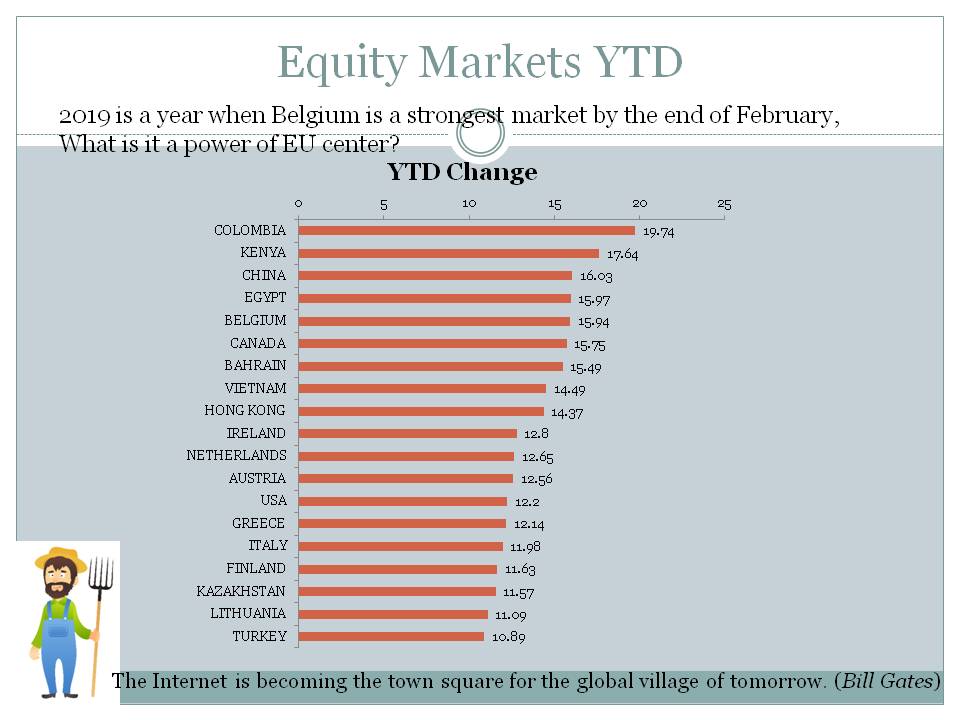

Equity Markets YTD to February End

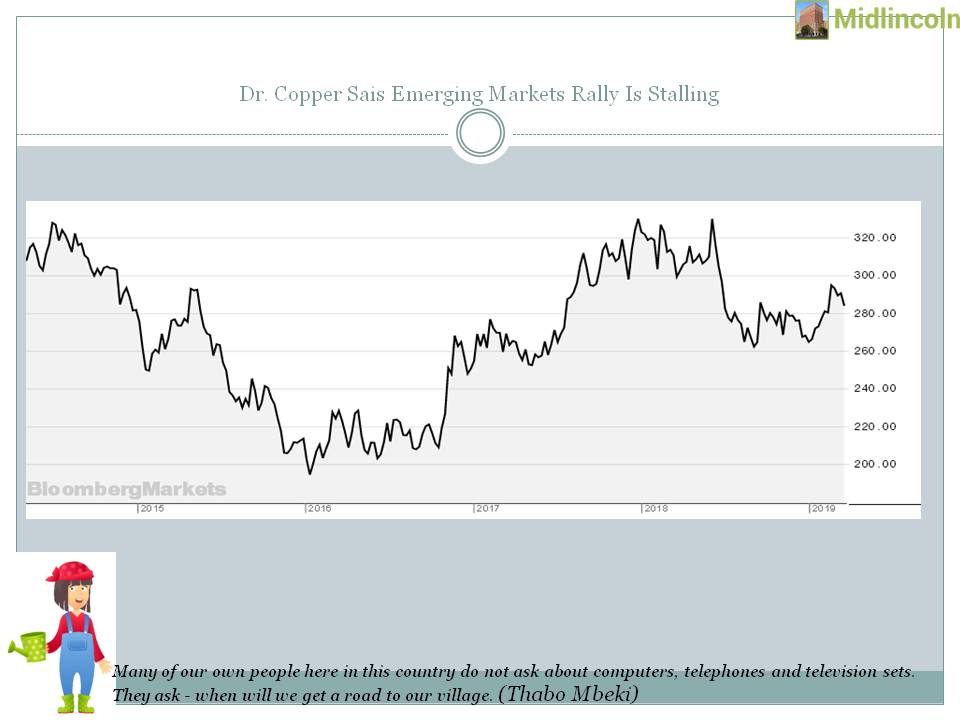

Dr. Copper Sais Emerging Markets Rally Is Stalling

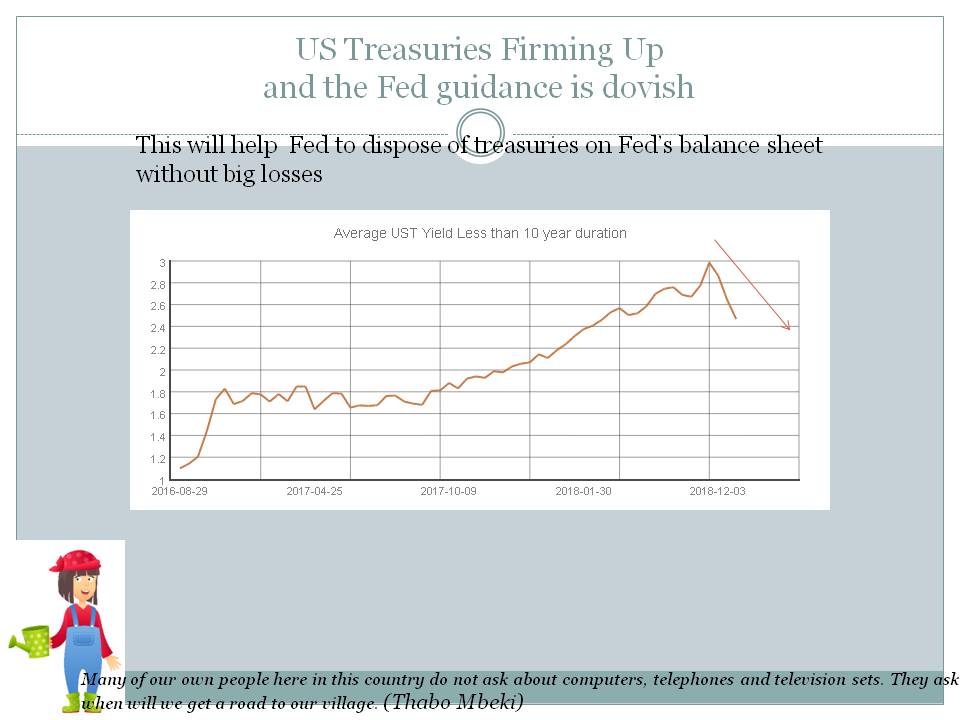

US Treasuries Firming Up and the Fed guidance is dovish

More of investment managers chasing local emerging markets yields

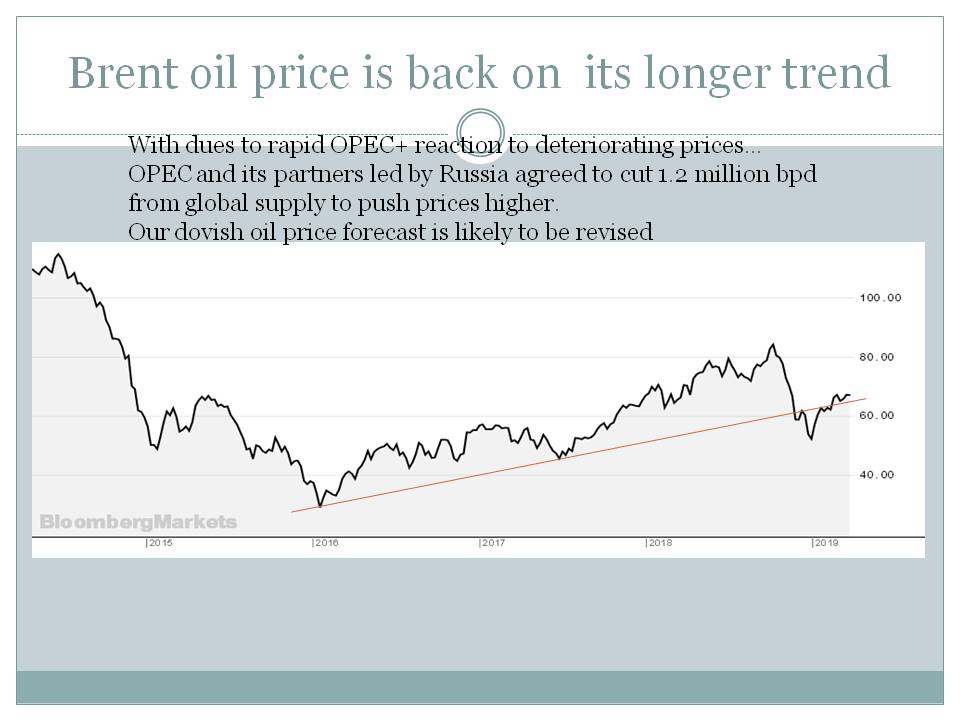

Brent oil price is back on its longer trend

Kashagan production cuts - one of the last decisions of Nursultan Nazarbaev before stepping down

Strong Oil, Weak Equities, Weaker Expectations on Economic Growth

DXY is supportive of carry trades

But Where Emerging Markets Local Yields Will Be If Global Economic Growth Would Stall?

Recent Strategy Chart Art

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Average Sovereign GEM Yields (USD)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Average Sov. Dev. Markets Yields (blended currency)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Average UST Yield

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Average Sovereign Local Currency Yields (USD)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Choose A Country

ARGENTINA: Argentina Still Pretty Lousy As Cristina Kirchner Risk Creeps In

