Fund flow data for the perioud between 2018-12-05 and 2018-10-19

Gold Monthly Forecast – December 2018 Gold ends at a 2-week high, turns higher week to date Gold price reversed early dip and climbed slightly Trading Day: live markets coverage, November 21, 2018 Gains in energy, metals help offset losses in agriculture sector

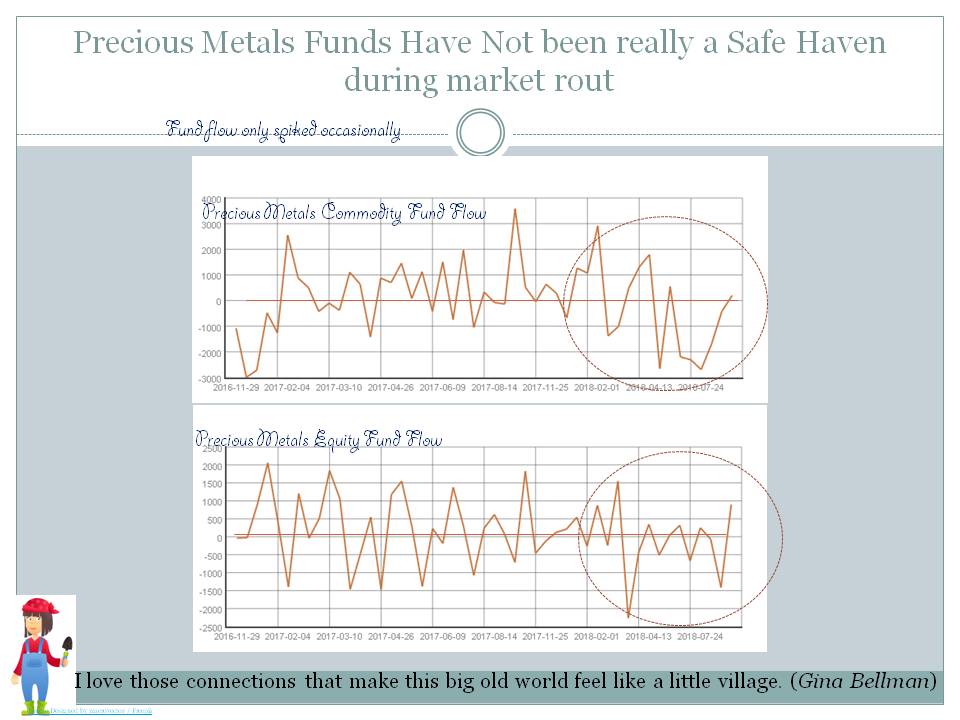

Emerging markets fund flow showed 3652.2 USD mn of inflow. While Frontier Markets funds showed 3.1 USD mn of inflows.

BRAZIL Equity funds showed 580.7 USD mn of inflow.

BRAZIL Fixed Income funds showed -1144.0 USD mn of outflow.

CHINA Equity funds showed 903.8 USD mn of inflow.

CHINA Fixed Income funds showed -48.9 USD mn of outflow.

INDIA Equity funds showed -1280.6 USD mn of outflow.

INDIA Fixed Income funds showed -36.2 USD mn of outflow.

KOREA Equity funds showed 417.3 USD mn of inflow.

RUSSIA Equity funds showed -138.1 USD mn of outflow.

RUSSIA Fixed Income funds showed -20.1 USD mn of outflow.

SOUTH AFRICA Equity funds showed 76.5 USD mn of inflow.

TURKEY Equity funds showed -0.2 USD mn of outflow.

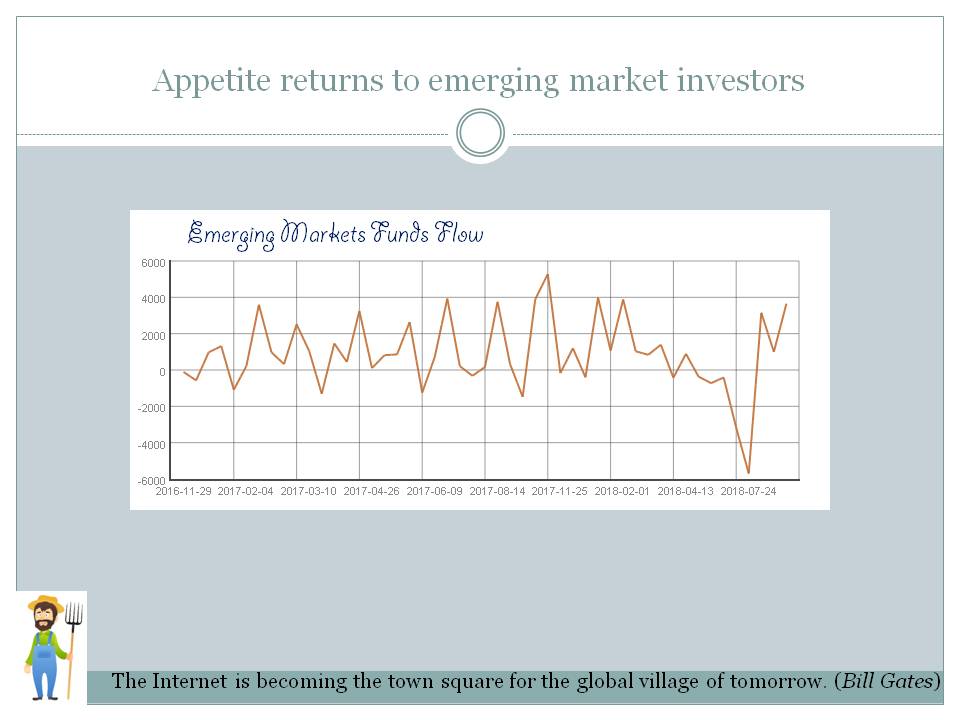

COMMUNICATIONS SECTOR Equity funds showed -1142.7 USD mn of outflow.

ENERGY SECTOR Equity funds showed -40.3 USD mn of outflow.

ENERGY SECTOR Mixed Allocation funds showed -0.1 USD mn of outflow.

FINANCIAL SECTOR Equity funds showed -673.2 USD mn of outflow.

REAL ESTATE SECTOR Equity funds showed -4485.5 USD mn of outflow.

TECHNOLOGY SECTOR Equity funds showed -3708.0 USD mn of outflow.

UTILITIES SECTOR Equity funds showed -387.8 USD mn of outflow.

LONG SHORT Alternative funds showed -567.5 USD mn of outflow.

LONG SHORT Equity funds showed -300.9 USD mn of outflow.

LONG SHORT Fixed Income funds showed -36.0 USD mn of outflow.

LONG SHORT Mixed Allocation funds showed -0.3 USD mn of outflow.

Best global markets since the begining of the week EFM ASIA +3.67%, EM (EMERGING MARKETS) +2.40%, FM (FRONTIER MARKETS) +0.74%,

While worst global markets since the begining of the week EM LATIN AMERICA -4.37%, EUROPE -2.06%, USA 0.57%,

Best since the start of the week among various stock markets were JAMAICA +19.22%, ESTONIA +13.44%, INDONESIA +10.87%, INDIA +9.74%, TURKEY +8.67%, HUNGARY +7.47%, POLAND +6.70%, HONG KONG +5.12%, PHILIPPINES +4.75%, CHINA +4.04%,

While worst since the start of the week among various stock markets were MEXICO -9.09%, IRELAND -6.43%, PERU -5.68%, NORWAY -5.65%, UNITED ARAB EMIRATES -5.57%, JORDAN -5.30%, FINLAND -5.16%, PAKISTAN -4.95%, AUSTRIA -4.80%, TUNISIA -3.66%,

Global Growth Powers International Fund Flows Investors Sell PowerShares FTSE RAFI Developed Markets (PXF ... International ETFs ready for takeoff Investors pulled $5.8 billion out of emerging market stocks in February Fund flows into India to be healthy despite LTCG tax: John Praveen ... The rush to emerging markets "Epic" flows to tech funds as "buy-the-dip" rules -BAML Flow Traders US LLC Has $4.90 Million Position in Schwab ... Investors pulled $5.8 billion out of emerging market stocks in February Fund flows into India to be healthy despite LTCG tax: John Praveen ... "Epic" flows to tech funds as "buy-the-dip" rules -BAML Navigating Through Stiff Income Crosswinds: What Are Cash Flow ... Investors Warm Up to Bond ETFs US Fund-Flows Weekly Report: All 4 Fund Macro-Groups Take In ... New Year, Not-So-New Trends in Fund Flows

