Tokenising Midlincoln Crafts

This section contains links to materials about Midlincoln Rural Crafts Initiatives

Midlincoln is testing rural co-working model as its core business. Half of the co-working space is dedicated to investment analytics service and half of the space is industrial, creative environment with machines and tools which can be used in product development and small scale production.

Investing into Midlincoln Craft fund tokens is a comprehensive investment into all of the portfolio companies and funds. But each of the mentioned companies and funds are also accessible for investment directly also via tokens. Each of the portfolio company or a fund can be considered as a standalone franchise and Stocken could provide security token investment for qualified investors in any of them.

Research Reports Highlights

Fund Flows By Objective

| Focus | Objective | Asset Class | Flow USD mn |

| Commodities | INDUSTRIAL METALS | Commodity | 2.81 |

| Commodities | PRECIOUS METAL SECTOR | Equity | -167.50 |

| Commodities | PRECIOUS METALS | Commodity | 4513.59 |

| Commodities | PRECIOUS METALS | Mixed Allocation | 451.53 |

| country | AUSTRALIA | Equity | -154.41 |

| country | AUSTRALIA | Fixed Income | 36.49 |

| country | AUSTRALIA | Mixed Allocation | -1.26 |

| country | BRAZIL | Equity | 658.65 |

| country | BRAZIL | Fixed Income | 209.27 |

| country | CHINA | Equity | 437.49 |

| country | CHINA | Fixed Income | -37.58 |

| Country | EGYPT | Equity | -2.02 |

| country | INDIA | Equity | 362.62 |

| country | INDIA | Fixed Income | 25.40 |

| country | ISRAEL | Equity | 0.39 |

| country | JAPAN | Equity | -1751.23 |

| country | JAPAN | Fixed Income | 14.90 |

| country | JAPAN | Mixed Allocation | 13.17 |

| country | KOREA | Equity | 701.86 |

| country | POLAND | Equity | 20.97 |

| country | RUSSIA | Equity | -89.37 |

| country | RUSSIA | Fixed Income | -4.11 |

| country | SOUTH AFRICA | Equity | -0.53 |

| country | SPAIN | Equity | 32.34 |

| Country | TAIWAN | Equity | 20.86 |

| country | TURKEY | Equity | -20.88 |

| country | UNITED KINGDOM | Equity | 499.72 |

| industry | BASIC MATERIALS SECTOR | Equity | -650.52 |

| industry | COMMUNICATIONS SECTOR | Equity | -40.90 |

| industry | ENERGY SECTOR | Equity | -1833.30 |

| industry | ENERGY SECTOR | Mixed Allocation | 0.25 |

| industry | FINANCIAL SECTOR | Equity | -284.12 |

| industry | HEALTH CARE SECTOR | Equity | 4887.26 |

| industry | INDUSTRIAL SECTOR | Equity | -294.38 |

| industry | MULTIPLE SECTOR | Equity | -5.27 |

| industry | NATURAL RESOURCES SECTOR | Equity | -226.08 |

| industry | REAL ESTATE SECTOR | Equity | -69.02 |

| industry | TECHNOLOGY SECTOR | Equity | -145.07 |

| industry | UTILITIES SECTOR | Equity | 1770.97 |

| region | AFRICAN REGION | Equity | -62.72 |

| region | ASIAN PACIFIC REGION | Equity | 1848.48 |

| region | ASIAN PACIFIC REGION | Fixed Income | 132.40 |

| region | ASIAN PACIFIC REGION | Mixed Allocation | 670.79 |

| region | ASIAN PACIFIC REGION EX JAPAN | Equity | 1536.75 |

| region | ASIAN PACIFIC REGION EX JAPAN | Fixed Income | -271.07 |

| region | ASIAN PACIFIC REGION EX JAPAN | Mixed Allocation | 102.56 |

| region | EASTERN EUROPEAN REGION | Equity | -75.33 |

| region | EASTERN EUROPEAN REGION | Fixed Income | -0.13 |

| region | EASTERN EUROPEAN REGION | Mixed Allocation | 0.52 |

| region | EUROPEAN REGION | Equity | -3024.06 |

| region | EUROPEAN REGION | Fixed Income | -282.11 |

| region | EUROPEAN REGION | Mixed Allocation | 128.62 |

| region | LATIN AMERICAN REGION | Equity | -667.54 |

| region | LATIN AMERICAN REGION | Fixed Income | -41.63 |

| region | MIDDLE EAST REGION | Equity | -23.53 |

| region | MIDDLE EAST REGION | Fixed Income | -2.22 |

| region | NORDIC REGION | Equity | 44.04 |

| region | NORTH AMERICAN REGION | Equity | -274.55 |

| region | NORTH AMERICAN REGION | Fixed Income | -99.86 |

| Risk | GOVERNMENT BOND | Alternative | -7.64 |

| Risk | GOVERNMENT BOND | Equity | 0.01 |

| Risk | GOVERNMENT BOND | Fixed Income | 1036.99 |

| Risk | GOVERNMENT BOND | Mixed Allocation | 3.44 |

| Risk | INFLATION PROTECTED | Brazil | 18.55 |

| Risk | INFLATION PROTECTED | Fixed Income | -2095.25 |

| Risk | LONG SHORT | Alternative | -1180.92 |

| Risk | LONG SHORT | Equity | 131.11 |

| Risk | LONG SHORT | Fixed Income | -5.46 |

| Risk | LONG SHORT | Mixed Allocation | -0.38 |

| Sector | AGRICULTURE | Commodity | -84.47 |

| Sector | AGRICULTURE | Equity | 0.00 |

| Sector | CONSUMER DISCRETIONARY | Equity | -426.73 |

| Sector | CONSUMER STAPLES | Equity | 16.80 |

| segment | BRIC | Equity | 6.49 |

| segment | BRIC | Fixed Income | 87.61 |

| segment | DEVELOPED MARKETS | Equity | 1034.48 |

| segment | EMEA | Equity | 7.53 |

| segment | EMEA | Fixed Income | 11.09 |

| segment | EMERGING MARKETS | Equity | 5425.13 |

| segment | GCC | Equity | -8.39 |

| segment | GCC | Fixed Income | -0.08 |

| segment | GCC | Mixed Allocation | 41.96 |

| segment | MENA | Equity | 5.30 |

| segment | MENA | Fixed Income | 2.13 |

| Size | LARGE-CAP | Equity | 23451.21 |

| Size | MID-CAP | Commodity | 0.59 |

| Size | MID-CAP | Equity | 1463.11 |

| Size | SMALL-CAP | Equity | 1507.72 |

Flows In Descending Order

| Focus | Objective | Asset Class | Flow USD mn |

| Size | LARGE-CAP | Equity | 23451.21 |

| segment | EMERGING MARKETS | Equity | 5425.13 |

| industry | HEALTH CARE SECTOR | Equity | 4887.26 |

| Commodities | PRECIOUS METALS | Commodity | 4513.59 |

| region | ASIAN PACIFIC REGION | Equity | 1848.48 |

| industry | UTILITIES SECTOR | Equity | 1770.97 |

| region | ASIAN PACIFIC REGION EX JAPAN | Equity | 1536.75 |

| Size | SMALL-CAP | Equity | 1507.72 |

| Size | MID-CAP | Equity | 1463.11 |

| Risk | GOVERNMENT BOND | Fixed Income | 1036.99 |

| segment | DEVELOPED MARKETS | Equity | 1034.48 |

| country | KOREA | Equity | 701.86 |

| region | ASIAN PACIFIC REGION | Mixed Allocation | 670.79 |

| country | BRAZIL | Equity | 658.65 |

| country | UNITED KINGDOM | Equity | 499.72 |

| Commodities | PRECIOUS METALS | Mixed Allocation | 451.53 |

| country | CHINA | Equity | 437.49 |

| country | INDIA | Equity | 362.62 |

| country | BRAZIL | Fixed Income | 209.27 |

| region | ASIAN PACIFIC REGION | Fixed Income | 132.40 |

| Risk | LONG SHORT | Equity | 131.11 |

| region | EUROPEAN REGION | Mixed Allocation | 128.62 |

| region | ASIAN PACIFIC REGION EX JAPAN | Mixed Allocation | 102.56 |

| segment | BRIC | Fixed Income | 87.61 |

| region | NORDIC REGION | Equity | 44.04 |

| segment | GCC | Mixed Allocation | 41.96 |

| country | AUSTRALIA | Fixed Income | 36.49 |

| country | SPAIN | Equity | 32.34 |

| country | INDIA | Fixed Income | 25.40 |

| country | POLAND | Equity | 20.97 |

| Country | TAIWAN | Equity | 20.86 |

| Risk | INFLATION PROTECTED | Brazil | 18.55 |

| Sector | CONSUMER STAPLES | Equity | 16.80 |

| country | JAPAN | Fixed Income | 14.90 |

| country | JAPAN | Mixed Allocation | 13.17 |

| segment | EMEA | Fixed Income | 11.09 |

| segment | EMEA | Equity | 7.53 |

| segment | BRIC | Equity | 6.49 |

| segment | MENA | Equity | 5.30 |

| Risk | GOVERNMENT BOND | Mixed Allocation | 3.44 |

| Commodities | INDUSTRIAL METALS | Commodity | 2.81 |

| segment | MENA | Fixed Income | 2.13 |

| Size | MID-CAP | Commodity | 0.59 |

| region | EASTERN EUROPEAN REGION | Mixed Allocation | 0.52 |

| country | ISRAEL | Equity | 0.39 |

| industry | ENERGY SECTOR | Mixed Allocation | 0.25 |

| Risk | GOVERNMENT BOND | Equity | 0.01 |

| Sector | AGRICULTURE | Equity | 0.00 |

| segment | GCC | Fixed Income | -0.08 |

| region | EASTERN EUROPEAN REGION | Fixed Income | -0.13 |

| Risk | LONG SHORT | Mixed Allocation | -0.38 |

| country | SOUTH AFRICA | Equity | -0.53 |

| country | AUSTRALIA | Mixed Allocation | -1.26 |

| Country | EGYPT | Equity | -2.02 |

| region | MIDDLE EAST REGION | Fixed Income | -2.22 |

| country | RUSSIA | Fixed Income | -4.11 |

| industry | MULTIPLE SECTOR | Equity | -5.27 |

| Risk | LONG SHORT | Fixed Income | -5.46 |

| Risk | GOVERNMENT BOND | Alternative | -7.64 |

| segment | GCC | Equity | -8.39 |

| country | TURKEY | Equity | -20.88 |

| region | MIDDLE EAST REGION | Equity | -23.53 |

| country | CHINA | Fixed Income | -37.58 |

| industry | COMMUNICATIONS SECTOR | Equity | -40.90 |