| AUSTRALIA: Australia Stocks trade mixed

| AUSTRIA: Equity Capital Markets in Austria

| BAHRAIN: Portfolio investment flows to UAE, rest of GCC to increase

| BELGIUM: AllianzGI Climate Transition fund is now available to Italian investors

|

BRAZIL: Brazil stocks to enjoy prolonged Bolsonaro boost, Mexico more ...

| BRITAIN: Going against the grain: Is Brexit pessimism creating a serious UK ...

| CANADA: Foyston, Gordon & Payne enhances global equity team

| CHILE: EMERGING MARKETS-Latam stocks rise as global equities stabilize ...

| CHINA: Asia-Pacific equities gain as US-China trade talks resume

|

COLOMBIA: Colombia Stocks Leading the World in 2019 After a Decade of Pain

| CZECH: Czech Republic - Factors To Watch on March 28

| DENMARK: Foreigners sell Danish shares after Danske Bank scandal: central ...

| EGYPT: Junior Gold Miners, Egyptian Stocks And E-Sports: Exotic Investing ...

| FINLAND: AM Best Affirms Credit Ratings of LocalTapiola General Mutual ...

|

FRANCE: France shares lower at close of trade; CAC 40 down 0.09%

| GERMANY: The Best German Stock Brokers

| GREECE: Greece Is The Best Stock Market In Europe In 2019

| HONG KONG: HSBC downgrades stocks in Singapore and Hong Kong