Fund Flows By Objective

| Focus | Objective | Asset Class | Flow USD mn |

| Commodities | INDUSTRIAL METALS | Commodity | -59.86 |

| Commodities | PRECIOUS METAL SECTOR | Equity | 899.16 |

| Commodities | PRECIOUS METALS | Commodity | 81.04 |

| Commodities | PRECIOUS METALS | Mixed Allocation | 117.29 |

| country | AUSTRALIA | Equity | 25.59 |

| country | AUSTRALIA | Fixed Income | 2.33 |

| country | AUSTRALIA | Mixed Allocation | -0.45 |

| country | BRAZIL | Equity | 580.73 |

| country | BRAZIL | Fixed Income | -1144.04 |

| country | CHINA | Equity | 903.81 |

| country | CHINA | Fixed Income | -48.87 |

| Country | EGYPT | Equity | -0.84 |

| country | INDIA | Equity | -1280.59 |

| country | INDIA | Fixed Income | -36.23 |

| country | ISRAEL | Equity | 12.01 |

| country | JAPAN | Equity | -1187.90 |

| country | JAPAN | Fixed Income | -26.16 |

| country | JAPAN | Mixed Allocation | -9.58 |

| country | KOREA | Equity | 417.32 |

| country | POLAND | Equity | 3.21 |

| country | RUSSIA | Equity | -138.11 |

| country | RUSSIA | Fixed Income | -20.09 |

| country | SOUTH AFRICA | Equity | 76.45 |

| country | SPAIN | Equity | 140.17 |

| Country | TAIWAN | Equity | 16.53 |

| country | TURKEY | Equity | -0.25 |

| country | UNITED KINGDOM | Equity | -398.96 |

| industry | BASIC MATERIALS SECTOR | Equity | -1204.03 |

| industry | COMMUNICATIONS SECTOR | Equity | -1142.67 |

| industry | ENERGY SECTOR | Equity | -40.34 |

| industry | ENERGY SECTOR | Mixed Allocation | -0.15 |

| industry | FINANCIAL SECTOR | Equity | -673.17 |

| industry | HEALTH CARE SECTOR | Equity | -9278.46 |

| industry | INDUSTRIAL SECTOR | Equity | -242.95 |

| industry | MULTIPLE SECTOR | Equity | -0.43 |

| industry | NATURAL RESOURCES SECTOR | Equity | -513.81 |

| industry | REAL ESTATE SECTOR | Equity | -4485.50 |

| industry | TECHNOLOGY SECTOR | Equity | -3707.96 |

| industry | UTILITIES SECTOR | Equity | -387.77 |

| region | AFRICAN REGION | Equity | -41.33 |

| region | ASIAN PACIFIC REGION | Equity | -9698.90 |

| region | ASIAN PACIFIC REGION | Fixed Income | -116.44 |

| region | ASIAN PACIFIC REGION | Mixed Allocation | 1222.14 |

| region | ASIAN PACIFIC REGION EX JAPAN | Equity | -3707.55 |

| region | ASIAN PACIFIC REGION EX JAPAN | Fixed Income | -736.58 |

| region | ASIAN PACIFIC REGION EX JAPAN | Mixed Allocation | 144.72 |

| region | EASTERN EUROPEAN REGION | Equity | -88.71 |

| region | EASTERN EUROPEAN REGION | Fixed Income | -7.68 |

| region | EASTERN EUROPEAN REGION | Mixed Allocation | -0.13 |

| region | EUROPEAN REGION | Equity | -5440.29 |

| region | EUROPEAN REGION | Fixed Income | -2223.11 |

| region | EUROPEAN REGION | Mixed Allocation | 134.63 |

| region | LATIN AMERICAN REGION | Equity | 16.71 |

| region | LATIN AMERICAN REGION | Fixed Income | 89.07 |

| region | MIDDLE EAST REGION | Equity | -69.33 |

| region | MIDDLE EAST REGION | Fixed Income | -8.08 |

| region | NORDIC REGION | Equity | -260.75 |

| region | NORTH AMERICAN REGION | Equity | -1248.79 |

| region | NORTH AMERICAN REGION | Fixed Income | -42.35 |

| Risk | GOVERNMENT BOND | Alternative | -18.86 |

| Risk | GOVERNMENT BOND | Equity | 0.01 |

| Risk | GOVERNMENT BOND | Fixed Income | -1441.09 |

| Risk | GOVERNMENT BOND | Mixed Allocation | -3.15 |

| Risk | INFLATION PROTECTED | Brazil | -22.81 |

| Risk | INFLATION PROTECTED | Fixed Income | -1297.04 |

| Risk | LONG SHORT | Alternative | -567.52 |

| Risk | LONG SHORT | Equity | -300.90 |

| Risk | LONG SHORT | Fixed Income | -35.98 |

| Risk | LONG SHORT | Mixed Allocation | -0.26 |

| Sector | AGRICULTURE | Commodity | 18.06 |

| Sector | AGRICULTURE | Equity | 0.00 |

| Sector | CONSUMER DISCRETIONARY | Equity | -3757.26 |

| Sector | CONSUMER STAPLES | Equity | -708.13 |

| segment | BRIC | Equity | -587.26 |

| segment | BRIC | Fixed Income | -130.12 |

| segment | DEVELOPED MARKETS | Equity | -555.81 |

| segment | EMEA | Equity | -11.16 |

| segment | EMEA | Fixed Income | -3.02 |

| segment | EMERGING MARKETS | Equity | 3652.23 |

| segment | GCC | Equity | -4.41 |

| segment | GCC | Fixed Income | -2.43 |

| segment | GCC | Mixed Allocation | -10.44 |

| segment | MENA | Equity | -0.54 |

| segment | MENA | Fixed Income | 19.11 |

| Size | LARGE-CAP | Equity | 16493.56 |

| Size | MID-CAP | Commodity | 3.18 |

| Size | MID-CAP | Equity | 14318.46 |

| Size | SMALL-CAP | Equity | -1257.69 |

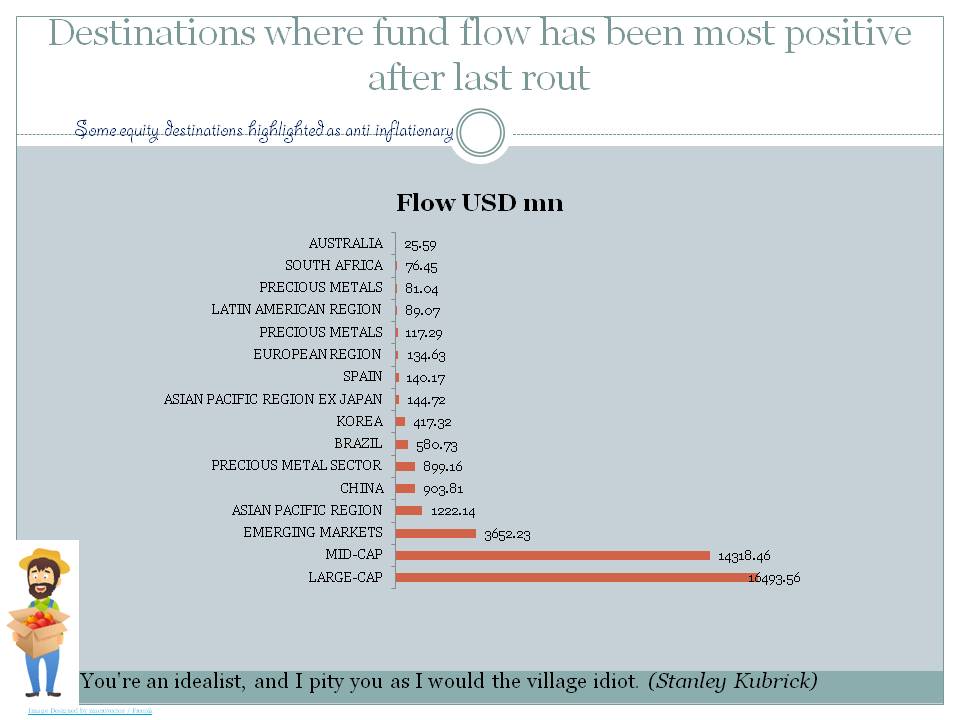

Flows In Descending Order

| Focus | Objective | Asset Class | Flow USD mn |

| Size | LARGE-CAP | Equity | 16493.56 |

| Size | MID-CAP | Equity | 14318.46 |

| segment | EMERGING MARKETS | Equity | 3652.23 |

| region | ASIAN PACIFIC REGION | Mixed Allocation | 1222.14 |

| country | CHINA | Equity | 903.81 |

| Commodities | PRECIOUS METAL SECTOR | Equity | 899.16 |

| country | BRAZIL | Equity | 580.73 |

| country | KOREA | Equity | 417.32 |

| region | ASIAN PACIFIC REGION EX JAPAN | Mixed Allocation | 144.72 |

| country | SPAIN | Equity | 140.17 |

| region | EUROPEAN REGION | Mixed Allocation | 134.63 |

| Commodities | PRECIOUS METALS | Mixed Allocation | 117.29 |

| region | LATIN AMERICAN REGION | Fixed Income | 89.07 |

| Commodities | PRECIOUS METALS | Commodity | 81.04 |

| country | SOUTH AFRICA | Equity | 76.45 |

| country | AUSTRALIA | Equity | 25.59 |

| segment | MENA | Fixed Income | 19.11 |

| Sector | AGRICULTURE | Commodity | 18.06 |

| region | LATIN AMERICAN REGION | Equity | 16.71 |

| Country | TAIWAN | Equity | 16.53 |

| country | ISRAEL | Equity | 12.01 |

| country | POLAND | Equity | 3.21 |

| Size | MID-CAP | Commodity | 3.18 |

| country | AUSTRALIA | Fixed Income | 2.33 |

| Risk | GOVERNMENT BOND | Equity | 0.01 |

| Sector | AGRICULTURE | Equity | 0.00 |

| region | EASTERN EUROPEAN REGION | Mixed Allocation | -0.13 |

| industry | ENERGY SECTOR | Mixed Allocation | -0.15 |

| country | TURKEY | Equity | -0.25 |

