Fund flow data for the perioud between 2018-07-24 and 2018-06-20

SLI Gars hits back at 'sniping' media in performance update Aberdeen Standard Investments sees wholesale outflows halve ... Investors pile into funds in record numbers but shun UK equities The Daily Shot: What's Causing the Turmoil in Emerging Markets? Fund of the Month: Fidelity EM manager's contrarian calls pay off SLI GARS loses largest IA fund crown to Woolnough's Optimal Income Standard Life hit by customer caution ahead of Aberdeen merger

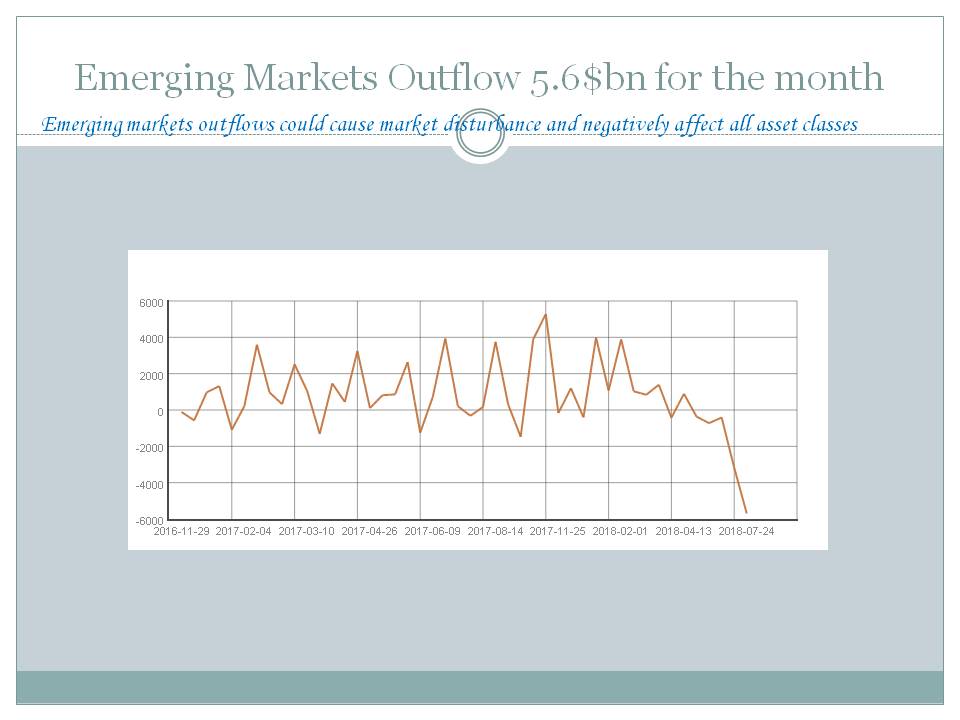

Emerging markets fund flow showed -5697.0 USD mn of outflow.. While Frontier Markets funds showed -24.5 USD mn of outflows.

BRAZIL Equity funds showed -558.3 USD mn of outflow.

BRAZIL Fixed Income funds showed -245.9 USD mn of outflow.

CHINA Equity funds showed -1018.8 USD mn of outflow.

CHINA Fixed Income funds showed -83.2 USD mn of outflow.

INDIA Equity funds showed -968.0 USD mn of outflow.

INDIA Fixed Income funds showed -83.2 USD mn of outflow.

KOREA Equity funds showed -55.4 USD mn of outflow.

RUSSIA Equity funds showed -125.8 USD mn of outflow.

RUSSIA Fixed Income funds showed -10.8 USD mn of outflow.

SOUTH AFRICA Equity funds showed -21.6 USD mn of outflow.

TURKEY Equity funds showed 19.6 USD mn of inflow.

COMMUNICATIONS SECTOR Equity funds showed 787.7 USD mn of inflow.

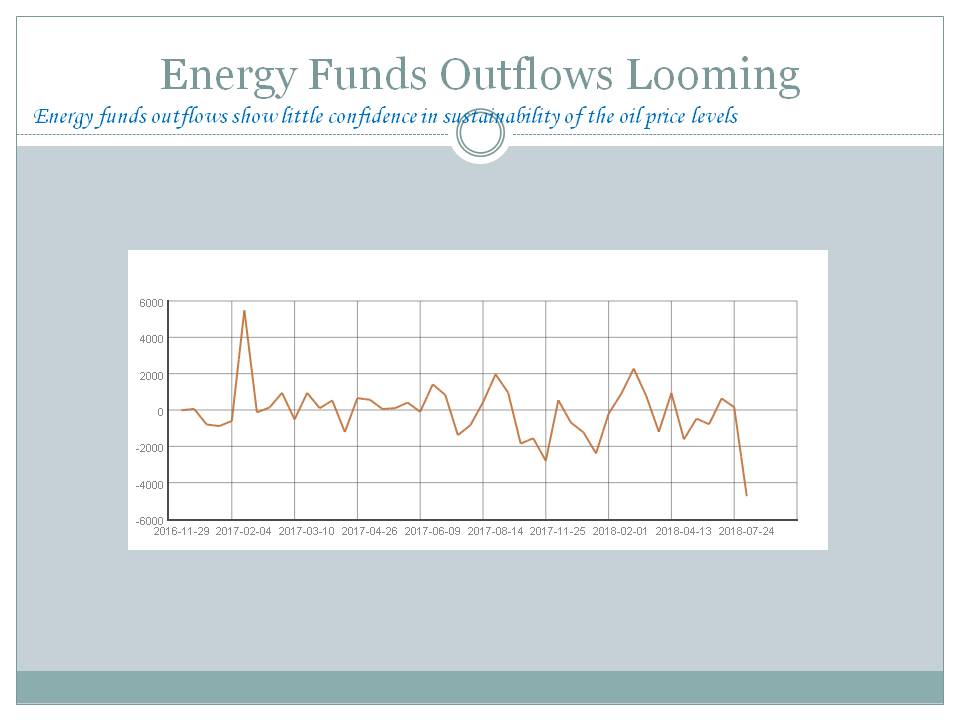

ENERGY SECTOR Equity funds showed -4744.5 USD mn of outflow.

ENERGY SECTOR Mixed Allocation funds showed 0.2 USD mn of inflow.

FINANCIAL SECTOR Equity funds showed -79.9 USD mn of outflow.

REAL ESTATE SECTOR Alternative funds showed -0.7 USD mn of outflow.

REAL ESTATE SECTOR Equity funds showed 179.2 USD mn of inflow.

TECHNOLOGY SECTOR Equity funds showed 953.2 USD mn of inflow.

UTILITIES SECTOR Equity funds showed -1022.8 USD mn of outflow.

LONG SHORT Alternative funds showed -177.1 USD mn of outflow.

LONG SHORT Equity funds showed -1084.3 USD mn of outflow.

LONG SHORT Fixed Income funds showed 17.4 USD mn of inflow.

LONG SHORT Mixed Allocation funds showed 3.0 USD mn of inflow.

Best global markets since the begining of the week USA-0.24%, EUROPE-3.09%, FM (FRONTIER MARKETS)-4.80%,

While worst global markets since the begining of the week EFM ASIA -6.54%, EM (EMERGING MARKETS) -6.27%, EM LATIN AMERICA -5.74%,

Best since the start of the week among various stock markets were TUNISIA +5.75%, KUWAIT +5.42%, TRINIDAD AND TOBAGO +3.12%, BAHRAIN +2.63%, NIGERIA +2.44%, MEXICO +2.19%, ROMANIA +1.84%, ISRAEL +1.67%, NEW ZEALAND +1.30%, BELGIUM +1.27%,

While worst since the start of the week among various stock markets were ARGENTINA -23.38%, BOTSWANA -10.68%, KOREA -10.44%, THAILAND -9.53%, BRAZIL -9.53%, SOUTH AFRICA -9.14%, SINGAPORE -8.81%, INDONESIA -8.72%, PAKISTAN -8.11%, LEBANON -7.61%,

Global Growth Powers International Fund Flows Investors Sell PowerShares FTSE RAFI Developed Markets (PXF ... International ETFs ready for takeoff Investors pulled $5.8 billion out of emerging market stocks in February Fund flows into India to be healthy despite LTCG tax: John Praveen ... The rush to emerging markets "Epic" flows to tech funds as "buy-the-dip" rules -BAML Flow Traders US LLC Has $4.90 Million Position in Schwab ... Investors pulled $5.8 billion out of emerging market stocks in February Fund flows into India to be healthy despite LTCG tax: John Praveen ... "Epic" flows to tech funds as "buy-the-dip" rules -BAML Navigating Through Stiff Income Crosswinds: What Are Cash Flow ... Investors Warm Up to Bond ETFs US Fund-Flows Weekly Report: All 4 Fund Macro-Groups Take In ... New Year, Not-So-New Trends in Fund Flows