| HUNGARY: Where Do Equities Go from Here?

|

INDIA: Oppenheimer's Memani says Indian equities expensive, other EMs ...

| INDONESIA: Unplanned Urbanization May Lift India, Indonesia Consumer Shares

| IRELAND: Accenture plc Class A (Ireland) (ACN) Rises 5.2% for March 28

| ISRAEL: Israel shares lower at close of trade; TA 35 down 1.03%

| ITALY: Will the Italian economy sink global equity markets?

|

JAPAN: It's Hedge Funds Against Long-Term Players in Japan Stock Market

| KAZAKHSTAN: Five Things You Need to Know to Start Your Day

| LEBANON: LCNB (LCNB) Lowered to “Sell” at Zacks Investment Research

| MALAYSIA: Malaysia's Biggest State Fund Sees Strong Revival for Stocks

| MEXICO: Brazil stocks to enjoy prolonged Bolsonaro boost, Mexico more ...

|

NETHERLANDS: European Equity Benchmarks Close Mixed; Investors Favor Health ...

| NEW ZEALAND: New Zealand stocks climb to record high

| NIGERIA: Bears Maintain Strong Hold on Nigerian Equities Market

| NORWAY: Social Security Should Buy Stocks, Like Norway Does

| OMAN: Portfolio investment flows to UAE, rest of GCC to increase

|

PAKISTAN: Pakistan's Emerging-Market Status Just Got Into Big Trouble

| PERU: Bolsa de Valores de Lima Offers New Securities Lending Platform ...