| Risk | LONG SHORT | Mixed Allocation | -0.26 |

| industry | MULTIPLE SECTOR | Equity | -0.43 |

| country | AUSTRALIA | Mixed Allocation | -0.45 |

| segment | MENA | Equity | -0.54 |

| Country | EGYPT | Equity | -0.84 |

| segment | GCC | Fixed Income | -2.43 |

| segment | EMEA | Fixed Income | -3.02 |

| Risk | GOVERNMENT BOND | Mixed Allocation | -3.15 |

| segment | GCC | Equity | -4.41 |

| region | EASTERN EUROPEAN REGION | Fixed Income | -7.68 |

| region | MIDDLE EAST REGION | Fixed Income | -8.08 |

| country | JAPAN | Mixed Allocation | -9.58 |

| segment | GCC | Mixed Allocation | -10.44 |

| segment | EMEA | Equity | -11.16 |

| Risk | GOVERNMENT BOND | Alternative | -18.86 |

| country | RUSSIA | Fixed Income | -20.09 |

| Risk | INFLATION PROTECTED | Brazil | -22.81 |

| country | JAPAN | Fixed Income | -26.16 |

| Risk | LONG SHORT | Fixed Income | -35.98 |

| country | INDIA | Fixed Income | -36.23 |

| industry | ENERGY SECTOR | Equity | -40.34 |

| region | AFRICAN REGION | Equity | -41.33 |

| region | NORTH AMERICAN REGION | Fixed Income | -42.35 |

| country | CHINA | Fixed Income | -48.87 |

| Commodities | INDUSTRIAL METALS | Commodity | -59.86 |

| region | MIDDLE EAST REGION | Equity | -69.33 |

| region | EASTERN EUROPEAN REGION | Equity | -88.71 |

| region | ASIAN PACIFIC REGION | Fixed Income | -116.44 |

| segment | BRIC | Fixed Income | -130.12 |

| country | RUSSIA | Equity | -138.11 |

| industry | INDUSTRIAL SECTOR | Equity | -242.95 |

| region | NORDIC REGION | Equity | -260.75 |

| Risk | LONG SHORT | Equity | -300.90 |

| industry | UTILITIES SECTOR | Equity | -387.77 |

| country | UNITED KINGDOM | Equity | -398.96 |

| industry | NATURAL RESOURCES SECTOR | Equity | -513.81 |

| segment | DEVELOPED MARKETS | Equity | -555.81 |

| Risk | LONG SHORT | Alternative | -567.52 |

| segment | BRIC | Equity | -587.26 |

| industry | FINANCIAL SECTOR | Equity | -673.17 |

| Sector | CONSUMER STAPLES | Equity | -708.13 |

| region | ASIAN PACIFIC REGION EX JAPAN | Fixed Income | -736.58 |

| industry | COMMUNICATIONS SECTOR | Equity | -1142.67 |

| country | BRAZIL | Fixed Income | -1144.04 |

| country | JAPAN | Equity | -1187.90 |

| industry | BASIC MATERIALS SECTOR | Equity | -1204.03 |

| region | NORTH AMERICAN REGION | Equity | -1248.79 |

| Size | SMALL-CAP | Equity | -1257.69 |

| country | INDIA | Equity | -1280.59 |

| Risk | INFLATION PROTECTED | Fixed Income | -1297.04 |

| Risk | GOVERNMENT BOND | Fixed Income | -1441.09 |

| region | EUROPEAN REGION | Fixed Income | -2223.11 |

| region | ASIAN PACIFIC REGION EX JAPAN | Equity | -3707.55 |

| industry | TECHNOLOGY SECTOR | Equity | -3707.96 |

| Sector | CONSUMER DISCRETIONARY | Equity | -3757.26 |

| industry | REAL ESTATE SECTOR | Equity | -4485.50 |

| region | EUROPEAN REGION | Equity | -5440.29 |

| industry | HEALTH CARE SECTOR | Equity | -9278.46 |

| region | ASIAN PACIFIC REGION | Equity | -9698.90 |

Fund flows YTD

| Focus | Objective | Asset Class | Flow USD mn |

| Size | LARGE-CAP | Equity | 51001.71 |

| Size | MID-CAP | Equity | 20606.04 |

| segment | EMERGING MARKETS | Equity | 10092.20 |

| industry | HEALTH CARE SECTOR | Equity | 7497.16 |

| region | ASIAN PACIFIC REGION | Mixed Allocation | 3318.98 |

| industry | INDUSTRIAL SECTOR | Equity | 2458.38 |

| industry | FINANCIAL SECTOR | Equity | 1546.62 |

| Sector | CONSUMER STAPLES | Equity | 1491.22 |

| industry | COMMUNICATIONS SECTOR | Equity | 1471.53 |

| region | ASIAN PACIFIC REGION | Fixed Income | 1216.10 |

| country | KOREA | Equity | 884.70 |

| region | EUROPEAN REGION | Mixed Allocation | 593.19 |

| Sector | CONSUMER DISCRETIONARY | Equity | 515.12 |

| country | TURKEY | Equity | 431.68 |

| region | ASIAN PACIFIC REGION EX JAPAN | Mixed Allocation | 310.20 |

| Commodities | INDUSTRIAL METALS | Commodity | 283.71 |

| Commodities | PRECIOUS METALS | Mixed Allocation | 241.51 |

| country | SOUTH AFRICA | Equity | 114.90 |

| country | BRAZIL | Equity | 102.14 |

| segment | EMEA | Equity | 92.39 |

| Risk | GOVERNMENT BOND | Alternative | 90.86 |

| region | EASTERN EUROPEAN REGION | Fixed Income | 65.08 |

| region | LATIN AMERICAN REGION | Fixed Income | 46.81 |

| Risk | LONG SHORT | Mixed Allocation | 26.60 |

| country | ISRAEL | Equity | 15.41 |

| segment | GCC | Fixed Income | 12.57 |

| segment | MENA | Fixed Income | 10.56 |

| country | CHINA | Fixed Income | 7.25 |

| segment | EMEA | Fixed Income | 4.35 |

| Sector | AGRICULTURE | Equity | 0.00 |

| Risk | GOVERNMENT BOND | Equity | -0.16 |

| industry | ENERGY SECTOR | Mixed Allocation | -1.17 |

| industry | MULTIPLE SECTOR | Equity | -1.85 |

| country | AUSTRALIA | Mixed Allocation | -2.62 |

| industry | REAL ESTATE SECTOR | Alternative | -6.84 |

| region | EASTERN EUROPEAN REGION | Mixed Allocation | -11.59 |

| Size | MID-CAP | Commodity | -13.69 |

| segment | MENA | Equity | -19.81 |

| country | JAPAN | Mixed Allocation | -27.84 |

| Country | EGYPT | Equity | -35.15 |

| segment | GCC | Mixed Allocation | -55.83 |

| country | POLAND | Equity | -61.92 |

| Risk | GOVERNMENT BOND | Mixed Allocation | -70.02 |

| segment | GCC | Equity | -71.44 |

| region | MIDDLE EAST REGION | Fixed Income | -91.21 |

| country | AUSTRALIA | Fixed Income | -102.76 |

| Risk | INFLATION PROTECTED | Brazil | -113.78 |

| Sector | AGRICULTURE | Commodity | -115.55 |

| region | AFRICAN REGION | Equity | -185.32 |

| country | RUSSIA | Fixed Income | -188.94 |

| Risk | LONG SHORT | Fixed Income | -214.66 |

| country | INDIA | Fixed Income | -221.49 |

| country | UNITED KINGDOM | Equity | -335.67 |

| Country | TAIWAN | Equity | -341.24 |

| segment | DEVELOPED MARKETS | Equity | -410.48 |

| country | SPAIN | Equity | -424.45 |

| region | NORTH AMERICAN REGION | Fixed Income | -497.04 |

| segment | BRIC | Fixed Income | -697.83 |

| region | LATIN AMERICAN REGION | Equity | -807.75 |

