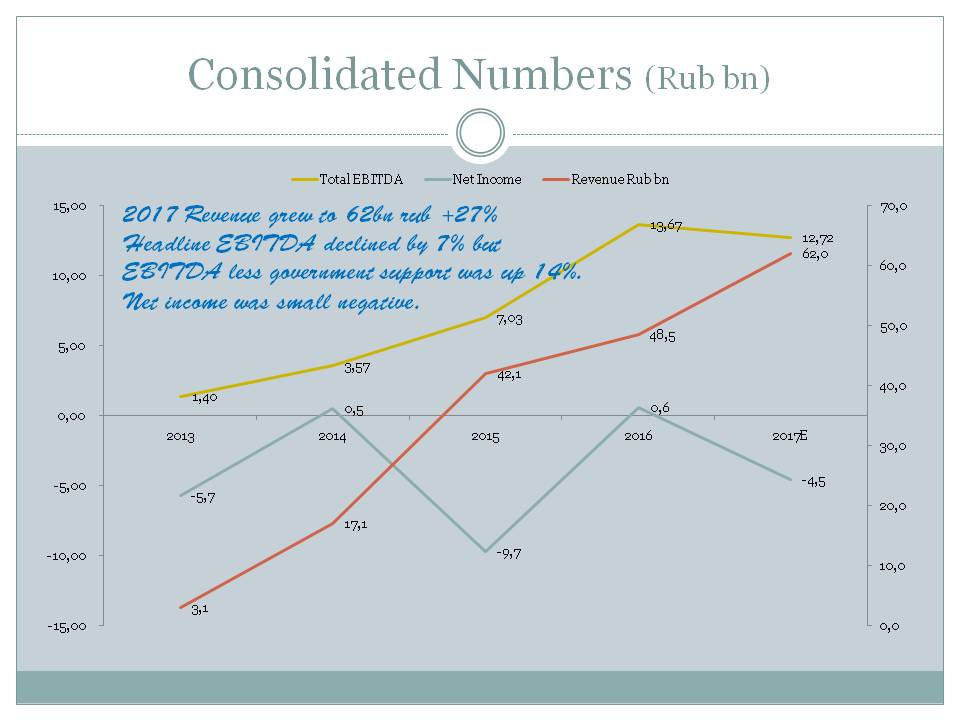

Consolidated Numbers

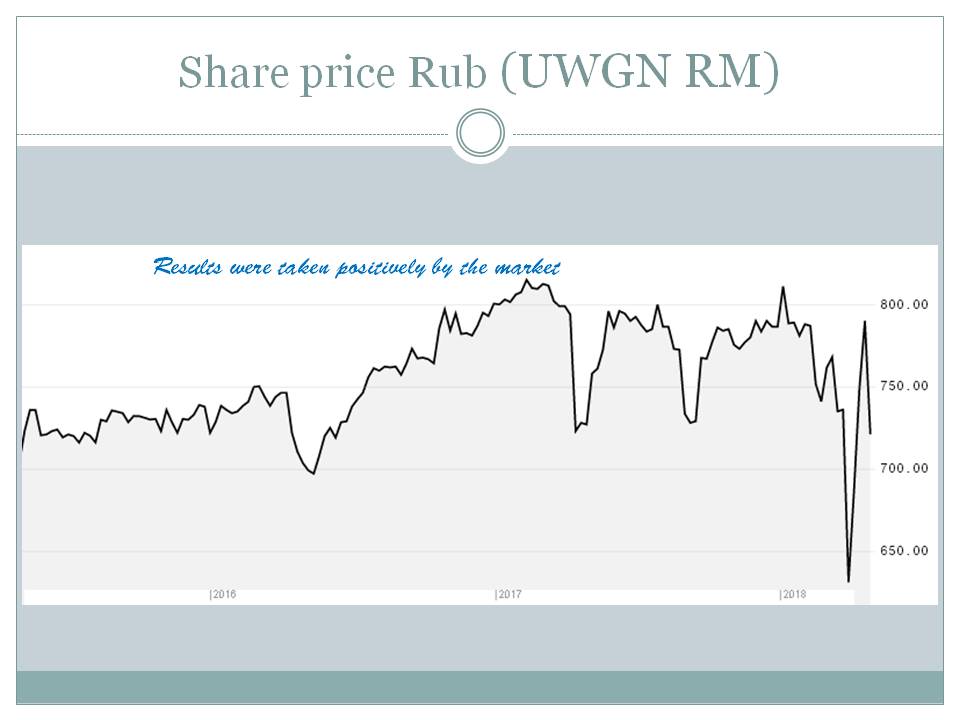

2017 Revenue grew to 62bn rub +27%

Headline EBITDA declined by 7% but EBITDA less government support was up 14%. Net income was small negative.