| region | LATIN AMERICAN REGION | Fixed Income | -41.63 |

| region | AFRICAN REGION | Equity | -62.72 |

| industry | REAL ESTATE SECTOR | Equity | -69.02 |

| region | EASTERN EUROPEAN REGION | Equity | -75.33 |

| Sector | AGRICULTURE | Commodity | -84.47 |

| country | RUSSIA | Equity | -89.37 |

| region | NORTH AMERICAN REGION | Fixed Income | -99.86 |

| industry | TECHNOLOGY SECTOR | Equity | -145.07 |

| country | AUSTRALIA | Equity | -154.41 |

| Commodities | PRECIOUS METAL SECTOR | Equity | -167.50 |

| industry | NATURAL RESOURCES SECTOR | Equity | -226.08 |

| region | ASIAN PACIFIC REGION EX JAPAN | Fixed Income | -271.07 |

| region | NORTH AMERICAN REGION | Equity | -274.55 |

| region | EUROPEAN REGION | Fixed Income | -282.11 |

| industry | FINANCIAL SECTOR | Equity | -284.12 |

| industry | INDUSTRIAL SECTOR | Equity | -294.38 |

| Sector | CONSUMER DISCRETIONARY | Equity | -426.73 |

| industry | BASIC MATERIALS SECTOR | Equity | -650.52 |

| region | LATIN AMERICAN REGION | Equity | -667.54 |

| Risk | LONG SHORT | Alternative | -1180.92 |

| country | JAPAN | Equity | -1751.23 |

| industry | ENERGY SECTOR | Equity | -1833.30 |

| Risk | INFLATION PROTECTED | Fixed Income | -2095.25 |

| region | EUROPEAN REGION | Equity | -3024.06 |

Fund flows YTD

| Focus | Objective | Asset Class | Flow USD mn |

| Size | LARGE-CAP | Equity | 23451.21 |

| segment | EMERGING MARKETS | Equity | 5425.13 |

| industry | HEALTH CARE SECTOR | Equity | 4887.26 |

| Commodities | PRECIOUS METALS | Commodity | 4513.59 |

| region | ASIAN PACIFIC REGION | Equity | 1848.48 |

| industry | UTILITIES SECTOR | Equity | 1770.97 |

| region | ASIAN PACIFIC REGION EX JAPAN | Equity | 1536.75 |

| Size | SMALL-CAP | Equity | 1507.72 |

| Size | MID-CAP | Equity | 1463.11 |

| Risk | GOVERNMENT BOND | Fixed Income | 1036.99 |

| segment | DEVELOPED MARKETS | Equity | 1034.48 |

| country | KOREA | Equity | 701.86 |

| region | ASIAN PACIFIC REGION | Mixed Allocation | 670.79 |

| country | BRAZIL | Equity | 658.65 |

| country | UNITED KINGDOM | Equity | 499.72 |

| Commodities | PRECIOUS METALS | Mixed Allocation | 451.53 |

| country | CHINA | Equity | 437.49 |

| country | INDIA | Equity | 362.62 |

| country | BRAZIL | Fixed Income | 209.27 |

| region | ASIAN PACIFIC REGION | Fixed Income | 132.40 |

| Risk | LONG SHORT | Equity | 131.11 |

| region | EUROPEAN REGION | Mixed Allocation | 128.62 |

| region | ASIAN PACIFIC REGION EX JAPAN | Mixed Allocation | 102.56 |

| segment | BRIC | Fixed Income | 87.61 |

| region | NORDIC REGION | Equity | 44.04 |

| segment | GCC | Mixed Allocation | 41.96 |

| country | AUSTRALIA | Fixed Income | 36.49 |

| country | SPAIN | Equity | 32.34 |

| country | INDIA | Fixed Income | 25.40 |

| country | POLAND | Equity | 20.97 |

| Country | TAIWAN | Equity | 20.86 |

| Risk | INFLATION PROTECTED | Brazil | 18.55 |

| Sector | CONSUMER STAPLES | Equity | 16.80 |

| country | JAPAN | Fixed Income | 14.90 |

| country | JAPAN | Mixed Allocation | 13.17 |

| segment | EMEA | Fixed Income | 11.09 |

| segment | EMEA | Equity | 7.53 |

| segment | BRIC | Equity | 6.49 |

| segment | MENA | Equity | 5.30 |

| Risk | GOVERNMENT BOND | Mixed Allocation | 3.44 |

| Commodities | INDUSTRIAL METALS | Commodity | 2.81 |

| segment | MENA | Fixed Income | 2.13 |

| Size | MID-CAP | Commodity | 0.59 |

| region | EASTERN EUROPEAN REGION | Mixed Allocation | 0.52 |

| country | ISRAEL | Equity | 0.39 |

| industry | ENERGY SECTOR | Mixed Allocation | 0.25 |

| Risk | GOVERNMENT BOND | Equity | 0.01 |

| Sector | AGRICULTURE | Equity | 0.00 |

| segment | GCC | Fixed Income | -0.08 |

| region | EASTERN EUROPEAN REGION | Fixed Income | -0.13 |

| Risk | LONG SHORT | Mixed Allocation | -0.38 |

| country | SOUTH AFRICA | Equity | -0.53 |

| country | AUSTRALIA | Mixed Allocation | -1.26 |

| Country | EGYPT | Equity | -2.02 |

| region | MIDDLE EAST REGION | Fixed Income | -2.22 |

| country | RUSSIA | Fixed Income | -4.11 |

| industry | MULTIPLE SECTOR | Equity | -5.27 |

| Risk | LONG SHORT | Fixed Income | -5.46 |

| Risk | GOVERNMENT BOND | Alternative | -7.64 |

| segment | GCC | Equity | -8.39 |

| country | TURKEY | Equity | -20.88 |

| region | MIDDLE EAST REGION | Equity | -23.53 |

| country | CHINA | Fixed Income | -37.58 |

| industry | COMMUNICATIONS SECTOR | Equity | -40.90 |

| region | LATIN AMERICAN REGION | Fixed Income | -41.63 |

| region | AFRICAN REGION | Equity | -62.72 |

| industry | REAL ESTATE SECTOR | Equity | -69.02 |

| region | EASTERN EUROPEAN REGION | Equity | -75.33 |

| Sector | AGRICULTURE | Commodity | -84.47 |

| country | RUSSIA | Equity | -89.37 |

| region | NORTH AMERICAN REGION | Fixed Income | -99.86 |

| industry | TECHNOLOGY SECTOR | Equity | -145.07 |

| country | AUSTRALIA | Equity | -154.41 |

| Commodities | PRECIOUS METAL SECTOR | Equity | -167.50 |

| industry | NATURAL RESOURCES SECTOR | Equity | -226.08 |

| region | ASIAN PACIFIC REGION EX JAPAN | Fixed Income | -271.07 |

| region | NORTH AMERICAN REGION | Equity | -274.55 |

| region | EUROPEAN REGION | Fixed Income | -282.11 |

| industry | FINANCIAL SECTOR | Equity | -284.12 |

| industry | INDUSTRIAL SECTOR | Equity | -294.38 |

| Sector | CONSUMER DISCRETIONARY | Equity | -426.73 |

| industry | BASIC MATERIALS SECTOR | Equity | -650.52 |

| region | LATIN AMERICAN REGION | Equity | -667.54 |

| Risk | LONG SHORT | Alternative | -1180.92 |

| country | JAPAN | Equity | -1751.23 |

| industry | ENERGY SECTOR | Equity | -1833.30 |

| Risk | INFLATION PROTECTED | Fixed Income | -2095.25 |

| region | EUROPEAN REGION | Equity | -3024.06 |

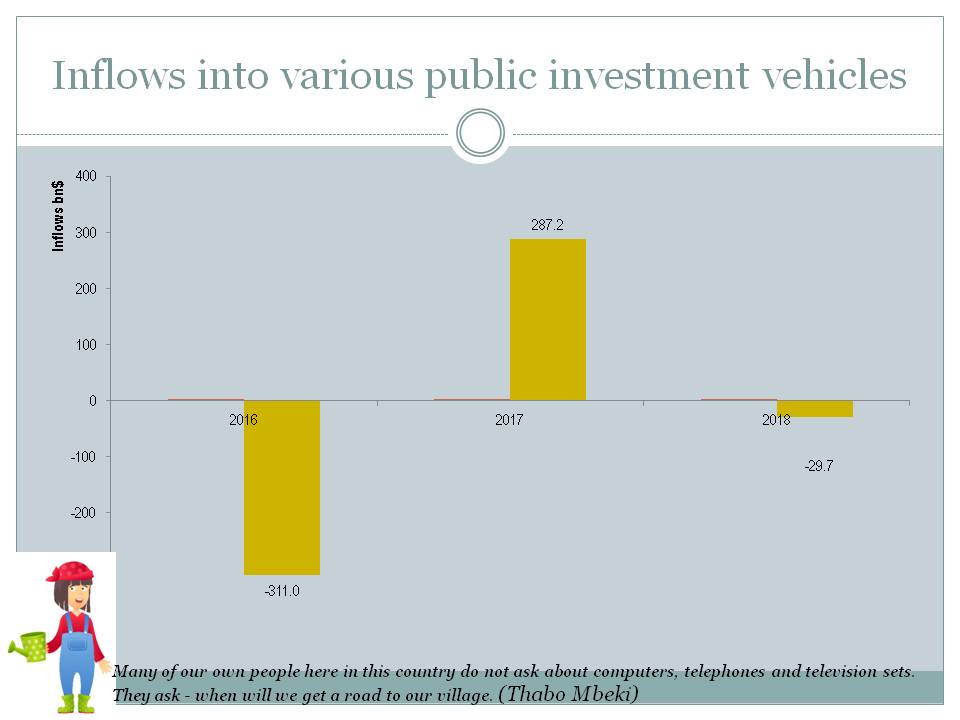

Chart: Inflows into various public investment vehicles

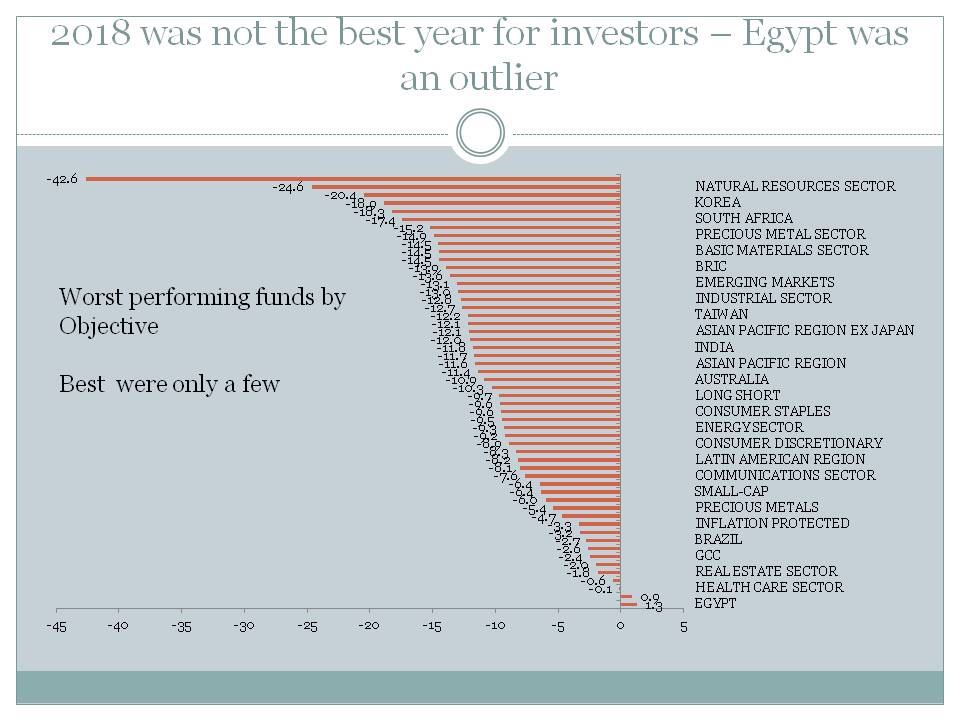

After stellar 2017 when new money generation was extreamly robust and net inflows into various public investment vehicles stood at 287$bn while MSCI World index was up 20.1% (data ex HF and FO) 2018 was a year when most of the things reversed direction vs. 2017

Source: ML

Download file in Power PointKey Topics and News

- Blackrock assets under management drop five per cent

- ETF Investors Sell US Equities in Downturn

- Trellus Management Company Stake in Universal Display (OLED ...

- Order inflows up 30% for infrastructure, capital goods companies in ...

- Goldman Sachs Group Inc (GS) Q4 2018 Earnings Conference Call ...

- Top 100 Real Estate Investment Managers 2018 | Magazine | IPE RA

- Top 400 Asset Managers 2018: 10 years of asset growth | Magazine ...

- The fund managers with the biggest Q1 inflows - Citywire

- 2018 Investment Company Fact Book (pdf)

- North American asset management 2018 - McKinsey

- 2018 Investment Company Fact Book (pdf)

- World Investment Report 2018 - UNCTAD

- Blackstone 2018 Investor Day Presentation

- Top 400 Asset Managers 2018: 10 years of asset growth | Magazine ...

- Asset Management in Europe - Efama

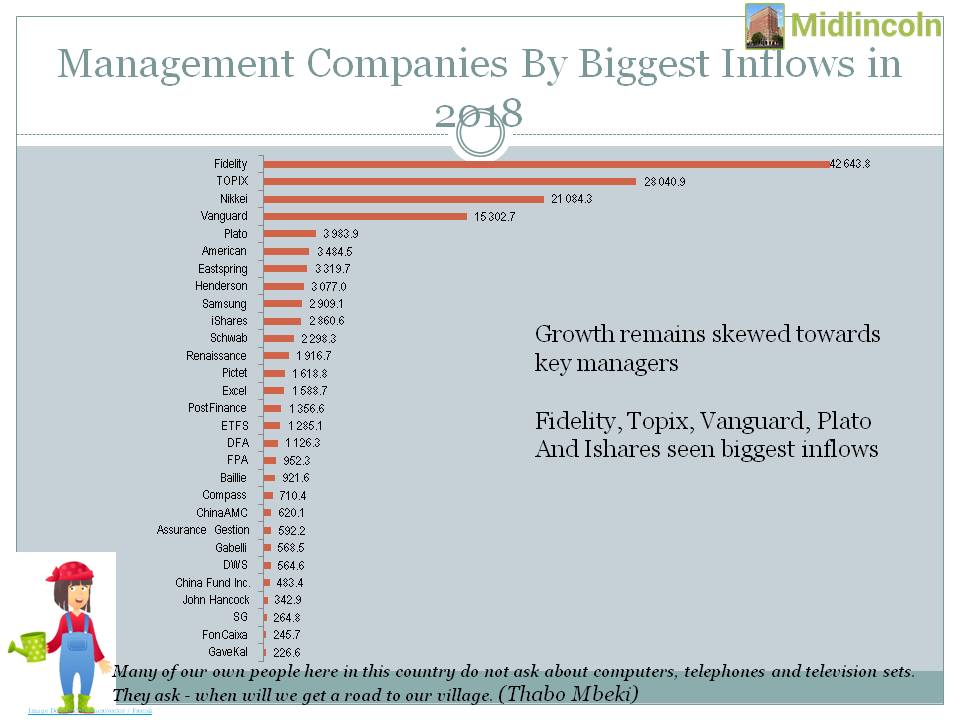

Still in year like this bulge bracket fund management companies recorded healthy inflows

Fidelity + 42bn$

Vanguard +15bn$

(All numbers in this report are Midlincoln Estimates based on data that Midlincoln collects and could be slightly different to absolute total numbers)

Source: ML

- Miton growth bolstered by Williams fund

- Morningstar Reports US Mutual Fund and ETF Asset Flows for Full ...

- ETF Investors Sell US Equities in Downturn

- BNY absorbs severance costs as investment management, wealth ...

- Ashmore inflows grind to halt amid emerging market woes

- Asset outflows/inflows table 2018 | Magazine | IPE Reference Hub

- 5 Charts on U.S. Fund Flows That Show the Shift to Passive ...

- Cash Inflows & Outflows of Operations | Chron.com

- What Are Net Fund Flows? - TheStreet Definition

- How Fund Flows Affect Performance | Morningstar

- The Relation between Past Flows and Future Performance ... - MDPI

- World Investment Report 2017 - UNCTAD

- What Factors Drive Investment Flows? - Fundresearch

- Evidence from Mutual Fund Flows - Haas faculty directory

- Return Persistence and Fund Flows in the Worst Performing Mutual ...

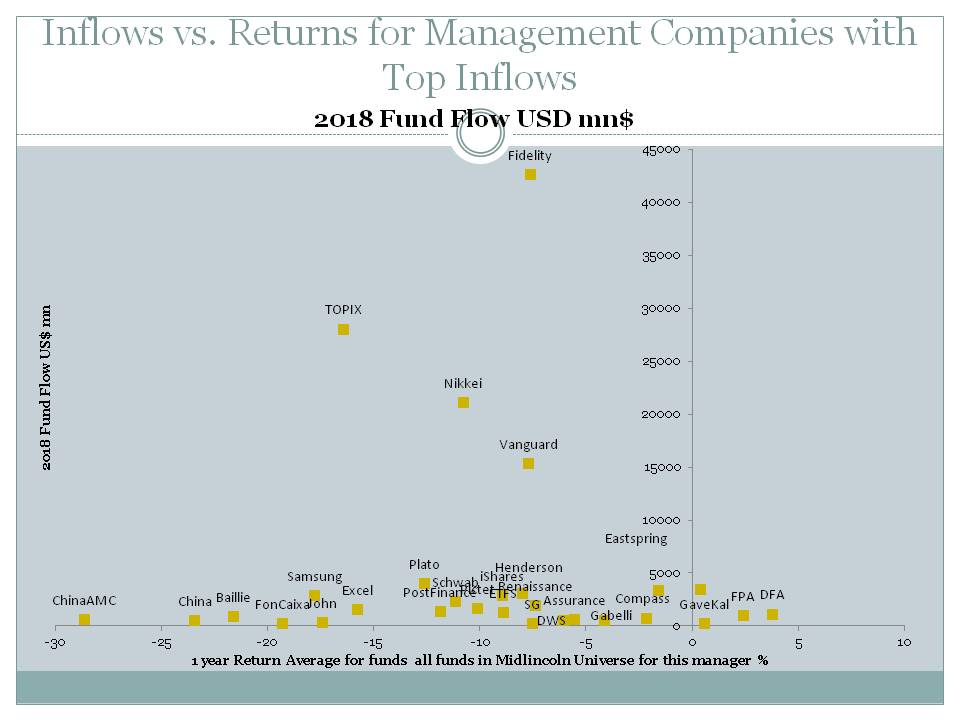

Still our village folks who invested with Vanguard and Fidelity have mostly lost money so the inflow top line has not resulted in significant beta.

