Monthly Fund Flows By Objective

| Focus | Objective | Asset Class | Flow USD mn |

| Commodities | INDUSTRIAL METALS | Commodity | 29.86 |

| Commodities | PRECIOUS METAL SECTOR | Equity | -459.13 |

| Commodities | PRECIOUS METALS | Commodity | 29.64 |

| Commodities | PRECIOUS METALS | Mixed Allocation | -70.90 |

| country | AUSTRALIA | Equity | -277.59 |

| country | AUSTRALIA | Fixed Income | -38.69 |

| country | AUSTRALIA | Mixed Allocation | -0.18 |

| country | BRAZIL | Equity | 288.81 |

| country | BRAZIL | Fixed Income | -660.51 |

| country | CHINA | Equity | -1125.71 |

| country | CHINA | Fixed Income | -165.92 |

| Country | EGYPT | Equity | 4.76 |

| country | INDIA | Equity | -1030.92 |

| country | INDIA | Fixed Income | 55.77 |

| country | ISRAEL | Equity | -3.86 |

| country | JAPAN | Equity | 4800.77 |

| country | JAPAN | Fixed Income | -39.76 |

| country | JAPAN | Mixed Allocation | 1.36 |

| country | KOREA | Equity | -196.85 |

| country | POLAND | Equity | -33.18 |

| country | RUSSIA | Equity | 56.84 |

| country | RUSSIA | Fixed Income | -79.16 |

| country | SOUTH AFRICA | Equity | 36.44 |

| country | SPAIN | Equity | -315.18 |

| Country | TAIWAN | Equity | -61.06 |

| country | TURKEY | Equity | -34.55 |

| country | UNITED KINGDOM | Equity | -172.23 |

| industry | BASIC MATERIALS SECTOR | Equity | -397.45 |

| industry | COMMUNICATIONS SECTOR | Equity | -160.03 |

| industry | ENERGY SECTOR | Equity | -2794.41 |

| industry | ENERGY SECTOR | Mixed Allocation | -0.43 |

| industry | FINANCIAL SECTOR | Equity | 453.57 |

| industry | HEALTH CARE SECTOR | Equity | -474.96 |

| industry | INDUSTRIAL SECTOR | Equity | -326.96 |

| industry | MULTIPLE SECTOR | Equity | -1.54 |

| industry | NATURAL RESOURCES SECTOR | Equity | -532.75 |

| industry | REAL ESTATE SECTOR | Alternative | -3.01 |

| industry | REAL ESTATE SECTOR | Equity | -2429.88 |

| industry | TECHNOLOGY SECTOR | Equity | -306.05 |

| industry | UTILITIES SECTOR | Equity | 212.35 |

| region | AFRICAN REGION | Equity | 27.83 |

| region | AFRICAN REGION | Fixed Income | 6.87 |

| region | ASIAN PACIFIC REGION | Equity | 1754.33 |

| region | ASIAN PACIFIC REGION | Fixed Income | 27.75 |

| region | ASIAN PACIFIC REGION | Mixed Allocation | 676.41 |

| region | ASIAN PACIFIC REGION EX JAPAN | Equity | -1240.37 |

| region | ASIAN PACIFIC REGION EX JAPAN | Fixed Income | 988.44 |

| region | ASIAN PACIFIC REGION EX JAPAN | Mixed Allocation | -188.42 |

| region | EASTERN EUROPEAN REGION | Equity | -134.64 |

| region | EASTERN EUROPEAN REGION | Fixed Income | 28.86 |

| region | EASTERN EUROPEAN REGION | Mixed Allocation | -1.88 |

| region | EUROPEAN REGION | Equity | 3501.05 |

| region | EUROPEAN REGION | Fixed Income | 1003.50 |

| region | EUROPEAN REGION | Mixed Allocation | 122.37 |

| region | LATIN AMERICAN REGION | Equity | 545.05 |

| region | LATIN AMERICAN REGION | Fixed Income | 384.59 |

| region | MIDDLE EAST REGION | Equity | -35.49 |

| region | NORDIC REGION | Equity | -518.45 |

| region | NORTH AMERICAN REGION | Equity | -414.54 |

| region | NORTH AMERICAN REGION | Fixed Income | -32.73 |