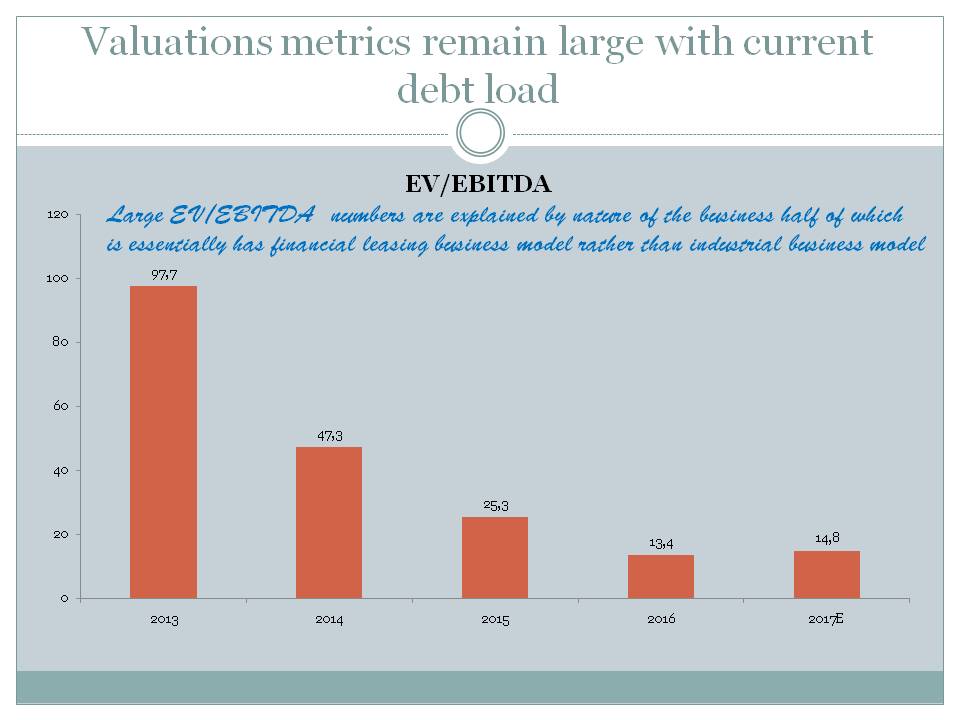

Valuations metrics remain large with current debt load

Large EV/EBITDA numbers are explained by nature of the business half of which is essentially has financial leasing business model rather than industrial business model

