 |

| Bahrain | 5.34 | -0.06 |

| Barbados | 5.34 | -0.34 |

| Azerbaijan | 5.28 | -0.17 |

| Dominican Republic | 5.21 | -0.19 |

| South Africa | 5.17 | 0.25 |

| New Zealand | 5.13 | -0.29 |

| Sri Lanka | 5.10 | -0.23 |

| Turkey | 5.09 | -0.21 |

| Ireland | 5.06 | -0.29 |

| Senegal | 5.00 | -0.15 |

| Nigeria | 5.00 | -0.10 |

| Kazakhstan | 4.95 | 0.01 |

| Bolivia | 4.84 | 0.12 |

| Mexico | 4.68 | -0.16 |

| Italy | 4.65 | -0.24 |

| Oman | 4.64 | -0.23 |

| Netherlands | 4.57 | -0.29 |

| Colombia | 4.46 | -0.17 |

| Spain | 4.34 | -0.04 |

| Uruguay | 4.28 | -0.14 |

| India | 4.23 | -0.03 |

| Vietnam | 4.20 | -0.07 |

| Indonesia | 4.18 | -0.07 |

| Guatemala | 4.15 | -0.20 |

| Morocco | 4.05 | -0.07 |

| Kuwait | 4.05 | 0.02 |

| Russian Federation | 3.92 | -0.08 |

| Peru | 3.79 | -0.08 |

| China | 3.79 | -0.04 |

| Germany | 3.77 | -0.22 |

| Chile | 3.66 | -0.16 |

| Taiwan | 3.62 | 0.01 |

| Romania | 3.61 | -0.06 |

| Panama | 3.56 | -0.07 |

| Israel | 3.55 | -0.18 |

| Croatia (Hrvatska) | 3.53 | -0.03 |

| Japan | 3.41 | -0.56 |

| Serbia | 3.38 | -0.21 |

| Hungary | 3.32 | -0.18 |

| Thailand | 3.32 | -0.14 |

| United Arab Emirates | 3.24 | -0.09 |

| Malaysia | 3.17 | -0.05 |

| Philippines | 3.16 | -0.09 |

| Qatar | 3.15 | -0.07 |

| Korea (South) | 3.01 | -0.08 |