Source: ML

- Bank of America's Wealth-Management Business Bucks Trend in ...

- ETF Investors Sell US Equities in Downturn

- Trellus Management Company Stake in Universal Display (OLED ...

- Asian Frontier Markets: Potential Risks, Rewards

- BlackRock (BLK) Q4 2018 Earnings Conference Call Transcript

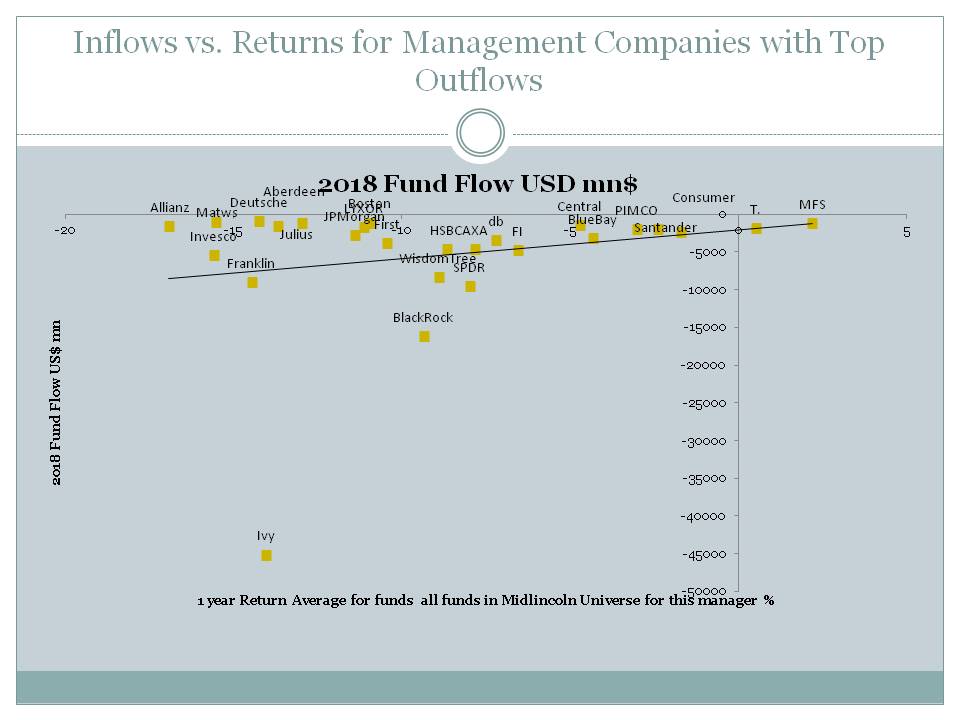

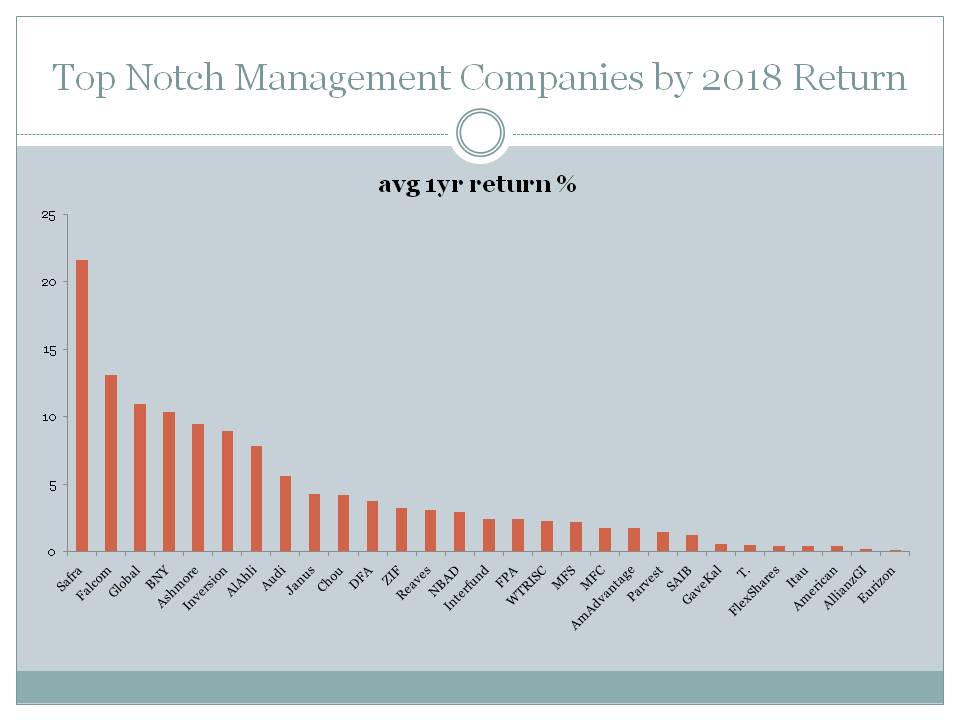

Top notch names among

Both winners and losers

Ivy, BlackRock ex Ishares, StateStreet, Franklin and

WisdomTree seen the biggest outlfows

Source: ML

- Morningstar Reports US Mutual Fund and ETF Asset Flows for Full ...

- Miton growth bolstered by Williams fund

- BNY absorbs severance costs as investment management, wealth ...

- ETF Investors Sell US Equities in Downturn

- David Driscoll's Top Picks: Jan. 17, 2019

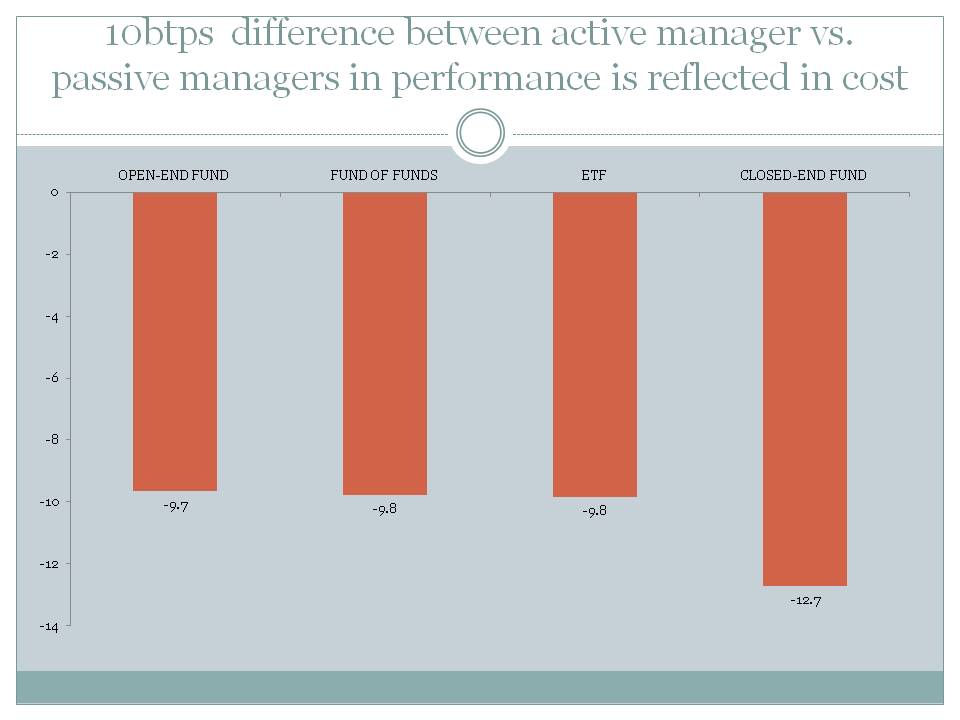

There was a better match between outflows and performance last year

Source: ML

- Oil: 2018 Might Be the Worst Year since 2016

- Which Bond Funds Manage to Outperform After Fees?

- Active Managers Fall Further Behind the Indexes They Aim to Beat

- Stocks' Worst Week Since March Leaves Fund Managers No Room ...

- US Leads Best-Performing ETFs of 2018

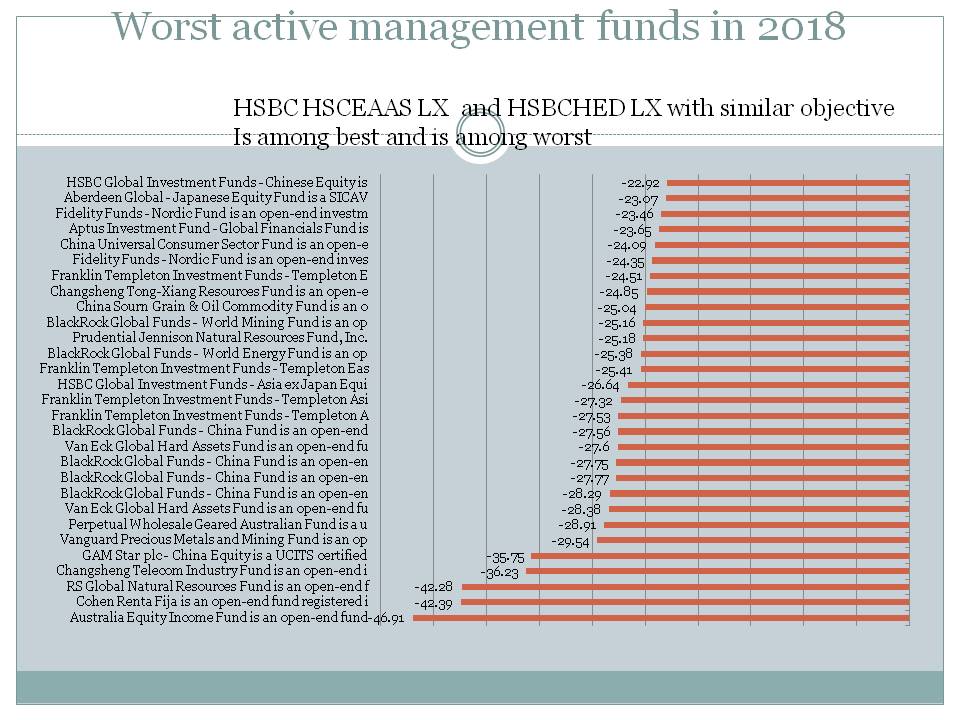

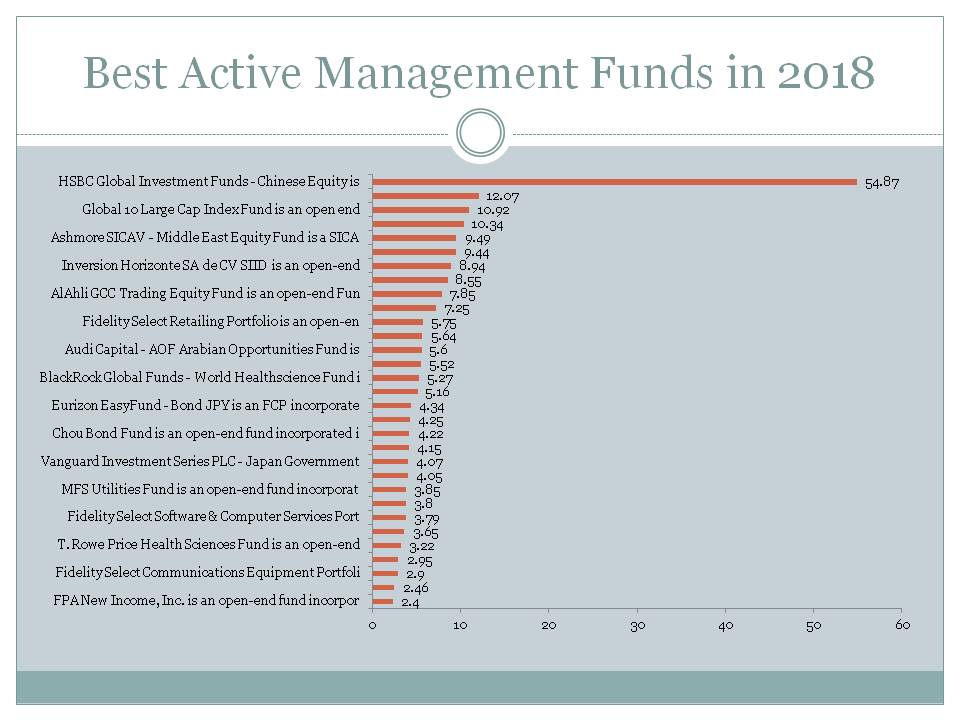

HSBC HSCEAAS LX and HSBCHED LX with similar objective Is among best and is among worst

Source: ML

- The year that was: 2018's best & worst-performing equity funds

- The Top-Performing Mutual Funds Of 2018

- This little-known tax plan beats every other ELSS fund; should you ...

