Chart: Commodities Strategy

February 2026

Source:

Midlincoln Commodities Rankings from best to worst

Commodities Monthly Performance

| Name | Units | LastPrice | Currency | WeekChange USDpct |

|---|---|---|---|---|

| Lean Hogs (CME) | USd/lb. | 0.9845 | USD | 16.10 |

| Crude Oil (Tokyo) | JPY/kl | 66770.00 | JPY | 15.82 |

| Heating Oil (Nymex) | USd/gal. | 2.4006 | USD | 14.83 |

| Gasoil (Nymex) | USD/MT | 695.25 | USD | 13.98 |

| Soybean Oil (CBOT) | USd/lb. | 0.5543 | USD | 12.03 |

| RBOB Gasoline (Nymex) | USd/gal. | 1.9472 | USD | 11.90 |

| WTI Crude Oil (Nymex) | USD/bbl. | 63.76 | USD | 11.72 |

| Cocking Coal | CNY/MT | 1167 | CNY | 11.57 |

| Brent Crude (ICE) | USD/bbl. | 68.11 | USD | 11.42 |

| Gold (Comex) | USD/t oz. | 4883.60 | USD | 10.16 |

| Silver (Tokyo) | JPY/g | 418.00 | JPY | 10.00 |

| Gold (Tokyo) | JPY/g | 25226.00 | JPY | 9.96 |

| Gold Spot | USD/t oz. | 4859.7000 | USD | 9.93 |

| Gold/Indian Rupee Spot | INR/t oz. | 437669.2500 | INR | 9.81 |

| Gold/Japanese Yen Spot | JPY/t oz. | 761463.5000 | JPY | 9.64 |

| 3Mo Tin (LME) | USD/MT | 48526.00 | USD | 9.48 |

| Gold/British Pound Spot | GBP/t oz. | 3578.4900 | GBP | 8.58 |

| Gold/Euro Spot | EUR/t oz. | 4117.2400 | EUR | 8.57 |

| Rough Rice (CBOT) | USD/cwt | 11.08 | USD | 6.74 |

| Canola (ICE) | CAD/MT | 658.50 | CAD | 5.39 |

| Silver Spot | USD/t oz. | 77.7547 | USD | 4.93 |

| 3Mo Zinc (LME) | USD/MT | 3309.00 | USD | 4.47 |

| Feeder Cattle (CME) | USd/lb. | 3.7007999999999996 | USD | 4.10 |

| Silver/Euro Spot | EUR/t oz. | 65.8331 | EUR | 3.49 |

| Silver/British Pound Spot | GBP/t oz. | 57.1403 | GBP | 3.46 |

| Silver (Comex) | USD/t oz. | 76.34 | USD | 3.43 |

| Live Cattle (CME) | USd/lb. | 2.418 | USD | 3.10 |

| Rubber (Tokyo) | USD/kg | 187.80 | JPY | 1.68 |

| Wheat (CBOT) | USd/bu. | 5.26 | USD | 1.54 |

| Natural Gas (Nymex) | USD/MMBtu | 3.52 | USD | 1.44 |

| 3Mo Copper (LME) | USD/MT | 13044.50 | USD | 1.12 |

| Silver/Japanese Yen Spot | JPY/t oz. | 12173.9700 | JPY | 0.99 |

| Copper (Comex) | USd/lb. | 5.803 | USD | 0.77 |

| Palladium Spot | USD/t oz. | 1722.7800 | USD | 0.26 |

| Oats (CBOT) | USd/bu. | 2.945 | USD | 0.00 |

| Soybean (CBOT) | USd/bu. | 10.235 | USD | 0.00 |

| Ethanol (CBOT) | USD/gal. | 2.16 | USD | 0.00 |

| 3Mo Aluminum (LME) | USD/MT | 3069.50 | USD | -0.62 |

| Steel | USD/MT | 560 | USD | -0.88 |

| Soybean Meal (CBOT) | USD/T. | 299.80 | USD | -1.51 |

| Nickel | USD/MT | 17435 | USD | -2.57 |

| Kerosene (Tokyo) | JPY/kl | 83000.00 | JPY | -3.49 |

| Corn (CBOT) | USd/bu. | 4.285 | USD | -3.98 |

| Cotton #2 (ICE) | USd/lb. | 0.6186 | USD | -4.20 |