| Poland | 2.80 | -0.04 |

| Finland | 2.59 | -0.12 |

| Lithuania | 2.50 | -0.14 |

| Slovak Republic | 2.50 | -0.05 |

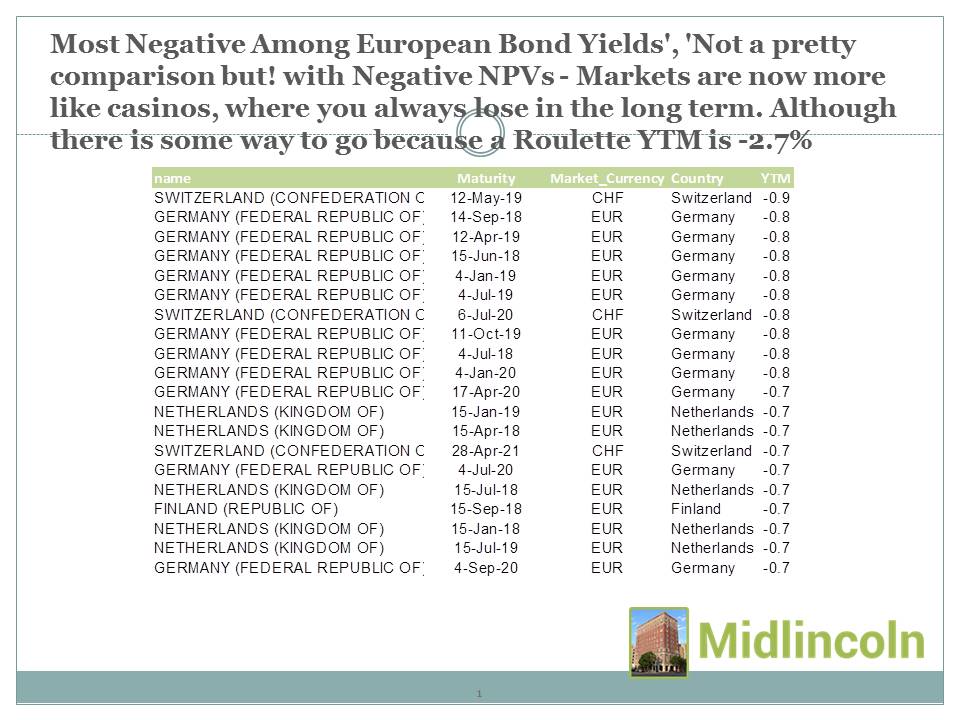

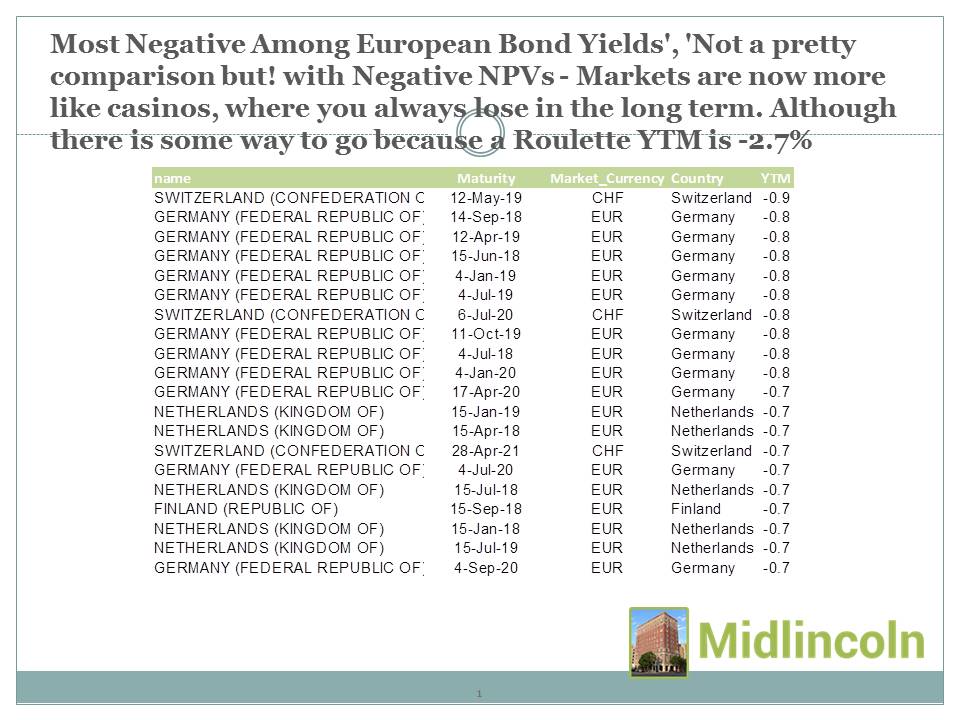

Chart: Most Negative Among European Bond Yields

Not a pretty comparison but! with Negative NPVs - Markets are now more like casinos, where you always lose in the long term. Although there is some way to go because a Roulette YTM is -2.7%

Source:

Download file in Power PointKey News

Average Sovereign GEM Yields (USD)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Average Sov. DEM Yields (blended currency)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Average UST Yield

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Bonds Datamine Queries

Top 20 GEM Sovereign Bonds Yields Climbs Change USD Eurobonds (Losers) Weekly

BondVENEZUELA (BOLVARIAN REPUBLIC OF) RegS 19VENEZUELA (BOLVARIAN REPUBLIC OF) RegS 20VENEZUELA BOLIVARIAN REPUBLIC OF RegS 22PETROLEOS DE VENEZUELA SA RegS 22

Top 20 GEM Sovereign Bonds Yields Drops Week Change USD Eurobonds (Winners)

BondPETROLEOS DE VENEZUELA SA RegS 26PETROLEOS DE VENEZUELA SA RegS 27PETROLEOS DE VENEZUELA SA RegS 37ARGENTINA REPUBLIC OF 33

Top 10 GEM Corporate Bonds Yields Climbs Week Change USD Eurobonds (Losers)