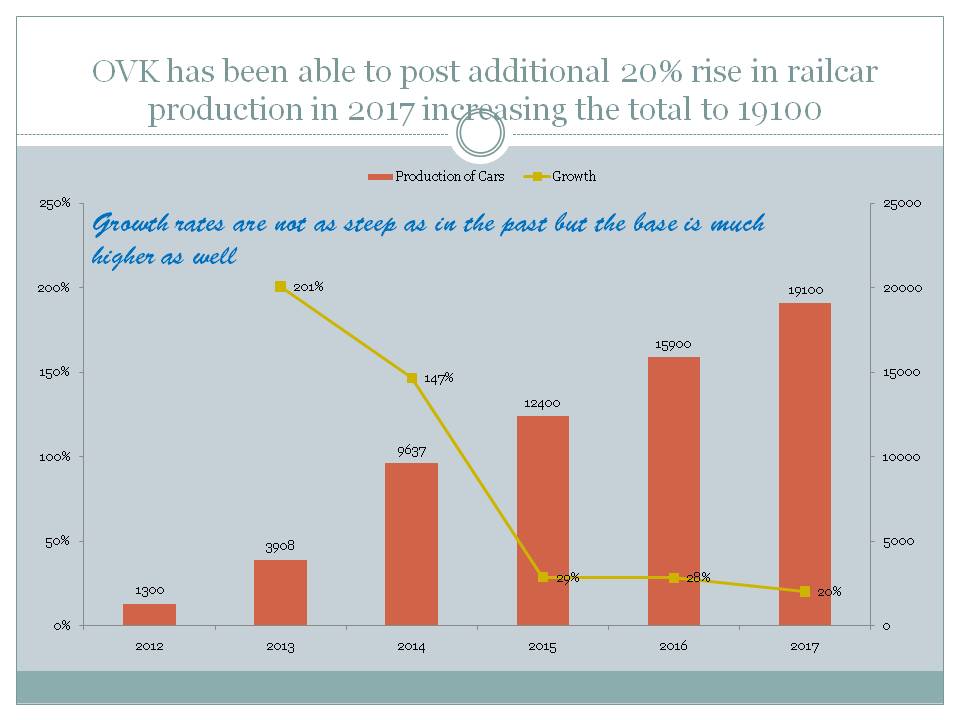

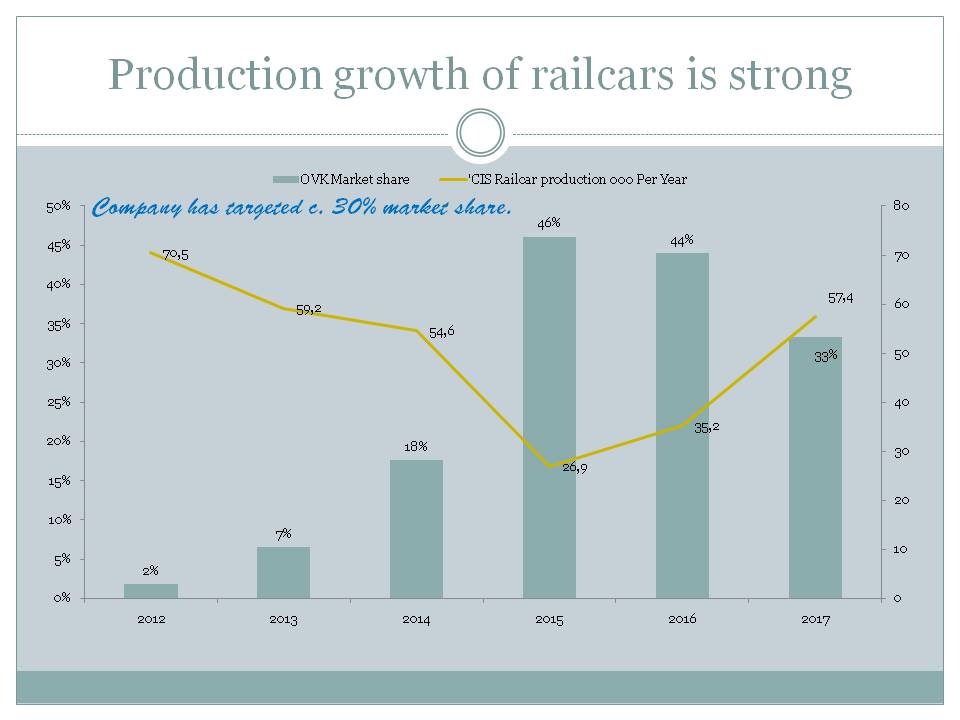

OVK has been able to post additional 20% rise in railcar production in 2017 increasing the total to 19100