| Sugar #11 (ICE) | USd/lb. | 0.1427 | USD | -4.68 |

| Platinum Spot | USD/t oz. | 2064.0000 | USD | -6.58 |

| ECX Emissions (ICE) | EUR/MT | 81.02 | USD | -7.38 |

| Coffee 'C' (ICE) | USd/lb. | 2.964 | USD | -22.48 |

| Orange Juice (ICE) | USd/lb. | 1.6369999999999998 | USD | -24.02 |

| Cocoa (ICE) | USD/MT | 4211.00 | USD | -31.46 |

| Lumber (CME) | USD/1000 board feet | -- | USD |

Commodities YTD Performance

| Name | Units | LastPrice | Currency | YTDChange USDpct |

|---|---|---|---|---|

| Silver (Tokyo) | JPY/g | 418.00 | JPY | 87.44 |

| Silver/Japanese Yen Spot | JPY/t oz. | 12173.9700 | JPY | 64.03 |

| Silver Spot | USD/t oz. | 77.7547 | USD | 61.54 |

| Silver (Comex) | USD/t oz. | 76.34 | USD | 60.18 |

| Silver/Euro Spot | EUR/t oz. | 65.8331 | EUR | 58.26 |

| Silver/British Pound Spot | GBP/t oz. | 57.1403 | GBP | 56.14 |

| 3Mo Tin (LME) | USD/MT | 48526.00 | USD | 34.11 |

| Platinum Spot | USD/t oz. | 2064.0000 | USD | 29.82 |

| Gold (Tokyo) | JPY/g | 25226.00 | JPY | 26.05 |

| Gold/Indian Rupee Spot | INR/t oz. | 437669.2500 | INR | 24.25 |

| Gold/Japanese Yen Spot | JPY/t oz. | 761463.5000 | JPY | 24.16 |

| Gold (Comex) | USD/t oz. | 4883.60 | USD | 22.68 |

| Gold Spot | USD/t oz. | 4859.7000 | USD | 22.16 |

| Lean Hogs (CME) | USd/lb. | 0.9845 | USD | 21.87 |

| Palladium Spot | USD/t oz. | 1722.7800 | USD | 21.69 |

| Gold/Euro Spot | EUR/t oz. | 4117.2400 | EUR | 19.75 |

| Gold/British Pound Spot | GBP/t oz. | 3578.4900 | GBP | 18.32 |

| 3Mo Copper (LME) | USD/MT | 13044.50 | USD | 16.64 |

| Nickel | USD/MT | 17435 | USD | 13.46 |

| Copper (Comex) | USd/lb. | 5.803 | USD | 12.80 |

| Soybean Oil (CBOT) | USd/lb. | 0.5543 | USD | 11.13 |

| Feeder Cattle (CME) | USd/lb. | 3.7007999999999996 | USD | 10.79 |

| Rubber (Tokyo) | USD/kg | 187.80 | JPY | 8.06 |

| Crude Oil (Tokyo) | JPY/kl | 66770.00 | JPY | 7.99 |

| Rough Rice (CBOT) | USD/cwt | 11.08 | USD | 7.47 |

| 3Mo Zinc (LME) | USD/MT | 3309.00 | USD | 7.35 |

| 3Mo Aluminum (LME) | USD/MT | 3069.50 | USD | 6.32 |

| WTI Crude Oil (Nymex) | USD/bbl. | 63.76 | USD | 6.21 |

| Cocking Coal | CNY/MT | 1167 | CNY | 6.09 |

| Brent Crude (ICE) | USD/bbl. | 68.11 | USD | 5.74 |

| Live Cattle (CME) | USd/lb. | 2.418 | USD | 4.72 |

| Steel | USD/MT | 560 | USD | 3.32 |

| Canola (ICE) | CAD/MT | 658.50 | CAD | 2.62 |

| ECX Emissions (ICE) | EUR/MT | 81.02 | USD | 2.22 |

| Sugar #11 (ICE) | USd/lb. | 0.1427 | USD | 0.99 |

| Oats (CBOT) | USd/bu. | 2.945 | USD | 0.00 |

| Soybean (CBOT) | USd/bu. | 10.235 | USD | 0.00 |

| Ethanol (CBOT) | USD/gal. | 2.16 | USD | 0.00 |

| Heating Oil (Nymex) | USd/gal. | 2.4006 | USD | -0.12 |

| Wheat (CBOT) | USd/bu. | 5.26 | USD | -0.19 |