| Risk | GOVERNMENT BOND | Alternative | 45.22 |

| Risk | GOVERNMENT BOND | Equity | -0.06 |

| Risk | GOVERNMENT BOND | Fixed Income | -1804.03 |

| Risk | GOVERNMENT BOND | Mixed Allocation | -13.14 |

| Risk | INFLATION PROTECTED | Brazil | -43.43 |

| Risk | INFLATION PROTECTED | Fixed Income | 1493.40 |

| Risk | LONG SHORT | Alternative | 495.09 |

| Risk | LONG SHORT | Equity | -473.62 |

| Risk | LONG SHORT | Fixed Income | -53.36 |

| Risk | LONG SHORT | Mixed Allocation | 2.83 |

| Sector | AGRICULTURE | Commodity | -5.92 |

| Sector | CONSUMER DISCRETIONARY | Equity | -2527.02 |

| Sector | CONSUMER STAPLES | Equity | -1691.77 |

| segment | BRIC | Equity | -109.76 |

| segment | BRIC | Fixed Income | -244.18 |

| segment | DEVELOPED MARKETS | Equity | -441.03 |

| segment | EMEA | Equity | -7.55 |

| segment | EMEA | Fixed Income | 18.95 |

| segment | EMERGING MARKETS | Equity | 5282.86 |

| segment | GCC | Equity | -1.92 |

| segment | GCC | Fixed Income | -0.03 |

| segment | MENA | Equity | -3.25 |

| segment | MENA | Fixed Income | -0.94 |

| Size | LARGE-CAP | Equity | -201.51 |

| Size | MID-CAP | Commodity | -5.77 |

| Size | MID-CAP | Equity | 3153.50 |

| Size | SMALL-CAP | Equity | 2091.80 |

Flows In Descending Order

| Focus | Objective | Asset Class | Flow USD mn |

| segment | EMERGING MARKETS | Equity | 5282.86 |

| country | JAPAN | Equity | 4800.77 |

| region | EUROPEAN REGION | Equity | 3501.05 |

| Size | MID-CAP | Equity | 3153.50 |

| Size | SMALL-CAP | Equity | 2091.80 |

| region | ASIAN PACIFIC REGION | Equity | 1754.33 |

| Risk | INFLATION PROTECTED | Fixed Income | 1493.40 |

| region | EUROPEAN REGION | Fixed Income | 1003.50 |

| region | ASIAN PACIFIC REGION EX JAPAN | Fixed Income | 988.44 |

| region | ASIAN PACIFIC REGION | Mixed Allocation | 676.41 |

| region | LATIN AMERICAN REGION | Equity | 545.05 |

| Risk | LONG SHORT | Alternative | 495.09 |

| industry | FINANCIAL SECTOR | Equity | 453.57 |

| region | LATIN AMERICAN REGION | Fixed Income | 384.59 |

| country | BRAZIL | Equity | 288.81 |

| industry | UTILITIES SECTOR | Equity | 212.35 |

| region | EUROPEAN REGION | Mixed Allocation | 122.37 |

| country | RUSSIA | Equity | 56.84 |

| country | INDIA | Fixed Income | 55.77 |

| Risk | GOVERNMENT BOND | Alternative | 45.22 |

| country | SOUTH AFRICA | Equity | 36.44 |

| Commodities | INDUSTRIAL METALS | Commodity | 29.86 |

| Commodities | PRECIOUS METALS | Commodity | 29.64 |

| region | EASTERN EUROPEAN REGION | Fixed Income | 28.86 |

| region | AFRICAN REGION | Equity | 27.83 |

| region | ASIAN PACIFIC REGION | Fixed Income | 27.75 |

| segment | EMEA | Fixed Income | 18.95 |

| region | AFRICAN REGION | Fixed Income | 6.87 |

| Country | EGYPT | Equity | 4.76 |

| Risk | LONG SHORT | Mixed Allocation | 2.83 |

| country | JAPAN | Mixed Allocation | 1.36 |

| segment | GCC | Fixed Income | -0.03 |

| Risk | GOVERNMENT BOND | Equity | -0.06 |

| country | AUSTRALIA | Mixed Allocation | -0.18 |

| industry | ENERGY SECTOR | Mixed Allocation | -0.43 |

| segment | MENA | Fixed Income | -0.94 |

