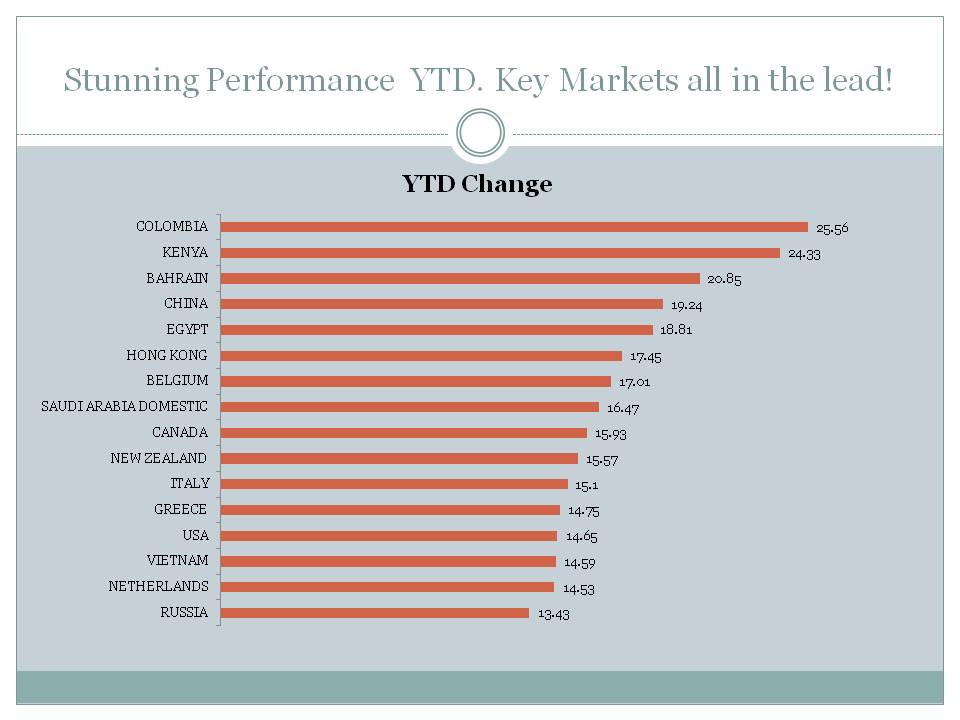

Stunning Performance YTD. Key Markets all in the lead!

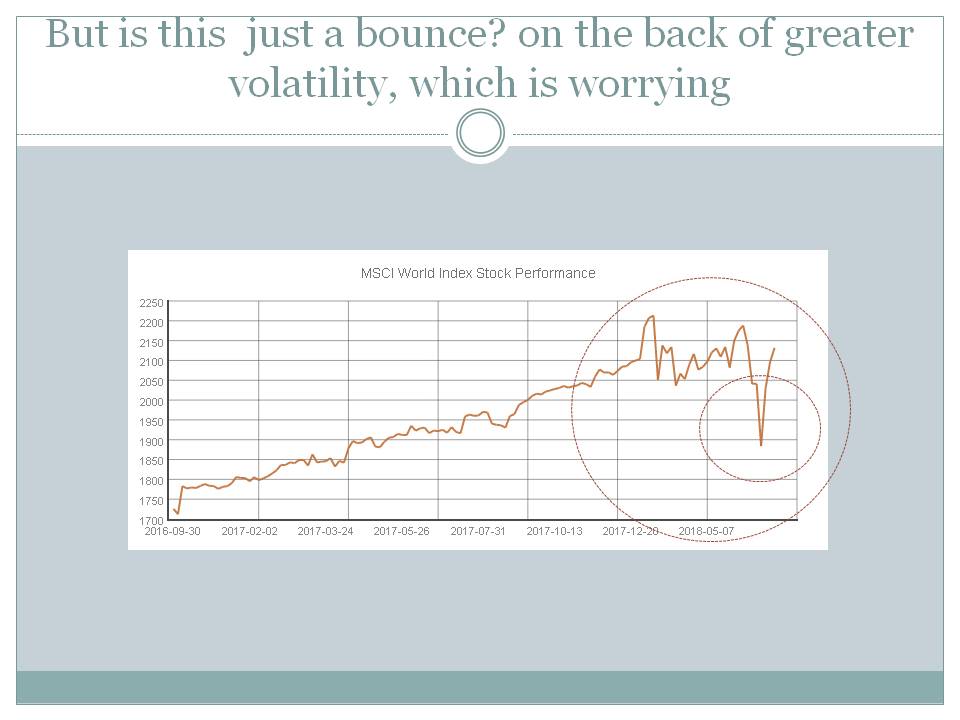

But is this just a bounce? on the back of greater volatility, which is worrying

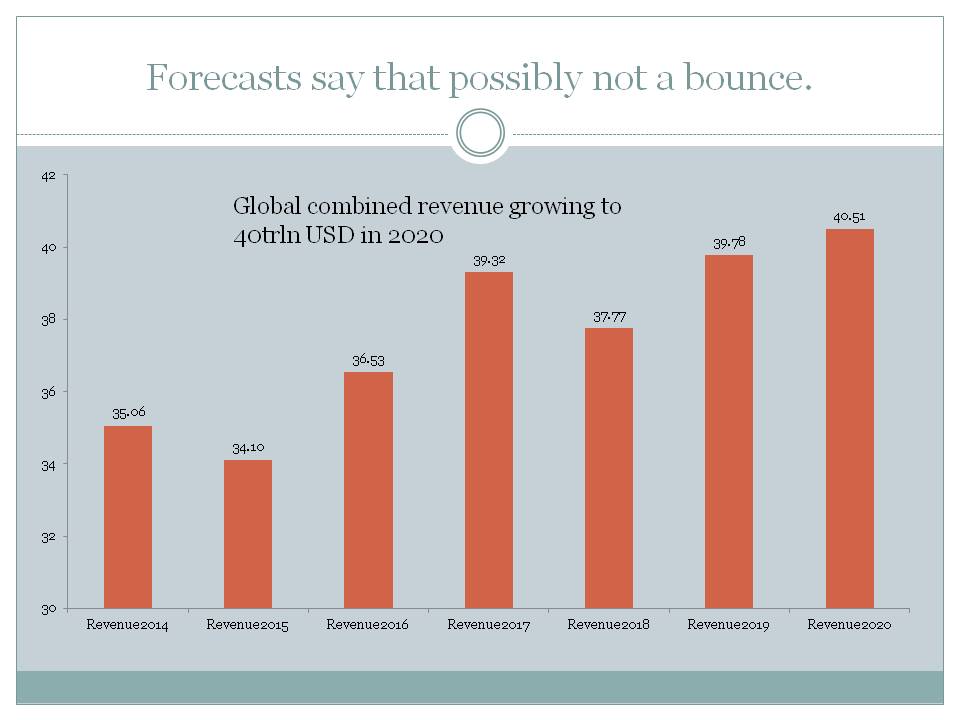

Forecasts say that possibly not a bounce.