| RBOB Gasoline (Nymex) | USd/gal. | 1.9472 | USD | -0.55 |

| Kerosene (Tokyo) | JPY/kl | 83000.00 | JPY | -1.19 |

| Corn (CBOT) | USd/bu. | 4.285 | USD | -1.38 |

| Gasoil (Nymex) | USD/MT | 695.25 | USD | -2.35 |

| Soybean Meal (CBOT) | USD/T. | 299.80 | USD | -4.80 |

| Cotton #2 (ICE) | USd/lb. | 0.6186 | USD | -5.09 |

| Natural Gas (Nymex) | USD/MMBtu | 3.52 | USD | -8.57 |

| Orange Juice (ICE) | USd/lb. | 1.6369999999999998 | USD | -9.31 |

| Coffee 'C' (ICE) | USd/lb. | 2.964 | USD | -23.09 |

| Cocoa (ICE) | USD/MT | 4211.00 | USD | -29.04 |

| Lumber (CME) | USD/1000 board feet | -- | USD |

Key Topics and News

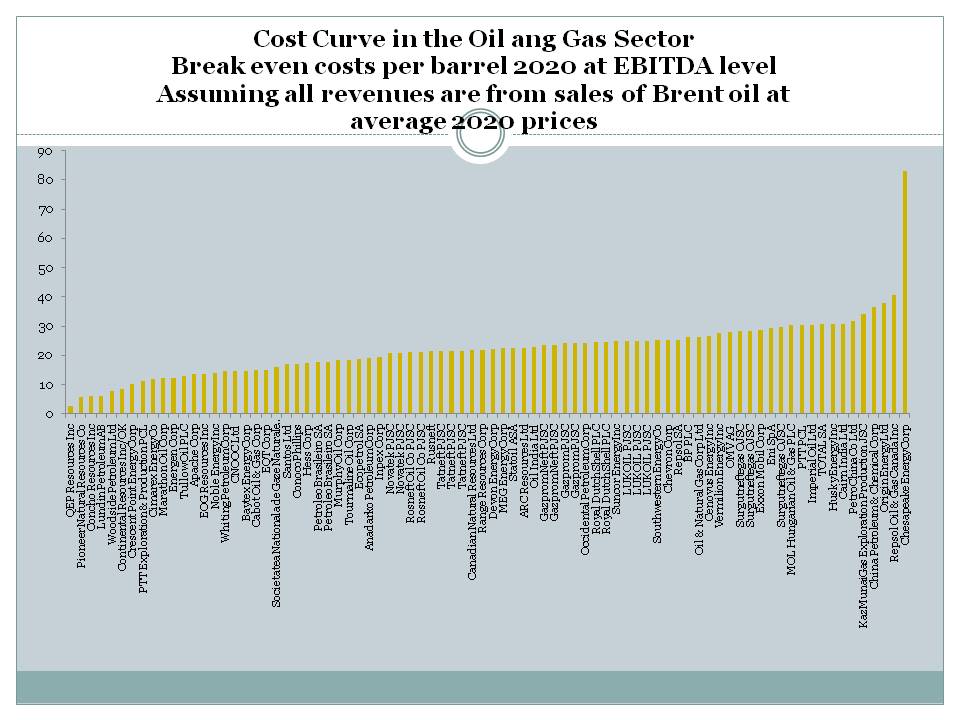

Oil Production Cost Curve

- Institute for Energy Economics and Financial Analysis (IEEFA)Oil producers face profit squeeze amid shifting policy landscape — A recent survey reveals a dark mood in the fossil fuel sector, as tariff talk shakes industry confidence..Apr 3, 2025

- Peak Oil Barrel — Record August World Oil Production — By Ovi. The focus of this post is an overview of World oil production along with a more detailed review of the top 11 Non-OPEC oil producing countries..1 month ago

- Crude Oil Prices Today | Oil — Price.com — U.S. Shale Costs to Soar to $95 per Barrel Within a Decade — Breakevens may rise from ~$70 to as much as $95 per barrel by the mid-2030s as core inventory depletes..Sep 25, 2025

- Towards Data Science — Exploring Merit Order and Marginal Abatement Cost Curve in Python — To achieve the global temperature limit goals of 1.5°C by the end of the century set by the Paris Agreement, different institutions have....Sep 9, 2025

- Oil Change International — The Oil & Gas Industry is Gaslighting the IEA on Methane Emissions — For eight years, the International Energy Agency (IEA) has presented research indicating that oil and gas companies can reduce their....Sep 3, 2025

Source:

Oil Supply and Demand

- IEA – International Energy Agency — Oil Market Report - December 2025 – Analysis — The IEA Oil Market Report (OMR) is one of the world's most authoritative and timely sources of data, forecasts and analysis on the global....Dec 11, 2025

- Mc — Kinsey & Company — Snapshot of global oil supply and demand: December 2025Global oil demand. Global oil demand remained flat at 104.67 MMb/d, with an increase of 0.9 MMb/d driven largely by a 1.2 MMb/d increase in....1 week ago

- World Bank Blogs — Oil Market Glut: Rising Supply and Slowing Demand Shape 2025 Outlook — The World Bank's October 2025 Commodity Markets Outlook highlights growing oversupply in the oil market. Global output is projected to rise....Nov 4, 2025

