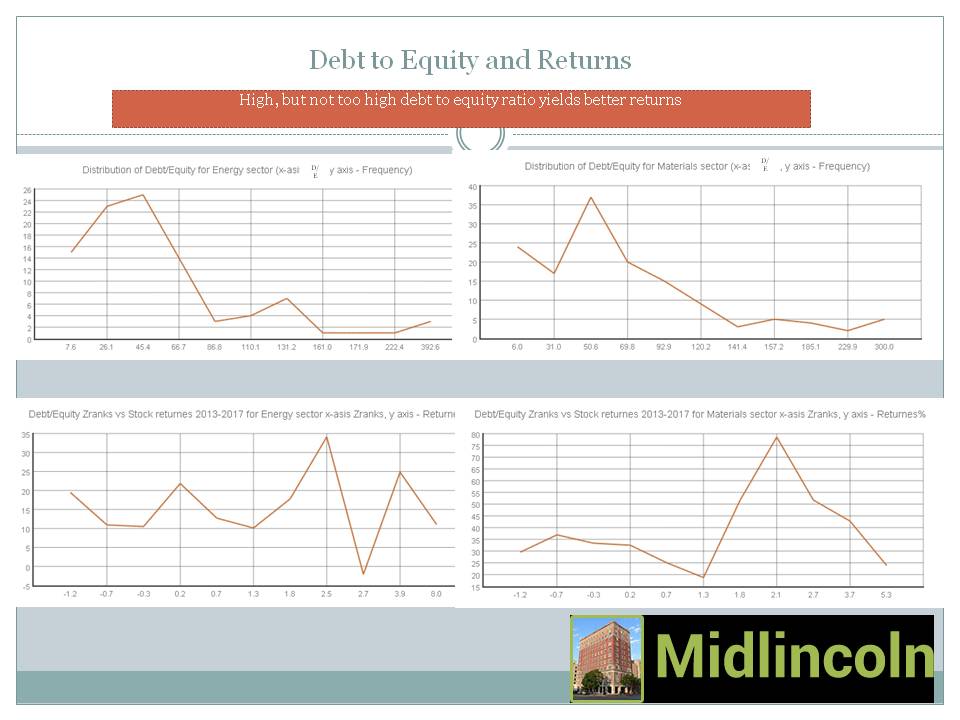

Chart: Debt to Equity and Returns

High, but not too high debt to equity ratio yields better returns

Source: ML

Download file in Power PointEquity Versus Debt: A ShowdownWhat You Must Know About Bharat Heavy Electricals Limited's (NSE ...Is Global Partner Acquisition Corp's (NASDAQ:GPAC) 16.06% ROE ...Why Axis Bank Limited (NSE:AXISBANK) Delivered An Inferior ROE ...With An ROE Of 24.53%, Has Geneva Finance Limited's (NZE:GFL ...Did F5 Networks Inc (NASDAQ:FFIV) Create Value For Shareholders?Did The Byke Hospitality Limited (NSE:THEBYKE) Create Value For ...Recent Strategy Chart Art

Strategy

Year started very strongly. Most of the markets were up in January except or Zimbabwe, Mauritius, Philippines and Egypt. US bonds higher yields have been signaling that some sort of effect for equities was on the cards, and the selloff in the beginning of February was not unexpected. Robots customarily overreacted. But it is most likely just a correction given that all charts went parabolic in January. The correction can make charts look more sustainable.

January performed Brazil, Russia trade with Kazakhstan and Nigeria also participating. This is not yet a very convincing trade, buoyed by the oil price. However the future of the oil price is slightly better in the higher global growth environment.

China was also strong performing rebalancing trade as well as china consumer’s story trade. New Silk roads trade is also still on, with China, Kazakhstan, Austria and other central European countries participating. Not yet a part of this trade but even the perennial laggard Ukraine where most of the economy is the black market has come out of the woods and performed.

Now when the mean face of the US bond markets scared off few investors, the remaining bunch of investors’ expectations are driven by hopes.

Market hopes are a few: there are hopes that higher US yields will not have material effect on stocks in the higher growth environment.

There are also hopes that China, China MSCI rebalancing, new Silk Roads and its consumer story will provide cushion for risk appetite or at least for steel price if things get worse.

There also hopes that oil price levels will be immune to large correction in risk appétit.

There are also hopes that military conflicts will be contained but gold will be immune to higher rates and possibly buoyed by occasional geopolitical risk spikes and demand.

And there are hopes that emerging markets central banks will provide some clever instruments to maintain liquidity in their countries in the environment of higher US rates.

While it was not too difficult so far to trade in the markets where the expectations are driven by hopes, It will be more volatile going forward as some hopes will prove impossible.

