Subscribe to ML Optimal or ML Premium

Midlincoln Funds Strategy

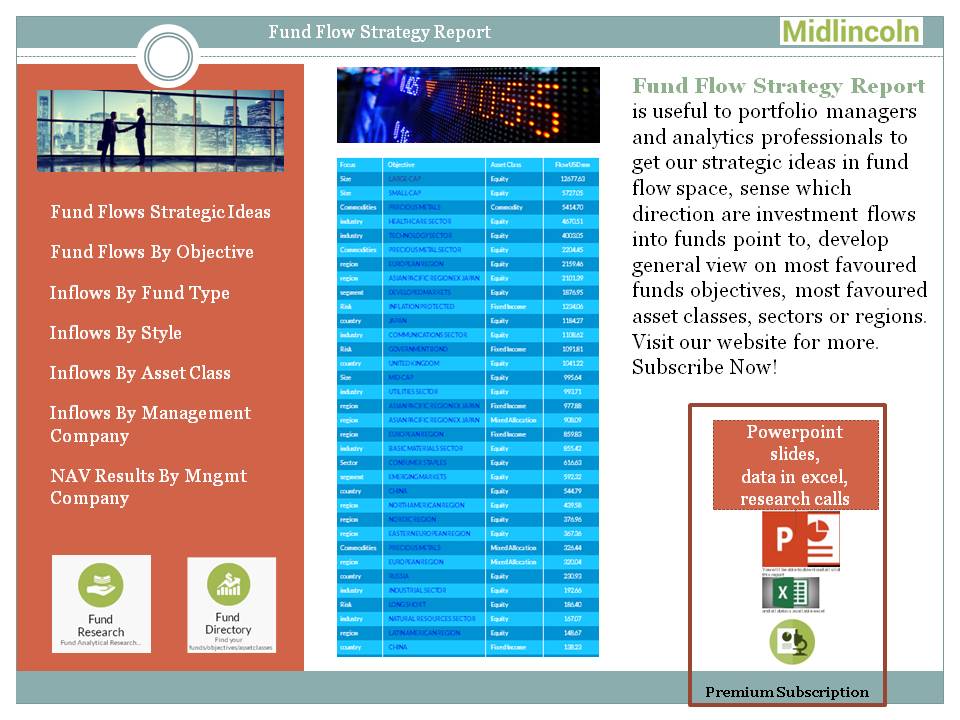

report is useful to analytics professionals to identify key investment ideas in investment funds universe

Monitor key fund flow info by funds, fund objectives, fund types etc..

Select best relevant fund ideas based on momentum, popularity and fund flow info

Supporting data for this publication is focused on fund flows and this You can view

Further data is presented for funds focused on particular objective. Here is an example of page for with Emerging Markets Focus

Midlincoln consulting services in Fund Data space include:

Bespoke research on strengths and weaknesses of particular fund strategy

Analysis of competition for given fund and strategy

Finding supporting data in fund flows, performance statistics to a fund idea or strategy

Writing Fund Factsheets

.. and many more

View Example of bespoke research on launching ITI Funds Russia RTS ETF

or view Example of bespoke research on launching Montold SME Private Debt Fund

If interested please reach out to research@midlincoln.com or call +79651095688

Midlincoln consulting services in Fund Data space include:

Bespoke research on strengths and weaknesses of particular fund strategy

Analysis of competition for given fund and strategy

Finding supporting data in fund flows, performance statistics to a fund idea or strategy

Writing Fund Factsheets

.. and many more

View Example of bespoke research on launching ITI Funds Russia RTS ETF

or view Example of bespoke research on launching Montold SME Private Debt Fund

If interested please reach out to research@midlincoln.com or call +79651095688

If interested please reach out to research@midlincoln.com or call +79651095688

Download pdf of the promo picture above

Tightly Abriged Example of Fund FLows Strategy Report

ML Fund Atlas January 26, 2023

If your are viewing this document on a mobile device click here to skip part with data and go directly to content part

If your are viewing this document on a mobile device click here to skip part with data and go directly to content part