- CNNGlobal oil market looks ‘bloated’ amid lackluster demand from major economies — World oil supply will rise more rapidly than expected this year and next as OPEC+ members further increase output and supply from outside....Aug 13, 2025

- Crude Oil Prices Today | Oil — Price.com — Low Prices, Strong Demand, and the Cracks in the Oil Glut Story — Oil glut fears are easing as demand surprises to the upside, with the International Energy Agency revising forecasts after stronger....1 week ago

Aluminium Cost Curve

- alcircle — Aluminium chip drying gets a rethink, and the cost curve bends sharply — The shift revolves around a patented chip dryer system known as Thermofuge, which is being deployed inside the casting house of one of the....Jul 28, 2025

- Shanghai Metals Market — Aluminum prices have shown a fluctuating trend in the near term, with a bullish outlook for long-term prices. However, the risk of overexpansion in other regions remains [ICM conference] | SMMAt the 2025 Indonesia Mining Conference & Critical Metals Conference - Aluminum Industry Forum, Duncan Hobbs, Director of Industry Research....Jun 3, 2025

- Linked — In — Outlook 2026 | Aluminium prices ending 2025 at its highs, more steam left? Nigel Dsouza explains #CNBCTV18Market @CNBCTV18News #Aluminium #stocks #stockmarket #stocknews1 month ago

- Boiling Cold — Alcoa flags 'pretty aggressive' cost cuts at alumina refineries — Alcoa chief executive Bill Oplinger has signalled a cost-cutting drive at the company's alumina refineries, which Western Australia - home....

- Aluminium International Today — Century Aluminium's Jamalco investment — Century Aluminium expect to invest up to a total of $30 million in Jamalco next year..Aug 19, 2025

Aluminium Supply and Demand

- Carbon — Credits.com — Aluminum Prices Hit 3-Year High: Is It the Next Key Metal in the Clean Energy Shift?Aluminum prices hit a 3-year high amid surging demand from EVs, solar, and grid upgrades, reshaping supply chains for a low-carbon future..Oct 16, 2025

- alcircle — Why the aluminium market is tightening and why prices may stay supported into 2026In recent years, people often explained aluminium prices using familiar demand stories like construction cycles, auto production,....3 weeks ago

- LSEGAluminium and copper: A rally fuelled by structural strains and political uncertainty — Aluminium and copper prices have seen notable gains, reflecting a mix of supply constraints and policy developments..2 weeks ago

- ING Think — Aluminium deficit will support prices in 2026We see further upside for prices amid supply disruptions and tighter power availability..Dec 8, 2025

- Chem — Analyst — US Aluminium Alloy Ingot Climbs 3.01% Backed by Energy Transition Demand — The Aluminium Alloy Ingot market in the USA experienced a significant increase for the week ending January 30, 2026, with DEL Alabama prices....

Nickel Metal Cost Curve

- Nature — Modeling interconnected minerals markets with multicommodity supply curves: examining the copper-cobalt-nickel system — Demand for many of the metals used in the energy transition is expected to grow rapidly. Many of these are by-products, often considered....Aug 7, 2025

- Crux Investor — Lifezone Metals’ Kabanga Nickel Project: Development-Stage Asset Targets 2026 FIDLifezone's Kabanga project targets 2026 FID with first-quartile nickel costs and government financing interest addressing Western supply....1 week ago

- Investing.com — Nickel prices outlook remains bearish as UBS warns of persistent surplus — The global nickel market is expected to remain in surplus through 2026 despite recent production cuts, according to a new UBS analysis released this week..Jul 18, 2025

- Bloomberg.com — The World’s Most Profitable Nickel Plants Face Cost Challenge — A pioneering group of Indonesian nickel smelters with the world's lowest production costs has been hit by a jump in the price of a key raw material..Jun 18, 2025

- Economies.com — Nickel prices inch up amid mixed outlook — Nickel prices rose slightly due to a stronger US dollar and mixed forecasts for the industrial metal; UBS predicts a surplus in the global....Jul 23, 2025

Nickel Metal Supply Demand

- ING Think — Nickel still capped by surplus — Global nickel supply is expected to outpace demand again in 2026. Indonesia accounts for around 60% of global nickel output and is the....Dec 8, 2025

- Carbon — Credits.com — The Nickel Market is Changing Big Time: Is a Supply-Demand Shift Underway?Nickel, a key component in electric vehicle (EV) batteries and stainless steel, is experiencing significant changes in supply dynamics and pricing..May 21, 2025

- S&P Global — Indonesia navigates nickel market with output cuts, policy shifts — Indonesia to cut nickel output in 2026 to support prices. Reverses mining quota policy to regulate supply volatility..1 month ago