Fund Flows By Objective

| Focus | Objective | Asset Class | Flow USD mn |

| Commodities | INDUSTRIAL METALS | Commodity | -193.78 |

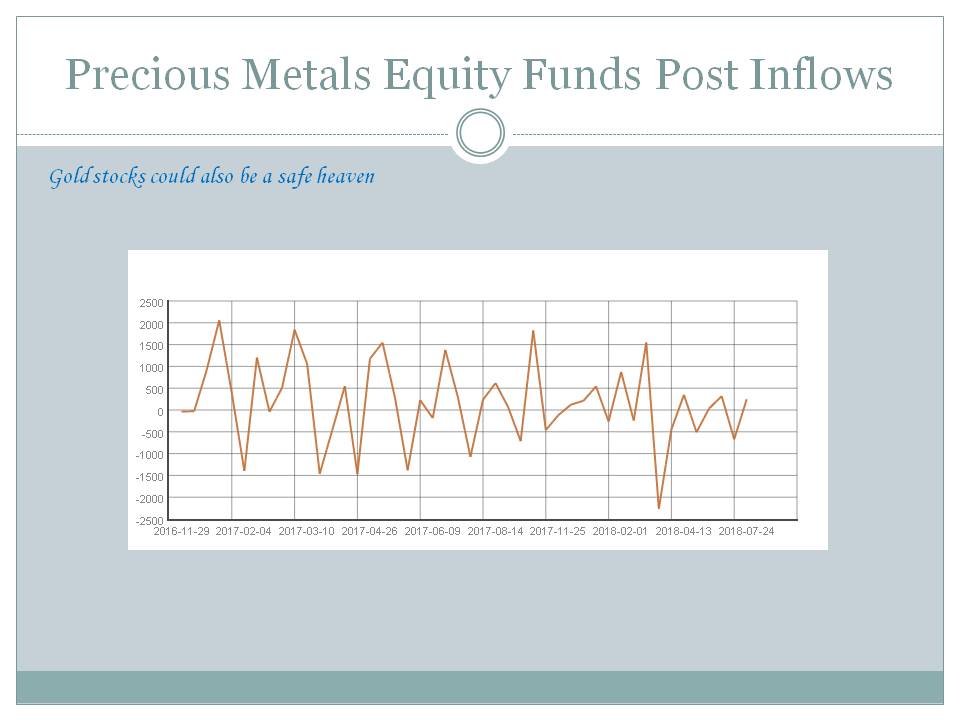

| Commodities | PRECIOUS METAL SECTOR | Equity | 247.44 |

| Commodities | PRECIOUS METALS | Commodity | -2665.03 |

| Commodities | PRECIOUS METALS | Mixed Allocation | -27.18 |

| country | AUSTRALIA | Equity | -139.58 |

| country | AUSTRALIA | Fixed Income | -64.96 |

| country | AUSTRALIA | Mixed Allocation | -0.33 |

| country | BRAZIL | Equity | -558.34 |

| country | BRAZIL | Fixed Income | -245.93 |

| country | CHINA | Equity | -1018.79 |

| country | CHINA | Fixed Income | -83.19 |

| Country | EGYPT | Equity | -3.14 |

| country | INDIA | Equity | -968.04 |

| country | INDIA | Fixed Income | -83.22 |

| country | ISRAEL | Equity | 0.74 |

| country | JAPAN | Equity | -4714.83 |

| country | JAPAN | Fixed Income | -112.62 |

| country | JAPAN | Mixed Allocation | 17.16 |

| country | KOREA | Equity | -55.38 |

| country | POLAND | Equity | -7.82 |

| country | RUSSIA | Equity | -125.83 |

| country | RUSSIA | Fixed Income | -10.80 |

| country | SOUTH AFRICA | Equity | -21.59 |

| country | SPAIN | Equity | 149.15 |

| Country | TAIWAN | Equity | -86.95 |

| country | TURKEY | Equity | 19.55 |

| country | UNITED KINGDOM | Equity | 20.68 |

| industry | BASIC MATERIALS SECTOR | Equity | 929.86 |

| industry | COMMUNICATIONS SECTOR | Equity | 787.73 |

| industry | ENERGY SECTOR | Equity | -4744.48 |

| industry | ENERGY SECTOR | Mixed Allocation | 0.17 |

| industry | FINANCIAL SECTOR | Equity | -79.91 |

| industry | HEALTH CARE SECTOR | Equity | -2031.75 |

| industry | INDUSTRIAL SECTOR | Equity | -436.61 |

| industry | MULTIPLE SECTOR | Equity | 0.69 |

| industry | NATURAL RESOURCES SECTOR | Equity | -54.12 |

| industry | REAL ESTATE SECTOR | Alternative | -0.73 |

| industry | REAL ESTATE SECTOR | Equity | 179.22 |

| industry | TECHNOLOGY SECTOR | Equity | 953.23 |

| industry | UTILITIES SECTOR | Equity | -1022.79 |

| region | AFRICAN REGION | Equity | -74.86 |

| region | ASIAN PACIFIC REGION | Equity | 2507.77 |

| region | ASIAN PACIFIC REGION | Fixed Income | -246.01 |

| region | ASIAN PACIFIC REGION | Mixed Allocation | 415.29 |

| region | ASIAN PACIFIC REGION EX JAPAN | Equity | -890.25 |

| region | ASIAN PACIFIC REGION EX JAPAN | Fixed Income | -710.13 |

| region | ASIAN PACIFIC REGION EX JAPAN | Mixed Allocation | 51.30 |

| region | EASTERN EUROPEAN REGION | Equity | -49.28 |

| region | EASTERN EUROPEAN REGION | Fixed Income | 16.86 |

| region | EASTERN EUROPEAN REGION | Mixed Allocation | 0.39 |

| region | EUROPEAN REGION | Equity | -3411.16 |

| region | EUROPEAN REGION | Fixed Income | -140.77 |

| region | EUROPEAN REGION | Mixed Allocation | 142.12 |

| region | LATIN AMERICAN REGION | Equity | -732.74 |

| region | LATIN AMERICAN REGION | Fixed Income | 182.32 |

| region | MIDDLE EAST REGION | Equity | -2.57 |

| region | MIDDLE EAST REGION | Fixed Income | -17.77 |

| region | NORDIC REGION | Equity | -132.04 |

| region | NORTH AMERICAN REGION | Equity | -69.38 |

| region | NORTH AMERICAN REGION | Fixed Income | -38.35 |

| Risk | GOVERNMENT BOND | Alternative | -10.72 |

| Risk | GOVERNMENT BOND | Equity | -0.03 |

| Risk | GOVERNMENT BOND | Fixed Income | 1616.18 |

| Risk | GOVERNMENT BOND | Mixed Allocation | -12.90 |

| Risk | INFLATION PROTECTED | Brazil | -3.93 |

| Risk | INFLATION PROTECTED | Fixed Income | 234.48 |

| Risk | LONG SHORT | Alternative | -177.06 |

| Risk | LONG SHORT | Equity | -1084.32 |

| Risk | LONG SHORT | Fixed Income | 17.42 |

| Risk | LONG SHORT | Mixed Allocation | 2.96 |

| Sector | AGRICULTURE | Commodity | -50.65 |

| Sector | AGRICULTURE | Equity | 0.00 |

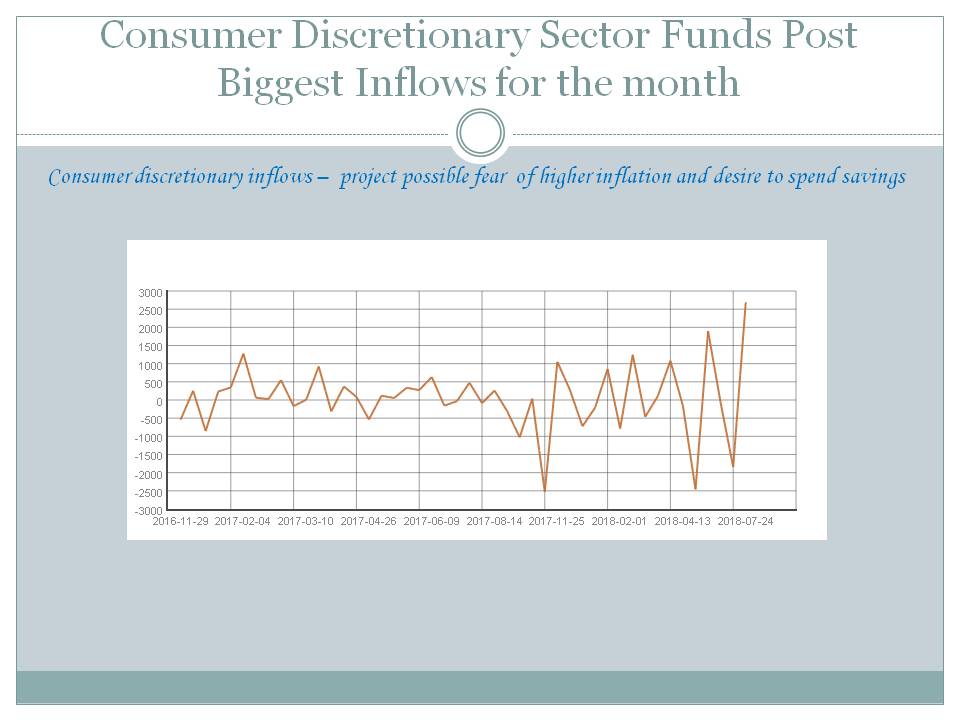

| Sector | CONSUMER DISCRETIONARY | Equity | 2689.38 |

| Sector | CONSUMER STAPLES | Equity | 799.07 |

| segment | BRIC | Equity | -62.78 |

| segment | BRIC | Fixed Income | -132.47 |

| segment | DEVELOPED MARKETS | Equity | -146.56 |

| segment | EMEA | Equity | 4.68 |

| segment | EMEA | Fixed Income | 2.10 |

| segment | EMERGING MARKETS | Equity | -5696.98 |

| segment | GCC | Equity | -16.58 |

| segment | GCC | Fixed Income | -4.73 |

| segment | GCC | Mixed Allocation | -2.22 |

| segment | MENA | Equity | 0.95 |

| segment | MENA | Fixed Income | 0.08 |

| Size | LARGE-CAP | Equity | -4965.35 |

| Size | MID-CAP | Commodity | -1.07 |

| Size | MID-CAP | Equity | -654.36 |

| Size | SMALL-CAP | Equity | -3867.13 |

Flows In Descending Order

| Focus | Objective | Asset Class | Flow USD mn |

| Sector | CONSUMER DISCRETIONARY | Equity | 2689.38 |

| region | ASIAN PACIFIC REGION | Equity | 2507.77 |

| Risk | GOVERNMENT BOND | Fixed Income | 1616.18 |

| industry | TECHNOLOGY SECTOR | Equity | 953.23 |

| industry | BASIC MATERIALS SECTOR | Equity | 929.86 |

| Sector | CONSUMER STAPLES | Equity | 799.07 |