Growth rates are not as steep as in the past but the base is much higher as well

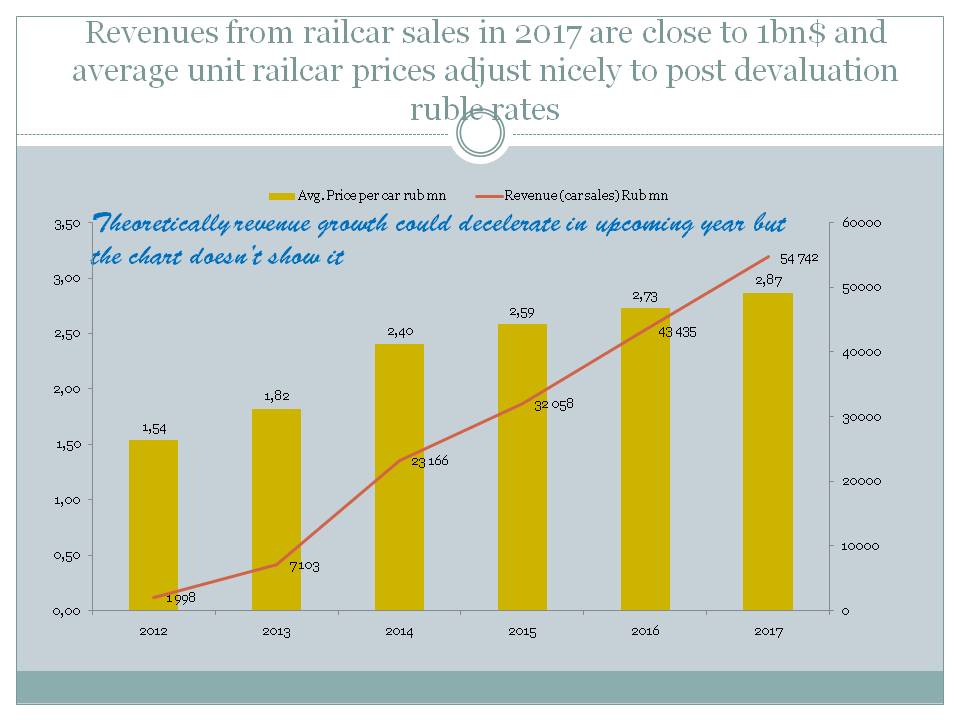

Revenues from railcar sales in 2017 are close to 1bn$ and average unit railcar prices adjust nicely to post devaluation ruble rates

Theoretically revenue growth could decelerate in upcoming year but the chart doesn’t show it