| region | ASIAN PACIFIC REGION | Equity | -818.96 |

| region | MIDDLE EAST REGION | Equity | -836.94 |

| segment | BRIC | Equity | -907.08 |

| industry | ENERGY SECTOR | Equity | -938.58 |

| region | NORDIC REGION | Equity | -1015.76 |

| industry | NATURAL RESOURCES SECTOR | Equity | -1028.17 |

| Commodities | PRECIOUS METAL SECTOR | Equity | -1062.77 |

| industry | BASIC MATERIALS SECTOR | Equity | -1141.75 |

| country | JAPAN | Fixed Income | -1189.19 |

| Risk | LONG SHORT | Alternative | -1239.91 |

| region | EASTERN EUROPEAN REGION | Equity | -1313.85 |

| industry | UTILITIES SECTOR | Equity | -1514.97 |

| Risk | GOVERNMENT BOND | Fixed Income | -1548.80 |

| country | BRAZIL | Fixed Income | -1863.97 |

| country | AUSTRALIA | Equity | -1901.39 |

| Risk | LONG SHORT | Equity | -2159.29 |

| country | RUSSIA | Equity | -2294.11 |

| country | CHINA | Equity | -2638.09 |

| region | NORTH AMERICAN REGION | Equity | -2734.37 |

| Risk | INFLATION PROTECTED | Fixed Income | -2834.38 |

| country | JAPAN | Equity | -3253.10 |

| industry | REAL ESTATE SECTOR | Equity | -3336.90 |

| Commodities | PRECIOUS METALS | Commodity | -5037.64 |

| country | INDIA | Equity | -5361.21 |

| region | ASIAN PACIFIC REGION EX JAPAN | Fixed Income | -6142.01 |

| region | EUROPEAN REGION | Fixed Income | -6938.78 |

| region | ASIAN PACIFIC REGION EX JAPAN | Equity | -12726.33 |

| industry | TECHNOLOGY SECTOR | Equity | -16845.97 |

| region | EUROPEAN REGION | Equity | -36762.68 |

| Size | SMALL-CAP | Equity | -40683.07 |

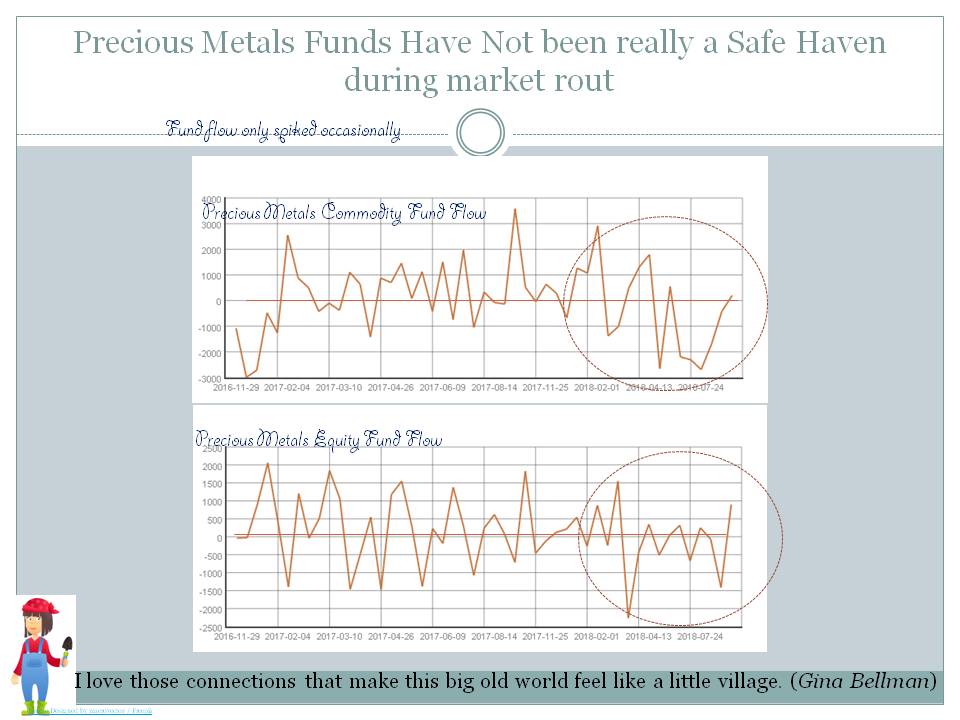

Chart: Precious Metals Funds Have Not been really a Safe Haven during market rout

Fund flow only spiked occasionally

Source: ML

Download file in Power PointKey Topics and News

Appetite returns to emerging market investors

- Rand firms as global investor appetite is revived by US-China trade ...

- EMERGING MARKETS-LatAm FX, stocks rise on trade truce optimism

- Old Mutual investment has a message for you

- BlackRock's Emerging-Markets ETF Had a Record Month

- Global markets surge on trade truce hopes

- Investors' appetite returns, but is fussy - Capital Economics

- EMERGING MARKETS-LatAm stocks, currencies down as tepid ...

- Revived appetite for emerging markets - Vontobel offers exciting ...

- A Change In Risk Appetite | Seeking Alpha

- Yield-hungry Investors Show Appetite For Emerging Market Debt

- Measuring Investors' Risk Appetite in Emerging Markets

- Global Investor Appetite - real estate expertise

- Nordic Investor Appetite for Emerging Market Debt - Aberdeen Asset ...

- Characterizing Global Investors' Risk Appetite for Emerging Market ...

Emerging Markets Funds Flow Shows

Source: ML

Health Care, Real Estate and Technology Funds loose most to outflows in a rout

- Around the world in eight investment trusts

- Form S-1/A DiaMedica Therapeutics

- KENYA'S ORIGINAL SIN: Root causes of rising human-wildlife ...

- THE CHINESE DEBT TRAP: A new form of colonialism?

- MATING RITUALS: Fault lines in the donor-NGO relationship

- Top 3 Health Care ETFs Took in $1 Billion in July - Bloomberg

- Stock Funds Suffering Big Outflows as Rattled Investors Rush to the ...

- ETF Investors Look to Healthcare Stocks | Morningstar

- Mutual Funds: 7 mutual fund investment mistakes that could prove ...

- August ETF Flows: Playing Offense and Defense | SPDR Blog

- Emerging Trends in Real Estate Europe 2016 - PwC Luxembourg

- Mutual funds: ready for the next leap - EY

- Globalization and Real Estate: Where next? - CBRE

- real estate fund - OppenheimerFunds

- invesco

Are they likely to bounce first?

Source: ML

Destinations where fund flow has been most positive after last rout

- MUGSHOTS: Last month in Hudson Valley crime (November)

- CNBC Transcript: SS Teo, Executive Chairman and YC Chang ...

- A football hero for a new generation of Somali-Americans

- Kevin Durant is enjoying 'big city' life in San Francisco

- EYEG: Is EyeGate Eyeing FDA Filings Following Positive OBG Data ...

Equity class destinations highlighted as anti inflationary overall

Source: ML

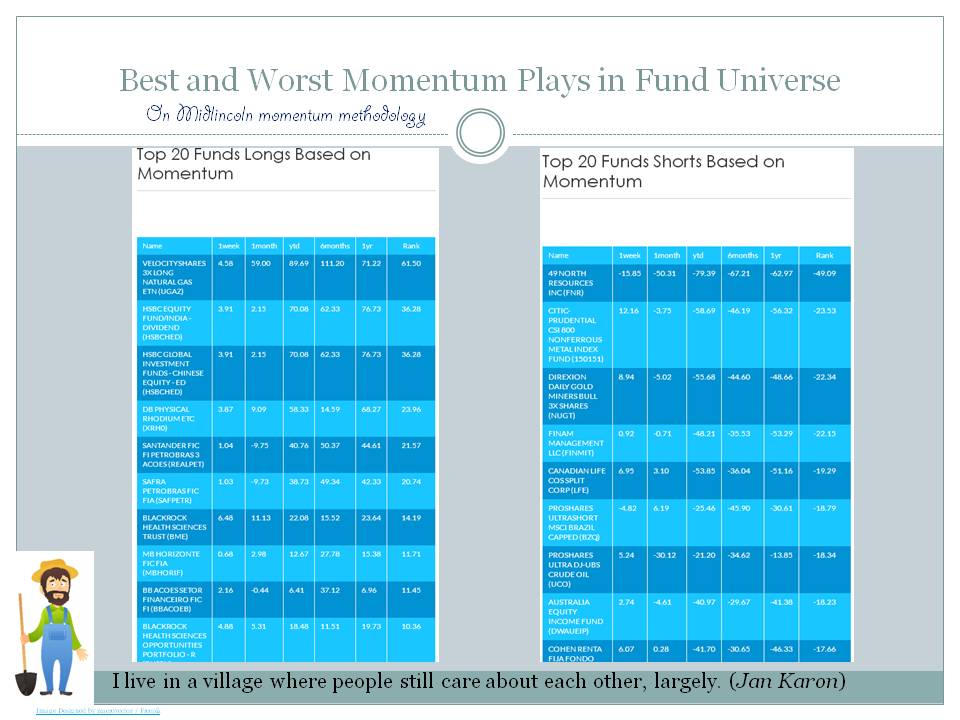

Best and Worst Momentum Plays in Fund Universe

- 5 Vanguard Mutual Funds to Depend On

- 3 Interesting ETFs You May Have Missed

- Safe Spaces in the Stock Market Are Looking Shaky Now

- Tron Price Analysis: TRON to Launch Gaming Fund Worth $100 ...

- The Zacks Analyst Blog Highlights: FAN, IHF, EMGF, FDN and MTUM

On Midlincoln momentum methodology

Source: ML

Emerging markets fund flow showed 3652.2 USD mn of inflow. While Frontier Markets funds showed 3.1 USD mn of inflows.

BRAZIL Equity funds showed 580.7 USD mn of inflow.

BRAZIL Fixed Income funds showed -1144.0 USD mn of outflow.

CHINA Equity funds showed 903.8 USD mn of inflow.

CHINA Fixed Income funds showed -48.9 USD mn of outflow.

INDIA Equity funds showed -1280.6 USD mn of outflow.

INDIA Fixed Income funds showed -36.2 USD mn of outflow.

KOREA Equity funds showed 417.3 USD mn of inflow.

RUSSIA Equity funds showed -138.1 USD mn of outflow.

RUSSIA Fixed Income funds showed -20.1 USD mn of outflow.

SOUTH AFRICA Equity funds showed 76.5 USD mn of inflow.

TURKEY Equity funds showed -0.2 USD mn of outflow.

COMMUNICATIONS SECTOR Equity funds showed -1142.7 USD mn of outflow.

ENERGY SECTOR Equity funds showed -40.3 USD mn of outflow.

ENERGY SECTOR Mixed Allocation funds showed -0.1 USD mn of outflow.

FINANCIAL SECTOR Equity funds showed -673.2 USD mn of outflow.

REAL ESTATE SECTOR Equity funds showed -4485.5 USD mn of outflow.

TECHNOLOGY SECTOR Equity funds showed -3708.0 USD mn of outflow.

UTILITIES SECTOR Equity funds showed -387.8 USD mn of outflow.

LONG SHORT Alternative funds showed -567.5 USD mn of outflow.

LONG SHORT Equity funds showed -300.9 USD mn of outflow.

LONG SHORT Fixed Income funds showed -36.0 USD mn of outflow.

LONG SHORT Mixed Allocation funds showed -0.3 USD mn of outflow.