| industry | COMMUNICATIONS SECTOR | Equity | 787.73 |

| region | ASIAN PACIFIC REGION | Mixed Allocation | 415.29 |

| Commodities | PRECIOUS METAL SECTOR | Equity | 247.44 |

| Risk | INFLATION PROTECTED | Fixed Income | 234.48 |

| region | LATIN AMERICAN REGION | Fixed Income | 182.32 |

| industry | REAL ESTATE SECTOR | Equity | 179.22 |

| country | SPAIN | Equity | 149.15 |

| region | EUROPEAN REGION | Mixed Allocation | 142.12 |

| region | ASIAN PACIFIC REGION EX JAPAN | Mixed Allocation | 51.30 |

| country | UNITED KINGDOM | Equity | 20.68 |

| country | TURKEY | Equity | 19.55 |

| Risk | LONG SHORT | Fixed Income | 17.42 |

| country | JAPAN | Mixed Allocation | 17.16 |

| region | EASTERN EUROPEAN REGION | Fixed Income | 16.86 |

| segment | EMEA | Equity | 4.68 |

| Risk | LONG SHORT | Mixed Allocation | 2.96 |

| segment | EMEA | Fixed Income | 2.10 |

| segment | MENA | Equity | 0.95 |

| country | ISRAEL | Equity | 0.74 |

| industry | MULTIPLE SECTOR | Equity | 0.69 |

| region | EASTERN EUROPEAN REGION | Mixed Allocation | 0.39 |

| industry | ENERGY SECTOR | Mixed Allocation | 0.17 |

| segment | MENA | Fixed Income | 0.08 |

| Sector | AGRICULTURE | Equity | 0.00 |

| Risk | GOVERNMENT BOND | Equity | -0.03 |

| country | AUSTRALIA | Mixed Allocation | -0.33 |

| industry | REAL ESTATE SECTOR | Alternative | -0.73 |

| Size | MID-CAP | Commodity | -1.07 |

| segment | GCC | Mixed Allocation | -2.22 |

| region | MIDDLE EAST REGION | Equity | -2.57 |

| Country | EGYPT | Equity | -3.14 |

| Risk | INFLATION PROTECTED | Brazil | -3.93 |

| segment | GCC | Fixed Income | -4.73 |

| country | POLAND | Equity | -7.82 |

| Risk | GOVERNMENT BOND | Alternative | -10.72 |

| country | RUSSIA | Fixed Income | -10.80 |

| Risk | GOVERNMENT BOND | Mixed Allocation | -12.90 |

| segment | GCC | Equity | -16.58 |

| region | MIDDLE EAST REGION | Fixed Income | -17.77 |

| country | SOUTH AFRICA | Equity | -21.59 |

| Commodities | PRECIOUS METALS | Mixed Allocation | -27.18 |

| region | NORTH AMERICAN REGION | Fixed Income | -38.35 |

| region | EASTERN EUROPEAN REGION | Equity | -49.28 |

| Sector | AGRICULTURE | Commodity | -50.65 |

| industry | NATURAL RESOURCES SECTOR | Equity | -54.12 |

| country | KOREA | Equity | -55.38 |

| segment | BRIC | Equity | -62.78 |

| country | AUSTRALIA | Fixed Income | -64.96 |

| region | NORTH AMERICAN REGION | Equity | -69.38 |

| region | AFRICAN REGION | Equity | -74.86 |

| industry | FINANCIAL SECTOR | Equity | -79.91 |

| country | CHINA | Fixed Income | -83.19 |

| country | INDIA | Fixed Income | -83.22 |

| Country | TAIWAN | Equity | -86.95 |

| country | JAPAN | Fixed Income | -112.62 |

| country | RUSSIA | Equity | -125.83 |

| region | NORDIC REGION | Equity | -132.04 |

| segment | BRIC | Fixed Income | -132.47 |

| country | AUSTRALIA | Equity | -139.58 |

| region | EUROPEAN REGION | Fixed Income | -140.77 |

| segment | DEVELOPED MARKETS | Equity | -146.56 |

| Risk | LONG SHORT | Alternative | -177.06 |

| Commodities | INDUSTRIAL METALS | Commodity | -193.78 |

| country | BRAZIL | Fixed Income | -245.93 |

| region | ASIAN PACIFIC REGION | Fixed Income | -246.01 |

| industry | INDUSTRIAL SECTOR | Equity | -436.61 |

| country | BRAZIL | Equity | -558.34 |

| Size | MID-CAP | Equity | -654.36 |

| region | ASIAN PACIFIC REGION EX JAPAN | Fixed Income | -710.13 |

| region | LATIN AMERICAN REGION | Equity | -732.74 |

| region | ASIAN PACIFIC REGION EX JAPAN | Equity | -890.25 |

| country | INDIA | Equity | -968.04 |

| country | CHINA | Equity | -1018.79 |

| industry | UTILITIES SECTOR | Equity | -1022.79 |

| Risk | LONG SHORT | Equity | -1084.32 |

| industry | HEALTH CARE SECTOR | Equity | -2031.75 |

| Commodities | PRECIOUS METALS | Commodity | -2665.03 |

| region | EUROPEAN REGION | Equity | -3411.16 |

| Size | SMALL-CAP | Equity | -3867.13 |

| country | JAPAN | Equity | -4714.83 |

| industry | ENERGY SECTOR | Equity | -4744.48 |

| Size | LARGE-CAP | Equity | -4965.35 |

| segment | EMERGING MARKETS | Equity | -5696.98 |

Chart: Emerging Markets Outflow 5.6$bn for the month

Emerging markets outflows could cause market disturbance and negatively affect all asset classes

Source: ML

Download file in Power PointKey Topics and News

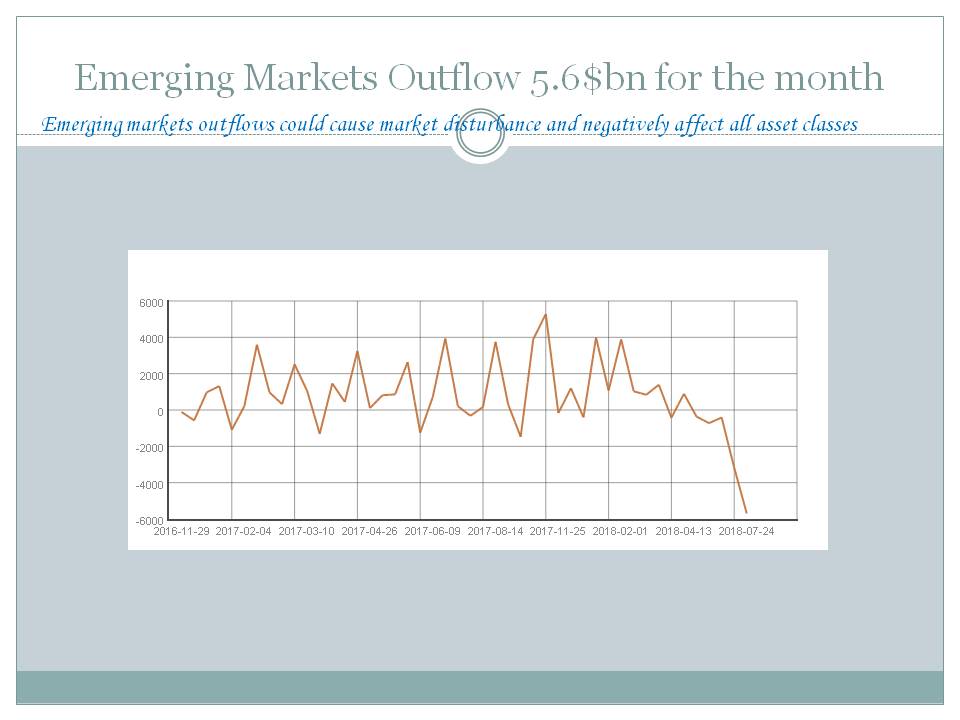

US Government Bond Funds Inflows Are Healthy

- A Bond Fund That Has Delivered 8% Returns

- Hedge-fund manager Marc Lasry says $40000 bitcoin is achievable

- Markets Head Into Busiest Week Of Earnings Season

- Bond ETF Flows Shift To Safety

- Duterte admin's Sona promises for 2016, 2017: A review

- Bond ETF Flows Shift To Safety | ETF.com

- U.S. Treasuries Led Bond Funds Higher As 10-Year Yield Tumbled

- Money is flowing into passively managed bond funds - CNBC.com

- Investors Feasted on Fixed Income ETFs in April | ThinkAdvisor

- Fund flows show investors favoring bonds over stocks - MarketWatch

- 2017 Investment Company Fact Book (pdf)