BondPETROLEOS DE VENEZUELA SA RegS 22CSN RESOURCES SA RegS 20PETROLEOS DE VENEZUELA SA RegS 20ODEBRECHT FINANCE LTD RegS 25

Top 10 GEM Corporate Bonds Yields Drops USD Eurobonds (Winners) Weekly

BondODEBRECHT OFFSHORE DRILLING FINANC RegS 22ODEBRECHT DRILL VIII/IX RegS 21DIGICEL LTD RegS 21YPF SA RegS 21

Country Average Sovereign Yield Change USD Eurobonds Weekly

CountryEcuadorVenezuelaEl SalvadorZambiaTrinidad and Tobago

Country Average Corporate Yield Change USD Eurobonds Weekly

CountrySouth AfricaKazakhstanKuwaitTaiwanUnited States

Top 30 GEM Souvereign Eurobonds by Yield

NameVENEZUELA (BOLVARIAN REPUBLIC OF) RegSPETROLEOS DE VENEZUELA SA MTN RegSPETROLEOS DE VENEZUELA SA RegS

Top 30 GEM Corporate Eurobonds by Yield

NamePETROLEOS DE VENEZUELA SA MTN RegSPETROLEOS DE VENEZUELA SA RegSPETROLEOS DE VENEZUELA SA RegS

Top 30 GEM Local (reasonably rated) Currency Bonds by Yield

NameTURKEY (REPUBLIC OF)TURKEY (REPUBLIC OF)TURKEY (REPUBLIC OF)

Big Country Table - Stance, Ratings and Datamine

Top 20 Developed Markets Sovereign Bonds Yields Climbs Change USD Eurobonds (Losers) Weekly

BondITALY (REPUBLIC OF) 17AUSTRIA (REPUBLIC OF) MTN 17CANADA (GOVERNMENT OF) 17SPAIN (KINGDOM OF) 17

Top 20 Developed Markets Sovereign Bonds Yields Drops Change USD Eurobonds (Winners) Weekly

BondPORTUGAL (REPUBLIC OF) 23PORTUGAL (REPUBLIC OF) 45PORTUGAL (REPUBLIC OF) 20PORTUGAL (REPUBLIC OF) 24

Top 10 Developed Markets Corporate Bonds Yields Climbs Week Change USD Eurobonds (Losers)

BondCountryYieldYield Change %ptsGRUPO ISOLUX CORSAN SA 21Spain399.4699.99GRUPO ISOLUX CORSAN SA 21Spain148.3773.39CONCORDIA HEALTHCARE CORP 144A 23Canada59.437.01CONCORDIA HEALTHCARE CORP 144A 22Canada66.816.31ALGECO SCOTSMAN GLOBAL FINANCE PLC 144A 18United Kingdom14.082.05

Top 10 Developed Markets Corporate Bonds Yields Drops Week Change USD Eurobonds (Winners)

BondCountryYieldYield Change %ptsBANCA POPOLARE DI VICENZA MTN RegS 18Italy13.42-7.78CLAIRES STORES INC 144A 19United States62.84-7.32T-MOBILE USA INC 17United States0.00-5.90VENETO BANCA SCPA MTN RegS 19Italy11.00-5.61PACIFIC DRILLING SA 144A 20United States34.19-2.60

Top 30 DM Souvereign Eurobonds by Yield

NameISINcountryMaturityCouponYTWPORTUGAL (REPUBLIC OF)PTOTEBOE0020PortugalFeb 15, 20454.104.47PORTUGAL (REPUBLIC OF)PTOTE5OE0007PortugalApr 15, 20374.104.28PORTUGAL (REPUBLIC OF)PTOTEROE0014PortugalFeb 15, 20303.884.17

Top 30 DM Corporate Eurobonds by Yield

NameISINcountryMaturityCouponYTWGRUPO ISOLUX CORSAN SAXS1542318388SpainDec 30, 20210.25399.46GRUPO ISOLUX CORSAN SAXS1527710963SpainDec 30, 20213.00148.37CONCORDIA HEALTHCARE CORP 144AUS206519AB61CanadaOct 21, 20229.5066.81