- Investing News Network — Nickel Price Update: Q2 2025 in Review — Nickel is expected to remain in oversupply through 2026 on the back of high output from Indonesia and soft demand from the manufacturing and....1 month ago

- Wood Mackenzie — Nickel: looking for a route back to safety — The outlook for the nickel market, particularly for use in batteries, is not as bullish as it once was - but demand is still buoyant in the....May 21, 2025

Copper Cost Curve

- Seeking Alpha — Southern Copper: King Of The Cost Curve, But Hold Your Horses (NYSE:SCCO)Summary · Southern Copper stands out as a stable, low-cost copper producer with the highest copper reserves among listed peers, supporting long-....Nov 25, 2025

- S&P Global — Capital demands soar for new copper supply — The accelerating global energy transition has enhanced the demand for copper, yet bringing new supply online has become increasingly costly..1 month ago

- Crux Investor — Global Supply Shortages and Critical-Mineral Policy Propel Copper Toward Record Highs — Copper prices surge past $11000/t as USGS adds it to critical minerals list. Supply deficits, mine disruptions, and policy shifts drive....Nov 13, 2025

- Benchmark Minerals — LME copper three month price climbs to record high — Reports that the US and China were close to reaching an agreement on trade sparked a copper price rally on 29 October that saw the LME....Oct 31, 2025

- Nature — Modeling interconnected minerals markets with multicommodity supply curves: examining the copper-cobalt-nickel system — Demand for many of the metals used in the energy transition is expected to grow rapidly. Many of these are by-products, often considered....Aug 7, 2025

Copper Supply Demand

- INDmoney — Global Copper Demand And Supply Crunch Explained — Explore how rising copper demand, supply shortages, and copper ETFs are shaping global investing and the future of electrification..

- J.P. Morgan — Copper Market Outlook | J.P. Morgan Global Research — Following a barrage of severe supply disruptions, copper prices are projected to rise to an average of $12500/mt in the second quarter of....Nov 28, 2025

- Investing News Network — Copper Crunch: Demand Could Surge 50 Percent as Supply Falls Short by 2040S&P Global's new report, Copper in the Age of AI: The Challenges of Electrification, warns that copper demand could surge 50 percent by 2040,....3 weeks ago

- Wood Mackenzie — Can copper supply keep up with surging demand?Consequently, Wood Mackenzie expects global copper demand to surge by 24%, reaching almost 43 Mtpa by 2035. Together, these four emerging demand....Nov 20, 2025

- Goldman Sachs — Copper Prices Are Forecast to Decline Somewhat from Record Highs in 2026Goldman Sachs Research expects copper prices to decline somewhat in 2026 from their recent record highs, even as demand for the metal from....Dec 11, 2025

Recent Commodities Ideas ChartArt

Top 5 Commodities Longs Based on Momentum

| Ticker | name | units | week | 1month | ytd | 6months | 1yr | Rank |

|---|---|---|---|---|---|---|---|---|

| JI1 Comdty | Silver (Tokyo) | JPY/g | 10.00 | 10.00 | 87.44 | 69.92 | 184.35 | 68.57 |

| XAGJPY Curncy | Silver/Japanese Yen Spot | JPY/t oz. | 0.99 | 0.99 | 64.03 | 62.83 | 165.74 | 57.64 |

| XAGUSD Curncy | Silver Spot | USD/t oz. | 4.93 | 4.93 | 61.54 | 59.32 | 154.52 | 55.93 |

| SI1 Comdty | Silver (Comex) | USD/t oz. | 3.43 | 3.43 | 60.18 | 61.36 | 146.50 | 53.68 |

| XAGGBP Curncy | Silver/British Pound Spot | GBP/t oz. | 3.46 | 3.46 | 56.14 | 55.73 | 136.51 | 49.79 |

Top 5 Commodities Shorts Based on Momentum

| Ticker | name | units | week | 1month | ytd | 6months | 1yr | Rank |

|---|---|---|---|---|---|---|---|---|

| CC1 Comdty | Cocoa (ICE) | USD/MT | -31.46 | -31.46 | -29.04 | -29.17 | -55.21 | -36.83 |

| JO1 Comdty | Orange Juice (ICE) | USd/lb. | -24.02 | -24.02 | -9.31 | -20.50 | -67.95 | -34.12 |

| KC1 Comdty | Coffee 'C' (ICE) | USd/lb. | -22.48 | -22.48 | -23.09 | -21.43 | 0.12 | -16.57 |

| SB1 Comdty | Sugar #11 (ICE) | USd/lb. | -4.68 | -4.68 | 0.99 | -12.24 | -32.27 | -13.47 |

| CT1 Comdty | Cotton #2 (ICE) | USd/lb. | -4.20 | -4.20 | -5.09 | -4.42 | -12.93 | -6.44 |