- Morningstar Fund Flows and Investment Trends

- Morningstar DirectSM Asset Flows Commentary: United States

- Investment Themes - Fidelity Institutional Asset Management

- China: Unpacking the world's third largest bond market - The Asset

But risk flight is also ongoing and prices on bond markets are assumed comfortable for many investors Forget those dividend stocks when triple A bonds yield 5%

Source: ML

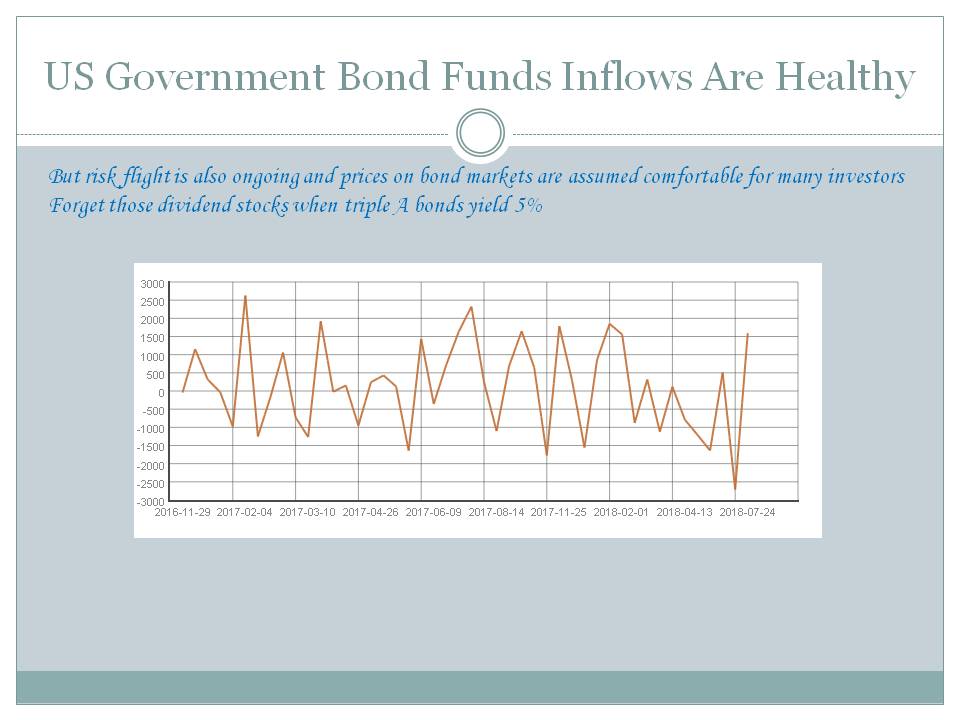

Inflation Protected Fixed Income Funds Post Inflows

- FUND FLOWS: Investors Pull Out of Riskier Bond Funds

- Investing Insights: Vanguard, Pepsi, and a Midyear Outlook

- FUND FLOWS: Despite Coming Rate Hikes, Investors Love US Bonds

- The Daily Shot: Housing Inventories Creep Higher as Prices Hit a ...

- Money managers with $160 trillion at stake are vulnerable to a ...

- FUND FLOWS: Despite Coming Rate Hikes, Investors Love U.S. ...

- FUND FLOWS: Investors Pull Out of Riskier Bond Funds | Wealth ...

- FUND FLOWS: Bond Investors Pull Money Ahead of Rate Hike ...

- UPDATE 1-Investors shrug off rate fears, pour cash into equity funds ...

- U.S. Weekly FundFlows Insight Report: Equity Funds Attract Net ...

- Bond Fund Prices Fall in Q1

- The Rise of Fixed Income ETFs - FA Mag

- Inflation-linked bonds - FTSE Russell

- Real Assets - Brookfield Asset Management

- FUND FLOWS: Despite Coming Rate Hikes, Investors Love U.S. ...

More evidence of inflationary fears

Source: ML

Precious Metals Equity Funds Post Inflows

- Amid trade war, US fund investors find little safe haven in gold

- Some see commodity-based funds ready to heat up

- On Pensions, Inflation, And Your Portfolio

- The Daily Shot: Speculators Are Betting on Treasury Debt Selloff

- US money market funds see biggest inflows in nearly five years: Lipper

Gold stocks could also be a safe heaven

Source: ML

Consumer Discretionary Sector Funds Post Biggest Inflows for the month

- Rotation to Safety Is Key for ETFs Amid Trade Fears

- Q2 Market Review: Equities, Treasuries, Oil, Gold & Crypto

- Chinese stock pickers have been chasing this investment theme ...

- How managers are playing 2018 graduates to EM status

- It's Hard to Know What the Safe Havens Are Anymore: Taking Stock

Source: ML

Energy Funds Outflows Looming

- Trade war looms over European company earnings

- Analysis: Trade war looms over European company earnings

- Liquidity-Thirsty Funds Brace for Downturn Via CDS Wagers

- Opinion: The bond market goes its own way

- Stocks Edge Higher During Momentary Pause in Trade Tensions

Energy funds outflows show little confidence in sustainability of the oil price levels

Source: ML

Emerging markets fund flow showed -5697.0 USD mn of outflow.. While Frontier Markets funds showed -24.5 USD mn of outflows.

BRAZIL Equity funds showed -558.3 USD mn of outflow.

BRAZIL Fixed Income funds showed -245.9 USD mn of outflow.

CHINA Equity funds showed -1018.8 USD mn of outflow.

CHINA Fixed Income funds showed -83.2 USD mn of outflow.

INDIA Equity funds showed -968.0 USD mn of outflow.

INDIA Fixed Income funds showed -83.2 USD mn of outflow.

KOREA Equity funds showed -55.4 USD mn of outflow.

RUSSIA Equity funds showed -125.8 USD mn of outflow.

RUSSIA Fixed Income funds showed -10.8 USD mn of outflow.

SOUTH AFRICA Equity funds showed -21.6 USD mn of outflow.

TURKEY Equity funds showed 19.6 USD mn of inflow.

COMMUNICATIONS SECTOR Equity funds showed 787.7 USD mn of inflow.

ENERGY SECTOR Equity funds showed -4744.5 USD mn of outflow.

ENERGY SECTOR Mixed Allocation funds showed 0.2 USD mn of inflow.

FINANCIAL SECTOR Equity funds showed -79.9 USD mn of outflow.

REAL ESTATE SECTOR Alternative funds showed -0.7 USD mn of outflow.

REAL ESTATE SECTOR Equity funds showed 179.2 USD mn of inflow.

TECHNOLOGY SECTOR Equity funds showed 953.2 USD mn of inflow.

UTILITIES SECTOR Equity funds showed -1022.8 USD mn of outflow.

LONG SHORT Alternative funds showed -177.1 USD mn of outflow.

LONG SHORT Equity funds showed -1084.3 USD mn of outflow.

LONG SHORT Fixed Income funds showed 17.4 USD mn of inflow.

LONG SHORT Mixed Allocation funds showed 3.0 USD mn of inflow.

Latest ML Comics

Markets

Market performance is between 2018-07-02 and 2018-06-01Best global markets since the begining of the week USA-0.24%, EUROPE-3.09%, FM (FRONTIER MARKETS)-4.80%,

While worst global markets since the begining of the week EFM ASIA -6.54%, EM (EMERGING MARKETS) -6.27%, EM LATIN AMERICA -5.74%,

Best since the start of the week among various stock markets were TUNISIA +5.75%, KUWAIT +5.42%, TRINIDAD AND TOBAGO +3.12%, BAHRAIN +2.63%, NIGERIA +2.44%, MEXICO +2.19%, ROMANIA +1.84%, ISRAEL +1.67%, NEW ZEALAND +1.30%, BELGIUM +1.27%,

While worst since the start of the week among various stock markets were ARGENTINA -23.38%, BOTSWANA -10.68%, KOREA -10.44%, THAILAND -9.53%, BRAZIL -9.53%, SOUTH AFRICA -9.14%, SINGAPORE -8.81%, INDONESIA -8.72%, PAKISTAN -8.11%, LEBANON -7.61%,