- The best-rated equity funds of 2018

- Most dependable equity mutual fund schemes to ride volatility

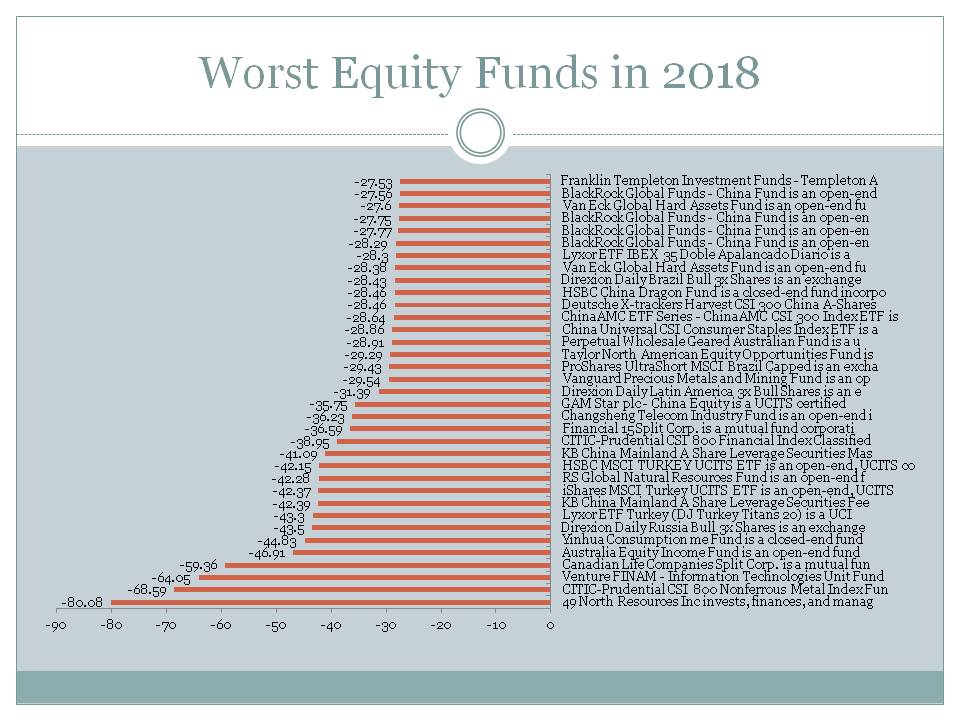

HSBC HSCEAAS LX and HSBCHED LX with similar objective Is among best and is among worst

Source: ML

- The year that was: 2018's best & worst-performing equity funds

- 2018 Was Equity Funds' Worst Year in a Decade

- Mutual fund performance review: The best and worst funds of 2018

- Worst European equity funds of 2018

- 5 Best and Worst-Performing Rated Funds in 2018

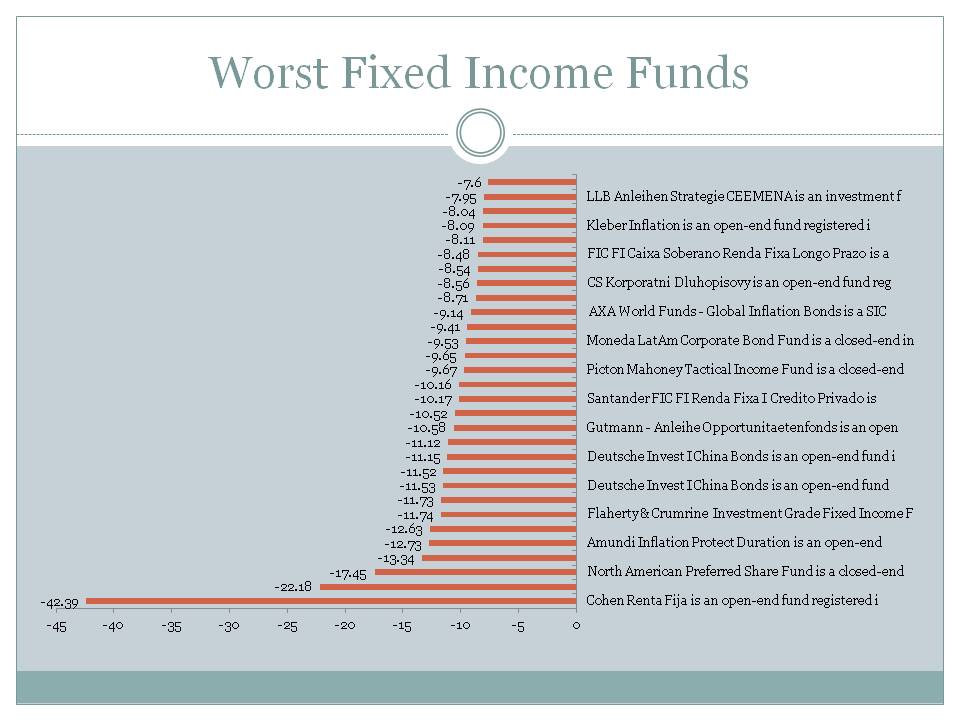

Source: ML

- Best & Worst Fixed Income ETFs Of The Year

- Investors pulled a record $143 billion out of active funds during ...

- These Money Managers Are Getting Ready to Profit From a US ...

- The trading business on Wall Street is struggling and that could ...

- IA stats: Outflows mount from UK retail funds to surpass £2bn

Source: ML

- The Best Bond Funds for 2019 and Beyond

- The 7 Best Bond Funds for Retirement Savers in 2019

- 10 of the Biggest and Best ETFs to Buy Now

- When to Reevaluate Fixed Income Investments

- High-Yield Bond Funds See Biggest Inflow Since December 2016

Source: ML

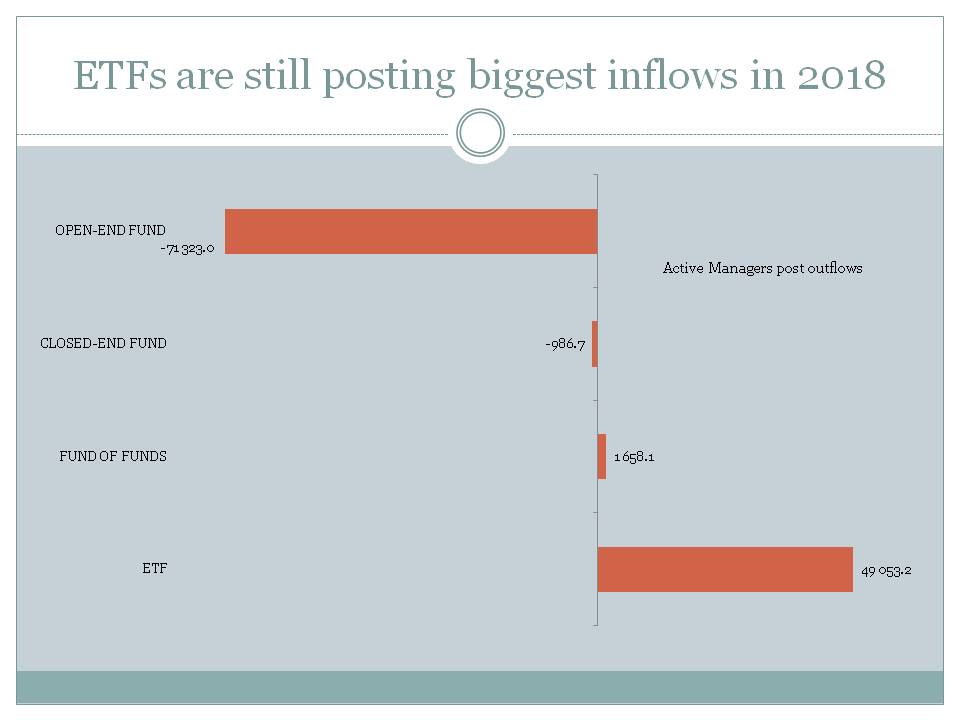

- 'Nowhere to hide' in 2018: Funds with biggest outflows

- Top inflows of 2018

- ETF Inflows Breach $300 Billion Again in 2018

- 2018 ETF Inflows Top $300 Bln Again

- ETF flows: Which two asset classes saw outflows in 2018?

Source: ML

- This little-known tax plan beats every other ELSS fund; should you ...

- Bad bets on oil, gas spark wave of energy-fund closures

- Shift From Active to Passive Approaches Tipping Point in 2019

- A tribute to the legendary investor and Vanguard Group founder ...

- Forge First Gains In December On Credit Card Shorts

Source: ML

- Emerging market funds continue to attract inflows after tough 2018

- ETF flows: Which two asset classes saw outflows in 2018?

- Morningstar Reports US Mutual Fund and ETF Asset Flows for Full ...

- Australian ETFs: end of year reviews 2018

- US investors chose passive over active in 2018

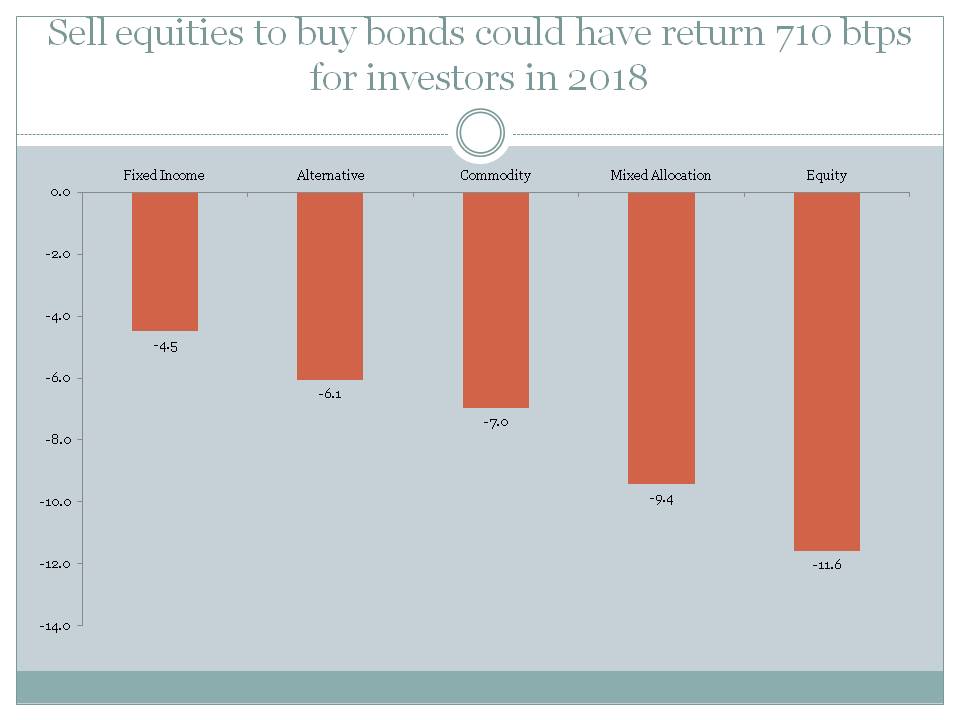

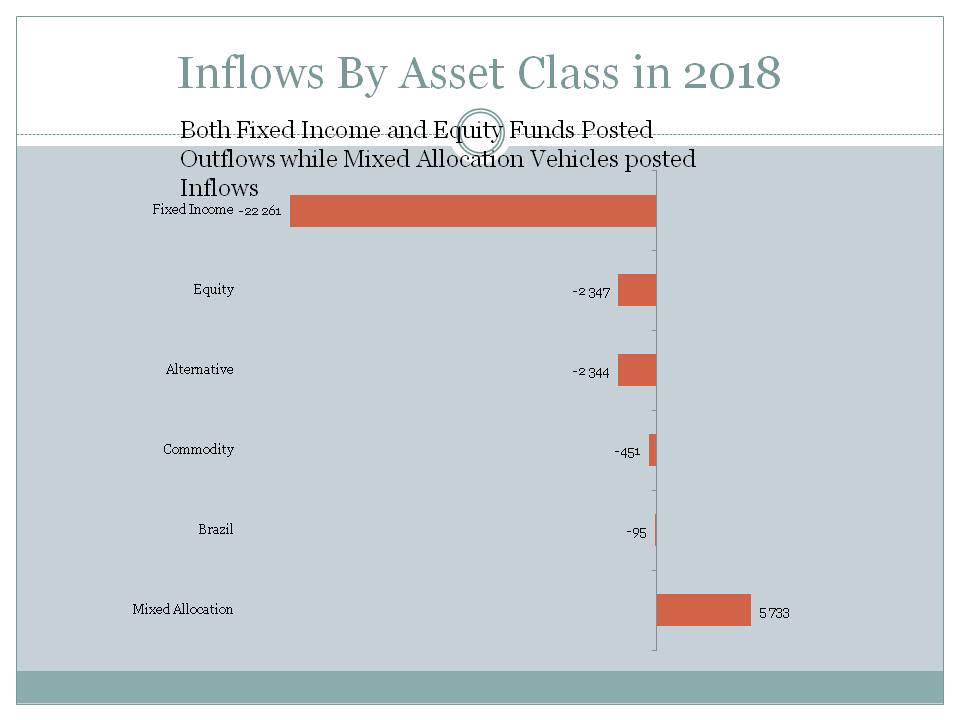

Both Fixed Income and Equity Funds Posted Outflows while Mixed Allocation Vehicles posted Inflows

Source: ML

- Schwab Fourth Quarter Net Income of $935 Million Caps Record Year

- Hancock Whitney Corporation (HWC) Q4 2018 Earnings ...

- Malawi Enhanced Market Analysis - September 2018

- Goldman Sachs Group Inc (GS) Q4 2018 Earnings Conference Call ...

- Synovus Financial Corp (SNV) Q4 2018 Earnings Conference Call ...