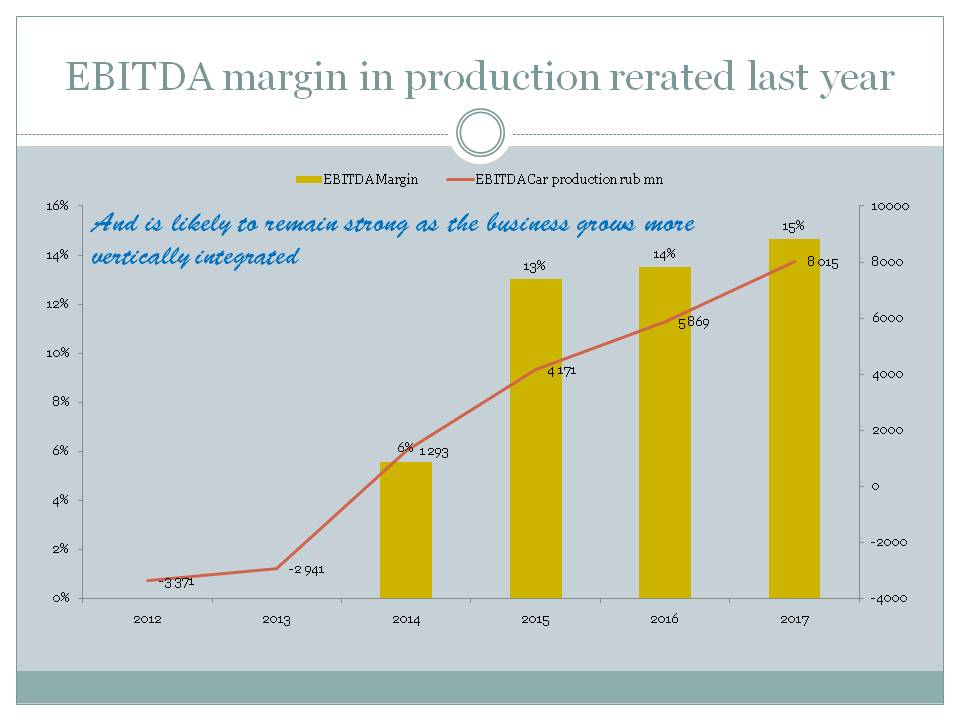

EBITDA margin in production rerated last year

And is likely to remain strong as the business grows more

vertically integrated