Key Fund Flow Headlines

Top 20 Funds Longs Based on Momentum

| Name | 1week | 1month | ytd | 6months | 1yr | Rank |

| DWS RUSSIA BOND FUND - EUR DIST (DWSRUBD) | -2.54 | 0.96 | 152.31 | 148.43 | 170.01 | 79.22 |

| HSBC EQUITY FUND/INDIA - DIVIDEND (HSBCHED) | -2.03 | 88.64 | 88.11 | 72.97 | 114.54 | 68.53 |

| HSBC GLOBAL INVESTMENT FUNDS - CHINESE EQUITY - ED (HSBCHED) | -2.03 | 88.64 | 88.11 | 72.97 | 114.54 | 68.53 |

| DB PHYSICAL RHODIUM ETC (XRH0) | 2.24 | 1.64 | 39.41 | 39.41 | 140.38 | 45.92 |

| NEXT NOTES NIKKEI TOCOM LEVERAGED CRUDE OIL ETN (2038) | -3.42 | 3.02 | 30.88 | 25.54 | 111.04 | 34.05 |

| PROSHARES ULTRA DJ-UBS CRUDE OIL (UCO) | -4.94 | 8.14 | 28.11 | 15.06 | 98.61 | 29.22 |

| HBM HEALTHCARE INVESTMENTS AG (5H5A) | 5.37 | 4.55 | 24.21 | 15.72 | 41.48 | 16.78 |

| FIRST TRUST DOW JONES INTERNET INDEX FUND (FDN) | -0.41 | -0.30 | 31.49 | 23.55 | 43.49 | 16.58 |

| WTI CRUDE OIL PRICE LINKED ETF (1671) | -1.98 | 5.12 | 15.95 | 10.54 | 44.47 | 14.54 |

| ISHARES NORTH AMERICAN TECH-SOFTWARE ETF (IGV) | -0.17 | 2.64 | 26.78 | 17.35 | 36.66 | 14.12 |

| ETFS WTI CRUDE OIL (CRUD) | -0.28 | 3.65 | 19.75 | 7.73 | 44.23 | 13.83 |

| WTI CRUDE OIL PRICE LINKED ETF (9D311097) | -2.62 | 5.10 | 15.53 | 8.14 | 43.54 | 13.54 |

| SANTANDER FIC FI VALE 3 ACOES (REALRIO) | 3.22 | 3.01 | 10.18 | 0.22 | 45.86 | 13.08 |

| FIDELITY SELECT RETAILING PORTFOLIO (FSRPX) | 0.32 | 0.38 | 20.49 | 12.26 | 38.91 | 12.97 |

| SAFRA VALE DO RIO DOCE FIC FIA (SAFVRDA) | 3.19 | 2.89 | 9.65 | -0.16 | 44.35 | 12.57 |

| UNITED STATES OIL FUND LP (U9N) | -5.69 | 3.46 | 14.18 | 8.42 | 42.88 | 12.27 |

| SCB OIL FUND (SCBOILH) | -2.44 | 0.82 | 13.38 | 5.36 | 44.83 | 12.14 |

| FIDELITY SELECT SOFTWARE & COMPUTER SERVICES PORTFOLIO (FSCSX) | -0.15 | 2.30 | 20.31 | 13.15 | 33.13 | 12.11 |

| K OIL FUND (KASOILF) | -2.40 | 0.84 | 13.10 | 5.28 | 43.96 | 11.92 |

| SPDR S&P OIL & GAS EXPLORATION & PRODUCTION ETF (XOP) | -1.20 | 0.73 | 15.18 | 10.60 | 34.22 | 11.09 |

Top 20 Funds Shorts Based on Momentum

| Name | 1week | 1month | ytd | 6months | 1yr | Rank |

| VELOCITYSHARES 3X LONG NATURAL GAS ETN (UGAZ) | -0.18 | -19.44 | -25.15 | -31.27 | -60.02 | -27.73 |

| LYXOR ETF TURKEY EURO (TURU) | 2.67 | -5.26 | -36.74 | -36.37 | -38.13 | -19.27 |

| FINAM MANAGEMENT LLC (FINMIT) | -1.97 | -0.27 | -33.65 | -34.70 | -40.14 | -19.27 |

| DIREXION DAILY BRAZIL BULL 3X SHARES (BRZU) | 3.70 | 15.78 | -45.73 | -58.83 | -34.75 | -18.53 |

| ISHARES MSCI TURKEY UCITS ETF (IDTK) | 3.51 | -4.88 | -35.61 | -35.57 | -37.05 | -18.50 |

| HSBC MSCI TURKEY UCITS ETF (HTRY) | 3.68 | -4.15 | -35.26 | -35.25 | -36.52 | -18.06 |

| ISHARES MSCI TURKEY ETF (ISVZ) | 3.37 | -4.63 | -34.73 | -35.03 | -35.48 | -17.94 |

| HSBC MSCI TURKEY UCITS ETF (H4Z2) | 4.48 | -4.12 | -35.60 | -35.37 | -36.15 | -17.79 |

| DIREXION DAILY GOLD MINERS BULL 3X SHARES (NUGT) | -4.68 | -6.13 | -29.70 | -32.14 | -28.18 | -17.78 |

| KB CHINA MAINLAND A SHARE LEVERAGE SEC FEEDER INVST TRUST-EQUITY-DERV FOF (3AF8926) | -3.67 | -13.16 | -29.59 | -38.31 | -14.33 | -17.37 |

| CANADIAN LIFE COS SPLIT CORP (LFE) | 2.31 | -6.18 | -36.09 | -39.12 | -25.97 | -17.24 |

| KB CHINA MAINLAND A SHARE LEVERAGE SEC MASTER INVST TRUST-EQUITY-DERV FOF (3AF8884) | -3.63 | -13.00 | -28.74 | -37.66 | -12.42 | -16.68 |

| 49 NORTH RESOURCES INC (FNR) | -7.91 | -6.94 | -46.75 | -28.22 | -23.00 | -16.52 |

| CITIC-PRUDENTIAL CSI 800 FINANCIAL INDEX CLASSIFIED FUND (150158) | 4.11 | -5.22 | -27.57 | -39.10 | -21.07 | -15.32 |

| CITIC-PRUDENTIAL CSI 800 FINANCIAL INDEX CLASSIFIED FUND-MAIN - MAIN (CITICFI) | -2.71 | -8.91 | -19.59 | -27.68 | -18.43 | -14.43 |

| AUSTRALIA EQUITY INCOME FUND (DWAUEIP) | -0.68 | -4.08 | -22.81 | -20.74 | -31.10 | -14.15 |

| SIMPLEX CHINA BULL 2X H-SHARE ETF (9D31112C) | -3.72 | -12.69 | -17.51 | -33.61 | -5.39 | -13.85 |

| ETFS COFFEE (COFF) | -2.24 | -7.11 | -17.36 | -15.24 | -27.69 | -13.07 |

| SIMPLEX CHINA BULL 2X H-SHARE ETF (1572) | -2.08 | -14.35 | -16.27 | -32.92 | -2.85 | -13.05 |

| YINHUA CONSUMPTION THEME FUND (150048) | -0.75 | -10.00 | -27.52 | -31.58 | -9.17 | -12.88 |

Best Funds last Week

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| HBM HEALTHCARE INVESTMENTS AG (5H5A) | 0.98 | 24.21 | 5.37 | 4.55 | 15.72 | 41.48 | 16.78 |

| DB X-TRACKERS FTSE VIETNAM UCITS ETF (XVTD) | -0.49 | -4.84 | 4.83 | -3.25 | -14.25 | 31.21 | 4.64 |

| DB X-TRACKERS MSCI BRAZIL INDEX UCITS ETF (XMBR) | 2.36 | -10.38 | 4.65 | 6.94 | -18.49 | -1.14 | -2.01 |

| HSBC MSCI TURKEY UCITS ETF (H4Z2) | 1.31 | -35.60 | 4.48 | -4.12 | -35.37 | -36.15 | -17.79 |

| CITIC-PRUDENTIAL CSI 800 FINANCIAL INDEX CLASSIFIED FUND (150158) | 7.93 | -27.57 | 4.11 | -5.22 | -39.10 | -21.07 | -15.32 |

| JPMORGAN FUNDS - LATIN AMERICA EQUITY FUND (JPJ0) | 3.17 | -9.62 | 3.72 | 7.92 | -15.67 | -6.49 | -2.63 |

| HSBC MSCI TURKEY UCITS ETF (HTRY) | 0.79 | -35.26 | 3.68 | -4.15 | -35.25 | -36.52 | -18.06 |

| ISHARES MSCI TURKEY UCITS ETF (IDTK) | 0.79 | -35.61 | 3.51 | -4.88 | -35.57 | -37.05 | -18.50 |

| ISHARES MSCI BRAZIL UCITS ETF (INC) (IBZL) | 5.42 | -12.57 | 3.47 | 5.56 | -19.86 | -0.62 | -2.86 |

| ISHARES MSCI TURKEY ETF (ISVZ) | 0.38 | -34.73 | 3.37 | -4.63 | -35.03 | -35.48 | -17.94 |

| FRANKLIN TEMPLETON INVESTMENT FUNDS - TEMPLETON LATIN AMERICA FUND - A YDISEUR (XQ1H) | 2.18 | -5.94 | 3.00 | 7.78 | -12.74 | -3.35 | -1.33 |

| NEXT FUNDS IBOVESPA LINKED EXCHANGE TRADED FUND (1325) | -0.72 | -11.16 | 2.85 | 3.74 | -19.43 | -3.29 | -4.03 |

| JOHN HANCOCK REGIONAL BANK FUND - B (FRBFX) | 0.47 | 5.95 | 2.55 | -2.05 | -0.22 | 15.44 | 3.93 |

| DB X-TRACKERS MSCI THAILAND TRN INDEX UCITS ETF - 1C (LG7) | 1.90 | -3.33 | 2.47 | 0.36 | -8.51 | 15.44 | 2.44 |

| AMUNDI ETF MSCI EM LATIN AMERICA UCITS ETF - EUR (AMEL) | -0.12 | -6.75 | 2.36 | 10.73 | -12.39 | -1.43 | -0.18 |

| SAMSUNG KODEX 200 EXCHANGE TRADED FUNDS (1313) | 4.47 | -11.47 | 2.34 | 0.29 | -10.22 | -2.96 | -2.64 |

| LYXOR ETF TAIWAN (LYXTWN) | 1.77 | 1.27 | 2.29 | 2.29 | -4.47 | 4.48 | 1.15 |

| LYXOR ETF FTSE MIB DAILY DOUBLE SHORT XBEAR (XBRMIB) | 1.77 | -12.64 | 2.29 | 3.69 | 2.38 | -16.47 | -2.03 |

| PICTET - JAPANESE EQUITY OPPORTUNITIES (PJAJ) | 0.82 | -5.88 | 2.26 | -1.16 | -11.65 | 7.06 | -0.87 |

| DB PHYSICAL RHODIUM ETC (XRH0) | -0.12 | 39.41 | 2.24 | 1.64 | 39.41 | 140.38 | 45.92 |

Worst Funds last Week

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| MIRAE ASSET TIGER CHINA CONSUMER ETF (150460) | 0.08 | -11.77 | -7.01 | -10.57 | -15.81 | 2.16 | -7.81 |