Estimates of Commodities Avg Annual Prices

| Name | Units | Avg2017 | Avg2018 | Avg2019 | Avg2020 | Avg2021 | Avg2022 | Avg2023 | Avg2024 | Avg2025 |

|---|---|---|---|---|---|---|---|---|---|---|

| WTI Crude Oil (Nymex) | USD/bbl. | 51.20 | 66.47 | 56.15 | 40.18 | 66.87 | 95.03 | 78.28 | 77.21 | 61.60 |

| Brent Crude (ICE) | USD/bbl. | 54.93 | 72.13 | 63.14 | 43.55 | 69.56 | 99.45 | 83.04 | 81.27 | 65.58 |

| Crude Oil (Tokyo) | JPY/kl | 37180.83 | 47237.50 | 40296.67 | 29553.33 | 44018.33 | 70425.00 | 71472.50 | 77248.00 | 62530.00 |

| Natural Gas (Nymex) | USD/MMBtu | 3.10 | 2.99 | 2.62 | 2.09 | 3.69 | 6.67 | 2.64 | 2.57 | 3.45 |

| RBOB Gasoline (Nymex) | USd/gal. | 1.66 | 1.97 | 1.70 | 1.21 | 2.05 | 2.93 | 2.49 | 2.38 | 1.87 |

| Heating Oil (Nymex) | USd/gal. | 1.67 | 2.09 | 1.92 | 1.28 | 2.03 | 3.47 | 2.78 | 2.50 | 2.24 |

| Gasoil (Nymex) | USD/MT | 495.81 | 645.10 | 584.38 | 379.44 | 575.48 | 1028.06 | 814.38 | 766.60 | 665.94 |

| Kerosene (Tokyo) | JPY/kl | 49809.17 | 64072.50 | 57185.83 | 43763.33 | 60145.00 | 81399.17 | 77566.67 | 82000.00 | 83750.00 |

| ECX Emissions (ICE) | EUR/MT | 6.28 | 15.05 | 24.64 | 24.78 | 51.47 | 80.81 | 83.86 | 65.26 | 78.70 |

| Cocking Coal | CNY/MT | 1268.21 | 1413.17 | 1308.79 | 1264.71 | 1978.75 | 2485.29 | 1698.58 | 1590.40 | 1098.50 |

| Gold (Comex) | USD/t oz. | 1261.42 | 1296.03 | 1393.65 | 1789.18 | 1793.08 | 1809.72 | 1959.54 | 2309.82 | 3761.63 |

| Gold (Tokyo) | JPY/g | 4528.00 | 4513.17 | 4856.42 | 6090.50 | 6300.08 | 7543.58 | 8749.67 | 11201.20 | 18878.75 |

| Gold Spot | USD/t oz. | 1260.77 | 1291.16 | 1390.27 | 1781.96 | 1792.23 | 1802.74 | 1946.00 | 2294.58 | 3748.52 |

| Gold/Euro Spot | EUR/t oz. | 1119.38 | 1082.19 | 1241.64 | 1555.33 | 1512.17 | 1713.25 | 1814.65 | 2139.96 | 3292.65 |

| Gold/British Pound Spot | GBP/t oz. | 977.94 | 953.38 | 1094.40 | 1384.48 | 1303.82 | 1456.45 | 1582.13 | 1812.57 | 2845.87 |

| Gold/Japanese Yen Spot | JPY/t oz. | 141150.35 | 140707.55 | 151395.17 | 189708.44 | 196137.93 | 235376.45 | 272542.25 | 347874.71 | 577271.72 |

| Gold/Indian Rupee Spot | INR/t oz. | 82136.46 | 86707.74 | 97986.21 | 132303.55 | 132329.73 | 140790.36 | 161008.04 | 190368.11 | 333380.03 |

| Silver (Comex) | USD/t oz. | 17.22 | 16.02 | 16.17 | 20.67 | 25.07 | 21.79 | 23.56 | 26.74 | 49.94 |

| Silver (Tokyo) | JPY/g | 61.41 | 55.99 | 56.49 | 70.08 | 88.20 | 89.96 | 104.98 | 129.00 | 249.00 |

| Silver Spot | USD/t oz. | 17.24 | 16.02 | 16.15 | 20.53 | 25.01 | 21.71 | 23.40 | 26.57 | 50.40 |

| Silver/Euro Spot | EUR/t oz. | 15.33 | 13.42 | 14.42 | 17.84 | 21.08 | 20.60 | 21.81 | 24.78 | 44.14 |