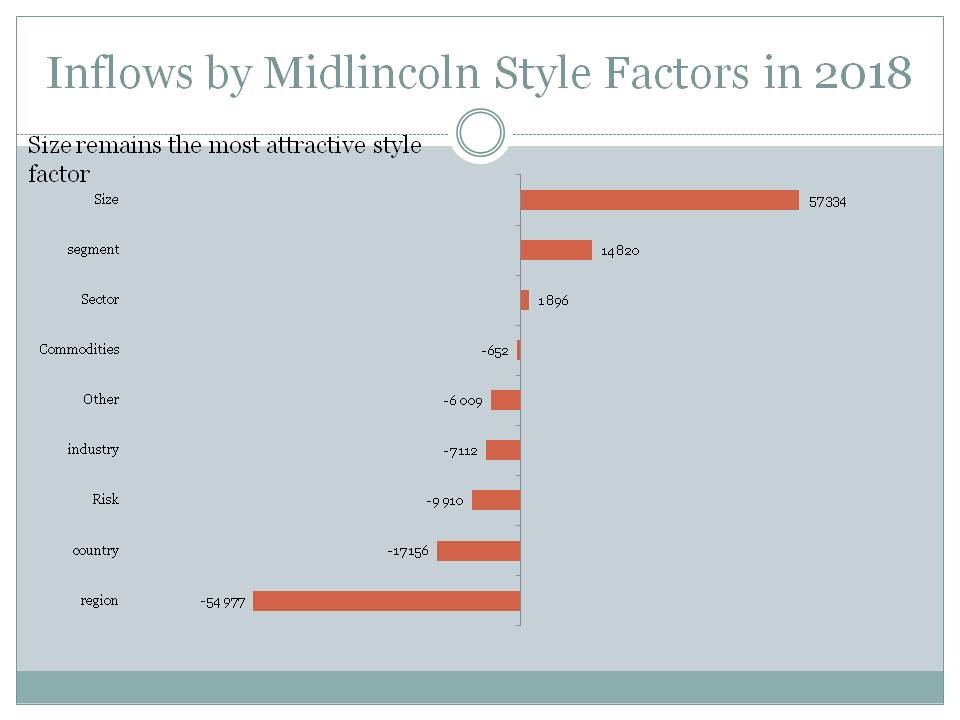

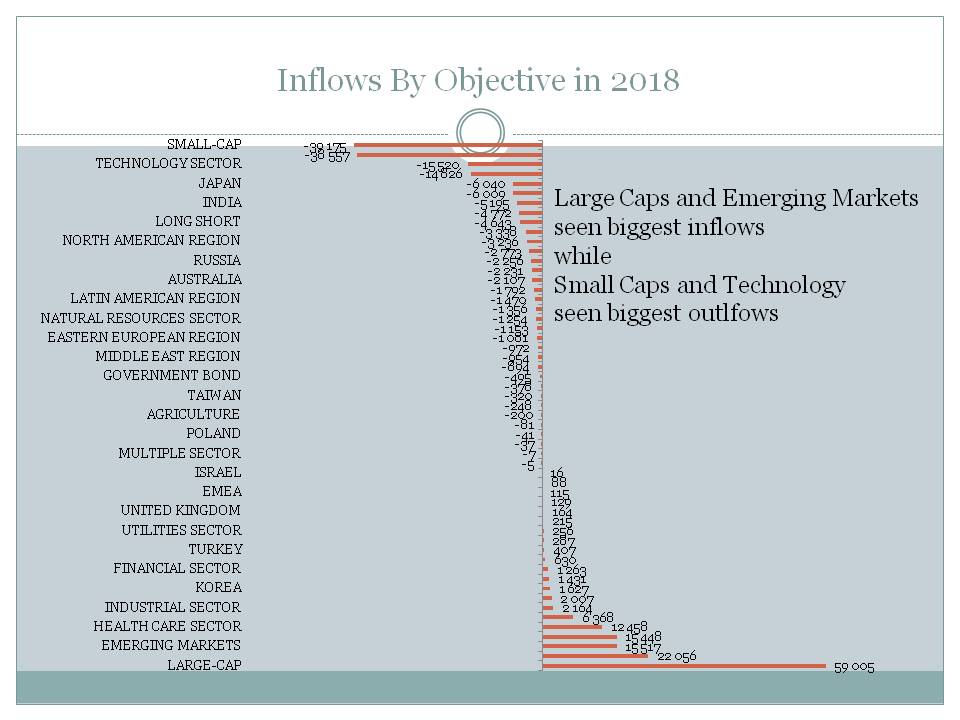

Large Caps and Emerging Markets seen biggest inflows while Small Caps and Technology seen biggest outlfows

Source: ML

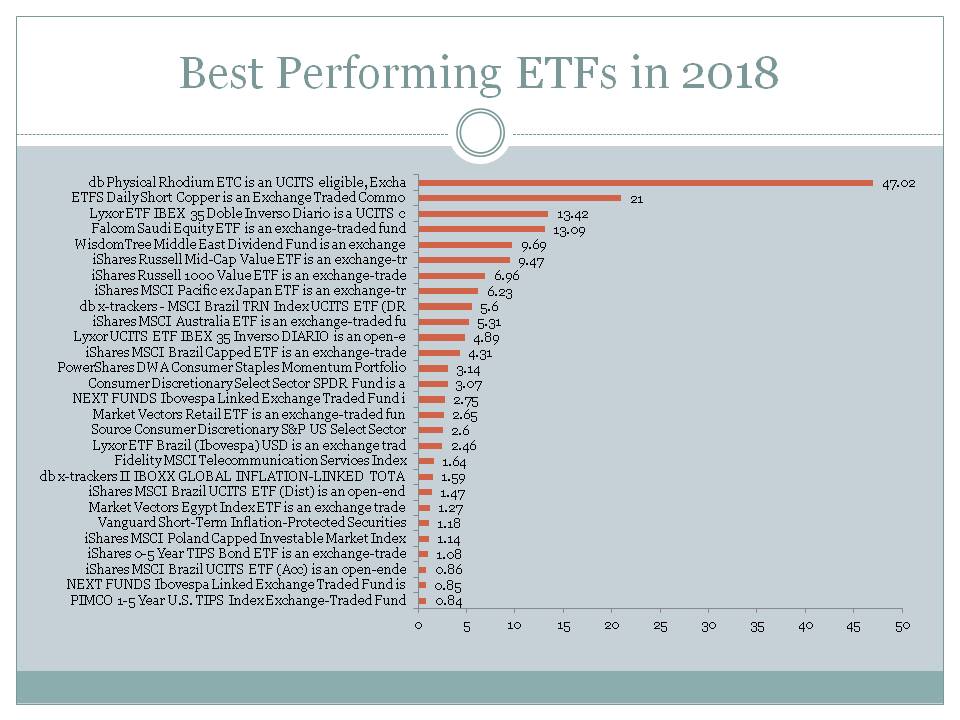

- Top Performing ETFs Of 2018

- 5 Best ETFs Of 2018

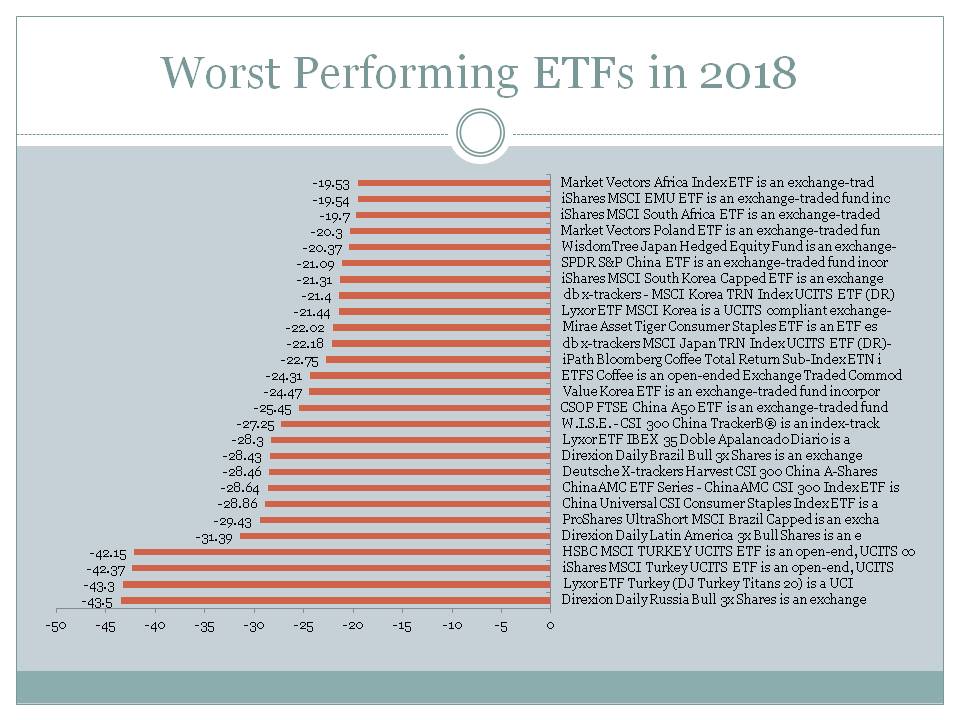

- Worst Performing ETFs Of 2018

- 5 Best Performing Stocks of the Top ETF of 2018

- These 3 Stocks Trounced the Top Marijuana ETFs in 2018, and ...

Source: ML

- Foreign buying of emerging Asian bonds fell sharply in 2018

- 'Nowhere to hide' in 2018: Funds with biggest outflows

- Top inflows of 2018

- Miton growth bolstered by Williams fund

- ETF Investors Sell US Equities in Downturn

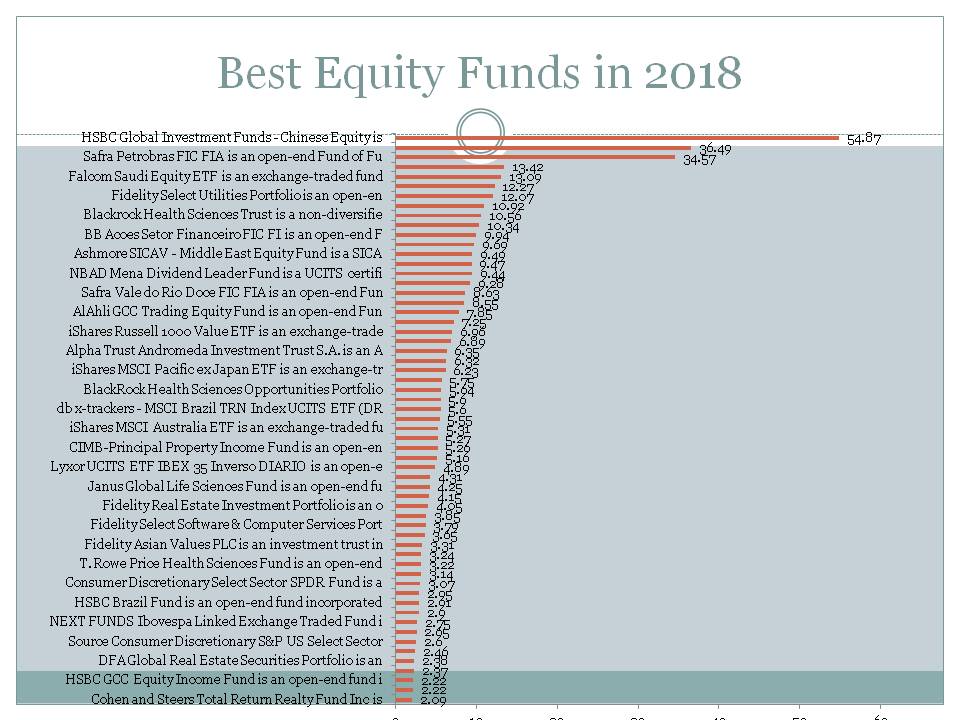

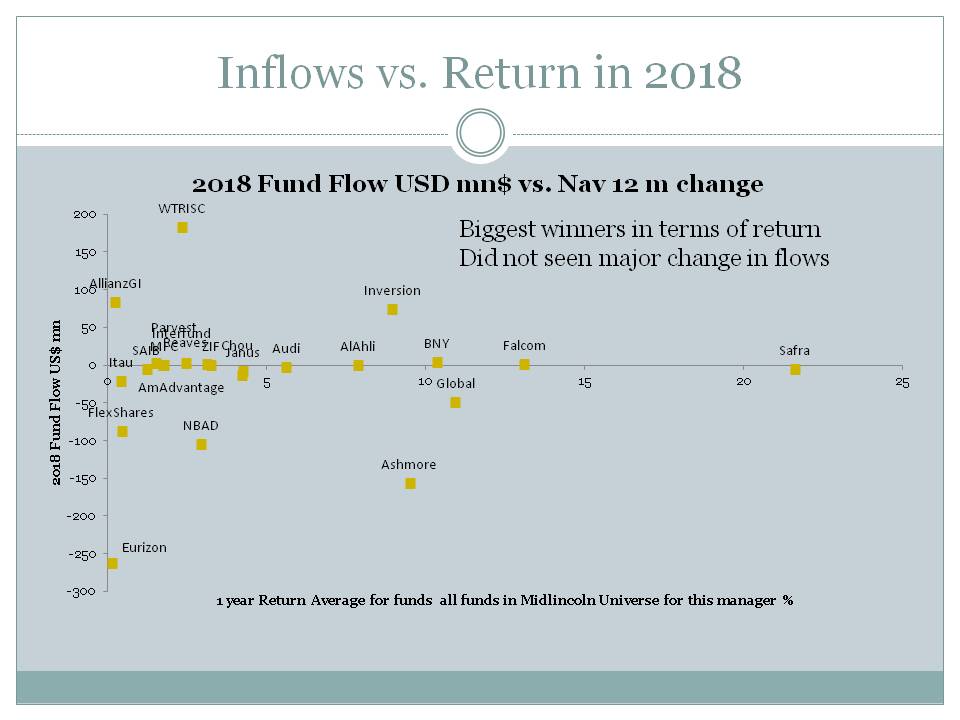

Biggest winners in terms of return Did not seen major change in flows

Source: ML

- What Made This 2018's Top Mutual Fund Focused On Small-Cap ...

- Canntrust Holdings is a steady grower in a rapidly maturing ...

- Fastenal Co (FAST) Q4 2018 Earnings Conference Call Transcript

- Hit the Jackpot With These 3 Top Stocks

- This Undiscovered Brain Stock Could Generate 2,3 or Even 4x ...

Source: ML

- Worst Performing ETFs Of 2018

- Top Performing ETFs Of 2018

- 5 Worst Performing Stocks of Dow ETF Last Week

- Best & Worst Fixed Income ETFs Of The Year

- Best & Worst Performing ETFs to Start 2019

Source: ML

- Total startup funding in MENA region jumps by 31% in 2018

- Here's (Almost) Everything Wall Street Expects in 2019

- MAGNiTT reveals their annual MENA Venture Investment Report ...

- 2018 MENA Startup Funding At Record $893 million, Up 31%

- Is Ancient DNA Research Revealing New Truths — or Falling Into ...

Source: ML

Emerging markets fund flow showed 5425.1 USD mn of inflow. While Frontier Markets funds showed -9.0 USD mn of outflows.