| industry | MULTIPLE SECTOR | Equity | -1.54 |

| region | EASTERN EUROPEAN REGION | Mixed Allocation | -1.88 |

| segment | GCC | Equity | -1.92 |

| industry | REAL ESTATE SECTOR | Alternative | -3.01 |

| segment | MENA | Equity | -3.25 |

| country | ISRAEL | Equity | -3.86 |

| Size | MID-CAP | Commodity | -5.77 |

| Sector | AGRICULTURE | Commodity | -5.92 |

| segment | EMEA | Equity | -7.55 |

| Risk | GOVERNMENT BOND | Mixed Allocation | -13.14 |

| region | NORTH AMERICAN REGION | Fixed Income | -32.73 |

| country | POLAND | Equity | -33.18 |

| country | TURKEY | Equity | -34.55 |

| region | MIDDLE EAST REGION | Equity | -35.49 |

| country | AUSTRALIA | Fixed Income | -38.69 |

| country | JAPAN | Fixed Income | -39.76 |

| Risk | INFLATION PROTECTED | Brazil | -43.43 |

| Risk | LONG SHORT | Fixed Income | -53.36 |

| Country | TAIWAN | Equity | -61.06 |

| Commodities | PRECIOUS METALS | Mixed Allocation | -70.90 |

| country | RUSSIA | Fixed Income | -79.16 |

| segment | BRIC | Equity | -109.76 |

| region | EASTERN EUROPEAN REGION | Equity | -134.64 |

| industry | COMMUNICATIONS SECTOR | Equity | -160.03 |

| country | CHINA | Fixed Income | -165.92 |

| country | UNITED KINGDOM | Equity | -172.23 |

| region | ASIAN PACIFIC REGION EX JAPAN | Mixed Allocation | -188.42 |

| country | KOREA | Equity | -196.85 |

| Size | LARGE-CAP | Equity | -201.51 |

| segment | BRIC | Fixed Income | -244.18 |

| country | AUSTRALIA | Equity | -277.59 |

| industry | TECHNOLOGY SECTOR | Equity | -306.05 |

| country | SPAIN | Equity | -315.18 |

| industry | INDUSTRIAL SECTOR | Equity | -326.96 |

| industry | BASIC MATERIALS SECTOR | Equity | -397.45 |

| region | NORTH AMERICAN REGION | Equity | -414.54 |

| segment | DEVELOPED MARKETS | Equity | -441.03 |

| Commodities | PRECIOUS METAL SECTOR | Equity | -459.13 |

| Risk | LONG SHORT | Equity | -473.62 |

| industry | HEALTH CARE SECTOR | Equity | -474.96 |

| region | NORDIC REGION | Equity | -518.45 |

| industry | NATURAL RESOURCES SECTOR | Equity | -532.75 |

| country | BRAZIL | Fixed Income | -660.51 |

| country | INDIA | Equity | -1030.92 |

| country | CHINA | Equity | -1125.71 |

| region | ASIAN PACIFIC REGION EX JAPAN | Equity | -1240.37 |

| Sector | CONSUMER STAPLES | Equity | -1691.77 |

| Risk | GOVERNMENT BOND | Fixed Income | -1804.03 |

| industry | REAL ESTATE SECTOR | Equity | -2429.88 |

| Sector | CONSUMER DISCRETIONARY | Equity | -2527.02 |

| industry | ENERGY SECTOR | Equity | -2794.41 |

Chart: Rhodium, China Consumers, Nickel and Oil

Are the best momentum ideas in funds space

Source: ML

Download file in Power PointEmerging markets fund flow showed 5282.9 USD mn of inflow. While Frontier Markets funds showed 2.6 USD mn of inflows.

BRAZIL Equity funds showed 288.8 USD mn of inflow.

BRAZIL Fixed Income funds showed -660.5 USD mn of outflow.

CHINA Equity funds showed -1125.7 USD mn of outflow.

CHINA Fixed Income funds showed -165.9 USD mn of outflow.

INDIA Equity funds showed -1030.9 USD mn of outflow.

INDIA Fixed Income funds showed 55.8 USD mn of inflow.

KOREA Equity funds showed -196.8 USD mn of outflow.