Net Income trln$

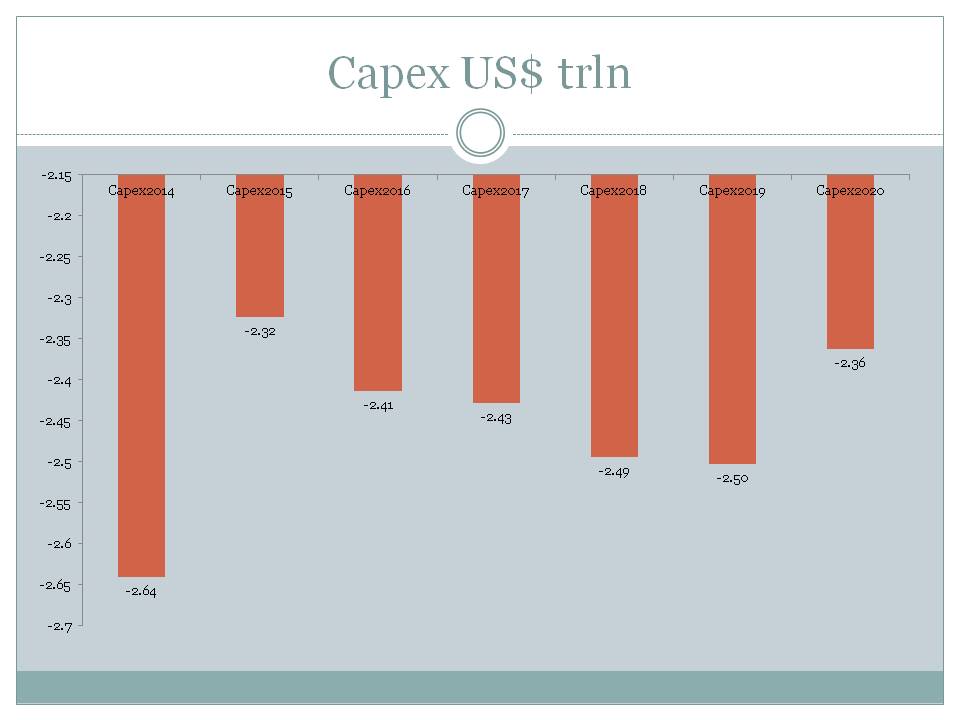

Capex US$ trln

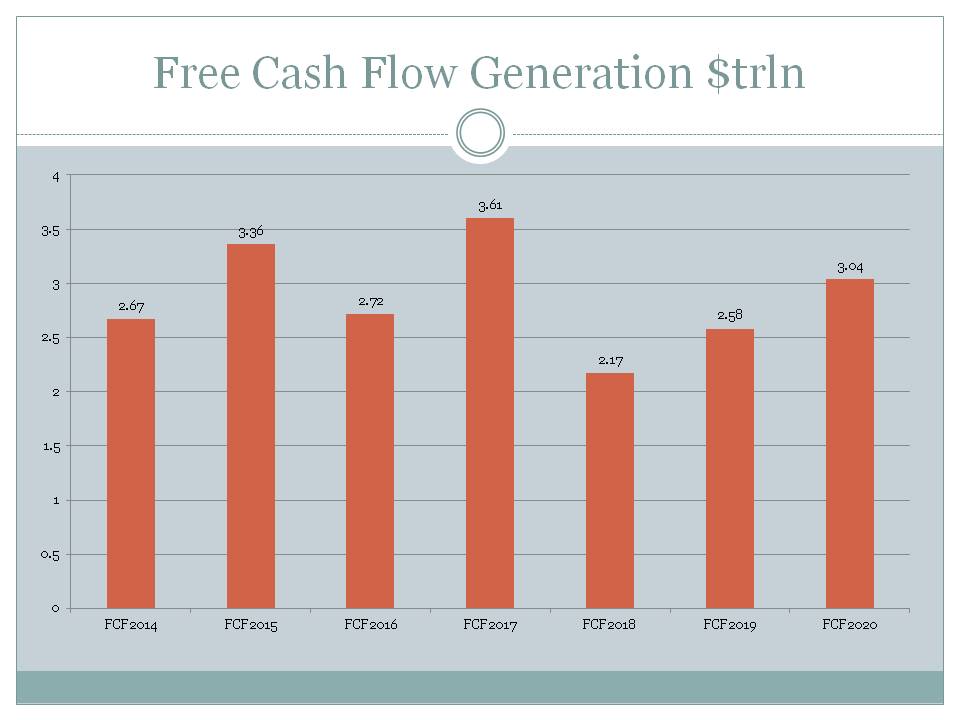

Free Cash Flow Generation $trln

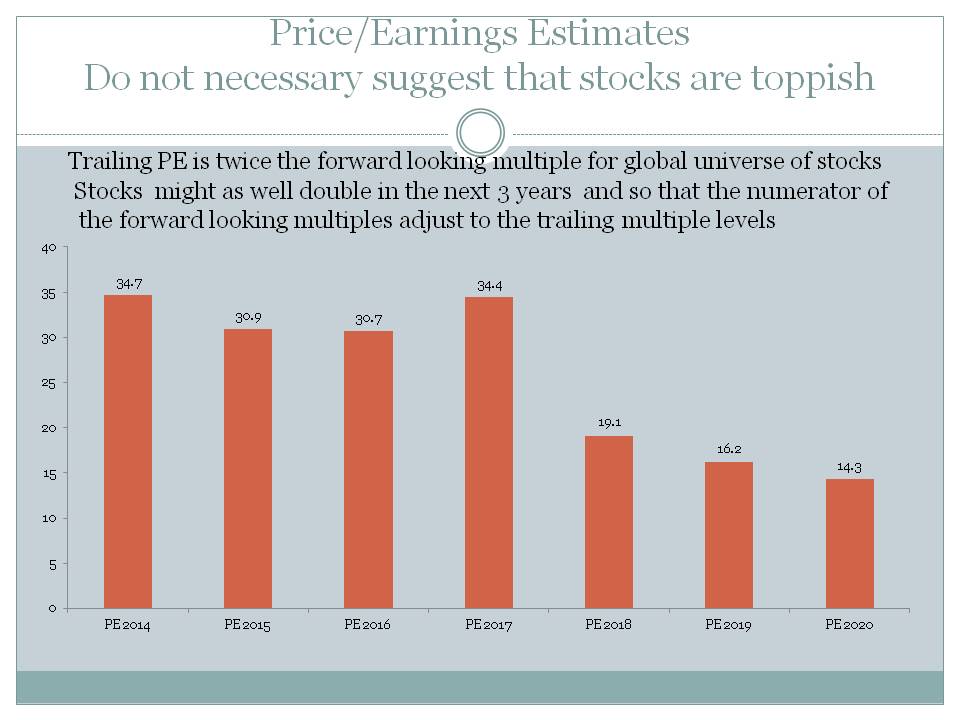

Price/Earnings Estimates �Do not necessary suggest that stocks are toppish