BRAZIL Equity funds showed 658.6 USD mn of inflow.

BRAZIL Fixed Income funds showed 209.3 USD mn of inflow.

CHINA Equity funds showed 437.5 USD mn of inflow.

CHINA Fixed Income funds showed -37.6 USD mn of outflow.

INDIA Equity funds showed 362.6 USD mn of inflow.

INDIA Fixed Income funds showed 25.4 USD mn of inflow.

KOREA Equity funds showed 701.9 USD mn of inflow.

RUSSIA Equity funds showed -89.4 USD mn of outflow.

RUSSIA Fixed Income funds showed -4.1 USD mn of outflow.

SOUTH AFRICA Equity funds showed -0.5 USD mn of outflow.

TURKEY Equity funds showed -20.9 USD mn of outflow.

COMMUNICATIONS SECTOR Equity funds showed -40.9 USD mn of outflow.

ENERGY SECTOR Equity funds showed -1833.3 USD mn of outflow.

ENERGY SECTOR Mixed Allocation funds showed 0.3 USD mn of inflow.

FINANCIAL SECTOR Equity funds showed -284.1 USD mn of outflow.

REAL ESTATE SECTOR Equity funds showed -69.0 USD mn of outflow.

TECHNOLOGY SECTOR Equity funds showed -145.1 USD mn of outflow.

UTILITIES SECTOR Equity funds showed 1771.0 USD mn of inflow.

LONG SHORT Alternative funds showed -1180.9 USD mn of outflow.

LONG SHORT Equity funds showed 131.1 USD mn of inflow.

LONG SHORT Fixed Income funds showed -5.5 USD mn of outflow.

LONG SHORT Mixed Allocation funds showed -0.4 USD mn of outflow.

Latest ML Comics

Markets

Market performance is between 2018-11-30 and 2018-11-01Best global markets since the begining of the week EFM ASIA +3.67%, EM (EMERGING MARKETS) +2.40%, FM (FRONTIER MARKETS) +0.74%,

While worst global markets since the begining of the week EM LATIN AMERICA -4.37%, EUROPE -2.06%, USA 0.57%,

Best since the start of the week among various stock markets were JAMAICA +19.22%, ESTONIA +13.44%, INDONESIA +10.87%, INDIA +9.74%, TURKEY +8.67%, HUNGARY +7.47%, POLAND +6.70%, HONG KONG +5.12%, PHILIPPINES +4.75%, CHINA +4.04%,

While worst since the start of the week among various stock markets were MEXICO -9.09%, IRELAND -6.43%, PERU -5.68%, NORWAY -5.65%, UNITED ARAB EMIRATES -5.57%, JORDAN -5.30%, FINLAND -5.16%, PAKISTAN -4.95%, AUSTRIA -4.80%, TUNISIA -3.66%,

Key Fund Flow Headlines

Top 20 Funds Longs Based on Momentum

| Name | 1week | 1month | ytd | 6months | 1yr | Rank |

| SANTANDER FIC FI PETROBRAS 3 ACOES (REALPET) | 5.49 | 16.09 | 19.23 | 45.86 | 36.49 | 25.98 |

| SAFRA PETROBRAS FIC FIA (SAFPETR) | 5.43 | 15.94 | 19.06 | 44.87 | 34.57 | 25.20 |

| DIREXION DAILY BRAZIL BULL 3X SHARES (BRZU) | 5.93 | 43.15 | 37.40 | 64.53 | -28.43 | 21.30 |

| BB ACOES SETOR FINANCEIRO FIC FI (BBACOEB) | 2.17 | 15.55 | 11.52 | 37.95 | 9.94 | 16.40 |

| DB X-TRACKERS MSCI BRAZIL INDEX UCITS ETF (XMBR) | 3.27 | 16.13 | 11.16 | 29.47 | 5.60 | 13.62 |

| BNY MELLON GLOBAL FUNDS PLC - BRAZIL EQUITY FUND (HZ5R) | 1.81 | 14.97 | 14.12 | 26.14 | 10.34 | 13.32 |

| DB PHYSICAL RHODIUM ETC (XRH0) | 0.08 | -3.49 | 0.08 | 7.44 | 47.02 | 12.76 |

| NEXT FUNDS IBOVESPA LINKED EXCHANGE TRADED FUND (01311087) | 4.45 | 15.33 | 13.95 | 27.95 | 2.75 | 12.62 |

| LYXOR ETF BRAZIL IBOVESPA USD (LYRIO) | 2.09 | 15.15 | 12.75 | 27.61 | 2.46 | 11.83 |

| HSBC BRAZIL FUND - DIVIDEND (HSBCBRD) | 1.72 | 15.26 | 11.90 | 26.67 | 2.91 | 11.64 |

| AMADVANTAGE BRAZIL (AMABRRM) | 1.84 | 14.39 | 11.96 | 27.55 | 1.74 | 11.38 |

| HSBC EQUITY FUND/INDIA - DIVIDEND (HSBCHED) | 3.70 | 1.57 | 2.99 | -14.71 | 54.87 | 11.36 |

| HSBC GLOBAL INVESTMENT FUNDS - CHINESE EQUITY - ED (HSBCHED) | 3.70 | 1.57 | 2.99 | -14.71 | 54.87 | 11.36 |

| ISHARES MSCI BRAZIL UCITS ETF (INC) (IBZL) | 1.88 | 15.90 | 12.33 | 26.05 | 1.47 | 11.33 |

| HSBC GLOBAL INVESTMENT FUNDS - BRAZIL EQUITY (JM5C) | 2.25 | 13.59 | 11.51 | 26.43 | 2.84 | 11.28 |

| ISHARES MSCI BRAZIL CAPPED ETF (EWZ) | 2.51 | 9.49 | 16.89 | 28.10 | 4.31 | 11.10 |

| JPMORGAN FUNDS - BRAZIL EQUITY - A$ (JPBRADA) | 3.82 | 12.21 | 9.84 | 26.94 | -0.20 | 10.69 |

| ISHARES MSCI BRAZIL UCITS ETF (CSBR) | 2.21 | 13.19 | 10.54 | 25.41 | 0.86 | 10.42 |

| JPMORGAN FUNDS - BRAZIL EQUITY - D$ (JPBRPAD) | 3.88 | 12.22 | 9.73 | 26.33 | -1.08 | 10.34 |

| BLACKROCK LATIN AMERICAN INVESTMENT TRUST PLC (BRLA) | 6.20 | 18.71 | 10.70 | 15.47 | -0.51 | 9.97 |

Top 20 Funds Shorts Based on Momentum

| Name | 1week | 1month | ytd | 6months | 1yr | Rank |

| 49 NORTH RESOURCES INC (FNR) | -18.57 | -32.49 | 2.92 | -69.14 | -80.08 | -50.07 |

| FINAM MANAGEMENT LLC (FINMIT) | 0.93 | -29.81 | 3.89 | -45.95 | -64.05 | -34.72 |

| VELOCITYSHARES 3X LONG NATURAL GAS ETN (UGAZ) | 1.17 | -69.38 | 5.80 | -22.28 | -44.64 | -33.78 |

| CITIC-PRUDENTIAL CSI 800 NONFERROUS METAL INDEX FUND (150151) | -3.60 | -11.57 | -5.14 | -51.16 | -68.59 | -33.73 |

| PROSHARES ULTRASHORT MSCI BRAZIL CAPPED (BZQ) | -4.24 | -24.54 | -21.17 | -48.36 | -29.43 | -26.64 |

| FINANCIAL 15 SPLIT CORP (FTN) | 5.98 | -19.08 | 6.99 | -36.20 | -36.59 | -21.47 |

| AUSTRALIA EQUITY INCOME FUND (DWAUEIP) | -1.94 | -2.54 | -1.87 | -33.69 | -46.91 | -21.27 |

| RS GLOBAL NATURAL RESOURCES FUND - C (RGNCX) | 3.71 | -4.32 | 10.58 | -39.65 | -42.28 | -20.63 |

| MARKET VECTORS OIL SERVICE ETF (OIH) | 6.85 | 2.15 | 15.79 | -36.99 | -42.78 | -17.69 |

| PROSHARES ULTRA DJ-UBS CRUDE OIL (UCO) | 14.70 | -2.88 | 26.92 | -46.63 | -35.39 | -17.55 |

| CANADIAN LIFE COS SPLIT CORP (LFE) | 12.00 | 16.09 | 24.59 | -34.95 | -59.36 | -16.56 |

| YINHUA CONSUMPTION THEME FUND (150048) | 1.32 | 1.76 | 4.39 | -20.85 | -44.83 | -15.65 |

| COHEN RENTA FIJA FONDO COMUN DE INVERSION - A-MINORISTA (CRTAFAM) | 1.11 | 4.91 | 2.70 | -25.00 | -42.39 | -15.34 |

| CAPITAL CHINA NEW OPPORTUNITY EQUITY FUND - USD (CAPGNEU) | 3.22 | -1.97 | 1.92 | -28.23 | -33.55 | -15.13 |

| DIREXION DAILY GOLD MINERS BULL 3X SHARES (NUGT) | -2.51 | 14.63 | -0.11 | -24.82 | -45.23 | -14.48 |

| JPMORGAN CHINESE INVESTMENT TRUST PLC (JMC) | 2.15 | -1.54 | 1.59 | -24.14 | -32.43 | -13.99 |

| LYXOR ETF FTSE ATHEX 20 (GRE) | 0.63 | -2.91 | 0.24 | -21.74 | -31.54 | -13.89 |

| GAM STAR FUND PLC - CHINA EQUITY - C EUR ACC (GAMCCEA) | 6.76 | 1.43 | 5.25 | -27.06 | -35.75 | -13.66 |

| KB CHINA MAINLAND A SHARE LEVERAGE SEC FEEDER INVST TRUST-EQUITY-DERV FOF (3AF8926) | 5.78 | -2.19 | 4.41 | -14.88 | -42.39 | -13.42 |

| UBS HANA AMBATOVY NICKEL OVERSEAS INVESTMENT COMPANY 1 (2772642) | 1.09 | 1.59 | 1.55 | -23.65 | -31.74 | -13.18 |

Best Funds last Week

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| NEXT NOTES NIKKEI TOCOM LEVERAGED CRUDE OIL ETN (2038) | 2.92 | 27.53 | 19.75 | -0.18 | -32.18 | -13.82 | -6.61 |

| ETFS WTI CRUDE OIL (CRUD) | 8.06 | 15.01 | 15.01 | 2.15 | -18.45 | -11.84 | -3.28 |

| PROSHARES ULTRA DJ-UBS CRUDE OIL (UCO) | -3.00 | 26.92 | 14.70 | -2.88 | -46.63 | -35.39 | -17.55 |

| LIFE & BANC SPLIT CORP (LBS) | -0.54 | 16.16 | 14.62 | 8.74 | -14.71 | -19.81 | -2.79 |

| WTI CRUDE OIL PRICE LINKED ETF (9D311097) | 0.73 | 17.33 | 12.60 | 2.96 | -22.06 | -12.45 | -4.74 |

| SIMPLEX CHINA BULL 2X H-SHARE ETF (9D31112C) | 0.20 | 6.84 | 12.04 | 1.54 | -10.11 | -29.93 | -6.62 |

| CANADIAN LIFE COS SPLIT CORP (LFE) | 1.44 | 24.59 | 12.00 | 16.09 | -34.95 | -59.36 | -16.56 |

| NUVEEN REAL ESTATE INCOME FUND (JRS) | 0.86 | 11.35 | 11.76 | 1.39 | -2.34 | -5.01 | 1.45 |

| UNITED STATES OIL FUND LP (U9N) | -1.19 | 18.08 | 11.70 | -0.33 | -26.06 | -16.06 | -7.69 |

| WTI CRUDE OIL PRICE LINKED ETF (1671) | 2.08 | 14.49 | 10.51 | 2.56 | -22.27 | -12.70 | -5.48 |

| SPDR S&P METALS & MINING ETF (SSGG) | -0.28 | 9.36 | 10.35 | 2.15 | -21.98 | -26.92 | -9.10 |

| ISHARES MSCI SOUTH AFRICA ETF (ISVW) | 1.17 | 12.17 | 10.15 | 11.12 | -5.54 | -19.70 | -0.99 |

| DIVIDEND 15 SPLIT CORP (DFN) | 0.44 | 14.23 | 8.86 | 9.47 | -10.72 | -16.38 | -2.19 |

| ABERDEEN AUSTRALIA EQUITY FUND INC (IAF) | 0.19 | 9.89 | 8.52 | 8.14 | -8.27 | -10.98 | -0.65 |

| DIREXION DAILY LATIN AMERICA BULL 3X SHARES (LBJ) | -1.96 | 32.31 | 8.40 | 37.31 | 15.68 | -31.39 | 7.50 |

| SIMPLEX CHINA BULL 2X H-SHARE ETF (1572) | 0.96 | 8.40 | 8.28 | 1.76 | -9.63 | -29.26 | -7.21 |

| ISHARES MSCI ITALY CAPPED ETF (ISVQ) | -0.29 | 4.70 | 8.19 | 5.01 | -11.57 | -18.81 | -4.30 |

| ISHARES MSCI SWEDEN ETF (ISVT) | -0.44 | 5.07 | 8.19 | 7.84 | -5.03 | -14.18 | -0.79 |

| SPOTR OMXS30 (SPOTROMX) | 8.19 | 5.30 | 8.17 | 1.48 | -6.49 | -13.62 | -2.61 |

| ALPINE GLOBAL PREMIER PROPERTIES FUND (AWP) | 0.09 | 9.34 | 7.71 | 1.66 | -9.76 | -12.96 | -3.34 |

Worst Funds last Week

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| LYXOR UCITS ETF IBEX 35 INVERSO DIARIO (INVEX) | -6.92 | -9.66 | -7.46 | -6.44 | -2.77 | -9.63 | -6.58 |

| SIMPLEX CHINA BEAR 1X H-SHARE ETF (1573) | -0.10 | -3.33 | -4.72 | -1.49 | 2.14 | 10.08 | 1.50 |

| SIMPLEX CHINA BEAR 1X H-SHARE ETF (9D31212C) | 0.35 | -4.00 | -4.39 | -0.81 | 1.90 | 10.31 | 1.75 |

| PROSHARES ULTRASHORT MSCI BRAZIL CAPPED (BZQ) | 1.22 | -21.17 | -4.24 | -24.54 | -48.36 | -29.43 | -26.64 |

| CITIC-PRUDENTIAL CSI 800 NONFERROUS METAL INDEX FUND (150151) | -5.07 | -5.14 | -3.60 | -11.57 | -51.16 | -68.59 | -33.73 |