| Silver/British Pound Spot | GBP/t oz. | 13.39 | 11.82 | 12.71 | 15.91 | 18.18 | 17.51 | 19.02 | 20.98 | 38.17 |

| Silver/Japanese Yen Spot | JPY/t oz. | 1930.39 | 1744.57 | 1758.40 | 2183.74 | 2735.59 | 2827.78 | 3275.58 | 4031.74 | 7883.42 |

| Platinum Spot | USD/t oz. | 958.52 | 908.21 | 861.19 | 896.21 | 1090.11 | 954.68 | 993.07 | 920.93 | 1591.75 |

| Palladium Spot | USD/t oz. | 862.40 | 1026.02 | 1512.27 | 2195.90 | 2423.55 | 2148.35 | 1397.87 | 961.76 | 1385.00 |

| Copper (Comex) | USd/lb. | 2.81 | 2.97 | 2.71 | 2.76 | 4.20 | 4.01 | 3.81 | 4.09 | 5.03 |

| 3Mo Copper (LME) | USD/MT | 6196.00 | 6659.25 | 5991.08 | 6143.96 | 9216.29 | 8863.00 | 8437.08 | 8950.70 | 10936.13 |

| 3Mo Aluminum (LME) | USD/MT | 1957.67 | 2138.58 | 1817.92 | 1723.33 | 2437.92 | 2737.04 | 2293.88 | 2395.10 | 2829.75 |

| 3Mo Zinc (LME) | USD/MT | 2872.25 | 3032.00 | 2483.58 | 2239.13 | 2956.58 | 3476.17 | 2622.67 | 2638.30 | 3082.88 |

| 3Mo Tin (LME) | USD/MT | 20154.17 | 20428.33 | 18467.50 | 17087.33 | 30047.00 | 31787.75 | 25346.33 | 28124.20 | 36369.00 |

| Nickel | USD/MT | 10585.83 | 13551.67 | 13755.83 | 13669.25 | 18449.67 | 26612.08 | 22084.58 | 16781.40 | 15806.50 |

| Steel | USD/MT | 493.71 | 548.13 | 451.42 | 446.42 | 679.28 | 734.83 | 638.00 | 588.40 | 556.75 |

| Corn (CBOT) | USd/bu. | 3.74 | 3.66 | 3.85 | 3.58 | 5.71 | 6.79 | 5.77 | 4.41 | 4.33 |

| Wheat (CBOT) | USd/bu. | 4.63 | 4.91 | 4.95 | 5.36 | 7.08 | 8.94 | 6.45 | 5.72 | 5.26 |

| Oats (CBOT) | USd/bu. | 2.41 | 2.51 | 2.83 | 2.82 | 4.73 | 5.41 | 3.67 | 3.57 | 3.14 |

| Rough Rice (CBOT) | USD/cwt | 10.95 | 11.50 | 11.50 | 12.80 | 13.45 | 16.57 | 16.37 | 16.24 | 11.70 |

| Soybean (CBOT) | USd/bu. | 9.77 | 9.42 | 8.95 | 9.31 | 13.70 | 15.03 | 13.97 | 11.54 | 10.14 |

| Soybean Meal (CBOT) | USD/T. | 312.35 | 340.27 | 306.84 | 313.10 | 387.33 | 426.30 | 431.56 | 335.90 | 296.50 |

| Soybean Oil (CBOT) | USd/lb. | 0.34 | 0.30 | 0.29 | 0.31 | 0.56 | 0.68 | 0.55 | 0.46 | 0.48 |

| Canola (ICE) | CAD/MT | 509.64 | 503.82 | 461.20 | 492.67 | 787.28 | 956.78 | 725.55 | 625.66 | 615.70 |

| Cocoa (ICE) | USD/MT | 2018.42 | 2266.75 | 2386.25 | 2486.17 | 2496.25 | 2472.67 | 3179.33 | 8574.80 | 6856.25 |

| Coffee 'C' (ICE) | USd/lb. | 1.34 | 1.14 | 1.02 | 1.13 | 1.67 | 2.16 | 1.71 | 2.15 | 3.60 |

| Sugar #11 (ICE) | USd/lb. | 0.16 | 0.12 | 0.12 | 0.13 | 0.18 | 0.18 | 0.24 | 0.22 | 0.17 |

| Orange Juice (ICE) | USd/lb. | 1.55 | 1.51 | 1.08 | 1.16 | 1.22 | 1.71 | 2.95 | 3.89 | 2.78 |

| Cotton #2 (ICE) | USd/lb. | 0.75 | 0.82 | 0.67 | 0.63 | 0.92 | 1.09 | 0.83 | 0.82 | 0.66 |