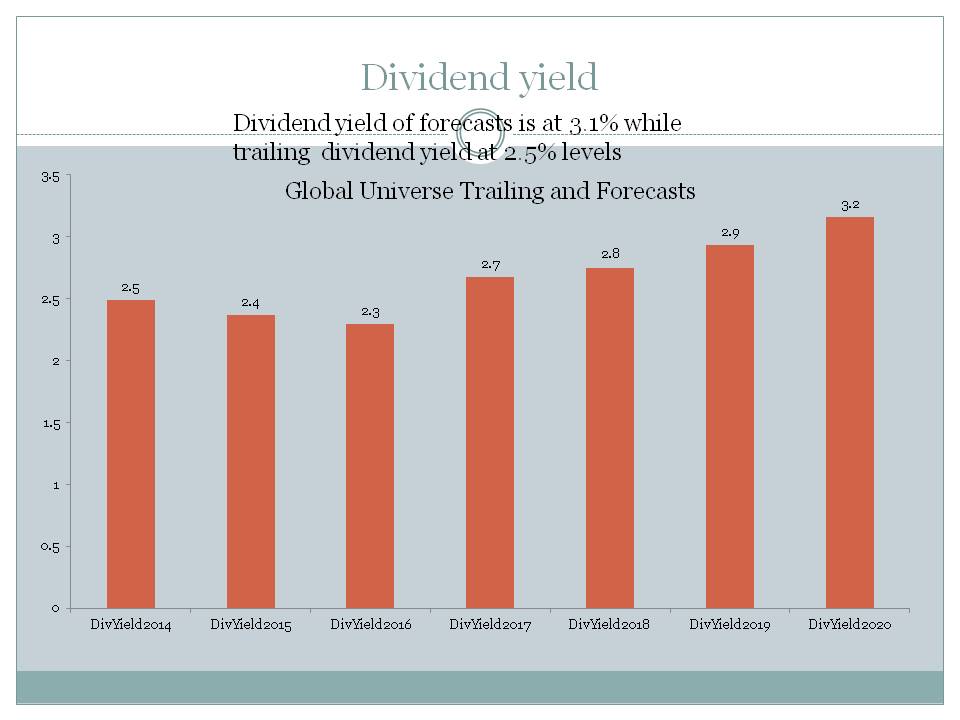

Dividend yield

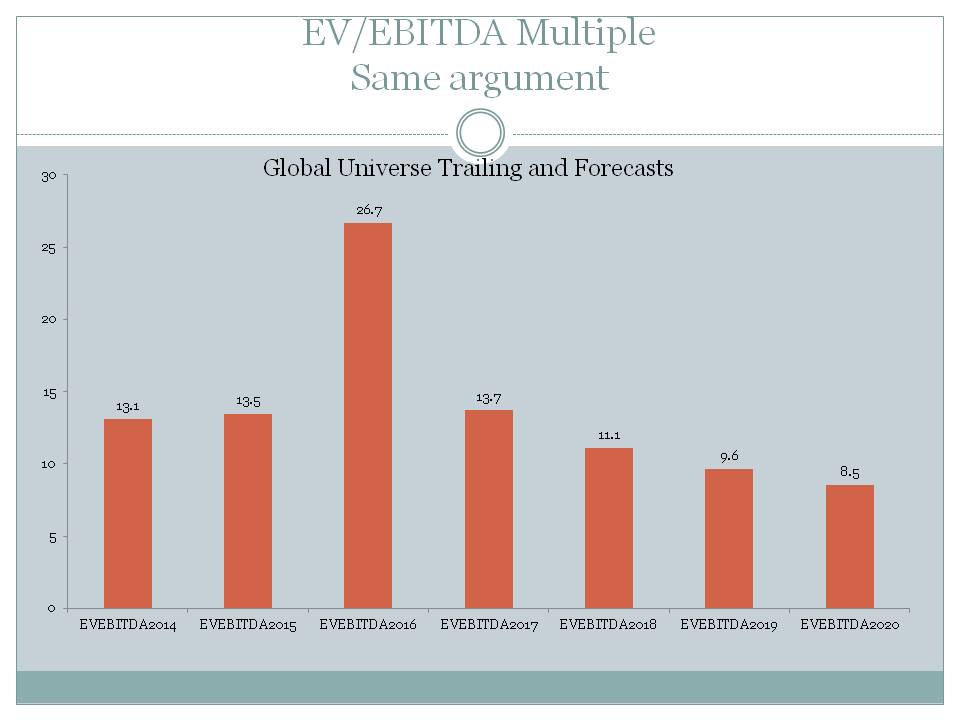

EV/EBITDA Multiple�Same argument

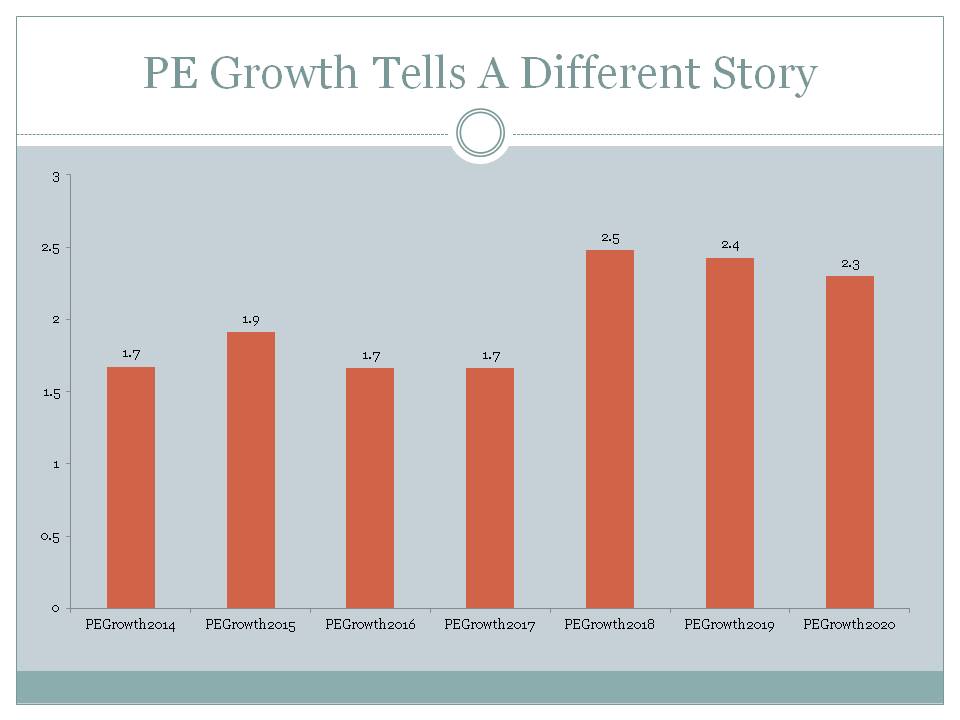

PE Growth Tells A Different Story

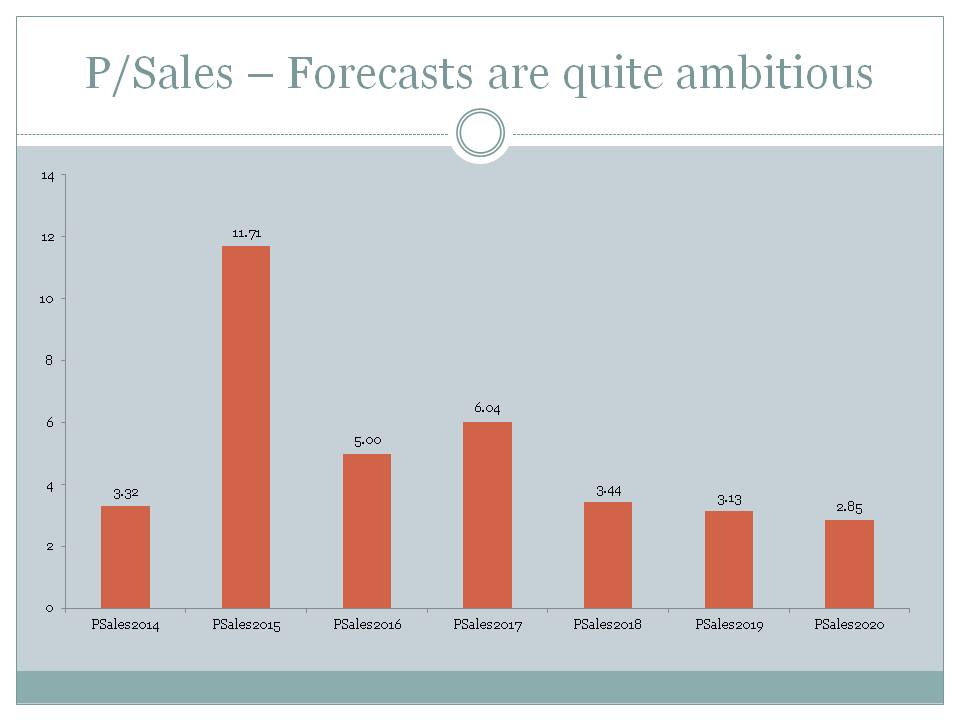