| LYXOR ETF IBEX 35 DOBLE INVERSO DIARIO (2INVE) | -0.70 | -7.35 | -2.85 | -3.86 | 10.85 | 13.42 | 4.39 |

| DB X-TRACKERS II IBOXX GLOBAL INFLATION-LINKED TOTAL RETURN INDEX HEDGED ETF-USD (XG7U) | 1.60 | 1.29 | -2.59 | 1.71 | 1.48 | 0.35 | 0.24 |

| DIREXION DAILY GOLD MINERS BULL 3X SHARES (NUGT) | 1.97 | -0.11 | -2.51 | 14.63 | -24.82 | -45.23 | -14.48 |

| FONDUL PROPRIETATEA SA/FUND (FP) | -1.35 | -1.04 | -2.39 | -7.29 | -3.21 | -2.26 | -3.79 |

| INVESCO FUNDS SICAV - GOLD & PRECIOUS METALS FUND - A-ACCUMULATION HKD (IVGPACH) | -1.00 | 1.82 | -2.09 | 5.38 | -10.42 | -20.75 | -6.97 |

| LYXOR ETF FTSE MIB DAILY SHORT BEAR (BERMIB) | -0.16 | -4.87 | -2.03 | -2.30 | 8.00 | 5.77 | 2.36 |

| ABERDEEN GLOBAL - INDIAN EQUITY FUND - A2 (AEF2) | 0.02 | -1.42 | -1.81 | 4.26 | -6.63 | -8.21 | -3.10 |

| HSBC FIC FI MULTIMERCADO LONGO PRAZO DIVERSIFICACAO (HSBCALT) | -1.04 | 0.79 | -1.75 | 3.52 | 3.04 | -4.96 | -0.04 |

| HSBC YATIRIM B TIPI ALTIN FONU (HSBCALT) | -1.04 | 0.79 | -1.75 | 3.52 | 3.04 | -4.96 | -0.04 |

| WISDOMTREE INDIA EARNINGS FUND (EPI) | -0.29 | -1.90 | -1.66 | 6.21 | -4.55 | -14.51 | -3.63 |

| MARKET VECTORS JUNIOR GOLD MINERS ETF (VE42) | -1.16 | 5.42 | -1.61 | 11.42 | -6.01 | -9.74 | -1.48 |

| ISHARES INDIA 50 ETF (INDY) | -0.39 | -1.44 | -1.55 | 5.55 | -3.33 | -7.21 | -1.64 |

| ISHARES MSCI INDIA ETF (INDA) | -0.59 | -1.60 | -1.53 | 5.55 | -3.03 | -10.69 | -2.43 |

| MIRAE ASSET TIGER CONSUMER STAPLES ETF (139280) | -0.40 | -1.50 | -1.52 | 1.28 | -7.58 | -22.02 | -7.46 |

| ABERDEEN GLOBAL - JAPANESE SMALLER COMPANIERS FUND - D2 GBP (AEF4) | -0.42 | 0.52 | -1.51 | -2.03 | -13.70 | -17.43 | -8.67 |

Best Funds last Month

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| DIREXION DAILY BRAZIL BULL 3X SHARES (BRZU) | -1.80 | 37.40 | 5.93 | 43.15 | 64.53 | -28.43 | 21.30 |

| DIREXION DAILY LATIN AMERICA BULL 3X SHARES (LBJ) | -1.96 | 32.31 | 8.40 | 37.31 | 15.68 | -31.39 | 7.50 |

| BLACKROCK LATIN AMERICAN INVESTMENT TRUST PLC (BRLA) | 0.87 | 10.70 | 6.20 | 18.71 | 15.47 | -0.51 | 9.97 |

| DB X-TRACKERS MSCI BRAZIL INDEX UCITS ETF (XMBR) | 1.04 | 11.16 | 3.27 | 16.13 | 29.47 | 5.60 | 13.62 |

| CANADIAN LIFE COS SPLIT CORP (LFE) | 1.44 | 24.59 | 12.00 | 16.09 | -34.95 | -59.36 | -16.56 |

| ISHARES MSCI BRAZIL UCITS ETF (INC) (IBZL) | -0.74 | 12.33 | 1.88 | 15.90 | 26.05 | 1.47 | 11.33 |

| NEXT FUNDS IBOVESPA LINKED EXCHANGE TRADED FUND (01311087) | -0.37 | 13.95 | 4.45 | 15.33 | 27.95 | 2.75 | 12.62 |

| LYXOR ETF BRAZIL IBOVESPA USD (LYRIO) | -0.27 | 12.75 | 2.09 | 15.15 | 27.61 | 2.46 | 11.83 |

| BNY MELLON GLOBAL FUNDS PLC - BRAZIL EQUITY FUND (HZ5R) | 0.05 | 14.12 | 1.81 | 14.97 | 26.14 | 10.34 | 13.32 |

| DIREXION DAILY GOLD MINERS BULL 3X SHARES (NUGT) | 1.97 | -0.11 | -2.51 | 14.63 | -24.82 | -45.23 | -14.48 |

| BLACKROCK WORLD MINING TRUST PLC (BRWM) | 1.65 | 6.04 | 4.76 | 13.66 | -4.83 | -16.05 | -0.61 |

| ISHARES MSCI BRAZIL UCITS ETF (CSBR) | -1.13 | 10.54 | 2.21 | 13.19 | 25.41 | 0.86 | 10.42 |

| JPMORGAN FUNDS - LATIN AMERICA EQUITY FUND (JPJ0) | -0.07 | 10.94 | 1.85 | 12.41 | 12.56 | -5.04 | 5.45 |

| ISHARES LATIN AMERICA 40 ETF (ILF) | -0.53 | 10.55 | 3.02 | 12.34 | 11.00 | -2.56 | 5.95 |

| BLACKROCK GLOBAL FUNDS - LATIN AMERICA FUND - EURA2 (ERDP) | -1.65 | 10.48 | 1.78 | 12.30 | 13.13 | 0.16 | 6.84 |

| LYXOR ETF MSCI EM LATIN AMERICA EUR (LATAM) | -0.58 | 10.48 | 2.76 | 12.09 | 10.73 | -2.07 | 5.88 |

| NEXT FUNDS IBOVESPA LINKED EXCHANGE TRADED FUND (1325) | 0.50 | 10.26 | 1.05 | 12.01 | 24.41 | 0.85 | 9.58 |

| ISHARES MSCI EM LATIN AMERICA (DLTM) | -0.72 | 8.95 | 2.80 | 11.87 | 10.78 | -2.43 | 5.75 |

| ISHARES MSCI MEXICO CAPPED UCITS ETF (CMXC) | -0.56 | 6.71 | 4.50 | 11.82 | -11.34 | -9.14 | -1.04 |

| HSBC MSCI MEXICO CAPPED UCITS ETF (HMED) | -0.49 | 7.31 | 4.68 | 11.81 | -11.30 | -9.08 | -0.97 |

Worst Funds last Month

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| DIREXION DAILY BRAZIL BULL 3X SHARES (BRZU) | -1.80 | 37.40 | 5.93 | 43.15 | 64.53 | -28.43 | 21.30 |

| DIREXION DAILY LATIN AMERICA BULL 3X SHARES (LBJ) | -1.96 | 32.31 | 8.40 | 37.31 | 15.68 | -31.39 | 7.50 |

| BLACKROCK LATIN AMERICAN INVESTMENT TRUST PLC (BRLA) | 0.87 | 10.70 | 6.20 | 18.71 | 15.47 | -0.51 | 9.97 |

| DB X-TRACKERS MSCI BRAZIL INDEX UCITS ETF (XMBR) | 1.04 | 11.16 | 3.27 | 16.13 | 29.47 | 5.60 | 13.62 |

| CANADIAN LIFE COS SPLIT CORP (LFE) | 1.44 | 24.59 | 12.00 | 16.09 | -34.95 | -59.36 | -16.56 |

| ISHARES MSCI BRAZIL UCITS ETF (INC) (IBZL) | -0.74 | 12.33 | 1.88 | 15.90 | 26.05 | 1.47 | 11.33 |

| NEXT FUNDS IBOVESPA LINKED EXCHANGE TRADED FUND (01311087) | -0.37 | 13.95 | 4.45 | 15.33 | 27.95 | 2.75 | 12.62 |

| LYXOR ETF BRAZIL IBOVESPA USD (LYRIO) | -0.27 | 12.75 | 2.09 | 15.15 | 27.61 | 2.46 | 11.83 |

| BNY MELLON GLOBAL FUNDS PLC - BRAZIL EQUITY FUND (HZ5R) | 0.05 | 14.12 | 1.81 | 14.97 | 26.14 | 10.34 | 13.32 |

| DIREXION DAILY GOLD MINERS BULL 3X SHARES (NUGT) | 1.97 | -0.11 | -2.51 | 14.63 | -24.82 | -45.23 | -14.48 |

| BLACKROCK WORLD MINING TRUST PLC (BRWM) | 1.65 | 6.04 | 4.76 | 13.66 | -4.83 | -16.05 | -0.61 |

| ISHARES MSCI BRAZIL UCITS ETF (CSBR) | -1.13 | 10.54 | 2.21 | 13.19 | 25.41 | 0.86 | 10.42 |

| JPMORGAN FUNDS - LATIN AMERICA EQUITY FUND (JPJ0) | -0.07 | 10.94 | 1.85 | 12.41 | 12.56 | -5.04 | 5.45 |

| ISHARES LATIN AMERICA 40 ETF (ILF) | -0.53 | 10.55 | 3.02 | 12.34 | 11.00 | -2.56 | 5.95 |

| BLACKROCK GLOBAL FUNDS - LATIN AMERICA FUND - EURA2 (ERDP) | -1.65 | 10.48 | 1.78 | 12.30 | 13.13 | 0.16 | 6.84 |

| LYXOR ETF MSCI EM LATIN AMERICA EUR (LATAM) | -0.58 | 10.48 | 2.76 | 12.09 | 10.73 | -2.07 | 5.88 |

| NEXT FUNDS IBOVESPA LINKED EXCHANGE TRADED FUND (1325) | 0.50 | 10.26 | 1.05 | 12.01 | 24.41 | 0.85 | 9.58 |

| ISHARES MSCI EM LATIN AMERICA (DLTM) | -0.72 | 8.95 | 2.80 | 11.87 | 10.78 | -2.43 | 5.75 |

| ISHARES MSCI MEXICO CAPPED UCITS ETF (CMXC) | -0.56 | 6.71 | 4.50 | 11.82 | -11.34 | -9.14 | -1.04 |

| HSBC MSCI MEXICO CAPPED UCITS ETF (HMED) | -0.49 | 7.31 | 4.68 | 11.81 | -11.30 | -9.08 | -0.97 |

Best Funds YTD

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| DIREXION DAILY BRAZIL BULL 3X SHARES (BRZU) | -1.80 | 37.40 | 5.93 | 43.15 | 64.53 | -28.43 | 21.30 |

| DIREXION DAILY LATIN AMERICA BULL 3X SHARES (LBJ) | -1.96 | 32.31 | 8.40 | 37.31 | 15.68 | -31.39 | 7.50 |

| NEXT NOTES NIKKEI TOCOM LEVERAGED CRUDE OIL ETN (2038) | 2.92 | 27.53 | 19.75 | -0.18 | -32.18 | -13.82 | -6.61 |

| PROSHARES ULTRA DJ-UBS CRUDE OIL (UCO) | -3.00 | 26.92 | 14.70 | -2.88 | -46.63 | -35.39 | -17.55 |

| CANADIAN LIFE COS SPLIT CORP (LFE) | 1.44 | 24.59 | 12.00 | 16.09 | -34.95 | -59.36 | -16.56 |

| DIREXION DAILY RUSSIA BULL 3X SHARES (RUSL) | -1.41 | 21.64 | 5.53 | 10.18 | -20.33 | -43.50 | -12.03 |

| UNITED STATES OIL FUND LP (U9N) | -1.19 | 18.08 | 11.70 | -0.33 | -26.06 | -16.06 | -7.69 |

| WTI CRUDE OIL PRICE LINKED ETF (9D311097) | 0.73 | 17.33 | 12.60 | 2.96 | -22.06 | -12.45 | -4.74 |

| TORTOISE ENERGY INFRASTRUCTURE CORP (TYG) | -1.48 | 17.04 | 4.54 | 7.38 | -8.47 | -18.24 | -3.70 |

| LIFE & BANC SPLIT CORP (LBS) | -0.54 | 16.16 | 14.62 | 8.74 | -14.71 | -19.81 | -2.79 |

| MARKET VECTORS OIL SERVICE ETF (OIH) | -1.61 | 15.79 | 6.85 | 2.15 | -36.99 | -42.78 | -17.69 |

| CLEARBRIDGE ENERGY MLP FUND INC (CEM) | -0.58 | 15.56 | 5.99 | 6.27 | -9.91 | -21.70 | -4.84 |

| ETFS WTI CRUDE OIL (CRUD) | 8.06 | 15.01 | 15.01 | 2.15 | -18.45 | -11.84 | -3.28 |

| SPDR S&P OIL & GAS EXPLORATION & PRODUCTION ETF (XOP) | -1.04 | 14.78 | 6.22 | 0.23 | -29.31 | -22.17 | -11.26 |

| H&Q LIFE SCIENCES INVESTORS (HQL) | -0.33 | 14.78 | 7.19 | 3.42 | -9.40 | -7.44 | -1.56 |

| WTI CRUDE OIL PRICE LINKED ETF (1671) | 2.08 | 14.49 | 10.51 | 2.56 | -22.27 | -12.70 | -5.48 |

| DIVIDEND 15 SPLIT CORP (DFN) | 0.44 | 14.23 | 8.86 | 9.47 | -10.72 | -16.38 | -2.19 |

| BNY MELLON GLOBAL FUNDS PLC - BRAZIL EQUITY FUND (HZ5R) | 0.05 | 14.12 | 1.81 | 14.97 | 26.14 | 10.34 | 13.32 |

| NEXT FUNDS IBOVESPA LINKED EXCHANGE TRADED FUND (01311087) | -0.37 | 13.95 | 4.45 | 15.33 | 27.95 | 2.75 | 12.62 |

| KAYNE ANDERSON MLP INVESTMENT CO (KYN) | -1.26 | 13.88 | 4.13 | 5.43 | -11.43 | -13.46 | -3.83 |

Worst Funds YTD

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| PROSHARES ULTRASHORT MSCI BRAZIL CAPPED (BZQ) | 1.22 | -21.17 | -4.24 | -24.54 | -48.36 | -29.43 | -26.64 |