| SOURCE RDX UCITS ETF (RDXS) | 0.66 | -1.38 | -5.71 | 1.35 | -11.91 | 13.42 | -0.71 |

| UNITED STATES OIL FUND LP (U9N) | -2.25 | 14.18 | -5.69 | 3.46 | 8.42 | 42.88 | 12.27 |

| MARKET VECTORS JUNIOR GOLD MINERS ETF (VE42) | -3.87 | -9.63 | -5.48 | -5.13 | -10.85 | -7.21 | -7.17 |

| ISHARES MSCI NEW ZEALAND CAPPED ETF (3ISI) | -2.82 | -1.61 | -4.69 | -5.54 | -2.93 | 1.66 | -2.88 |

| MARKET VECTORS AFRICA INDEX ETF (VEF2) | -2.94 | -9.88 | -4.40 | -4.91 | -15.79 | -0.78 | -6.47 |

| ISHARES GOLD TRUST (I6HB) | -1.77 | -8.76 | -4.39 | -6.60 | -11.08 | -5.30 | -6.84 |

| ISHARES MSCI RUSSIA ADR/GDR UCITS ETF (CEBB) | 1.46 | 0.09 | -4.35 | 4.83 | -10.35 | 19.28 | 2.35 |

| DB X-TRACKERS - MSCI RUSSIA CAPPED INDEX UCITS ETF - 2D (XMRC) | -1.01 | 3.34 | -4.24 | 4.04 | -8.19 | 17.67 | 2.32 |

| ISHARES MSCI SOUTH AFRICA ETF (ISVW) | -1.75 | -17.34 | -3.80 | 5.58 | -19.51 | -5.26 | -5.75 |

| KB CHINA MAINLAND A SHARE LEVERAGE SEC FEEDER INVST TRUST-EQUITY-DERV FOF (3AF8926) | 0.23 | -29.59 | -3.67 | -13.16 | -38.31 | -14.33 | -17.37 |

| KB CHINA MAINLAND A SHARE LEVERAGE SEC MASTER INVST TRUST-EQUITY-DERV FOF (3AF8884) | 0.23 | -28.74 | -3.63 | -13.00 | -37.66 | -12.42 | -16.68 |

| HSBC MSCI RUSSIA CAPPED UCITS ETF $ (H4ZM) | 1.65 | 2.43 | -3.41 | 5.16 | -7.74 | 17.50 | 2.88 |

| SPDR S&P METALS & MINING ETF (SSGG) | -2.72 | -3.49 | -3.37 | -4.96 | -8.91 | 11.91 | -1.33 |

| JPMORGAN FUNDS - RUSSIA FUND - A$ (FH5Q) | 0.64 | -0.48 | -3.37 | 1.40 | -9.02 | 5.00 | -1.50 |

| ISHARES GLOBAL ENERGY ETF (ISQQ) | -1.54 | 2.69 | -3.32 | -0.55 | -1.49 | 16.49 | 2.78 |

| INVESCO KOREAN EQUITY FUND - A INC (IUVD) | 0.86 | -22.52 | -3.25 | -6.28 | -23.27 | -15.77 | -12.14 |

| ETFS NICKEL (NICK) | 0.94 | 9.12 | -3.24 | -9.26 | 5.88 | 39.97 | 8.34 |

| HSBC GLOBAL INVESTMENT FUNDS - RUSSIA EQUITY (XU8R) | 0.49 | 0.27 | -3.09 | 0.73 | -8.43 | 7.94 | -0.71 |

| HANG SENG INVESTMENT SERIES - CHINA H-SHARE INDEX FUND - A (HANCHHA) | -1.08 | -8.23 | -2.95 | -7.09 | -18.45 | -1.25 | -7.44 |

Best Funds last Month

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| YINHUA CSI CHINA MAINLAND NATURAL RESOURCE INDEX FUND (150059) | 0.38 | 8.77 | -2.82 | 14.44 | 12.93 | -4.21 | 5.08 |

| AMUNDI ETF MSCI EM LATIN AMERICA UCITS ETF - EUR (AMEL) | -0.12 | -6.75 | 2.36 | 10.73 | -12.39 | -1.43 | -0.18 |

| JPMORGAN FUNDS - LATIN AMERICA EQUITY FUND (JPJ0) | 3.17 | -9.62 | 3.72 | 7.92 | -15.67 | -6.49 | -2.63 |

| FRANKLIN TEMPLETON INVESTMENT FUNDS - TEMPLETON LATIN AMERICA FUND - A YDISEUR (XQ1H) | 2.18 | -5.94 | 3.00 | 7.78 | -12.74 | -3.35 | -1.33 |

| BLACKROCK GLOBAL FUNDS - LATIN AMERICA FUND - EURA2 (ERDP) | 2.16 | -6.23 | 1.63 | 7.76 | -13.17 | -0.88 | -1.16 |

| FIDELITY FUNDS - LATIN AMERICA FUND - A (FJRC) | 1.66 | -8.73 | 1.67 | 7.22 | -15.58 | -3.95 | -2.66 |

| SIMPLEX CHINA BEAR 1X H-SHARE ETF (1573) | -0.11 | 3.49 | 0.98 | 7.14 | 16.23 | -6.04 | 4.58 |

| DB X-TRACKERS MSCI BRAZIL INDEX UCITS ETF (XMBR) | 2.36 | -10.38 | 4.65 | 6.94 | -18.49 | -1.14 | -2.01 |

| LYXOR ETF MSCI EM LATIN AMERICA EUR (LATAM) | 2.70 | -6.68 | 2.13 | 6.76 | -13.46 | -2.01 | -1.65 |

| EAST CAPITAL LUX - RUSSIAN FUND (EC0A) | 1.35 | -3.89 | -2.56 | 6.17 | -11.84 | 9.75 | 0.38 |

| ISHARES MSCI SOUTH AFRICA ETF (ISVW) | -1.75 | -17.34 | -3.80 | 5.58 | -19.51 | -5.26 | -5.75 |

| ISHARES MSCI BRAZIL UCITS ETF (INC) (IBZL) | 5.42 | -12.57 | 3.47 | 5.56 | -19.86 | -0.62 | -2.86 |

| UBS ETF - MSCI SWITZERLAND 20/35 100% HEDGED TO EUR UCITS ETF (S2EUBH) | 0.78 | -4.41 | 0.95 | 5.42 | -7.29 | 2.91 | 0.50 |

| DB X-TRACKERS SMI UCITS ETF DR (XSMI) | 0.85 | -4.34 | 1.80 | 5.20 | -6.20 | -2.91 | -0.53 |

| HSBC MSCI RUSSIA CAPPED UCITS ETF $ (H4ZM) | 1.65 | 2.43 | -3.41 | 5.16 | -7.74 | 17.50 | 2.88 |

| WTI CRUDE OIL PRICE LINKED ETF (1671) | 0.95 | 15.95 | -1.98 | 5.12 | 10.54 | 44.47 | 14.54 |

| UBS ETF - MSCI SWITZERLAND 20/35 100% HEDGED TO USD UCITS ETF (S2USBH) | 0.51 | 0.25 | 1.26 | 5.00 | -1.16 | 5.17 | 2.57 |

| ISHARES MSCI RUSSIA ADR/GDR UCITS ETF (CEBB) | 1.46 | 0.09 | -4.35 | 4.83 | -10.35 | 19.28 | 2.35 |

| DB X-TRACKERS SMI UCITS ETF DR - 1C (XSMC) | 0.84 | -4.04 | 1.72 | 4.63 | -6.49 | -2.83 | -0.74 |

| UBS ETF - MSCI SWITZERLAND 20/35 UCITS ETF (SW2CHB) | 0.70 | -3.69 | 1.58 | 4.62 | -6.08 | -2.04 | -0.48 |

Worst Funds last Month

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| YINHUA CSI CHINA MAINLAND NATURAL RESOURCE INDEX FUND (150059) | 0.38 | 8.77 | -2.82 | 14.44 | 12.93 | -4.21 | 5.08 |

| AMUNDI ETF MSCI EM LATIN AMERICA UCITS ETF - EUR (AMEL) | -0.12 | -6.75 | 2.36 | 10.73 | -12.39 | -1.43 | -0.18 |

| JPMORGAN FUNDS - LATIN AMERICA EQUITY FUND (JPJ0) | 3.17 | -9.62 | 3.72 | 7.92 | -15.67 | -6.49 | -2.63 |

| FRANKLIN TEMPLETON INVESTMENT FUNDS - TEMPLETON LATIN AMERICA FUND - A YDISEUR (XQ1H) | 2.18 | -5.94 | 3.00 | 7.78 | -12.74 | -3.35 | -1.33 |