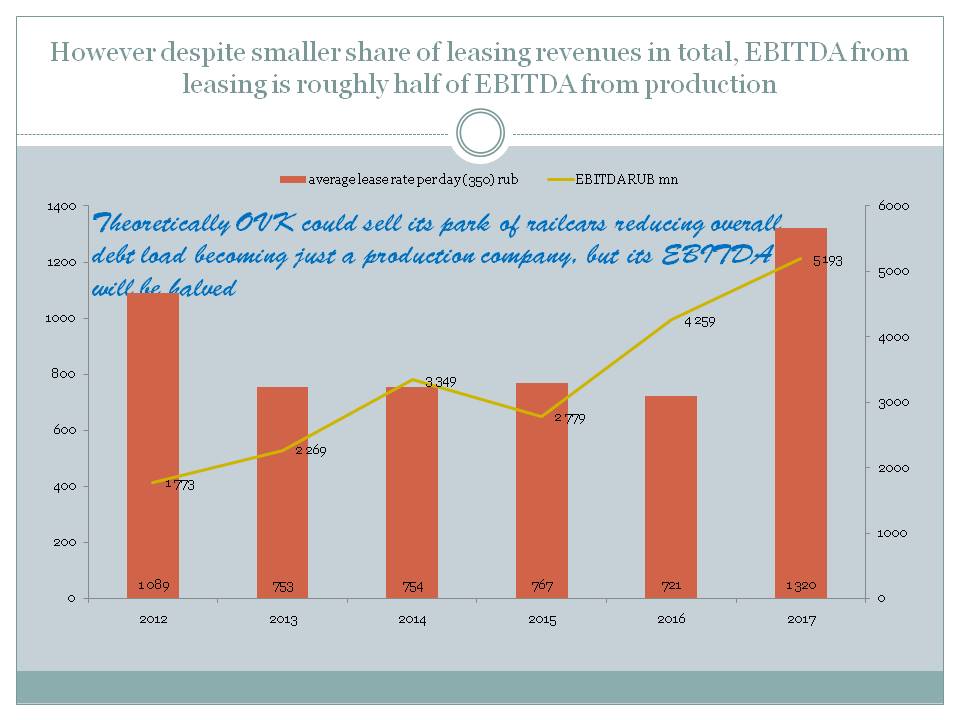

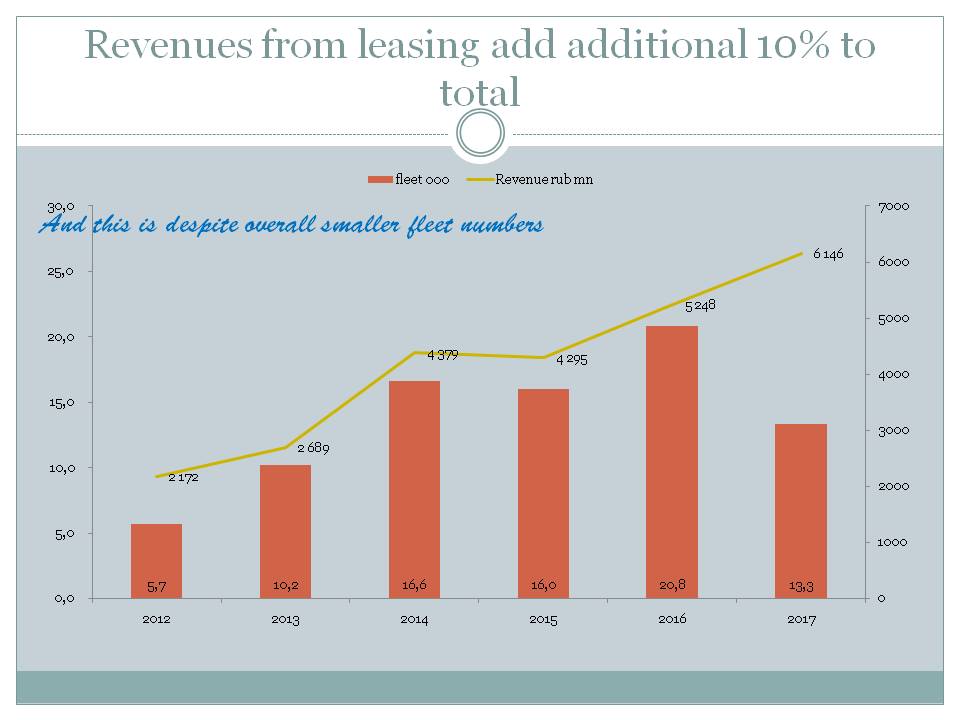

However despite smaller share of leasing revenues in total, EBITDA from leasing is roughly half of EBITDA from production