P/Sales – Forecasts are quite ambitious

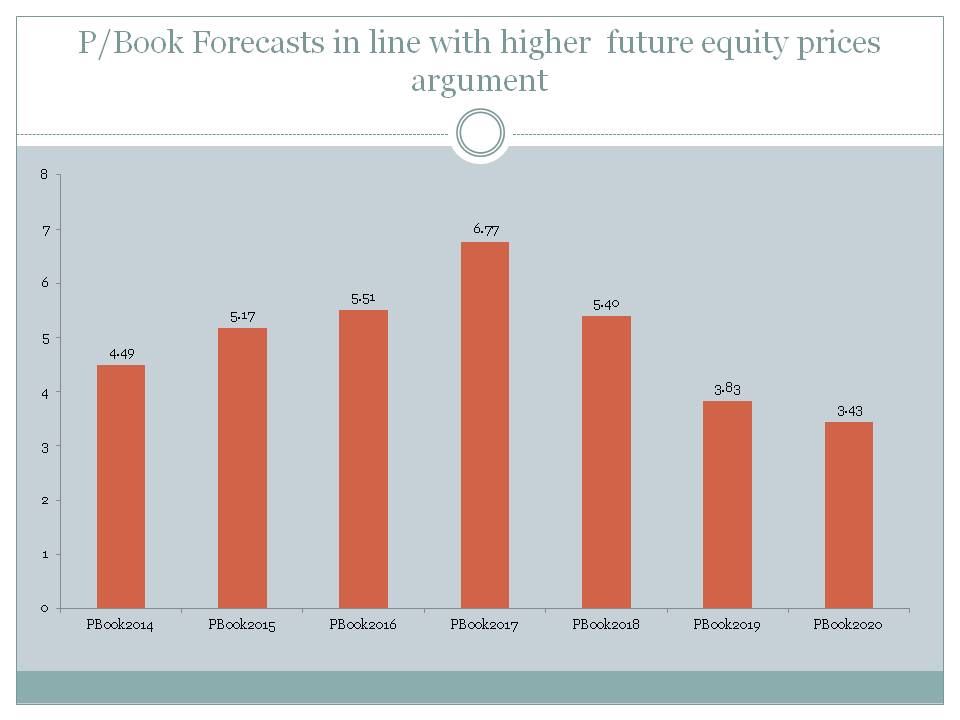

P/Book Forecasts in line with higher future equity prices argument

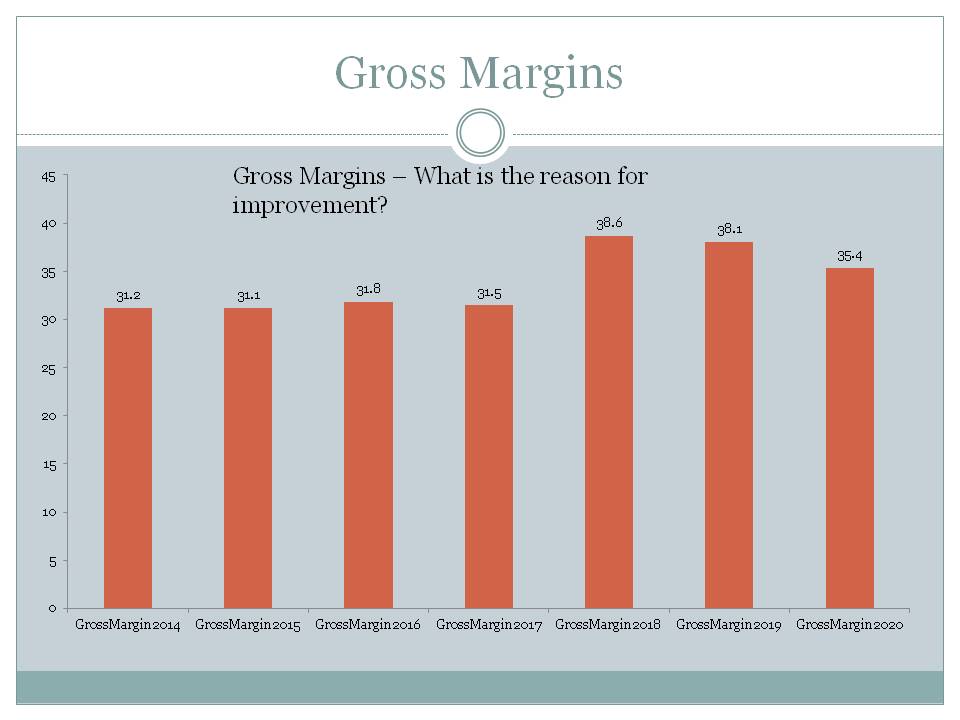

Gross Margins

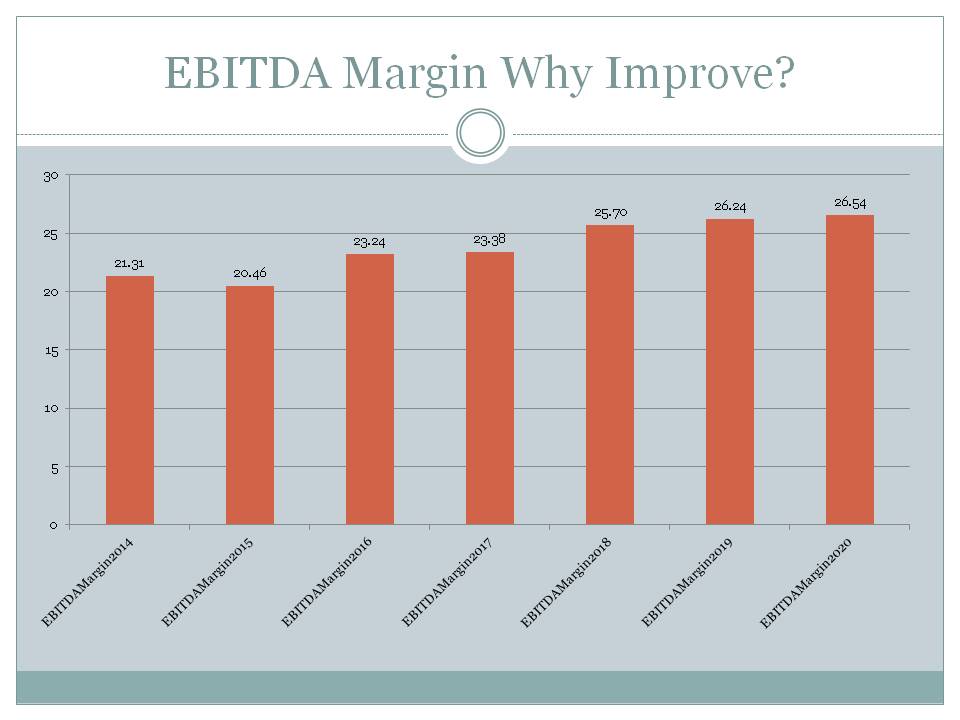

EBITDA Margin Why Improve?

