-

When Power No Longer Needs Countries

Feb 2, 2026 -

Gold, Sovereignty, and the Quiet Reordering of the Monetary System

Jan 9, 2026 -

Prime Mining as Cooperative Proof-of-Work:

Dec 5, 2025 -

From Thermodynamic Markets to the Thermodynamic Economy

Nov 13, 2025 -

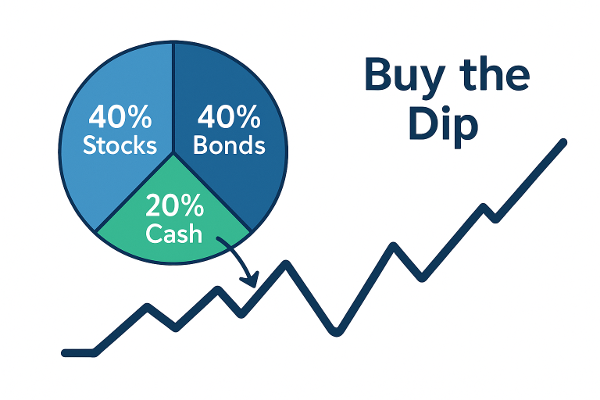

Midlincoln View: Buy the Dip 40/40/20 Portfolio Strategy

Oct 21, 2025 -

MidLincoln View - Markets, Money & AI

Oct 15, 2025 -

MidLincoln View Five Loaves, Two Fish

Oct 1, 2025