Fund flow data for the perioud between 2023-01-25 and 2022-08-04

This is abriged version of a table in this report, please to see the full report

This is abriged version of a table in this report, please to see the full report

This is abriged version of a table in this report, please to see the full report

This is abriged version of a table in this report, please to see the full report

This is abriged version of a table in this report, please to see the full report

This is abriged version of a table in this report, please to see the full report

This is abriged version of a table in this report, please to see the full report

This is abriged version of a table in this report, please to see the full report

This is abriged version of a table in this report, please to see the full report

This is abriged version of a table in this report, please to see the full report

This is abriged version of a table in this report, please to see the full report

This is abriged version of a table in this report, please to see the full report

This is abriged version of a table in this report, please to see the full report

Period Flows By Objective In Descending Order

| Focus | Objective | Asset Class | Flow USD mn |

| Size | LARGE-CAP | Equity | 86928.38 |

| Size | SMALL-CAP | Equity | 8669.45 |

This is abriged version of a table in this report, please to see the full report

Fund flows YTD

| Focus | Objective | Asset Class | Flow USD mn |

| Size | LARGE-CAP | Equity | 23563.95 |

| segment | EMERGING MARKETS | Equity | 19962.11 |

This is abriged version of a table in this report, please to see the full report

YTD Inflows By Fund Type USD mn

| type | ytdflow |

| CLOSED-END FUND | -3368.6 |

| ETF | 54052.7 |

This is abriged version of a table in this report, please to see the full report

YTD Inflows By Style USD mn

| style | ytdflow |

| region | -91348.7 |

| industry | -47265.1 |

This is abriged version of a table in this report, please to see the full report

YTD Inflows By Asset Class USD mn

| assclass | ytdflow |

| Equity | -108422.4 |

| Mixed Allocation | -50952.4 |

This is abriged version of a table in this report, please to see the full report

Biggest Fund Inflows YTD By Management Company

| manager | flowytd |

| iShares | 55726.9 |

| Vanguard | 51950.6 |

This is abriged version of a table in this report, please to see the full report

Best Average NAV Growth Results YTD By Mngmt Company

| manager | YTDPerfPct |

| Samsung | 20.14 |

| Faircourt | 15.67 |

This is abriged version of a table in this report, please to see the full report

Biggest Fund Outflows YTD By Management Company

| manager | flowytd |

| Nikkei | -40681.9 |

| TOPIX | -33782.6 |

This is abriged version of a table in this report, please to see the full report

Average NAV Decline Results YTD By Management Company

| manager | YTDPerfPct |

| ZIF | -86.51 |

| ProShares | -13.14 |

This is abriged version of a table in this report, please to see the full report

10 Best Select Equity ETFs By Performance in 2022

| name | ytd |

| SAMSUNG KODEX 200 EXCHANGE TRADED FUNDS (1313) | 20.14 |

| LYXOR ETF IBEX 35 DOBLE APALANCADO DIARIO (IBEXA) | 20.12 |

This is abriged version of a table in this report, please to see the full report

10 Best Select Fixed Income ETFs By Performance in 2022

| name | ytd |

| ITI Funds Russian Eurobonds ETF | 6.3 |

| Finex Russian Eurobonds ETF | 6.3 |

This is abriged version of a table in this report, please to see the full report

10 Best Select Equity Active Funds By Performance in 2022

| name | ytd |

| BLACKROCK GLOBAL FUNDS - CHINA FUND - HEDGE EURA2 (H2ZP) | 15.32 |

| BLACKROCK GLOBAL FUNDS - CHINA FUND - D2RF GBP HEDGED (BGCD2RF) | 14.13 |

This is abriged version of a table in this report, please to see the full report

10 Best Select Fixed Income Active Funds By Performance in 2022

| name | ytd |

| PICTET - EMERGING LOCAL CURRENCY DEBT (PJAC) | 5.88 |

| BNY MELLON GLOBAL FUNDS PLC - MELLON EMERGING MARKETS DEBT LOCAL CURRENCY FUND - GBP W HEDGED (MEDCWPH) | 5.47 |

This is abriged version of a table in this report, please to see the full report

Chart: Fund Strategy

Jan 2023

Read more about Fund Strategy ! Please to get to this and other reports regularly