Latest ML Comics

Markets

Market performance is between 2018-11-30 and 2018-11-01Best global markets since the begining of the week EFM ASIA +3.67%, EM (EMERGING MARKETS) +2.40%, FM (FRONTIER MARKETS) +0.74%,

While worst global markets since the begining of the week EM LATIN AMERICA -4.37%, EUROPE -2.06%, USA 0.57%,

Best since the start of the week among various stock markets were JAMAICA +19.22%, ESTONIA +13.44%, INDONESIA +10.87%, INDIA +9.74%, TURKEY +8.67%, HUNGARY +7.47%, POLAND +6.70%, HONG KONG +5.12%, PHILIPPINES +4.75%, CHINA +4.04%,

While worst since the start of the week among various stock markets were MEXICO -9.09%, IRELAND -6.43%, PERU -5.68%, NORWAY -5.65%, UNITED ARAB EMIRATES -5.57%, JORDAN -5.30%, FINLAND -5.16%, PAKISTAN -4.95%, AUSTRIA -4.80%, TUNISIA -3.66%,

Key Fund Flow Headlines

Top 20 Funds Longs Based on Momentum

| Name | 1week | 1month | ytd | 6months | 1yr | Rank |

| VELOCITYSHARES 3X LONG NATURAL GAS ETN (UGAZ) | 4.58 | 59.00 | 89.69 | 111.20 | 71.22 | 61.50 |

| HSBC EQUITY FUND/INDIA - DIVIDEND (HSBCHED) | 3.91 | 2.15 | 70.08 | 62.33 | 76.73 | 36.28 |

| HSBC GLOBAL INVESTMENT FUNDS - CHINESE EQUITY - ED (HSBCHED) | 3.91 | 2.15 | 70.08 | 62.33 | 76.73 | 36.28 |

| DB PHYSICAL RHODIUM ETC (XRH0) | 3.87 | 9.09 | 58.33 | 14.59 | 68.27 | 23.96 |

| SANTANDER FIC FI PETROBRAS 3 ACOES (REALPET) | 1.04 | -9.75 | 40.76 | 50.37 | 44.61 | 21.57 |

| SAFRA PETROBRAS FIC FIA (SAFPETR) | 1.03 | -9.73 | 38.73 | 49.34 | 42.33 | 20.74 |

| BLACKROCK HEALTH SCIENCES TRUST (BME) | 6.48 | 11.13 | 22.08 | 15.52 | 23.64 | 14.19 |

| MB HORIZONTE FIC FIA (MBHORIF) | 0.68 | 2.98 | 12.67 | 27.78 | 15.38 | 11.71 |

| BB ACOES SETOR FINANCEIRO FIC FI (BBACOEB) | 2.16 | -0.44 | 6.41 | 37.12 | 6.96 | 11.45 |

| BLACKROCK HEALTH SCIENCES OPPORTUNITIES PORTFOLIO - R (BHSRX) | 4.88 | 5.31 | 18.48 | 11.51 | 19.73 | 10.36 |

| FIDELITY SELECT HEALTH CARE PORTFOLIO (FSPHX) | 5.31 | 4.10 | 21.27 | 6.80 | 22.22 | 9.61 |

| BLACKROCK GLOBAL FUNDS - WORLD HEALTHSCIENCE FUND - EURA2 (ERDV) | 5.88 | 5.25 | 14.46 | 10.75 | 15.97 | 9.46 |

| ETRACS MONTHLY PAY 2XLEVERAGED S&P DIVIDEND ETN (SDYL) | 6.09 | 8.55 | 9.02 | 12.96 | 9.93 | 9.38 |

| BLACKROCK HEALTH SCIENCES TRUST (XBMEX) | 4.22 | 4.78 | 16.63 | 10.29 | 18.08 | 9.34 |

| BNY MELLON GLOBAL FUNDS PLC - BRAZIL EQUITY FUND (HZ5R) | 5.96 | -0.45 | 6.69 | 22.13 | 9.36 | 9.25 |

| JPMORGAN FUNDS - JPM GLOBAL HEALTHCARE - X (JPGLHXJ) | 5.36 | 4.16 | 15.70 | 10.16 | 16.68 | 9.09 |

| ISHARES MSCI BRAZIL UCITS ETF (INC) (IBZL) | 8.62 | -2.38 | 0.04 | 25.11 | 3.87 | 8.81 |

| GABELLI HEALTHCARE & WELLNESSRX TRUST/THE (GRX) | 4.03 | 4.84 | 9.07 | 11.78 | 14.04 | 8.67 |

| T ROWE PRICE HEALTH SCIENCES FUND INC - RETAIL (PRHSX) | 5.64 | 3.52 | 15.38 | 6.94 | 18.18 | 8.57 |

| ISHARES NORTH AMERICAN TECH-SOFTWARE ETF (IGV) | 6.34 | 2.03 | 20.98 | 0.11 | 24.76 | 8.31 |

Top 20 Funds Shorts Based on Momentum

| Name | 1week | 1month | ytd | 6months | 1yr | Rank |

| 49 NORTH RESOURCES INC (FNR) | -15.85 | -50.31 | -79.39 | -67.21 | -62.97 | -49.09 |

| CITIC-PRUDENTIAL CSI 800 NONFERROUS METAL INDEX FUND (150151) | 12.16 | -3.75 | -58.69 | -46.19 | -56.32 | -23.53 |

| DIREXION DAILY GOLD MINERS BULL 3X SHARES (NUGT) | 8.94 | -5.02 | -55.68 | -44.60 | -48.66 | -22.34 |

| FINAM MANAGEMENT LLC (FINMIT) | 0.92 | -0.71 | -48.21 | -35.53 | -53.29 | -22.15 |

| CANADIAN LIFE COS SPLIT CORP (LFE) | 6.95 | 3.10 | -53.85 | -36.04 | -51.16 | -19.29 |

| PROSHARES ULTRASHORT MSCI BRAZIL CAPPED (BZQ) | -4.82 | 6.19 | -25.46 | -45.90 | -30.61 | -18.79 |

| PROSHARES ULTRA DJ-UBS CRUDE OIL (UCO) | 5.24 | -30.12 | -21.20 | -34.62 | -13.85 | -18.34 |

| AUSTRALIA EQUITY INCOME FUND (DWAUEIP) | 2.74 | -4.61 | -40.97 | -29.67 | -41.38 | -18.23 |

| COHEN RENTA FIJA FONDO COMUN DE INVERSION - A-MINORISTA (CRTAFAM) | 6.07 | 0.28 | -41.70 | -30.65 | -46.33 | -17.66 |

| YINHUA CONSUMPTION THEME FUND (150048) | 4.43 | 4.48 | -42.64 | -35.62 | -40.57 | -16.82 |

| MARKET VECTORS OIL SERVICE ETF (OIH) | 1.72 | -9.52 | -28.14 | -32.05 | -24.31 | -16.04 |

| RS GLOBAL NATURAL RESOURCES FUND - C (RGNCX) | 3.86 | -6.98 | -30.41 | -29.40 | -27.74 | -15.06 |

| ETFS COFFEE (COFF) | -5.93 | -13.17 | -22.64 | -15.10 | -25.74 | -14.99 |

| UBS HANA AMBATOVY NICKEL OVERSEAS INVESTMENT COMPANY 1 (2772642) | 3.43 | -1.67 | -36.68 | -28.82 | -32.38 | -14.86 |

| PRECIOUS METALS & MINING TRUST (MMP-U) | 3.37 | -14.44 | -32.05 | -25.24 | -21.58 | -14.47 |

| HSBC MSCI TURKEY UCITS ETF (H4Z2) | -2.22 | 0.04 | -41.64 | -20.83 | -34.23 | -14.31 |

| HSBC CHINA DRAGON FUND (820) | 2.97 | -3.14 | -22.51 | -28.27 | -26.40 | -13.71 |

| CHANGSHENG TELECOM INDUSTRY FUND (CHTEINF) | 4.65 | -0.40 | -31.75 | -24.06 | -32.16 | -12.99 |

| PINEBRIDGE WORLD GOLD FUND - GROWTH (AIGWGLG) | 0.52 | -6.44 | -26.34 | -22.12 | -22.27 | -12.58 |

| CAPITAL CHINA NEW OPPORTUNITY EQUITY FUND - USD (CAPGNEU) | 5.07 | -0.98 | -26.63 | -28.95 | -25.29 | -12.54 |

Best Funds last Week

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| CITIC-PRUDENTIAL CSI 800 NONFERROUS METAL INDEX FUND (150151) | 8.03 | -58.69 | 12.16 | -3.75 | -46.19 | -56.32 | -23.53 |

| CHINA UNIVERSAL CSI CONSUMER STAPLES INDEX ETF (159928) | 1.02 | -22.73 | 9.20 | 4.57 | -27.78 | -15.63 | -7.41 |

| NEXT FUNDS IBOVESPA LINKED EXCHANGE TRADED FUND (01311087) | 1.57 | 0.20 | 8.26 | -1.36 | 17.63 | 4.36 | 7.22 |

| LYXOR ETF FTSE ATHEX 20 (GRE) | -0.24 | -23.57 | 7.98 | 4.54 | -17.63 | -14.61 | -4.93 |

| SIMPLEX CHINA BULL 2X H-SHARE ETF (9D31112C) | 6.50 | -13.17 | 7.94 | 13.65 | -19.46 | -9.66 | -1.88 |

| KB CHINA MAINLAND A SHARE LEVERAGE SEC MASTER INVST TRUST-EQUITY-DERV FOF (3AF8884) | 5.62 | -29.01 | 7.93 | 4.25 | -22.71 | -25.33 | -8.97 |

| KB CHINA MAINLAND A SHARE LEVERAGE SEC FEEDER INVST TRUST-EQUITY-DERV FOF (3AF8926) | 5.63 | -30.46 | 7.90 | 4.05 | -23.58 | -26.98 | -9.65 |

| CITIC-PRUDENTIAL CSI 800 FINANCIAL INDEX CLASSIFIED FUND (150158) | 0.87 | -24.34 | 7.52 | -3.52 | -10.25 | -27.17 | -8.36 |