US dollar price is a mystery. While US dollar is weaker, providing more evidence that risk appetite is still there. It does not provide US with armor in currency wars; it is still stronger against Chinese Yuan, buoying gold, oil, steel and euro.

Dollar is probably reacting to US new administration not yet very successful attempts to increase its global reach out everywhere from North Korea, Iran, Kazakhstan, Russia, Ukraine to Syria and Middle East, shifting focus from just middle east. Dollar weakness is reflected in the US limited ability to influence global events due to emergence of many other forces and players all pursuing their own interests, with little focus on nuclear non-proliferation, democratisation or counter terrorism.

G20 moves reflect much better the scent of the times. Upcoming Olympic Games is another informal version G20 meeting. Russian Olympic ban is especially acute in this line of comparison.

For years Russia has been trading its geopolitical influence with the west. When Russia gave up some of its influence it gained in the economic sense from better integration and when Russia tried to get more influence the integration got sacrificed. Last time, however, it was integrated at the unfortunate instance, when its economy was mostly oil and gas and industry and financial sector nonexistent. Some disintegration from the west is now aiding Russia to rebalance its economy.

Anticipating higher US dollar rates and lower emerging markets Eurobond prices, fragility of the new emerging global organism is more evident. Central banks are likely to take larger role substituting dollar credits with local bonds when leveraged Chinese Eurobond borrowers are confronted with stress. And some central banks are even likely to be successful shrinking share of dollar credits in global bond markets. It is difficult to see equities higher with this inputs, more of equity is likely to be swapped for debt or just issued anew to finance growth. But debt now is so much more expensive then equity, not sure where the equilibrium will set in and what will be the effects on WACCs and discount rates is a complex math.

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Average Sovereign GEM Yields (USD)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Average Sov. Dev. Markets Yields (blended currency)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Average UST Yield

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Average Sovereign Local Currency Yields (USD)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Choose A Country

ARGENTINA: Stock Picker Who Made 420% in Argentina Sees More Gains Ahead

| AUSTRALIA: Australia equities fall nearly 3% as sell-off continues

| AUSTRIA: Gold dips as US dollar, equities strengthen

| BAHRAIN: Saudi rises on royal handouts

| BELGIUM: Belgium shares lower at close of trade; BEL 20 down 1.35%

|

BRAZIL: Fiesta time: Brazil stocks cruise to new high

| BRITAIN: European Stocks Tumble Amid Global Selloff, Weak UK Service ...

| CANADA: CANADA FX DEBT-C$ hits near two-week low as stocks, oil fall

| CHILE: EMERGING MARKETS-Chilean, Argentine equities hit record highs

| CHINA: China and Hong Kong shares slide in global sell-off

|

COLOMBIA: Colombia shares lower at close of trade; COLCAP unchanged

| CZECH: Czech, Central European equity funds grabbing worldwide notice

| DENMARK: Infrastructure, equities returns boost PensionDanmark's 2017 result

| EGYPT: Stocks punished as inflation shadow spooks bonds

| FINLAND: Finland shares lower at close of trade; OMX Helsinki 25 down 0.89%

|

FRANCE: French and Benelux stocks-Factors to watch on Feb 5

| GERMANY: German stocks fall 1.6% in broad pullback

| GREECE: Greek Stock Rally Holds On as Traders Eye End of Bailout

| HONG KONG: China and Hong Kong shares slide in global sell-off

| HUNGARY: Yields continue to weigh on equities

|

INDIA: India shares extend losses amid global equity rout

| INDONESIA: Three of the World's Biggest Money Managers Are Buying ...

| IRELAND: In pictures: Bank of Ireland of Ireland's Bond Trader event

| ISRAEL: Delek Shares Tumble on Report That Israel-Turkey Gas-export Deal ...

| ITALY: LIVE MARKETS-Italian elections? "Handle with care"

|

JAPAN: Japan, South Korea stocks slide following US sell-off

| KAZAKHSTAN: Malaysian stocks little changed, Singapore equities hit record high

| LEBANON: Markets waited a while for a pullback. Then, pow!

| MALAYSIA: Singapore, Malaysia stocks plunge as US inflation concerns spark ...

| MEXICO: Is the bull run over for US equities?