Key Topics and News

Period Flows By Objective In Descending Order

Period Flows By Objective In Descending Order

Fund flows YTD

Fund flows YTD

YTD Inflows By Fund Type USD mn

YTD Inflows By Fund Type USD mn

YTD Inflows By Style USD mn

YTD Inflows By Style USD mn

YTD Inflows By Asset Class USD mn

YTD Inflows By Asset Class USD mn

Biggest Fund Inflows YTD By Management Company

Biggest Fund Inflows YTD By Management Company

Best Average NAV Growth Results YTD By Mngmt Company

Best Average NAV Growth Results YTD By Mngmt Company

Biggest Fund Outflows YTD By Management Company

Biggest Fund Outflows YTD By Management Company

Average NAV Decline Results YTD By Management Company

Average NAV Decline Results YTD By Management Company

10 Best Select Equity ETFs By Performance in 2019

10 Best Select Equity ETFs By Performance in 2019

10 Best Select Fixed Income ETFs By Performance in 2019

10 Best Select Fixed Income ETFs By Performance in 2019

10 Best Select Equity Active Funds By Performance in 2019

10 Best Select Equity Active Funds By Performance in 2019

10 Best Select Fixed Income Active Funds By Performance in 2019

10 Best Select Fixed Income Active Funds By Performance in 2019

Emerging markets fund flow showed 4514.1 USD mn of inflow. While Frontier Markets funds showed -25.1 USD mn of outflows.

BRAZIL Equity funds showed -96.4 USD mn of outflow.

BRAZIL Fixed Income funds showed -25.6 USD mn of outflow.

CHINA Equity funds showed 602.9 USD mn of inflow.

CHINA Fixed Income funds showed -774.8 USD mn of outflow.

INDIA Equity funds showed 872.9 USD mn of inflow.

INDIA Fixed Income funds showed -3.7 USD mn of outflow.

KOREA Equity funds showed 695.7 USD mn of inflow.

RUSSIA Equity funds showed 90.3 USD mn of inflow.

Russia Fixed Income funds showed 0.0 USD mn of inflow.

SOUTH AFRICA Equity funds showed 157.6 USD mn of inflow.

TURKEY Equity funds showed -1762.5 USD mn of outflow.

COMMUNICATIONS SECTOR Equity funds showed 299.6 USD mn of inflow.

ENERGY SECTOR Equity funds showed 985.9 USD mn of inflow.

ENERGY SECTOR Mixed Allocation funds showed 2.0 USD mn of inflow.

FINANCIAL SECTOR Equity funds showed -660.3 USD mn of outflow.

REAL ESTATE SECTOR Equity funds showed -3458.9 USD mn of outflow.

TECHNOLOGY SECTOR Equity funds showed -306.1 USD mn of outflow.

UTILITIES SECTOR Equity funds showed 3114.1 USD mn of inflow.

LONG SHORT Alternative funds showed 376.3 USD mn of inflow.

LONG SHORT Equity funds showed -3167.7 USD mn of outflow.

LONG SHORT Fixed Income funds showed 15.0 USD mn of inflow.

LONG SHORT Mixed Allocation funds showed 20.1 USD mn of inflow.

Latest ML Comics

Markets

Market performance is between 2023-01-01 and 2022-12-01Best global markets between 2023-01-01 and 2022-12-01 FM (FRONTIER MARKETS)-0.54%, EFM ASIA-1.08%, EUROPE-1.56%,

While worst global markets between 2023-01-01 and 2022-12-01 EM LATIN AMERICA -8.60%, USA -6.38%, EM (EMERGING MARKETS) -1.61%,

Best during the period among various stock markets were ZIMBABWE +70.33%, LEBANON +9.24%, TURKEY +9.23%, TRINIDAD AND TOBAGO +8.18%, ARGENTINA +8.11%, HONG KONG +7.55%, CHINA +6.57%, UKRAINE +6.54%, COLOMBIA +5.34%, DENMARK +5.28%,