| Lumber (CME) | USD/1000 board feet | 379.39 | 464.43 | 362.89 | 496.94 | 837.69 | 725.05 | 163.36 | 0.00 | 0.00 |

| Rubber (Tokyo) | USD/kg | 241.90 | 177.54 | 181.20 | 167.08 | 167.90 | 167.90 | 167.90 | 167.90 | 173.58 |

| Ethanol (CBOT) | USD/gal. | 1.52 | 1.40 | 1.37 | 1.21 | 2.10 | 2.16 | 2.16 | 2.16 | 2.16 |

| Live Cattle (CME) | USd/lb. | 1.18 | 1.14 | 1.15 | 1.07 | 1.24 | 1.42 | 1.72 | 1.81 | 2.23 |

| Feeder Cattle (CME) | USd/lb. | 1.43 | 1.48 | 1.42 | 1.37 | 1.51 | 1.74 | 2.25 | 2.48 | 3.30 |

| Lean Hogs (CME) | USd/lb. | 0.70 | 0.69 | 0.72 | 0.58 | 0.91 | 0.97 | 0.80 | 0.92 | 0.85 |

Commodities News, Table of Contents:

Oil 68.11 (USD/bbl.)

Natural Gas 3.52 (USD/MMBtu)

Cocking Coal 1,167.00 (CNY/MT)

Gold 4,859.70 (USD/t oz.)

Silver 76.34 (USD/t oz.)

Platinum 2,064.00 (USD/t oz.)

Palladium 1,722.78 (USD/t oz.)

Copper 5.80 (USd/lb.)

3Mo Aluminum 3,069.50 (USD/MT)

3Mo Zinc 3,309.00 (USD/MT)

3Mo Tin 48,526.00 (USD/MT)

Nickel 17,435.00 (USD/MT)

Steel 560.00 (USD/MT)

Corn 4.29 (USd/bu.)

Wheat 5.26 (USd/bu.)

Oats 2.95 (USd/bu.)

Rough Rice 11.08 (USD/cwt)

Soybean 10.24 (USd/bu.)

Canola 658.50 (CAD/MT)

Cocoa 4,211.00 (USD/MT)

Coffee 2.96 (USd/lb.)

Sugar 0.14 (USd/lb.)

Orange Juice 1.64 (USd/lb.)

Cotton 0.62 (USd/lb.)

Lumber 0.00 (USD/1000 board feet)

Ethanol 2.16 (USD/gal.)

Live Cattle 2.42 (USd/lb.)

Feeder Cattle 3.70 (USd/lb.)

Lean Hogs 0.98 (USd/lb.)

Best Commodities 1yr

| Ticker | name | units | ytd | week | 1month | 6months | 1yr | Rank |

|---|---|---|---|---|---|---|---|---|

| JI1 Comdty | Silver (Tokyo) | JPY/g | 87.44 | 10.00 | 10.00 | 69.92 | 184.35 | 68.57 |

| XAGJPY Curncy | Silver/Japanese Yen Spot | JPY/t oz. | 64.03 | 0.99 | 0.99 | 62.83 | 165.74 | 57.64 |

| XAGUSD Curncy | Silver Spot | USD/t oz. | 61.54 | 4.93 | 4.93 | 59.32 | 154.52 | 55.93 |

| SI1 Comdty | Silver (Comex) | USD/t oz. | 60.18 | 3.43 | 3.43 | 61.36 | 146.50 | 53.68 |

| XAGGBP Curncy | Silver/British Pound Spot | GBP/t oz. | 56.14 | 3.46 | 3.46 | 55.73 | 136.51 | 49.79 |

Worst Commodities 1yr

| Ticker | name | units | ytd | week | 1month | 6months | 1yr | Rank |

|---|---|---|---|---|---|---|---|---|

| JO1 Comdty | Orange Juice (ICE) | USd/lb. | -9.31 | -24.02 | -24.02 | -20.50 | -67.95 | -34.12 |

| CC1 Comdty | Cocoa (ICE) | USD/MT | -29.04 | -31.46 | -31.46 | -29.17 | -55.21 | -36.83 |

| SB1 Comdty | Sugar #11 (ICE) | USd/lb. | 0.99 | -4.68 | -4.68 | -12.24 | -32.27 | -13.47 |

| RR1 Comdty | Rough Rice (CBOT) | USD/cwt | 7.47 | 6.74 | 6.74 | 2.03 | -27.39 | -2.97 |

| CT1 Comdty | Cotton #2 (ICE) | USd/lb. | -5.09 | -4.20 | -4.20 | -4.42 | -12.93 | -6.44 |