| PHILIPPINES: HSBC downgrades stocks in Singapore and Hong Kong

| POLAND: Poland - Factors to Watch March 27

| PORTUGAL: The Daily Shot: The Fed Becomes a Net Buyer of Treasuries in ...

|

QATAR: Qatar shares edge higher on bullish foreign institutions

| QATAR: Qatar shares edge higher on bullish foreign institutions

| ROMANIA: Eldorado Gold Corporation (ELD:CA) Rises 5.63% for March 25

| RUSSIA: Turkey Close to Becoming Cheapest Emerging Market

| SINGAPORE: HSBC downgrades stocks in Singapore and Hong Kong

|

SOUTH AFRICA: Foreign Investors Are Fleeing South African Stocks

| SOUTH KOREA: Asia Stocks Gain, Capping Strong Quarterly Rebound: Markets Wrap

| SPAIN: French alts manager enters Spain with L/S market neutral fund

| SWEDEN: Five Things You Need to Know to Start Your Day

| SWITZERLAND: Your guide to the Swiss stock exchange: everything you need to know

|

TAIWAN: Brexit Uncertainty Deepens as Parliament is Divided, while Turkey's ...

| THAILAND: Thai Stocks Fall Less Than Most Peers as Markets Digest Poll

| TURKEY: Turkish stocks dive and key interest rate hits 1200%

| UAE: UAE stocks: Emaar Properties falls as traders opt to cash in

| UKRAINE: India to outperform poll-bound emerging markets in 2019

|

UNITED STATES: TREASURIES-US yields rise off 15-month lows as equities steady

| VIETNAM: SE Asian stocks end lower on US recession fears; Vietnam sheds 2%

|

Comment

Monthly performance is between 2019-03-01 and 2019-02-01

Best global markets YTD USA +12.20%, EUROPE +10.20%, EFM ASIA +9.56%,

While worst global markets YTD FM (FRONTIER MARKETS) 5.37%, EM LATIN AMERICA 8.18%, EM (EMERGING MARKETS) 8.85%,

Best global markets last month USA +3.69%, EUROPE +3.25%, EFM ASIA +2.00%,

While worst global markets last month EM LATIN AMERICA -5.92%, EM (EMERGING MARKETS) 0.13%, FM (FRONTIER MARKETS) 0.44%,

AllianceBernstein Looks to Japan, EM as US Equities too 'Rich'US equities reverse on trade war headlinesHow emerging-market local-currency bonds might fit in your portfolioPakistan's Emerging-Market Status Just Got Into Big TroubleAsian stocks advance as US, China resume trade talksStocks in China soar as US-China trade talks resumeEuropean Equities: Stats and Brexit Chatter to Set the Early ToneEuropean Equities: Progress on Trade Talks Ease Market Jitters ...Russia Balks At Continued Oil Production Cut Alliance with OPECThe One Thing That Could Derail The US Oil BoomSteel prices to remain firm in coming months: Steel Authority of IndiaRising implement prices blamed on steel tariffGold Prices Slide With Dollar SurgingGold Prices Sharply Lower as Dollar Resurgence Takes a Toll

Best last month among various countries' equity markets were VIETNAM +11.28%, ROMANIA +10.99%, KAZAKHSTAN +7.14%, HONG KONG +6.37%, GREECE +5.73%, NIGERIA +5.62%, IRELAND +5.61%, BELGIUM +5.27%, JAMAICA +4.83%, EGYPT +4.82%,

While worst last month among various countries' equity markets were ARGENTINA -13.16%, SERBIA -9.46%, ZIMBABWE -8.85%, BRAZIL -7.65%, QATAR -7.13%, PHILIPPINES -5.26%, SOUTH AFRICA -5.21%, INDONESIA -4.86%, CHILE -4.48%, TURKEY -4.20%,

Best YTD among various country equities were COLOMBIA +19.74%, KENYA +17.64%, CHINA +16.03%, EGYPT +15.97%, BELGIUM +15.94%, CANADA +15.75%, BAHRAIN +15.49%, VIETNAM +14.49%, HONG KONG +14.37%, PAKISTAN +13.24%,

While worst YTD among various country equities were SERBIA -25.54%, BOTSWANA -11.81%, LEBANON -5.13%, QATAR -3.68%, ZIMBABWE -2.79%, OMAN -2.69%, MOROCCO -2.34%, JAMAICA -1.86%, INDIA -1.15%, TUNISIA -0.89%,

Download All Slides in Power Point

Download All Slides in Power Point