While worst during the period among various stock markets were BRAZIL -10.18%, QATAR -9.13%, KOREA -8.39%, ISRAEL -7.82%, CHILE -7.40%, CANADA -6.63%, TAIWAN -6.60%, AUSTRALIA -6.47%, USA -6.38%, KUWAIT -6.35%,

Key Fund Flow Headlines

Top 20 Funds Longs Based on Momentum

| Name | 1week | 1month | ytd | 6months | 1yr | Rank |

| LYXOR ETF TURKEY EURO (TURU) | 11.75 | 4.5 | -3.07 | 93.71 | 85.13 | 48.77 |

| ISHARES MSCI TURKEY UCITS ETF (IDTK) | 11.64 | 3.46 | -3.85 | 90.81 | 82.24 | 47.04 |

This is abriged version of a table in this report, please to see the full report

Top 20 Funds Shorts Based on Momentum

| Name | 1week | 1month | ytd | 6months | 1yr | Rank |

| ZIF BREZA INVEST DD VARAZDIN (BRINRA) | 0.31 | -86.49 | -86.51 | -82.37 | -84.08 | -63.16 |

| LATIN AMERICAN DISCOVERY FUND INC/THE (LDF) | 29.59 | -16.06 | 1.4 | -72.99 | -87.99 | -36.86 |

This is abriged version of a table in this report, please to see the full report

Best Funds last Month

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| LYXOR ETF IBEX 35 DOBLE APALANCADO DIARIO (IBEXA) | 1.85 | 20.12 | 5.79 | 24.51 | 31.53 | 0.64 | 15.62 |

| SIMPLEX CHINA BULL 2X H-SHARE ETF (1572) | 1.55 | 16.58 | -0.04 | 20.73 | -2.84 | -33.11 | -3.81 |

This is abriged version of a table in this report, please to see the full report

Worst Funds last Month

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| LYXOR ETF IBEX 35 DOBLE APALANCADO DIARIO (IBEXA) | 1.85 | 20.12 | 5.79 | 24.51 | 31.53 | 0.64 | 15.62 |

| SIMPLEX CHINA BULL 2X H-SHARE ETF (1572) | 1.55 | 16.58 | -0.04 | 20.73 | -2.84 | -33.11 | -3.81 |

This is abriged version of a table in this report, please to see the full report

Best Funds YTD

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| SAMSUNG KODEX 200 EXCHANGE TRADED FUNDS (1313) | 0.14 | 20.14 | 1.88 | 6.88 | 4.41 | -23.41 | -2.56 |

| LYXOR ETF IBEX 35 DOBLE APALANCADO DIARIO (IBEXA) | 1.85 | 20.12 | 5.79 | 24.51 | 31.53 | 0.64 | 15.62 |

This is abriged version of a table in this report, please to see the full report

Worst Funds YTD

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| LYXOR ETF IBEX 35 DOBLE INVERSO DIARIO (2INVE) | -0.5 | -14.87 | -3.77 | -16.36 | -18.93 | -23.65 | -15.68 |

| ETFS NICKEL (NICK) | -0.99 | -12.18 | -2.39 | -6.88 | 19.55 | 21.09 | 7.84 |

This is abriged version of a table in this report, please to see the full report

Best Funds 1yr

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| LYXOR ETF TURKEY EURO (TURU) | 1.27 | -3.07 | 11.75 | 4.5 | 93.71 | 85.13 | 48.77 |

| HSBC MSCI TURKEY UCITS ETF (HTRY) | 0.92 | -4.04 | 12.05 | 3.66 | 90.91 | 80.2 | 46.71 |

This is abriged version of a table in this report, please to see the full report

Worst Funds 1yr

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| LATIN AMERICAN DISCOVERY FUND INC/THE (LDF) | 7.49 | 1.4 | 29.59 | -16.06 | -72.99 | -87.99 | -36.86 |

| DB X-TRACKERS FTSE VIETNAM UCITS ETF (XVTD) | 0.8 | 11.11 | 4.19 | 7.35 | -12.95 | -33.94 | -8.84 |

This is abriged version of a table in this report, please to see the full report