Theoretically OVK could sell its park of railcars reducing overall debt load, but its EBITDA will be halved

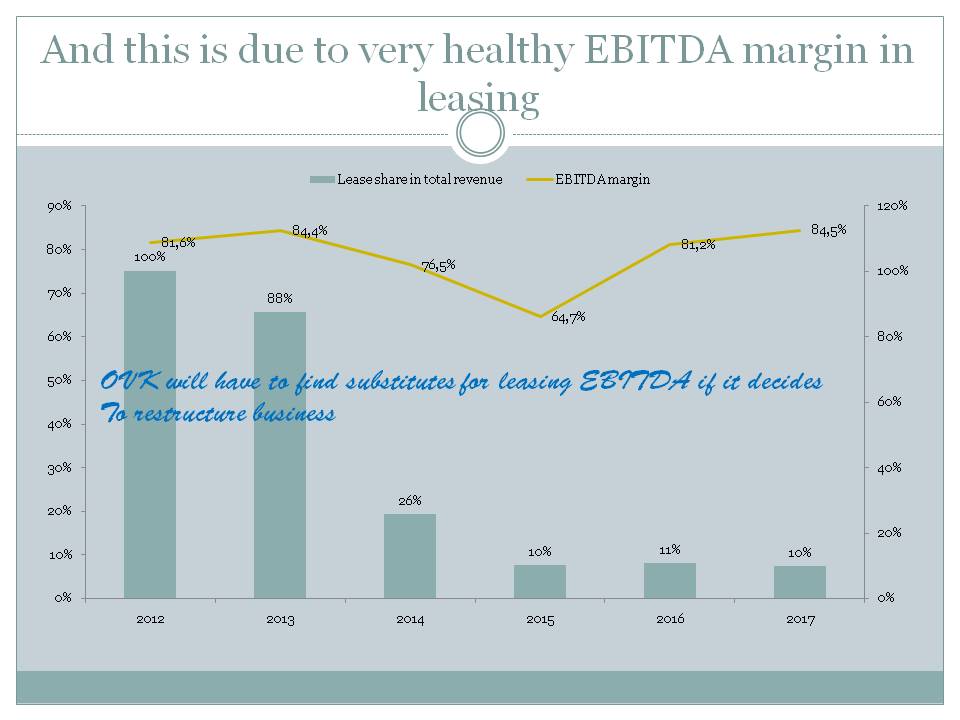

And this is due to very healthy EBITDA margin in leasing

OVK will have to find substitutes for leasing EBITDA if it decides

To restructure business

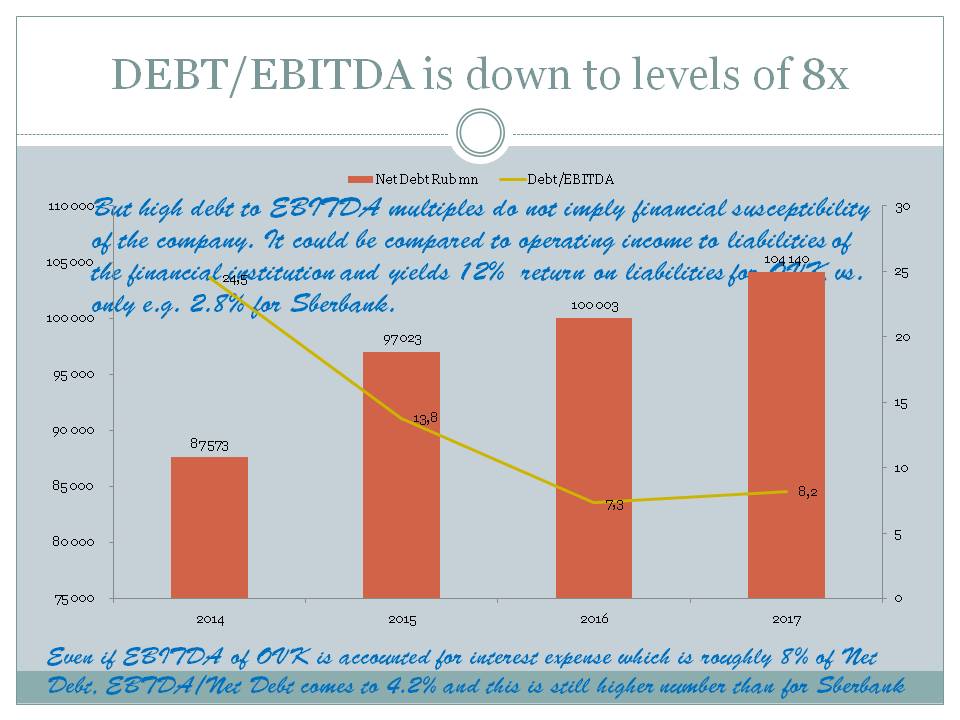

DEBT/EBITDA is down to levels of 8x

But high debt to EBITDA multiples do not imply financial susceptibility of the company. It could be compared to operating income to liabilities of the financial institution and yields 12% return on liabilities for OVK vs. only e.g. 2.8% for Sberbank. Even if EBITDA of OVK is accounted for interest expense which is roughly 8% of Net Debt, EBTDA/Net Debt comes to 4.2% and this is still higher number than for Sberbank

News

Top Headlines

- UWC ships first batch of freight cars to Guinea

- VanEck Vectors Russia Small-Cap ETF (RSXJ) Declines 0.39% for ...

- Gulf Navigation Holding Appoints Al Ramz Corporation as a Co ...

- VanEck Vectors Russia Small-Cap ETF (RSXJ) Declines 0.39% for ...

- VanEck Vectors Russia Small-Cap ETF (RSXJ) Rises 0.87% for Apr 29

- Today May 3 VanEck Vectors Russia Small-Cap ETF (RSXJ) Drops ...