| YINHUA CSI CHINA MAINLAND NATURAL RESOURCE INDEX FUND (150059) | 0.38 | -10.00 | 2.32 | -9.73 | -14.68 | 0.62 | -5.37 |

| LYXOR UCITS ETF IBEX 35 INVERSO DIARIO (INVEX) | -6.92 | -9.66 | -7.46 | -6.44 | -2.77 | -9.63 | -6.58 |

| LYXOR ETF IBEX 35 DOBLE INVERSO DIARIO (2INVE) | -0.70 | -7.35 | -2.85 | -3.86 | 10.85 | 13.42 | 4.39 |

| CITIC-PRUDENTIAL CSI 800 NONFERROUS METAL INDEX FUND (150151) | -5.07 | -5.14 | -3.60 | -11.57 | -51.16 | -68.59 | -33.73 |

| LYXOR ETF FTSE MIB DAILY SHORT BEAR (BERMIB) | -0.16 | -4.87 | -2.03 | -2.30 | 8.00 | 5.77 | 2.36 |

| SIMPLEX CHINA BEAR 1X H-SHARE ETF (9D31212C) | 0.35 | -4.00 | -4.39 | -0.81 | 1.90 | 10.31 | 1.75 |

| LYXOR UCITS ETF IBEX 35 INVERSO DIARIO (INVEX) | -0.43 | -3.63 | -1.12 | -1.12 | 4.73 | 4.89 | 1.85 |

| DB X-TRACKERS SHORTDAX DAILY UCITS ETF (XSDX) | 0.70 | -3.62 | -0.18 | 0.43 | 11.76 | 11.92 | 5.98 |

| SIMPLEX CHINA BEAR 1X H-SHARE ETF (1573) | -0.10 | -3.33 | -4.72 | -1.49 | 2.14 | 10.08 | 1.50 |

| ISHARES MSCI INDIA INDEX ETF (INDIAS) | -0.31 | -2.81 | -0.39 | 3.95 | -5.36 | -12.79 | -3.65 |

| BIRLA SUN LIFE GOLD FUND - DIRECT-G (BGOLDDG) | -0.75 | -2.14 | -0.84 | 1.99 | 2.92 | -5.02 | -0.24 |

| ABERDEEN GLOBAL - INDIAN EQUITY FUND - A2 (AGINDA2) | -0.32 | -1.99 | -0.89 | 3.58 | -7.22 | -8.30 | -3.21 |

| HSBC MSCI TURKEY UCITS ETF (H4Z2) | -0.94 | -1.97 | -0.25 | 1.17 | -7.03 | -42.56 | -12.17 |

| WISDOMTREE INDIA EARNINGS FUND (EPI) | -0.29 | -1.90 | -1.66 | 6.21 | -4.55 | -14.51 | -3.63 |

| LYXOR ETF TURKEY EURO (TURU) | -0.59 | -1.86 | 0.45 | 0.13 | -8.36 | -43.30 | -12.77 |

| HSBC MSCI TURKEY UCITS ETF (HTRY) | -0.68 | -1.71 | 0.37 | 0.24 | -7.62 | -42.15 | -12.29 |

| ABERDEEN GLOBAL - INDIAN EQUITY FUND - R 2 ACC (AGINR2A) | -0.35 | -1.70 | -1.31 | 4.48 | -7.46 | -8.12 | -3.10 |

| ISHARES MSCI INDIA ETF (INDA) | -0.59 | -1.60 | -1.53 | 5.55 | -3.03 | -10.69 | -2.43 |

| ISHARES MSCI TURKEY UCITS ETF (IDTK) | -0.79 | -1.59 | 0.64 | 0.06 | -7.71 | -42.37 | -12.34 |

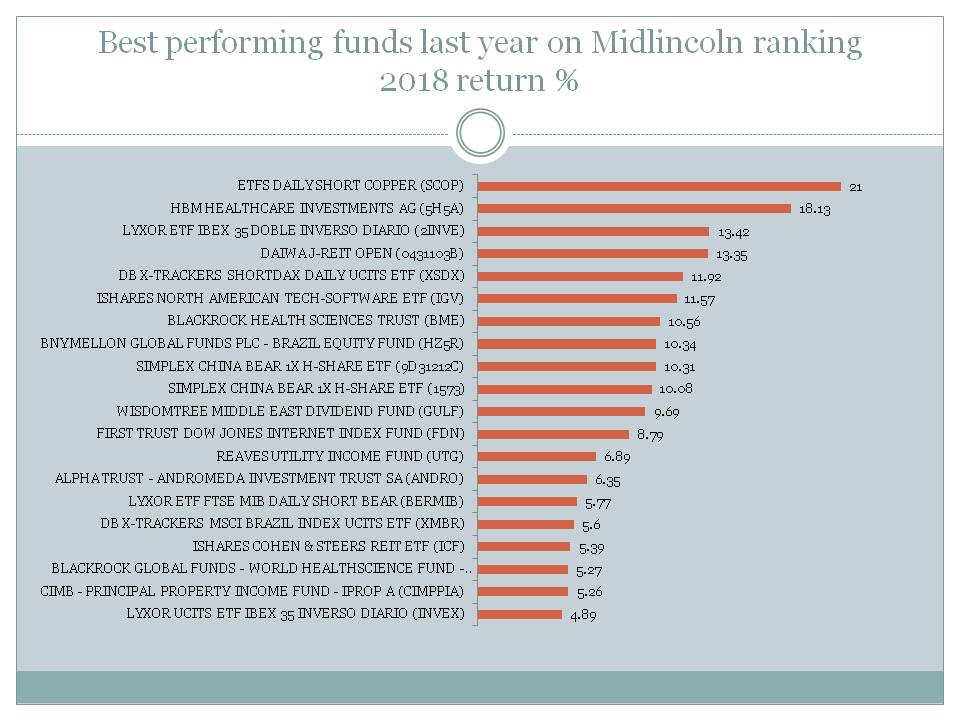

Best Funds 1yr

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| ETFS DAILY SHORT COPPER (SCOP) | 0.02 | 1.13 | -0.39 | 4.20 | 4.29 | 21.00 | 7.28 |

| HBM HEALTHCARE INVESTMENTS AG (5H5A) | 0.04 | 2.99 | 3.29 | 0.85 | 4.09 | 18.13 | 6.59 |

| LYXOR ETF IBEX 35 DOBLE INVERSO DIARIO (2INVE) | -0.70 | -7.35 | -2.85 | -3.86 | 10.85 | 13.42 | 4.39 |

| DAIWA J-REIT OPEN (0431103B) | 0.88 | 3.91 | 3.44 | 6.10 | 7.90 | 13.35 | 7.70 |

| DB X-TRACKERS SHORTDAX DAILY UCITS ETF (XSDX) | 0.70 | -3.62 | -0.18 | 0.43 | 11.76 | 11.92 | 5.98 |

| ISHARES NORTH AMERICAN TECH-SOFTWARE ETF (IGV) | -0.65 | 4.97 | 4.17 | 1.35 | -7.06 | 11.57 | 2.51 |

| BLACKROCK HEALTH SCIENCES TRUST (BME) | -1.90 | 4.32 | 1.88 | -2.77 | -5.32 | 10.56 | 1.09 |

| BNY MELLON GLOBAL FUNDS PLC - BRAZIL EQUITY FUND (HZ5R) | 0.05 | 14.12 | 1.81 | 14.97 | 26.14 | 10.34 | 13.32 |

| SIMPLEX CHINA BEAR 1X H-SHARE ETF (9D31212C) | 0.35 | -4.00 | -4.39 | -0.81 | 1.90 | 10.31 | 1.75 |

| SIMPLEX CHINA BEAR 1X H-SHARE ETF (1573) | -0.10 | -3.33 | -4.72 | -1.49 | 2.14 | 10.08 | 1.50 |

| WISDOMTREE MIDDLE EAST DIVIDEND FUND (GULF) | -1.28 | 2.56 | 0.77 | 3.24 | 0.07 | 9.69 | 3.44 |

| FIRST TRUST DOW JONES INTERNET INDEX FUND (FDN) | -0.16 | 7.70 | 4.76 | 2.27 | -13.50 | 8.79 | 0.58 |

| REAVES UTILITY INCOME FUND (UTG) | 0.07 | 3.77 | 3.89 | -1.96 | 7.90 | 6.89 | 4.18 |

| ALPHA TRUST - ANDROMEDA INVESTMENT TRUST SA (ANDRO) | -0.24 | 0.24 | 0.63 | 11.46 | 15.49 | 6.35 | 8.48 |

| LYXOR ETF FTSE MIB DAILY SHORT BEAR (BERMIB) | -0.16 | -4.87 | -2.03 | -2.30 | 8.00 | 5.77 | 2.36 |

| DB X-TRACKERS MSCI BRAZIL INDEX UCITS ETF (XMBR) | 1.04 | 11.16 | 3.27 | 16.13 | 29.47 | 5.60 | 13.62 |

| ISHARES COHEN & STEERS REIT ETF (ICF) | -0.13 | 2.86 | 4.13 | -4.92 | -0.75 | 5.39 | 0.96 |

| BLACKROCK GLOBAL FUNDS - WORLD HEALTHSCIENCE FUND - EURA2 (ERDV) | 0.88 | 3.69 | 2.47 | -1.49 | -0.43 | 5.27 | 1.46 |

| CIMB - PRINCIPAL PROPERTY INCOME FUND - IPROP A (CIMPPIA) | 0.08 | 4.11 | 1.16 | 4.37 | 8.56 | 5.26 | 4.84 |

| LYXOR UCITS ETF IBEX 35 INVERSO DIARIO (INVEX) | -0.43 | -3.63 | -1.12 | -1.12 | 4.73 | 4.89 | 1.85 |

Worst Funds 1yr

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| CITIC-PRUDENTIAL CSI 800 NONFERROUS METAL INDEX FUND (150151) | -5.07 | -5.14 | -3.60 | -11.57 | -51.16 | -68.59 | -33.73 |

| FINAM MANAGEMENT LLC (FINMIT) | 0.08 | 3.89 | 0.93 | -29.81 | -45.95 | -64.05 | -34.72 |

| CANADIAN LIFE COS SPLIT CORP (LFE) | 1.44 | 24.59 | 12.00 | 16.09 | -34.95 | -59.36 | -16.56 |

| DIREXION DAILY GOLD MINERS BULL 3X SHARES (NUGT) | 1.97 | -0.11 | -2.51 | 14.63 | -24.82 | -45.23 | -14.48 |

| YINHUA CONSUMPTION THEME FUND (150048) | -2.26 | 4.39 | 1.32 | 1.76 | -20.85 | -44.83 | -15.65 |

| VELOCITYSHARES 3X LONG NATURAL GAS ETN (UGAZ) | 5.77 | 5.80 | 1.17 | -69.38 | -22.28 | -44.64 | -33.78 |

| DIREXION DAILY RUSSIA BULL 3X SHARES (RUSL) | -1.41 | 21.64 | 5.53 | 10.18 | -20.33 | -43.50 | -12.03 |

| LYXOR ETF TURKEY EURO (TURU) | -0.59 | -1.86 | 0.45 | 0.13 | -8.36 | -43.30 | -12.77 |

| MARKET VECTORS OIL SERVICE ETF (OIH) | -1.61 | 15.79 | 6.85 | 2.15 | -36.99 | -42.78 | -17.69 |

| HSBC MSCI TURKEY UCITS ETF (H4Z2) | -0.94 | -1.97 | -0.25 | 1.17 | -7.03 | -42.56 | -12.17 |

| KB CHINA MAINLAND A SHARE LEVERAGE SEC FEEDER INVST TRUST-EQUITY-DERV FOF (3AF8926) | -0.09 | 4.41 | 5.78 | -2.19 | -14.88 | -42.39 | -13.42 |

| ISHARES MSCI TURKEY UCITS ETF (IDTK) | -0.79 | -1.59 | 0.64 | 0.06 | -7.71 | -42.37 | -12.34 |

| HSBC MSCI TURKEY UCITS ETF (HTRY) | -0.68 | -1.71 | 0.37 | 0.24 | -7.62 | -42.15 | -12.29 |

| KB CHINA MAINLAND A SHARE LEVERAGE SEC MASTER INVST TRUST-EQUITY-DERV FOF (3AF8884) | -0.08 | 4.48 | 5.83 | -2.01 | -13.89 | -41.09 | -12.79 |

| CITIC-PRUDENTIAL CSI 800 FINANCIAL INDEX CLASSIFIED FUND (150158) | 1.77 | 5.01 | 0.89 | -6.77 | -6.26 | -38.95 | -12.77 |

| FINANCIAL 15 SPLIT CORP (FTN) | 0.85 | 6.99 | 5.98 | -19.08 | -36.20 | -36.59 | -21.47 |

| CHANGSHENG TELECOM INDUSTRY FUND (CHTEINF) | 0.75 | 2.74 | 3.27 | -2.16 | -17.41 | -36.23 | -13.13 |

| PROSHARES ULTRA DJ-UBS CRUDE OIL (UCO) | -3.00 | 26.92 | 14.70 | -2.88 | -46.63 | -35.39 | -17.55 |

| JPMORGAN CHINESE INVESTMENT TRUST PLC (JMC) | 0.66 | 1.59 | 2.15 | -1.54 | -24.14 | -32.43 | -13.99 |

| UBS HANA AMBATOVY NICKEL OVERSEAS INVESTMENT COMPANY 1 (2772642) | 0.05 | 1.55 | 1.09 | 1.59 | -23.65 | -31.74 | -13.18 |