|

NETHERLANDS: Top five Dutch schemes ride equity rally to boost funding levels

| NEW ZEALAND: US Stock-Index Futures Pare Drops in Sign Selloff to Ease

| NIGERIA: Investors shift to penny stocks as equities open negative

| NORWAY: Norway's $1.1tn oil fund seeks to invest in private equity

| OMAN: Mideast funds positive on Saudi, but negative on UAE

|

PAKISTAN: Pakistan equities land in red zone, index sheds 236 points

| PERU: US Stocks Sink Most Since 2011 as Rout Deepens: Markets Wrap

| PHILIPPINES: Philippine stocks log biggest single-day price drop in over a year

| POLAND: Warsaw stocks, a top gainer in 2017, seen surging further

| PORTUGAL: European stocks drop as equity sell-off spreads

|

QATAR: QSE falls further on across-the-board selling pressure

| QATAR: QSE falls further on across-the-board selling pressure

| ROMANIA: US Stocks Sink Most Since 2011 as Rout Deepens: Markets Wrap

| RUSSIA: 5 Russia Stocks to Consider Buying

| SINGAPORE: Singapore, Malaysia stocks plunge as US inflation concerns spark ...

|

SOUTH AFRICA: #RandReport: South African stocks post biggest daily fall in 14 months

| SOUTH KOREA: Japan, South Korea stocks slide following US sell-off

| SPAIN: Dow and S.&P. Drop by More Than 4%, Extending Stock Sell-Off

| SWEDEN: H&M Gets Support From a $12 Billion Manager of Stocks in Sweden

| SWITZERLAND: Now is the time to buy equities and the euro zone is looking good ...

|

TAIWAN: Taiwan Stocks' Bull Run Seen Coming to a Halt as Rates Rise

| THAILAND: Fed rate fears spark SET correction

| TURKEY: BlackRock Emerges as Biggest Buyer in Turkey's First IPO of 2018

| UAE: Mideast funds positive on Saudi, Kuwait – Most negative ratio for ...

| UKRAINE: Who Profits From The Broken Russia-Ukraine Peace Deal?

|

UNITED STATES: Dow and S.&P. Drop by More Than 4%, Extending Stock Sell-Off

| VIETNAM: SET closes lower, Vietnam stocks hit 10-year closing high

|

Comment

Monthly performance is between 2018-01-31 and 2018-01-01

Best global markets YTD EM LATIN AMERICA +13.08%, EM (EMERGING MARKETS) +8.30%, EFM ASIA +7.99%,

While worst global markets YTD EUROPE 5.36%, USA 5.63%, FM (FRONTIER MARKETS) 5.73%,

Best global markets last month EM LATIN AMERICA +13.08%, EM (EMERGING MARKETS) +8.30%, EFM ASIA +7.99%,

While worst global markets last month EUROPE 5.36%, USA 5.63%, FM (FRONTIER MARKETS) 5.73%, US stocks suffer worst fall in 6 yearsMore Than $1 Trillion Wiped From US Equities in Market RoutEmerging Markets: 3 Key Insights For 2018Emerging Markets From Vanguard And An AlternativeMainland China and Hong Kong shares slide in global sell-offShanghai stocks post worst day in 2 years, more companies ...European Equities Lead MoveEuropean equities off to a rough start on the dayOil Prices Ravaged By Financial TurmoilEuropean Refiners Could Ditch Poor Quality Russian CrudeNo consensus on steel prices for 2BHK schemeLocal steel prices in Russia to be driven by global moves, currency ...Monday massacre: Gold price rises as stocks craterGold Prices Jump To 14-Month High Amid Rout In Stock Markets: 5 ...

Best last month among various countries' equity markets were BRAZIL +16.74%, UKRAINE +15.51%, ROMANIA +13.64%, NIGERIA +13.42%, RUSSIA +12.52%, CHINA +12.48%, GREECE +11.77%, KAZAKHSTAN +11.40%, ITALY +11.37%, COLOMBIA +11.23%,

While worst last month among various countries' equity markets were ZIMBABWE -11.23%, MAURITIUS -9.08%, PHILIPPINES -1.33%, EGYPT -1.08%, OMAN 0.23%, JAMAICA 0.59%, CANADA 0.76%, TRINIDAD AND TOBAGO 1.44%, BANGLADESH 1.90%, BAHRAIN 2.08%,

Best YTD among various country equities were BRAZIL +16.74%, UKRAINE +15.51%, ROMANIA +13.64%, NIGERIA +13.42%, RUSSIA +12.52%, CHINA +12.48%, GREECE +11.77%, KAZAKHSTAN +11.40%, ITALY +11.37%, COLOMBIA +11.23%,

While worst YTD among various country equities were ZIMBABWE -11.23%, MAURITIUS -9.08%, PHILIPPINES -1.33%, EGYPT -1.08%, OMAN 0.23%, JAMAICA 0.59%, CANADA 0.76%, TRINIDAD AND TOBAGO 1.44%, BANGLADESH 1.90%, BAHRAIN 2.08%,