- Russia's STLC to buy 5122 freight railcars from UWC

Results

Important Reports

United Wagon Co PJSC Presentation

Select Equity Data Snapshot

Historic and Consesus Forecast numbers from Bloomberg USD mn

United Wagon Co PJSC, , Capital Goods

Fundamentals

| Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|---|---|

| Revenue | 96.48 | 451.74 | 608.07 | 728.02 | 1,122.89 | 1,183.11 | 1,252.18 |

| Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|---|---|

| Operating Profit | 15.29 | 11.96 | 27.24 | 120.61 |

| Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|---|---|

| PTP | -162.79 | -22.24 | -166.76 | -37.21 | 14.17 | 38.97 | 113.35 |

| Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|---|---|

| Net Income | 6.19 | 11.69 | 30.82 | 90.15 |

| Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|---|---|

| EPS | 0.06 |

| Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|---|---|

| EBITDA | 44.08 | 94.59 | 115.03 | 206.58 | 324.12 | 359.54 | 398.50 |

| Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|---|---|

| BPS | 10,516.20 | 12,905.31 | 0.19 | 2.36 |

| Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|---|---|

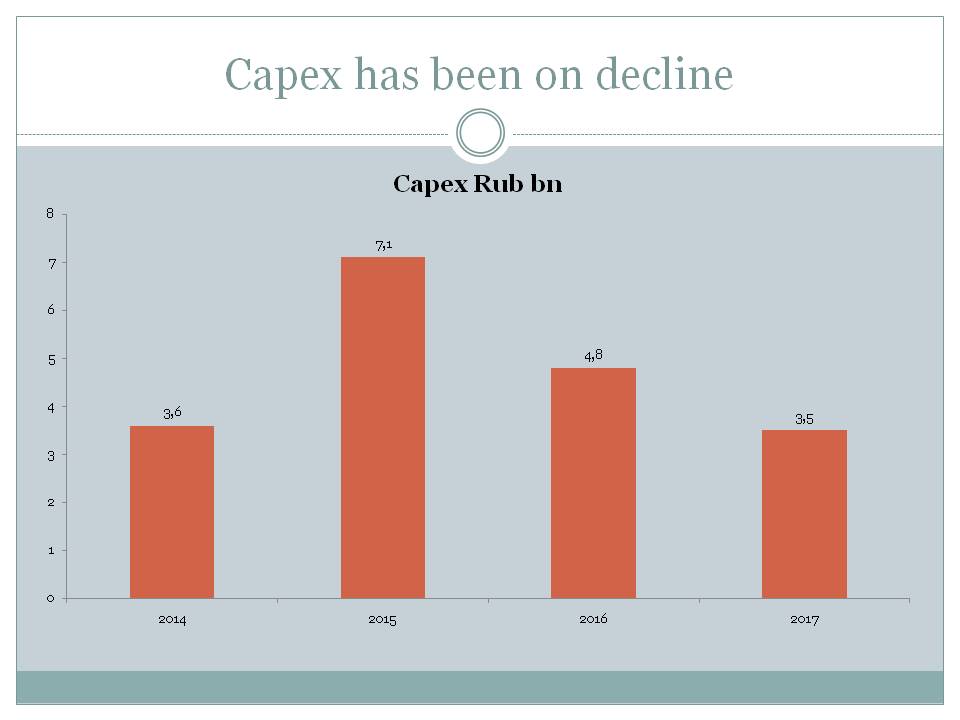

| Capex | -336.41 | -412.74 | -67.52 | -89.38 | -61.99 | -53.13 | -35.42 |

| Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|---|---|

| FCF | -398.92 | -606.34 | -85.72 | 60.71 |

Growth

| Year | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|---|

| revenue Growth | 368.2% | 34.6% | 19.7% | 54.2% | 5.4% | 5.8% |

| Year | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|---|

| Operating Profit Growth | -21.8% | 127.7% | 342.9% | 0.0% | 0.0% | 0.0% |

| Year | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|---|

| PTP Growth | 0.0% | 0.0% | 0.0% | 0.0% | 175.0% | 190.9% |

| Year | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|---|

| Net Income Growth | 0.0% | 0.0% | 0.0% | 88.9% | 163.6% | 192.5% |

| Year | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|---|

| EBITDA Growth | 114.6% | 21.6% | 79.6% | 56.9% | 10.9% | 10.8% |

| Year | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|---|

| BPS Growth | 22.7% | -100.0% | 1,112.9% | 0.0% | 0.0% | 0.0% |

| Year | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|---|

| Capex Growth | 22.7% | -83.6% | 32.4% | -30.6% | -14.3% | -33.3% |

Ratios

| Year | 2013 | 2014 | 2015 | 2016 |

|---|---|---|---|---|

| EV TO T12M EBIT | 109.00 | 23.00 |

| Year | 2017 | 2018 | 2019 |

|---|---|---|---|

| BEST CURRENT EV BEST EBIT | 13.00 | 13.00 | 11.00 |

| Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|---|---|

| EV/EBITDA | 26.00 | 13.00 | 9.00 | 8.00 | 7.00 |

| Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|

| P/S | 1.00 | 1.00 | 1.00 | 1.00 |

| Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2019 |

|---|---|---|---|---|---|---|---|---|

| P/B | 52.00 | 5.00 | 1.00 |

| Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|---|---|

| GROSS MARGIN | 45.00 | 12.00 | 10.00 | 20.00 |

| Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|---|---|

| ROA | -9.00 | 0.00 | -8.00 | 0.00 |

| Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|---|---|

| ROE | -64.00 | 10.00 | -210.00 | 6.00 |

| Year | 2013 | 2014 | 2015 | 2016 |

|---|---|---|---|---|

| CUR RATIO | 0.00 | 1.00 | 0.00 | 0.00 |

| Year | 2013 | 2014 | 2015 |

|---|---|---|---|

| TOT DEBT TO TOT CAP | 94.00 | 92.00 | 98.00 |

| Year | 2016 |

|---|---|

| Debt/Equity | 1,591.00 |

| Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2018 | 2019 |

|---|---|---|---|---|---|---|---|---|

| EBITDA Margin | 45.00 | 20.00 | 18.00 | 28.00 | 28.00 | 30.00 | 31.00 |

| Year | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Operating Margin | 15.00 | 2.00 | 4.00 | 16.00 |

| Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|---|---|

| Profit Margin | -186.00 | 3.00 | -26.00 | 1.00 | 0.00 | 0.00 | 0.00 |

| Year | 2017 |

|---|---|

| Market Cap | 1,239.00 |

| Year | 2018 |

|---|---|

| 1 month return | -22.00 |

| Year | 2018 |

|---|---|

| 6 month return | -20.00 |

Key Info

United Wagon Co PJSC Web - www.uniwagon.com

Tel - 7-499-999-15-20