| NEXT NOTES NIKKEI TOCOM LEVERAGED CRUDE OIL ETN (2038) | -0.44 | 0.69 | 7.10 | -28.27 | -22.96 | 11.40 | -8.18 |

| WORLDWIDE HEALTHCARE TRUST PLC (P8W) | 0.21 | 3.13 | 6.95 | 4.30 | -0.55 | 5.33 | 4.01 |

| DB X-TRACKERS MSCI BRAZIL INDEX UCITS ETF (XMBR) | -3.01 | 2.05 | 6.93 | -5.75 | 18.39 | 5.33 | 6.23 |

| CHINAAMC ETF SERIES - CHINAAMC CSI 300 INDEX ETF (83188) | 0.90 | -21.94 | 6.70 | -0.77 | -19.22 | -20.20 | -8.37 |

| JPMORGAN CHINESE INVESTMENT TRUST PLC (JMC) | 0.16 | -21.31 | 6.46 | 0.85 | -26.63 | -19.18 | -9.63 |

| EAST CAPITAL LUX - RUSSIAN FUND (EC0A) | 3.14 | -5.62 | 6.37 | 1.18 | 1.60 | -4.55 | 1.15 |

| LYXOR ETF WIG20 (ETFW20L) | 0.35 | -11.48 | 6.35 | 7.64 | 0.19 | -7.75 | 1.61 |

| BLACKROCK GLOBAL FUNDS - CHINA FUND - HEDGE EURA2 (H2ZP) | 0.78 | -20.31 | 6.31 | 3.84 | -21.92 | -17.85 | -7.41 |

| GOLDMAN SACHS BRICS PORTFOLIO (GSBLU) | 2.51 | -10.87 | 6.28 | 8.44 | -10.67 | -6.86 | -0.70 |

| DB X-TRACKERS - MSCI RUSSIA CAPPED INDEX UCITS ETF - 2D (XMRC) | 0.08 | 7.44 | 6.25 | 1.34 | 2.63 | 9.53 | 4.94 |

| SIMPLEX CHINA BULL 2X H-SHARE ETF (1572) | -0.72 | -15.86 | 6.04 | 2.35 | -22.22 | -13.29 | -6.78 |

| POLAR CAPITAL TECHNOLOGY TRUST PLC (PCT) | -1.78 | 0.51 | 6.00 | 0.81 | -11.29 | 1.91 | -0.64 |

Worst Funds last Week

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| ETFS COFFEE (COFF) | -1.90 | -22.64 | -5.93 | -13.17 | -15.10 | -25.74 | -14.99 |

| SIMPLEX CHINA BEAR 1X H-SHARE ETF (1573) | 0.89 | 0.59 | -3.14 | -1.18 | 10.57 | -0.17 | 1.52 |

| HSBC FIC FI MULTIMERCADO LONGO PRAZO DIVERSIFICACAO (HSBCALT) | -3.01 | -10.76 | -2.80 | -5.09 | -11.26 | -11.26 | -7.60 |

| HSBC YATIRIM B TIPI ALTIN FONU (HSBCALT) | -3.01 | -10.76 | -2.80 | -5.09 | -11.26 | -11.26 | -7.60 |

| SIMPLEX CHINA BEAR 1X H-SHARE ETF (9D31212C) | -2.31 | -0.37 | -2.64 | -5.57 | 8.12 | -2.12 | -0.55 |

| HSBC MSCI TURKEY UCITS ETF (H4Z2) | -4.08 | -41.64 | -2.22 | 0.04 | -20.83 | -34.23 | -14.31 |

| ETFS DAILY SHORT COPPER (SCOP) | 1.08 | 16.40 | -2.18 | 0.27 | 17.70 | 9.21 | 6.25 |

| MARKET VECTORS AFRICA INDEX ETF (VEF2) | -2.83 | -19.44 | -1.28 | -2.23 | -20.34 | -16.91 | -10.19 |

| ISHARES EUROPEAN PROPERTY YIELD UCITS ETF (IPRP) | 0.28 | -7.93 | -1.18 | -0.56 | -8.14 | -4.30 | -3.55 |

| ISHARES MSCI MALAYSIA ETF (ISVF) | -2.19 | -8.05 | -1.09 | -2.08 | -9.66 | -3.72 | -4.14 |

| LYXOR ETF FTSE MIB DAILY SHORT BEAR (BERMIB) | 0.89 | -1.99 | -1.02 | -1.07 | 3.92 | 1.41 | 0.81 |

| SPDR DOW JONES INTERNATIONAL REAL ESTATE ETF (SSGJ) | -3.25 | -6.59 | -0.79 | -1.34 | -6.96 | -3.84 | -3.23 |

| JPMORGAN INDIAN INVESTMENT TRUST PLC (3J8) | -0.29 | -16.72 | -0.75 | 11.70 | -6.36 | -12.24 | -1.91 |

| ISHARES MSCI SPAIN CAPPED ETF (ISVS) | -1.74 | -13.01 | -0.53 | 0.12 | -9.53 | -13.47 | -5.85 |

| SCHRODER JAPAN GROWTH FUND PLC (SJG) | -0.33 | -13.05 | -0.52 | -1.52 | -10.12 | -9.60 | -5.44 |

| ISHARES MSCI NETHERLANDS ETF (ISVR) | -1.62 | -10.58 | -0.51 | -1.44 | -11.44 | -9.52 | -5.73 |

| DB X-TRACKERS MSCI JAPAN INDEX UCITS ETF USD HEDGED (XMUJ) | -2.14 | -5.80 | -0.16 | 0.31 | -5.42 | -4.08 | -2.34 |

| DWS INVEST - AFRICA - DS1 GBP DIST (HVJG) | -1.04 | -16.67 | 0.10 | -0.63 | -16.87 | -14.41 | -7.95 |

| ISHARES MSCI SOUTH AFRICA ETF (ISVW) | -1.95 | -22.04 | 0.14 | 3.64 | -13.11 | -14.70 | -6.01 |

| UBS ETF MSCI UNITED KINGDOM 100% HEDGED TO USD UCITS ETF (UKUSBH) | -0.59 | -3.38 | 0.17 | -0.59 | -6.69 | 0.33 | -1.70 |

Best Funds last Month

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| SIMPLEX CHINA BULL 2X H-SHARE ETF (9D31112C) | 6.50 | -13.17 | 7.94 | 13.65 | -19.46 | -9.66 | -1.88 |

| JPMORGAN INDIAN INVESTMENT TRUST PLC (3J8) | -0.29 | -16.72 | -0.75 | 11.70 | -6.36 | -12.24 | -1.91 |

| MIRAE ASSET TIGER CHINA CONSUMER ETF (150460) | 0.42 | -13.29 | 2.40 | 9.93 | -17.82 | -13.42 | -4.73 |

| DB X-TRACKERS MSCI INDONESIA TRN INDEX UCITS ETF - 2C (3099) | -1.08 | -9.61 | 3.25 | 9.81 | 1.18 | -3.32 | 2.73 |

| DB X-TRACKERS MSCI INDONESIA TRN INDEX UCITS ETF (XMIN) | -0.79 | -8.97 | 3.63 | 9.48 | 0.93 | -2.64 | 2.85 |

| GOLDMAN SACHS BRICS PORTFOLIO (GSBLU) | 2.51 | -10.87 | 6.28 | 8.44 | -10.67 | -6.86 | -0.70 |

| TRACKER FUND OF HONG KONG LTD (TF5) | 2.65 | -7.19 | 3.91 | 8.35 | -10.34 | -5.79 | -0.97 |

| LYXOR ETF WIG20 (ETFW20L) | 0.35 | -11.48 | 6.35 | 7.64 | 0.19 | -7.75 | 1.61 |

| HSBC GLOBAL INVESTMENT FUNDS - INDIAN EQUITY (JHSC) | -0.62 | -16.16 | 2.41 | 7.55 | -6.61 | -11.82 | -2.12 |

| MIRAE ASSET TIGER CONSUMER STAPLES ETF (139280) | 0.36 | -19.86 | 3.72 | 7.19 | -12.63 | -18.87 | -5.15 |

| ABERDEEN GLOBAL - INDIAN EQUITY FUND - A2 (AEF2) | -0.44 | -5.66 | 3.51 | 7.12 | -4.65 | -1.67 | 1.08 |

| EDINBURGH DRAGON TRUST PLC/FUND (EFM) | 0.71 | -5.43 | 4.42 | 7.10 | -6.03 | -1.36 | 1.03 |

| GOLDMAN SACHS INDIA EQUITY PORTFOLIO (GS06) | -0.09 | -17.98 | 2.84 | 7.08 | -9.85 | -13.08 | -3.25 |

| AMUNDI ETF MSCI EUROPE TELECOM SERVICES UCITS ETF (CT5) | 0.15 | -9.43 | 1.35 | 7.05 | -0.72 | -8.26 | -0.14 |

| DB X-TRACKERS MSCI PHILIPPINES IM TRN INDEX UCITS ETF (N2E) | 1.06 | -15.29 | 4.20 | 6.72 | -1.84 | -8.81 | 0.07 |

| AMUNDI ETF MSCI EASTERN EUROPE EX RUSSIA UCITS ETF - EUR (CE9U) | -0.15 | -9.41 | 4.70 | 6.59 | -0.44 | -5.25 | 1.40 |

| DB X-TRACKERS MSCI PHILIP IM INDEX UCITS ETF (3016) | 0.95 | -15.32 | 4.42 | 6.56 | -2.01 | -9.27 | -0.07 |

| SCHOELLERBANK - ALL ASIA (ALLASIA) | 2.55 | -13.54 | 4.68 | 6.55 | -13.94 | -10.29 | -3.25 |

| LYXOR ETF MSCI INDIA (INDI) | 0.15 | -9.70 | 2.47 | 6.47 | -3.12 | -3.99 | 0.46 |

| AMUNDI ETF MSCI INDIA UCITS ETF (CI2U) | -0.01 | -9.21 | 2.10 | 6.39 | -3.41 | -3.64 | 0.36 |

Worst Funds last Month

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| SIMPLEX CHINA BULL 2X H-SHARE ETF (9D31112C) | 6.50 | -13.17 | 7.94 | 13.65 | -19.46 | -9.66 | -1.88 |