| BLACKROCK GLOBAL FUNDS - LATIN AMERICA FUND - EURA2 (ERDP) | 2.16 | -6.23 | 1.63 | 7.76 | -13.17 | -0.88 | -1.16 |

| FIDELITY FUNDS - LATIN AMERICA FUND - A (FJRC) | 1.66 | -8.73 | 1.67 | 7.22 | -15.58 | -3.95 | -2.66 |

| SIMPLEX CHINA BEAR 1X H-SHARE ETF (1573) | -0.11 | 3.49 | 0.98 | 7.14 | 16.23 | -6.04 | 4.58 |

| DB X-TRACKERS MSCI BRAZIL INDEX UCITS ETF (XMBR) | 2.36 | -10.38 | 4.65 | 6.94 | -18.49 | -1.14 | -2.01 |

| LYXOR ETF MSCI EM LATIN AMERICA EUR (LATAM) | 2.70 | -6.68 | 2.13 | 6.76 | -13.46 | -2.01 | -1.65 |

| EAST CAPITAL LUX - RUSSIAN FUND (EC0A) | 1.35 | -3.89 | -2.56 | 6.17 | -11.84 | 9.75 | 0.38 |

| ISHARES MSCI SOUTH AFRICA ETF (ISVW) | -1.75 | -17.34 | -3.80 | 5.58 | -19.51 | -5.26 | -5.75 |

| ISHARES MSCI BRAZIL UCITS ETF (INC) (IBZL) | 5.42 | -12.57 | 3.47 | 5.56 | -19.86 | -0.62 | -2.86 |

| UBS ETF - MSCI SWITZERLAND 20/35 100% HEDGED TO EUR UCITS ETF (S2EUBH) | 0.78 | -4.41 | 0.95 | 5.42 | -7.29 | 2.91 | 0.50 |

| DB X-TRACKERS SMI UCITS ETF DR (XSMI) | 0.85 | -4.34 | 1.80 | 5.20 | -6.20 | -2.91 | -0.53 |

| HSBC MSCI RUSSIA CAPPED UCITS ETF $ (H4ZM) | 1.65 | 2.43 | -3.41 | 5.16 | -7.74 | 17.50 | 2.88 |

| WTI CRUDE OIL PRICE LINKED ETF (1671) | 0.95 | 15.95 | -1.98 | 5.12 | 10.54 | 44.47 | 14.54 |

| UBS ETF - MSCI SWITZERLAND 20/35 100% HEDGED TO USD UCITS ETF (S2USBH) | 0.51 | 0.25 | 1.26 | 5.00 | -1.16 | 5.17 | 2.57 |

| ISHARES MSCI RUSSIA ADR/GDR UCITS ETF (CEBB) | 1.46 | 0.09 | -4.35 | 4.83 | -10.35 | 19.28 | 2.35 |

| DB X-TRACKERS SMI UCITS ETF DR - 1C (XSMC) | 0.84 | -4.04 | 1.72 | 4.63 | -6.49 | -2.83 | -0.74 |

| UBS ETF - MSCI SWITZERLAND 20/35 UCITS ETF (SW2CHB) | 0.70 | -3.69 | 1.58 | 4.62 | -6.08 | -2.04 | -0.48 |

Best Funds YTD

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| DB PHYSICAL RHODIUM ETC (XRH0) | -0.12 | 39.41 | 2.24 | 1.64 | 39.41 | 140.38 | 45.92 |

| HBM HEALTHCARE INVESTMENTS AG (5H5A) | 0.98 | 24.21 | 5.37 | 4.55 | 15.72 | 41.48 | 16.78 |

| ISHARES NORTH AMERICAN TECH ETF (ISQ8) | -1.91 | 15.99 | -1.94 | -1.08 | 10.12 | 28.83 | 8.98 |

| WTI CRUDE OIL PRICE LINKED ETF (1671) | 0.95 | 15.95 | -1.98 | 5.12 | 10.54 | 44.47 | 14.54 |

| UNITED STATES OIL FUND LP (U9N) | -2.25 | 14.18 | -5.69 | 3.46 | 8.42 | 42.88 | 12.27 |

| SOURCE CONS DISC S&P US SECTOR (XLYS) | -0.37 | 13.25 | -0.08 | 0.36 | 7.12 | 24.54 | 7.98 |

| ISHARES CORE S&P SMALL-CAP ETF (IJR) | 0.95 | 12.66 | 0.30 | 1.04 | 11.27 | 22.56 | 8.79 |

| HENDERSON HORIZON - GLOBAL TECHNOLOGY FUND - A2 (HZ5I) | 1.98 | 10.95 | 1.01 | 0.43 | 5.60 | 24.63 | 7.92 |

| MONTANARO EUROPEAN SMALLER COS TRUST PLC (MTE) | 2.17 | 9.62 | 0.14 | 1.63 | 3.05 | 17.40 | 5.56 |

| JUPITER EUROPEAN OPPORTUNITIES TRUST PLC (JEO) | 0.10 | 9.50 | 0.60 | 2.82 | -1.87 | 17.40 | 4.74 |

| MARKET VECTORS RETAIL ETF (VEFW) | -2.91 | 9.49 | -2.50 | -2.23 | 1.72 | 27.30 | 6.07 |

| PICTET - DIGITAL COMMUNICATION - P$ (PBF1) | 0.79 | 9.48 | -0.51 | 1.58 | 5.92 | 19.17 | 6.54 |

| ETFS NICKEL (NICK) | 0.94 | 9.12 | -3.24 | -9.26 | 5.88 | 39.97 | 8.34 |

| YINHUA CSI CHINA MAINLAND NATURAL RESOURCE INDEX FUND (150059) | 0.38 | 8.77 | -2.82 | 14.44 | 12.93 | -4.21 | 5.08 |

| WORLDWIDE HEALTHCARE TRUST PLC (P8W) | 1.21 | 8.31 | 0.63 | 3.96 | 3.60 | 11.57 | 4.94 |

| BLACKROCK GLOBAL FUNDS - WORLD HEALTHSCIENCE FUND - EURA2 (ERDV) | 0.68 | 7.84 | 0.02 | 2.73 | 3.98 | 9.65 | 4.10 |

| FONDUL PROPRIETATEA SA/FUND (FP) | 0.60 | 7.53 | 0.19 | 0.45 | -1.11 | 7.73 | 1.82 |

| VALUE TAIWAN ETF (3060) | 0.02 | 6.54 | 0.12 | -0.82 | -0.16 | 5.98 | 1.28 |

| JOHN HANCOCK REGIONAL BANK FUND - B (FRBFX) | 0.47 | 5.95 | 2.55 | -2.05 | -0.22 | 15.44 | 3.93 |

| GLOBAL X FTSE COLOMBIA 20 ETF (4GXB) | 0.48 | 5.60 | -0.73 | 2.18 | -1.08 | 9.09 | 2.37 |

Worst Funds YTD

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| ISHARES MSCI TURKEY UCITS ETF (IDTK) | 0.79 | -35.61 | 3.51 | -4.88 | -35.57 | -37.05 | -18.50 |

| HSBC MSCI TURKEY UCITS ETF (H4Z2) | 1.31 | -35.60 | 4.48 | -4.12 | -35.37 | -36.15 | -17.79 |

| HSBC MSCI TURKEY UCITS ETF (HTRY) | 0.79 | -35.26 | 3.68 | -4.15 | -35.25 | -36.52 | -18.06 |

| ISHARES MSCI TURKEY ETF (ISVZ) | 0.38 | -34.73 | 3.37 | -4.63 | -35.03 | -35.48 | -17.94 |

| CITIC-PRUDENTIAL CSI 800 NONFERROUS METAL INDEX FUND (150151) | -0.07 | -31.95 | -1.47 | 0.98 | -31.38 | -16.83 | -12.17 |

| KB CHINA MAINLAND A SHARE LEVERAGE SEC FEEDER INVST TRUST-EQUITY-DERV FOF (3AF8926) | 0.23 | -29.59 | -3.67 | -13.16 | -38.31 | -14.33 | -17.37 |

| KB CHINA MAINLAND A SHARE LEVERAGE SEC MASTER INVST TRUST-EQUITY-DERV FOF (3AF8884) | 0.23 | -28.74 | -3.63 | -13.00 | -37.66 | -12.42 | -16.68 |

| CITIC-PRUDENTIAL CSI 800 FINANCIAL INDEX CLASSIFIED FUND (150158) | 7.93 | -27.57 | 4.11 | -5.22 | -39.10 | -21.07 | -15.32 |

| YINHUA CONSUMPTION THEME FUND (150048) | 0.38 | -27.52 | -0.75 | -10.00 | -31.58 | -9.17 | -12.88 |

| INVESCO KOREAN EQUITY FUND - A INC (IUVD) | 0.86 | -22.52 | -3.25 | -6.28 | -23.27 | -15.77 | -12.14 |

| DB X-TRACKERS MSCI PHILIP IM INDEX UCITS ETF (3016) | 0.17 | -19.70 | 0.30 | 1.03 | -20.59 | -13.83 | -8.27 |

| UBS HANA AMBATOVY NICKEL OVERSEAS INVESTMENT COMPANY 1 (2772642) | 1.01 | -19.61 | -1.19 | -5.89 | -10.83 | -22.27 | -10.05 |