Net Margin

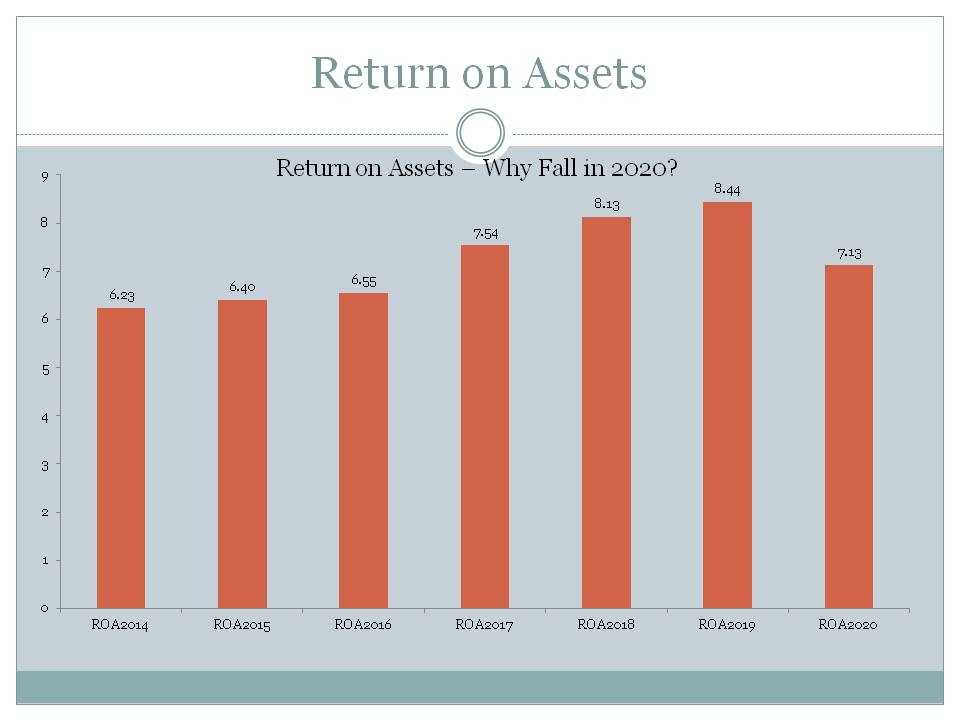

Return on Assets

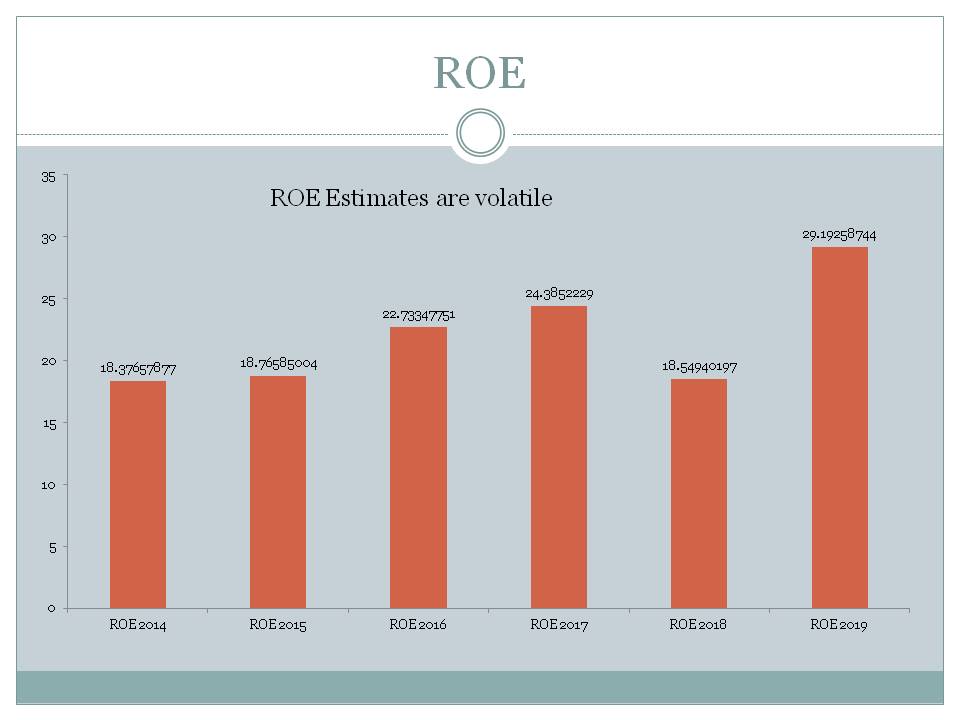

ROE

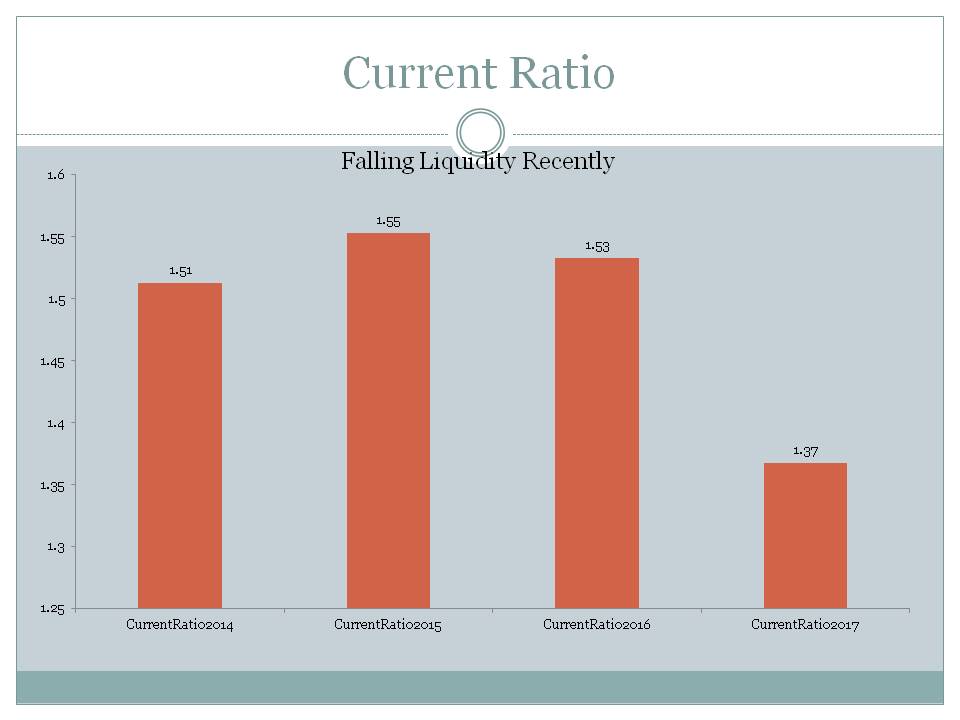

Current Ratio

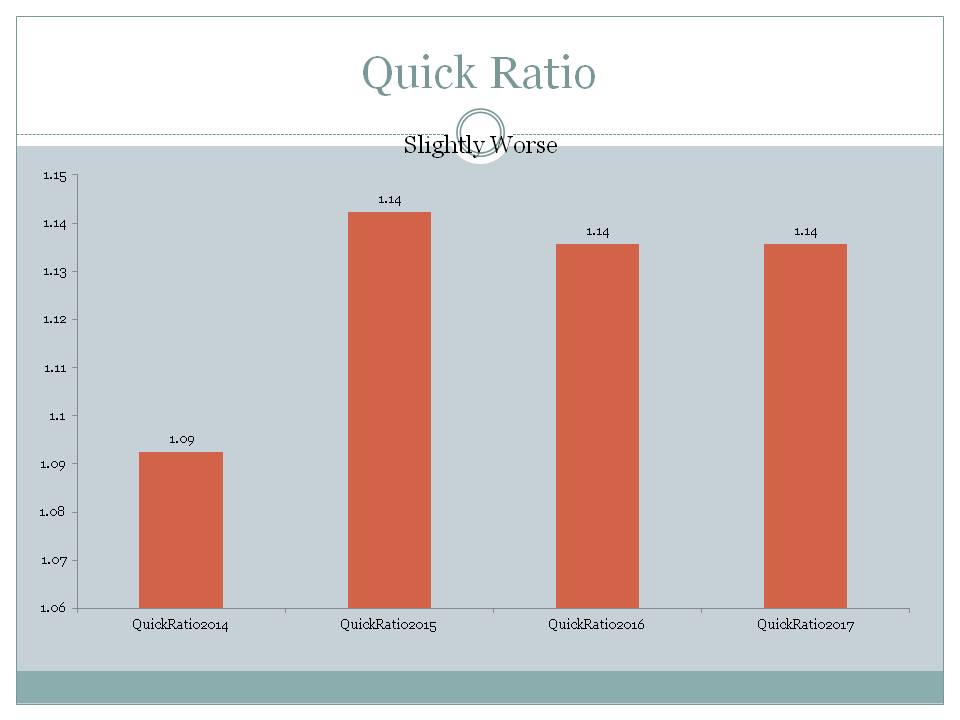

Quick Ratio

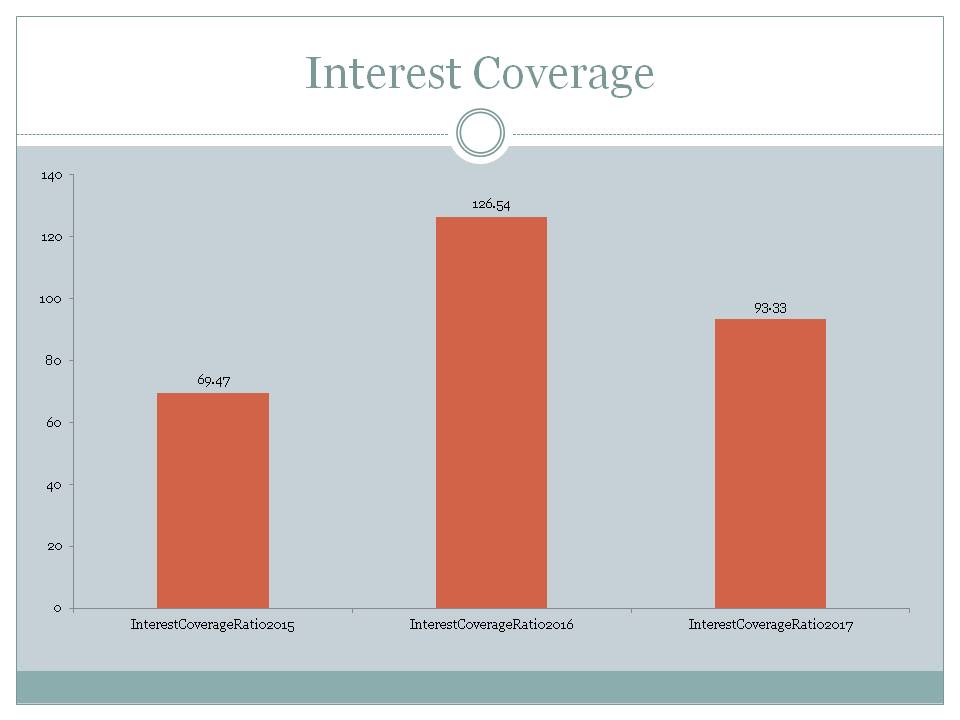

Interest Coverage

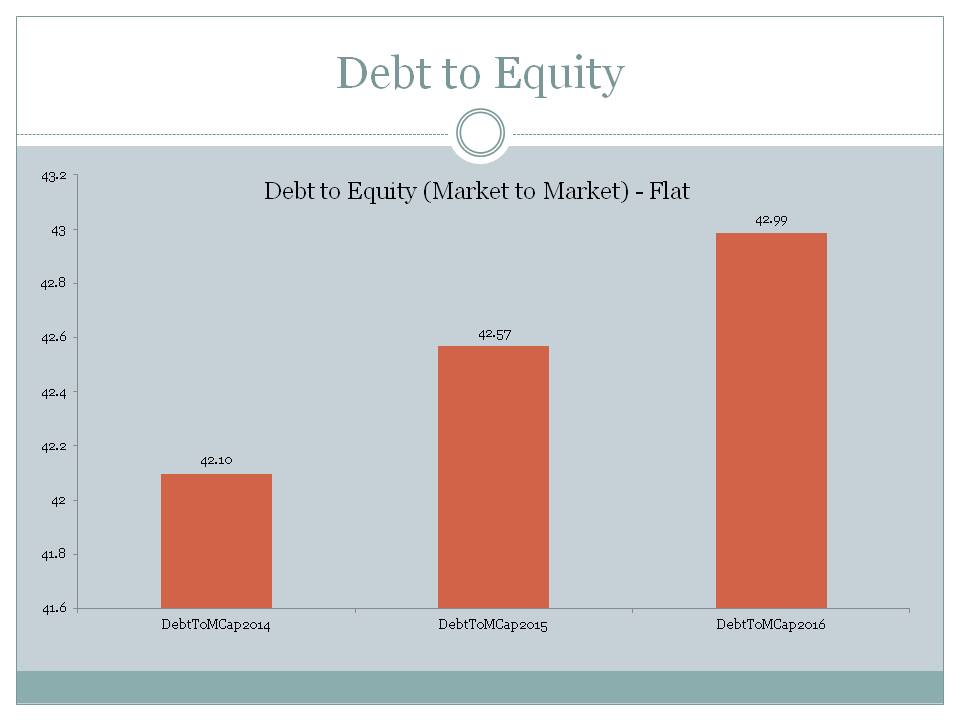

Debt to Equity

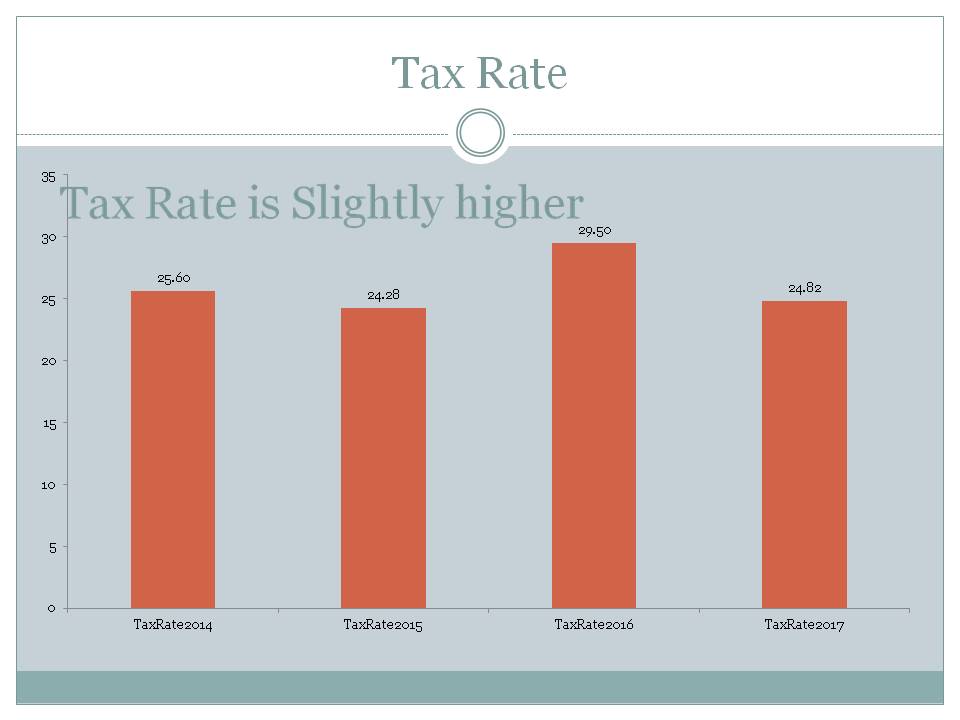

Tax Rate

Recent Strategy Chart Art

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Average Sovereign GEM Yields (USD)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Average Sov. Dev. Markets Yields (blended currency)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Average UST Yield

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Average Sovereign Local Currency Yields (USD)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Choose A Country

ARGENTINA: Citi Says 'Be Brave' and Buy Argentine Stocks

| AUSTRALIA: Australia shares end at near 8-month peak; NZ hits all-time high

| AUSTRIA: Equity Capital Markets in Austria

| BAHRAIN: Mideast Stocks: Factors to watch on April 23

| BELGIUM: European Equity Benchmarks Close Higher as Health Care, Oil ...

|

BRAZIL: Strategists Love Brazilian Stocks While Colombia, Mexico Draw Bears

| BRITAIN: UPDATE 1-UK Stocks-Factors to watch on April 23

| CANADA: What every Canadian investor needs to know today

| CHILE: Sociedad Quimica y Minera de Chile (SQM) Shares Bought by ...