| JPMORGAN INDIAN INVESTMENT TRUST PLC (3J8) | -0.29 | -16.72 | -0.75 | 11.70 | -6.36 | -12.24 | -1.91 |

| MIRAE ASSET TIGER CHINA CONSUMER ETF (150460) | 0.42 | -13.29 | 2.40 | 9.93 | -17.82 | -13.42 | -4.73 |

| DB X-TRACKERS MSCI INDONESIA TRN INDEX UCITS ETF - 2C (3099) | -1.08 | -9.61 | 3.25 | 9.81 | 1.18 | -3.32 | 2.73 |

| DB X-TRACKERS MSCI INDONESIA TRN INDEX UCITS ETF (XMIN) | -0.79 | -8.97 | 3.63 | 9.48 | 0.93 | -2.64 | 2.85 |

| GOLDMAN SACHS BRICS PORTFOLIO (GSBLU) | 2.51 | -10.87 | 6.28 | 8.44 | -10.67 | -6.86 | -0.70 |

| TRACKER FUND OF HONG KONG LTD (TF5) | 2.65 | -7.19 | 3.91 | 8.35 | -10.34 | -5.79 | -0.97 |

| LYXOR ETF WIG20 (ETFW20L) | 0.35 | -11.48 | 6.35 | 7.64 | 0.19 | -7.75 | 1.61 |

| HSBC GLOBAL INVESTMENT FUNDS - INDIAN EQUITY (JHSC) | -0.62 | -16.16 | 2.41 | 7.55 | -6.61 | -11.82 | -2.12 |

| MIRAE ASSET TIGER CONSUMER STAPLES ETF (139280) | 0.36 | -19.86 | 3.72 | 7.19 | -12.63 | -18.87 | -5.15 |

| ABERDEEN GLOBAL - INDIAN EQUITY FUND - A2 (AEF2) | -0.44 | -5.66 | 3.51 | 7.12 | -4.65 | -1.67 | 1.08 |

| EDINBURGH DRAGON TRUST PLC/FUND (EFM) | 0.71 | -5.43 | 4.42 | 7.10 | -6.03 | -1.36 | 1.03 |

| GOLDMAN SACHS INDIA EQUITY PORTFOLIO (GS06) | -0.09 | -17.98 | 2.84 | 7.08 | -9.85 | -13.08 | -3.25 |

| AMUNDI ETF MSCI EUROPE TELECOM SERVICES UCITS ETF (CT5) | 0.15 | -9.43 | 1.35 | 7.05 | -0.72 | -8.26 | -0.14 |

| DB X-TRACKERS MSCI PHILIPPINES IM TRN INDEX UCITS ETF (N2E) | 1.06 | -15.29 | 4.20 | 6.72 | -1.84 | -8.81 | 0.07 |

| AMUNDI ETF MSCI EASTERN EUROPE EX RUSSIA UCITS ETF - EUR (CE9U) | -0.15 | -9.41 | 4.70 | 6.59 | -0.44 | -5.25 | 1.40 |

| DB X-TRACKERS MSCI PHILIP IM INDEX UCITS ETF (3016) | 0.95 | -15.32 | 4.42 | 6.56 | -2.01 | -9.27 | -0.07 |

| SCHOELLERBANK - ALL ASIA (ALLASIA) | 2.55 | -13.54 | 4.68 | 6.55 | -13.94 | -10.29 | -3.25 |

| LYXOR ETF MSCI INDIA (INDI) | 0.15 | -9.70 | 2.47 | 6.47 | -3.12 | -3.99 | 0.46 |

| AMUNDI ETF MSCI INDIA UCITS ETF (CI2U) | -0.01 | -9.21 | 2.10 | 6.39 | -3.41 | -3.64 | 0.36 |

Best Funds YTD

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| HBM HEALTHCARE INVESTMENTS AG (5H5A) | -1.55 | 24.44 | 2.98 | -2.76 | 1.22 | 30.22 | 7.92 |

| ETFS DAILY SHORT COPPER (SCOP) | 1.08 | 16.40 | -2.18 | 0.27 | 17.70 | 9.21 | 6.25 |

| BLACKROCK GLOBAL FUNDS - WORLD HEALTHSCIENCE FUND - EURA2 (ERDV) | 1.76 | 14.46 | 5.88 | 5.25 | 10.75 | 15.97 | 9.46 |

| MFC PROPERTY WEALTH FUND (MPROPTY) | -0.13 | 13.00 | 0.84 | -0.11 | 3.67 | 15.32 | 4.93 |

| FONDUL PROPRIETATEA SA/FUND (FP) | 1.10 | 12.67 | 1.89 | 1.21 | 2.89 | 15.93 | 5.48 |

| DAIWA J-REIT OPEN (0431103B) | 0.76 | 12.03 | 1.10 | 4.00 | 2.94 | 12.59 | 5.16 |

| FALCOM - SAUDI EQUITY ETF (FALCOM30) | 0.64 | 11.02 | 5.42 | 0.30 | -4.36 | 10.62 | 2.99 |

| MARKET VECTORS RETAIL ETF (VEFW) | -1.25 | 10.58 | 3.44 | -1.24 | 1.45 | 14.31 | 4.49 |

| SOURCE CONS DISC S&P US SECTOR (XLYS) | -0.13 | 10.45 | 4.62 | 1.55 | 0.11 | 12.40 | 4.67 |

| RAIFFEISEN - RAIFFEISEN-HEALTHCARE-AKTIENFONDS - A (ACTHLTA) | 0.59 | 9.63 | 5.44 | 5.36 | 9.34 | 10.83 | 7.74 |

| ISHARES NORTH AMERICAN TECH ETF (ISQ8) | -1.48 | 9.54 | 4.09 | -0.33 | -5.08 | 10.69 | 2.34 |

| ISHARES RUSSELL 1000 GROWTH ETF (IWF) | -0.37 | 8.64 | 5.37 | 1.60 | -0.29 | 10.78 | 4.37 |

| DB X-TRACKERS - MSCI RUSSIA CAPPED INDEX UCITS ETF - 2D (XMRC) | 0.08 | 7.44 | 6.25 | 1.34 | 2.63 | 9.53 | 4.94 |

| YINHUA CSI CHINA MAINLAND NATURAL RESOURCE INDEX FUND (150059) | 0.75 | 6.83 | 1.75 | -9.22 | 11.13 | 6.29 | 2.49 |

| BNY MELLON GLOBAL FUNDS PLC - BRAZIL EQUITY FUND (HZ5R) | -2.16 | 6.69 | 5.96 | -0.45 | 22.13 | 9.36 | 9.25 |

| BARRAMUNDI LTD (BRM) | 0.27 | 6.45 | 4.19 | 6.34 | 3.31 | 14.70 | 7.14 |

| HSBC MSCI RUSSIA CAPPED UCITS ETF $ (H4ZM) | -0.27 | 5.54 | 5.16 | 1.70 | 3.14 | 8.58 | 4.65 |

| ISHARES DOW JONES INDUSTRIAL AVERAGE UCITS ETF DE (INDUEX) | -0.26 | 4.37 | 5.01 | 2.28 | 2.95 | 7.25 | 4.37 |

| ISHARES MSCI RUSSIA ADR/GDR UCITS ETF (CEBB) | -0.22 | 4.29 | 5.64 | 1.27 | 3.35 | 7.99 | 4.56 |

| GOLDMAN SACHS US REIT FUND A COURSE - COLUMBUS EGG (3531103A) | 1.22 | 3.69 | 3.82 | 5.45 | 2.85 | 3.41 | 3.88 |

Worst Funds YTD

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| CITIC-PRUDENTIAL CSI 800 NONFERROUS METAL INDEX FUND (150151) | 8.03 | -58.69 | 12.16 | -3.75 | -46.19 | -56.32 | -23.53 |

| YINHUA CONSUMPTION THEME FUND (150048) | 1.01 | -42.64 | 4.43 | 4.48 | -35.62 | -40.57 | -16.82 |

| HSBC MSCI TURKEY UCITS ETF (H4Z2) | -4.08 | -41.64 | -2.22 | 0.04 | -20.83 | -34.23 | -14.31 |

| ISHARES MSCI TURKEY UCITS ETF (IDTK) | -1.17 | -39.29 | 0.99 | 3.68 | -17.54 | -32.79 | -11.42 |

| UBS HANA AMBATOVY NICKEL OVERSEAS INVESTMENT COMPANY 1 (2772642) | 0.80 | -36.68 | 3.43 | -1.67 | -28.82 | -32.38 | -14.86 |

| KB CHINA MAINLAND A SHARE LEVERAGE SEC FEEDER INVST TRUST-EQUITY-DERV FOF (3AF8926) | 5.63 | -30.46 | 7.90 | 4.05 | -23.58 | -26.98 | -9.65 |

| BLACKROCK GLOBAL FUNDS - WORLD GOLD FUND - A2EUR HEDGED (H2ZG) | 0.37 | -29.35 | 3.34 | -2.69 | -18.99 | -24.52 | -10.72 |

| KB CHINA MAINLAND A SHARE LEVERAGE SEC MASTER INVST TRUST-EQUITY-DERV FOF (3AF8884) | 5.62 | -29.01 | 7.93 | 4.25 | -22.71 | -25.33 | -8.97 |

| FIRST JANATA BANK MUTUAL FUND (1JANATA) | 1.42 | -27.71 | 2.38 | 0.21 | -21.28 | -26.84 | -11.38 |

| CITIC-PRUDENTIAL CSI 800 FINANCIAL INDEX CLASSIFIED FUND (150158) | 0.87 | -24.34 | 7.52 | -3.52 | -10.25 | -27.17 | -8.36 |