| DB X-TRACKERS MSCI PHILIPPINES IM TRN INDEX UCITS ETF (N2E) | 0.64 | -19.55 | 0.64 | 1.84 | -20.59 | -13.18 | -7.82 |

| GLOBAL X FTSE ARGENTINA 20 ETF (GX0A) | -1.65 | -19.23 | 0.56 | 0.65 | -23.29 | -3.59 | -6.42 |

| DB X-TRACKERS MSCI INDONESIA TRN INDEX UCITS ETF - 2C (3099) | -0.91 | -18.55 | -1.65 | -2.49 | -20.39 | -13.19 | -9.43 |

| DB X-TRACKERS MSCI INDONESIA TRN INDEX UCITS ETF (XMIN) | 0.29 | -18.05 | -1.38 | -2.85 | -20.30 | -13.08 | -9.40 |

| BLACKROCK GLOBAL FUNDS - WORLD GOLD FUND - A2EUR HEDGED (H2ZG) | 0.60 | -17.38 | -1.18 | -0.70 | -19.46 | -13.92 | -8.82 |

| ETFS COFFEE (COFF) | -0.74 | -17.36 | -2.24 | -7.11 | -15.24 | -27.69 | -13.07 |

| ISHARES MSCI SOUTH AFRICA ETF (ISVW) | -1.75 | -17.34 | -3.80 | 5.58 | -19.51 | -5.26 | -5.75 |

| LYXOR ETF WIG20 (ETFW20L) | 1.40 | -17.23 | -0.25 | 2.00 | -22.60 | -9.92 | -7.69 |

Best Funds 1yr

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| DB PHYSICAL RHODIUM ETC (XRH0) | -0.12 | 39.41 | 2.24 | 1.64 | 39.41 | 140.38 | 45.92 |

| WTI CRUDE OIL PRICE LINKED ETF (1671) | 0.95 | 15.95 | -1.98 | 5.12 | 10.54 | 44.47 | 14.54 |

| UNITED STATES OIL FUND LP (U9N) | -2.25 | 14.18 | -5.69 | 3.46 | 8.42 | 42.88 | 12.27 |

| HBM HEALTHCARE INVESTMENTS AG (5H5A) | 0.98 | 24.21 | 5.37 | 4.55 | 15.72 | 41.48 | 16.78 |

| ETFS NICKEL (NICK) | 0.94 | 9.12 | -3.24 | -9.26 | 5.88 | 39.97 | 8.34 |

| DB X-TRACKERS FTSE VIETNAM UCITS ETF (XVTD) | -0.49 | -4.84 | 4.83 | -3.25 | -14.25 | 31.21 | 4.64 |

| UBS HANA AMBATOVY NICKEL OVERSEAS INVESTMENT COMPANY 1 (099340) | 0.03 | -3.36 | 0.75 | 3.46 | -4.39 | 29.51 | 7.33 |

| FIDELITY JAPANESE VALUES PLC (FJV) | -0.73 | -0.87 | -0.69 | -4.38 | -6.81 | 29.11 | 4.31 |

| ISHARES NORTH AMERICAN TECH ETF (ISQ8) | -1.91 | 15.99 | -1.94 | -1.08 | 10.12 | 28.83 | 8.98 |

| CHINA UNIVERSAL CSI CONSUMER STAPLES INDEX ETF (159928) | 0.56 | -7.48 | -2.74 | -8.68 | -14.32 | 28.13 | 0.60 |

| MARKET VECTORS RETAIL ETF (VEFW) | -2.91 | 9.49 | -2.50 | -2.23 | 1.72 | 27.30 | 6.07 |

| BAILLIE GIFFORD JAPAN TRUST PLC/THE (BGFD) | 0.58 | -0.35 | 0.51 | -1.09 | -7.36 | 26.49 | 4.64 |

| HENDERSON HORIZON - GLOBAL TECHNOLOGY FUND - A2 (HZ5I) | 1.98 | 10.95 | 1.01 | 0.43 | 5.60 | 24.63 | 7.92 |

| SOURCE CONS DISC S&P US SECTOR (XLYS) | -0.37 | 13.25 | -0.08 | 0.36 | 7.12 | 24.54 | 7.98 |

| ISHARES CORE S&P SMALL-CAP ETF (IJR) | 0.95 | 12.66 | 0.30 | 1.04 | 11.27 | 22.56 | 8.79 |

| ISHARES MSCI RUSSIA ADR/GDR UCITS ETF (CEBB) | 1.46 | 0.09 | -4.35 | 4.83 | -10.35 | 19.28 | 2.35 |

| PICTET - DIGITAL COMMUNICATION - P$ (PBF1) | 0.79 | 9.48 | -0.51 | 1.58 | 5.92 | 19.17 | 6.54 |

| DB X-TRACKERS - MSCI RUSSIA CAPPED INDEX UCITS ETF - 2D (XMRC) | -1.01 | 3.34 | -4.24 | 4.04 | -8.19 | 17.67 | 2.32 |

| HSBC MSCI RUSSIA CAPPED UCITS ETF $ (H4ZM) | 1.65 | 2.43 | -3.41 | 5.16 | -7.74 | 17.50 | 2.88 |

| JUPITER EUROPEAN OPPORTUNITIES TRUST PLC (JEO) | 0.10 | 9.50 | 0.60 | 2.82 | -1.87 | 17.40 | 4.74 |

Worst Funds 1yr

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| ISHARES MSCI TURKEY UCITS ETF (IDTK) | 0.79 | -35.61 | 3.51 | -4.88 | -35.57 | -37.05 | -18.50 |

| HSBC MSCI TURKEY UCITS ETF (HTRY) | 0.79 | -35.26 | 3.68 | -4.15 | -35.25 | -36.52 | -18.06 |

| HSBC MSCI TURKEY UCITS ETF (H4Z2) | 1.31 | -35.60 | 4.48 | -4.12 | -35.37 | -36.15 | -17.79 |

| ISHARES MSCI TURKEY ETF (ISVZ) | 0.38 | -34.73 | 3.37 | -4.63 | -35.03 | -35.48 | -17.94 |

| ETFS COFFEE (COFF) | -0.74 | -17.36 | -2.24 | -7.11 | -15.24 | -27.69 | -13.07 |

| UBS HANA AMBATOVY NICKEL OVERSEAS INVESTMENT COMPANY 1 (2772642) | 1.01 | -19.61 | -1.19 | -5.89 | -10.83 | -22.27 | -10.05 |

| CITIC-PRUDENTIAL CSI 800 FINANCIAL INDEX CLASSIFIED FUND (150158) | 7.93 | -27.57 | 4.11 | -5.22 | -39.10 | -21.07 | -15.32 |

| ETFS AGRICULTURE DJ-UBSCI (AIGA) | 0.22 | -8.32 | 1.27 | -2.92 | -7.79 | -18.52 | -6.99 |

| CITIC-PRUDENTIAL CSI 800 NONFERROUS METAL INDEX FUND (150151) | -0.07 | -31.95 | -1.47 | 0.98 | -31.38 | -16.83 | -12.17 |

| LYXOR ETF FTSE MIB DAILY DOUBLE SHORT XBEAR (XBRMIB) | 1.77 | -12.64 | 2.29 | 3.69 | 2.38 | -16.47 | -2.03 |

| INVESCO KOREAN EQUITY FUND - A INC (IUVD) | 0.86 | -22.52 | -3.25 | -6.28 | -23.27 | -15.77 | -12.14 |

| POWERSHARES DB AGRICULTURE FUND (P44A) | 0.54 | -7.84 | -0.24 | -0.18 | -6.93 | -14.65 | -5.50 |

| KB CHINA MAINLAND A SHARE LEVERAGE SEC FEEDER INVST TRUST-EQUITY-DERV FOF (3AF8926) | 0.23 | -29.59 | -3.67 | -13.16 | -38.31 | -14.33 | -17.37 |

| BLACKROCK GLOBAL FUNDS - WORLD GOLD FUND - A2EUR HEDGED (H2ZG) | 0.60 | -17.38 | -1.18 | -0.70 | -19.46 | -13.92 | -8.82 |

| DB X-TRACKERS MSCI PHILIP IM INDEX UCITS ETF (3016) | 0.17 | -19.70 | 0.30 | 1.03 | -20.59 | -13.83 | -8.27 |

| DB X-TRACKERS MSCI INDONESIA TRN INDEX UCITS ETF - 2C (3099) | -0.91 | -18.55 | -1.65 | -2.49 | -20.39 | -13.19 | -9.43 |

| DB X-TRACKERS MSCI PHILIPPINES IM TRN INDEX UCITS ETF (N2E) | 0.64 | -19.55 | 0.64 | 1.84 | -20.59 | -13.18 | -7.82 |

| DB X-TRACKERS MSCI INDONESIA TRN INDEX UCITS ETF (XMIN) | 0.29 | -18.05 | -1.38 | -2.85 | -20.30 | -13.08 | -9.40 |

| AMUNDI ETF MSCI EUROPE TELECOM SERVICES UCITS ETF (CT5) | 0.22 | -13.08 | -2.41 | -2.31 | -14.00 | -12.60 | -7.83 |

| KB CHINA MAINLAND A SHARE LEVERAGE SEC MASTER INVST TRUST-EQUITY-DERV FOF (3AF8884) | 0.23 | -28.74 | -3.63 | -13.00 | -37.66 | -12.42 | -16.68 |