| CHINA: China Signals Less Stimulus, Undermining World's Hottest Stocks

|

COLOMBIA: Colombian equities wait for IPOs

| CZECH: Czech Republic - Factors To Watch on April 18

| DENMARK: European Equity Benchmarks Close Higher as Health Care, Oil ...

| EGYPT: Stocks splutter as oil races to near six-month high

| FINLAND: US investors maintain their steady push into Chinese equities as ...

|

FRANCE: France shares higher at close of trade; CAC 40 up 0.20%

| GERMANY: Germany shares higher at close of trade; DAX up 0.11%

| GREECE: European Equity Benchmarks Close Higher as Health Care, Oil ...

| HONG KONG: Hong Kong's MPF managers lobby for access to Shanghai and ...

| HUNGARY: Hungary: Foundation Trusts Set For Introduction In Hungary

|

INDIA: Higher Oil Erases India Equity Gain on Economy, Earnings Concern

| INDONESIA: The Post-Election Bull Case for Indonesia Equities: Taking Stock

| IRELAND: ON THE MOVE: Northern Trust Hires for Americas and Ireland

| ISRAEL: Israel shares higher at close of trade; TA 35 up 0.72%

| ITALY: An Equity Index Is Doing the Perfect Italian Job: Taking Stock

|

JAPAN: Stock Investors Reluctant to Return to Japan Despite Rally

| KAZAKHSTAN: Mitsubishi: 'Medium- To Longer-Term Conditions For Gold Are Still ...

| LEBANON: Mideast Stocks: Factors to watch on April 2

| MALAYSIA: US investors maintain their steady push into Chinese equities as ...

| MEXICO: Strategists Love Brazilian Stocks While Colombia, Mexico Draw Bears

|

NETHERLANDS: European Equity Benchmarks Close Higher as Health Care, Oil ...

| NEW ZEALAND: What a run: NZX50 up 284 per cent in past decade

| NIGERIA: Nigeria's equities market resumes in red

| NORWAY: Are the Quant Signals Identifying Value in Norway Royal Salmon AS ...

| OMAN: Investors optimistic about global markets despite volatility

|

PAKISTAN: Pakistan equities face turmoil after Asad Umar's removal as FM

| PERU: Cinemark Holdings, Inc. (CNK) Receives Consensus ...

| PHILIPPINES: SE Asia Stocks-Indonesia leads gains; Philippines recovers most ...

| POLAND: Poland - Factors to Watch March 27

| PORTUGAL: European Equity Benchmarks Close Higher as Health Care, Oil ...

|

QATAR: Gulf institutions' buying interests lift Qatar stocks

| QATAR: Gulf institutions' buying interests lift Qatar stocks

| ROMANIA: European Equity Benchmarks Close Higher as Health Care, Oil ...

| RUSSIA: The best performing funds of the past three years: Brazil, Russia and ...

| SINGAPORE: HSBC downgrades stocks in Singapore and Hong Kong

|

SOUTH AFRICA: Ghana's equities market review

| SOUTH KOREA: GLOBAL MARKETS-Asian shares fall despite strong Wall Street ...

| SPAIN: European Equity Benchmarks Close Higher as Health Care, Oil ...

| SWEDEN: Why Sweden's Government Bought Aurora Cannabis and Canopy ...

| SWITZERLAND: Mirabaud AM appoints senior institutional sales head for Swiss ...

|

TAIWAN: South Korea, Taiwan benefit most from trade deal

| THAILAND: Thai Stocks Fall Less Than Most Peers as Markets Digest Poll

| TURKEY: Turkey Stocks Revert to Roller-Coaster Mode as Polls Loom

| UAE: Franklin Templeton Sees 'Attractive Opportunity' in UAE Stocks

| UKRAINE: Evening Update: The latest on the Sri Lanka bombings; Ukraine ...

|

UNITED STATES: US equities is still the place to be for growth

| VIETNAM: Vietnam's Stocks Offer Long-Term Profits With Status Upgrades

|

Comment

Monthly performance is between 2019-04-01 and 2019-03-01

Best global markets YTD USA +14.65%, EFM ASIA +11.91%, EUROPE +11.26%,

While worst global markets YTD FM (FRONTIER MARKETS) 6.67%, EM LATIN AMERICA 8.46%, EM (EMERGING MARKETS) 10.77%,

Best global markets last month USA +2.19%, EFM ASIA +2.14%, EM (EMERGING MARKETS) +1.76%,

While worst global markets last month EM LATIN AMERICA 0.26%, EUROPE 0.96%, FM (FRONTIER MARKETS) 1.24%,

US stocks rally again to record highs as earnings smash ...Gold steps higher as US stock-market rally looks set to pauseEMERGING MARKETS-Emerging-market currencies hit by strong ...How to Succeed in Asia's Emerging Markets | Infiniti Research's ...China stocks fall as cenbank may likely hold broad monetary easingCash-Flow King for Templeton Seeing More Riches in China StocksEuropean Equities: Business Confidence and Corporate Earnings in ...End to $1 Trillion Buyback Binge May Help 'Uniquely Hated' AssetOil price rally ends as report shows spare production capacity is ...Survey: Canada's Government To Blame For Oil CrisisWeaker restrictions lift China's winter steel outputNucor's Q1 revenues rise Y/Y but fall Q/Q alongside steel priceGold edges up from multi-month low as dollar and equities pauseNew Home Sales Surpass Yearly High in March, Gold Price Ticks ...

Best last month among various countries' equity markets were KUWAIT +9.24%, INDIA +8.58%, ROMANIA +7.25%, KENYA +5.69%, SAUDI ARABIA DOMESTIC +5.34%, SERBIA +5.30%, COLOMBIA +4.86%, BAHRAIN +4.64%, NEW ZEALAND +4.45%, PERU +3.15%,

While worst last month among various countries' equity markets were ZIMBABWE -23.72%, TURKEY -11.04%, JORDAN -7.51%, BULGARIA -5.97%, ARGENTINA -5.57%, PAKISTAN -5.49%, MAURITIUS -5.34%, QATAR -3.94%, MALAYSIA -3.92%, NIGERIA -3.59%,

Best YTD among various country equities were COLOMBIA +25.56%, KENYA +24.33%, BAHRAIN +20.84%, CHINA +19.24%, EGYPT +18.81%, HONG KONG +17.45%, BELGIUM +17.01%, SAUDI ARABIA DOMESTIC +16.04%, CANADA +15.93%, NEW ZEALAND +15.57%,

While worst YTD among various country equities were ZIMBABWE -25.85%, SERBIA -21.60%, BOTSWANA -12.45%, QATAR -7.48%, OMAN -6.05%, BULGARIA -5.39%, MOROCCO -4.90%, LEBANON -3.80%, NIGERIA -3.21%, TUNISIA -3.16%,

Download All Slides in Power Point

Download All Slides in Power Point