| LYXOR ETF FTSE ATHEX 20 (GRE) | -0.24 | -23.57 | 7.98 | 4.54 | -17.63 | -14.61 | -4.93 |

| BLACKROCK GLOBAL FUNDS - WORLD MINING FUND (B92A) | -0.69 | -23.35 | 5.42 | -4.21 | -23.76 | -15.56 | -9.53 |

| CHINA UNIVERSAL CSI CONSUMER STAPLES INDEX ETF (159928) | 1.02 | -22.73 | 9.20 | 4.57 | -27.78 | -15.63 | -7.41 |

| ETFS COFFEE (COFF) | -1.90 | -22.64 | -5.93 | -13.17 | -15.10 | -25.74 | -14.99 |

| HANWHA CHINA MAINLAND SECURITIES FEEDER INVESTMENT TRUST H - EQUITY - C-F (3991497) | 2.65 | -22.53 | 5.07 | 2.34 | -22.01 | -18.55 | -8.29 |

| HSBC CHINA DRAGON FUND (820) | -0.50 | -22.51 | 2.97 | -3.14 | -28.27 | -26.40 | -13.71 |

| BOCI-PRUDENTIAL - W.I.S.E. - CSI CHINA TRACKER FUND (2827) | 0.43 | -22.50 | 4.28 | -1.28 | -19.98 | -21.11 | -9.52 |

| FRANKLIN TEMPLETON INVESTMENT FUNDS - TEMPLETON ASIAN GROWTH FUND - N HEDGED 1 (XQ12) | 1.58 | -22.17 | 4.39 | 2.97 | -18.39 | -19.25 | -7.57 |

| ISHARES MSCI SOUTH AFRICA ETF (ISVW) | -1.95 | -22.04 | 0.14 | 3.64 | -13.11 | -14.70 | -6.01 |

| CHINAAMC ETF SERIES - CHINAAMC CSI 300 INDEX ETF (83188) | 0.90 | -21.94 | 6.70 | -0.77 | -19.22 | -20.20 | -8.37 |

Best Funds 1yr

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| HBM HEALTHCARE INVESTMENTS AG (5H5A) | -1.55 | 24.44 | 2.98 | -2.76 | 1.22 | 30.22 | 7.92 |

| BLACKROCK GLOBAL FUNDS - WORLD HEALTHSCIENCE FUND - EURA2 (ERDV) | 1.76 | 14.46 | 5.88 | 5.25 | 10.75 | 15.97 | 9.46 |

| FONDUL PROPRIETATEA SA/FUND (FP) | 1.10 | 12.67 | 1.89 | 1.21 | 2.89 | 15.93 | 5.48 |

| MFC PROPERTY WEALTH FUND (MPROPTY) | -0.13 | 13.00 | 0.84 | -0.11 | 3.67 | 15.32 | 4.93 |

| BARRAMUNDI LTD (BRM) | 0.27 | 6.45 | 4.19 | 6.34 | 3.31 | 14.70 | 7.14 |

| MARKET VECTORS RETAIL ETF (VEFW) | -1.25 | 10.58 | 3.44 | -1.24 | 1.45 | 14.31 | 4.49 |

| DAIWA J-REIT OPEN (0431103B) | 0.76 | 12.03 | 1.10 | 4.00 | 2.94 | 12.59 | 5.16 |

| SOURCE CONS DISC S&P US SECTOR (XLYS) | -0.13 | 10.45 | 4.62 | 1.55 | 0.11 | 12.40 | 4.67 |

| NEXT NOTES NIKKEI TOCOM LEVERAGED CRUDE OIL ETN (2038) | -0.44 | 0.69 | 7.10 | -28.27 | -22.96 | 11.40 | -8.18 |

| RAIFFEISEN - RAIFFEISEN-HEALTHCARE-AKTIENFONDS - A (ACTHLTA) | 0.59 | 9.63 | 5.44 | 5.36 | 9.34 | 10.83 | 7.74 |

| ISHARES RUSSELL 1000 GROWTH ETF (IWF) | -0.37 | 8.64 | 5.37 | 1.60 | -0.29 | 10.78 | 4.37 |

| ISHARES NORTH AMERICAN TECH ETF (ISQ8) | -1.48 | 9.54 | 4.09 | -0.33 | -5.08 | 10.69 | 2.34 |

| FALCOM - SAUDI EQUITY ETF (FALCOM30) | 0.64 | 11.02 | 5.42 | 0.30 | -4.36 | 10.62 | 2.99 |

| DB X-TRACKERS - MSCI RUSSIA CAPPED INDEX UCITS ETF - 2D (XMRC) | 0.08 | 7.44 | 6.25 | 1.34 | 2.63 | 9.53 | 4.94 |

| BNY MELLON GLOBAL FUNDS PLC - BRAZIL EQUITY FUND (HZ5R) | -2.16 | 6.69 | 5.96 | -0.45 | 22.13 | 9.36 | 9.25 |

| ETFS DAILY SHORT COPPER (SCOP) | 1.08 | 16.40 | -2.18 | 0.27 | 17.70 | 9.21 | 6.25 |

| HSBC MSCI RUSSIA CAPPED UCITS ETF $ (H4ZM) | -0.27 | 5.54 | 5.16 | 1.70 | 3.14 | 8.58 | 4.65 |

| ISHARES MSCI RUSSIA ADR/GDR UCITS ETF (CEBB) | -0.22 | 4.29 | 5.64 | 1.27 | 3.35 | 7.99 | 4.56 |

| ISHARES MSCI NEW ZEALAND CAPPED ETF (3ISI) | -1.61 | 0.98 | 2.94 | 3.88 | -4.68 | 7.61 | 2.44 |

| ISHARES DOW JONES INDUSTRIAL AVERAGE UCITS ETF DE (INDUEX) | -0.26 | 4.37 | 5.01 | 2.28 | 2.95 | 7.25 | 4.37 |

Worst Funds 1yr

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| CITIC-PRUDENTIAL CSI 800 NONFERROUS METAL INDEX FUND (150151) | 8.03 | -58.69 | 12.16 | -3.75 | -46.19 | -56.32 | -23.53 |

| YINHUA CONSUMPTION THEME FUND (150048) | 1.01 | -42.64 | 4.43 | 4.48 | -35.62 | -40.57 | -16.82 |

| HSBC MSCI TURKEY UCITS ETF (H4Z2) | -4.08 | -41.64 | -2.22 | 0.04 | -20.83 | -34.23 | -14.31 |

| ISHARES MSCI TURKEY UCITS ETF (IDTK) | -1.17 | -39.29 | 0.99 | 3.68 | -17.54 | -32.79 | -11.42 |

| UBS HANA AMBATOVY NICKEL OVERSEAS INVESTMENT COMPANY 1 (2772642) | 0.80 | -36.68 | 3.43 | -1.67 | -28.82 | -32.38 | -14.86 |

| CITIC-PRUDENTIAL CSI 800 FINANCIAL INDEX CLASSIFIED FUND (150158) | 0.87 | -24.34 | 7.52 | -3.52 | -10.25 | -27.17 | -8.36 |

| KB CHINA MAINLAND A SHARE LEVERAGE SEC FEEDER INVST TRUST-EQUITY-DERV FOF (3AF8926) | 5.63 | -30.46 | 7.90 | 4.05 | -23.58 | -26.98 | -9.65 |

| FIRST JANATA BANK MUTUAL FUND (1JANATA) | 1.42 | -27.71 | 2.38 | 0.21 | -21.28 | -26.84 | -11.38 |

| HSBC CHINA DRAGON FUND (820) | -0.50 | -22.51 | 2.97 | -3.14 | -28.27 | -26.40 | -13.71 |

| ETFS COFFEE (COFF) | -1.90 | -22.64 | -5.93 | -13.17 | -15.10 | -25.74 | -14.99 |

| KB CHINA MAINLAND A SHARE LEVERAGE SEC MASTER INVST TRUST-EQUITY-DERV FOF (3AF8884) | 5.62 | -29.01 | 7.93 | 4.25 | -22.71 | -25.33 | -8.97 |

| BLACKROCK GLOBAL FUNDS - WORLD GOLD FUND - A2EUR HEDGED (H2ZG) | 0.37 | -29.35 | 3.34 | -2.69 | -18.99 | -24.52 | -10.72 |

| BOCI-PRUDENTIAL - W.I.S.E. - CSI CHINA TRACKER FUND (2827) | 0.43 | -22.50 | 4.28 | -1.28 | -19.98 | -21.11 | -9.52 |

| LYXOR ETF IBEX 35 DOBLE APALANCADO DIARIO (IBEXA) | -1.30 | -19.49 | 1.30 | 2.70 | -15.38 | -20.41 | -7.95 |

| CHINAAMC ETF SERIES - CHINAAMC CSI 300 INDEX ETF (83188) | 0.90 | -21.94 | 6.70 | -0.77 | -19.22 | -20.20 | -8.37 |

| VALUE KOREA ETF (3041) | -0.09 | -20.16 | 5.42 | 4.95 | -18.51 | -19.87 | -7.00 |

| FRANKLIN TEMPLETON INVESTMENT FUNDS - TEMPLETON ASIAN GROWTH FUND - N HEDGED 1 (XQ12) | 1.58 | -22.17 | 4.39 | 2.97 | -18.39 | -19.25 | -7.57 |

| JPMORGAN CHINESE INVESTMENT TRUST PLC (JMC) | 0.16 | -21.31 | 6.46 | 0.85 | -26.63 | -19.18 | -9.63 |

| MIRAE ASSET TIGER CONSUMER STAPLES ETF (139280) | 0.36 | -19.86 | 3.72 | 7.19 | -12.63 | -18.87 | -5.15 |

| HANWHA CHINA MAINLAND SECURITIES FEEDER INVESTMENT TRUST H - EQUITY - C-F (3991497) | 2.65 | -22.53 | 5.07 | 2.34 | -22.01 | -18.55 | -8.29 |