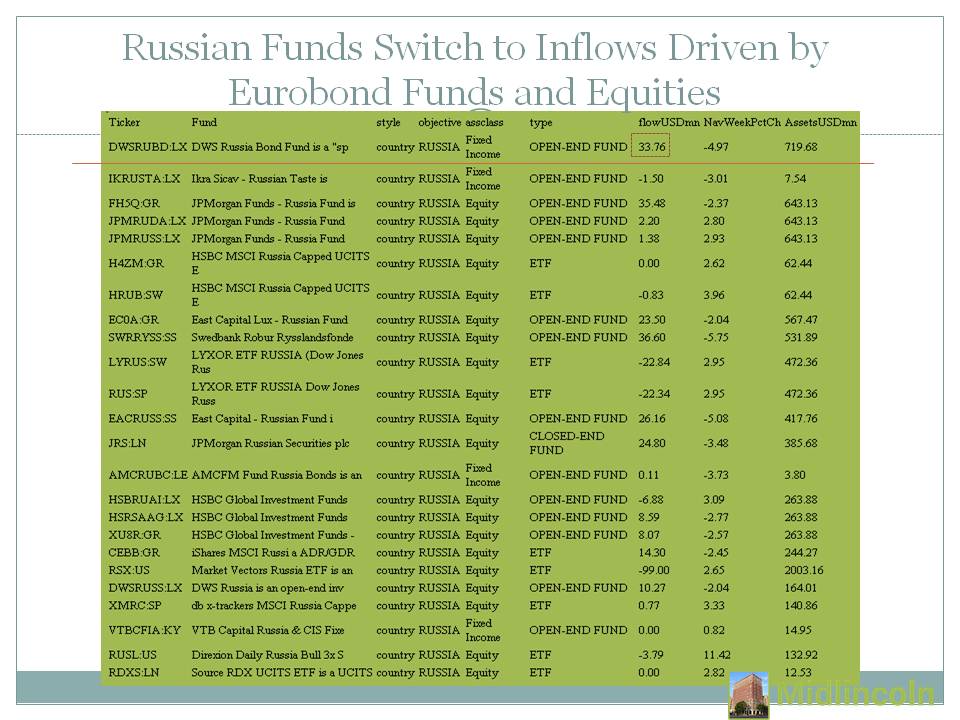

RUSSIA Equity funds showed 56.8 USD mn of inflow.

RUSSIA Fixed Income funds showed -79.2 USD mn of outflow.

SOUTH AFRICA Equity funds showed 36.4 USD mn of inflow.

TURKEY Equity funds showed -34.5 USD mn of outflow.

COMMUNICATIONS SECTOR Equity funds showed -160.0 USD mn of outflow.

ENERGY SECTOR Equity funds showed -2794.4 USD mn of outflow.

ENERGY SECTOR Mixed Allocation funds showed -0.4 USD mn of outflow.

FINANCIAL SECTOR Equity funds showed 453.6 USD mn of inflow.

REAL ESTATE SECTOR Alternative funds showed -3.0 USD mn of outflow.

REAL ESTATE SECTOR Equity funds showed -2429.9 USD mn of outflow.

TECHNOLOGY SECTOR Equity funds showed -306.0 USD mn of outflow.

UTILITIES SECTOR Equity funds showed 212.3 USD mn of inflow.

LONG SHORT Alternative funds showed 495.1 USD mn of inflow.

LONG SHORT Equity funds showed -473.6 USD mn of outflow.

LONG SHORT Fixed Income funds showed -53.4 USD mn of outflow.

LONG SHORT Mixed Allocation funds showed 2.8 USD mn of inflow.

Markets

Best global markets since the begining of the week EFM ASIA +0.53%, USA +0.12%, EM (EMERGING MARKETS) +0.10%,

While worst global markets since the begining of the week EUROPE -1.64%, EM LATIN AMERICA -1.52%, FM (FRONTIER MARKETS) -1.34%,

Best since the start of the week among various stock markets were KAZAKHSTAN +6.80%, VIETNAM +5.65%, RUSSIA +4.23%, CHINA +2.68%, COLOMBIA +2.65%, MOROCCO +2.40%, HONG KONG +1.72%, ZIMBABWE +1.57%, SERBIA +1.33%, CANADA +1.29%,

While worst since the start of the week among various stock markets were GREECE -6.64%, BAHRAIN -6.27%, LEBANON -5.49%, KUWAIT -5.44%, TURKEY -5.39%, UKRAINE -4.24%, BOTSWANA -3.89%, UNITED ARAB EMIRATES -3.76%, SPAIN -3.48%, HUNGARY -3.46%,

Key Fund Flow Headlines

Recent Fund Atlas Ideas ChArt

Latest ML Comics

Recent ML Rural Highlights. Small Towns and Villages

Vaskoh-Romania | Artvin-Turkey | Gorishkino-Russia |

Top 20 Funds Longs Based on Momentum

| Name | 1week | 1month | ytd | 6months | 1yr | Rank |

| DB PHYSICAL RHODIUM ETC (XRH0) | 7.39081 | 19.46849 | 76.38195 | 60.12483 | 71.59168 | 39.64 |

| JPMORGAN CHINESE INVESTMENT TRUST PLC (JMC) | 5.526658 | 11.88762 | 75.11398 | 44.97231 | 76.19755 | 34.65 |

| NEXT NOTES NIKKEI TOCOM LEVERAGED CRUDE OIL ETN (2038) | -2.21047 | 26.5651 | 5.884463 | 31.70621 | 72.04562 | 32.03 |

| DB X-TRACKERS CAC 40 UCITS ETF DR (DX2G) | 1.28804 | 2.901082 | 68.34305 | 53.10341 | 65.17947 | 30.62 |

| LYXOR ETF FTSE MIB DAILY LEVERAGED (LEVMI) | -4.309479 | -1.464898 | 52.10779 | 18.99232 | 98.96245 | 28.05 |

| KB CHINA MAINLAND A SHARE LEVERAGE SEC MASTER INVST TRUST-EQUITY-DERV FOF (3AF8884) | 3.943467 | 10.28797 | 66.13433 | 44.10835 | 52.27083 | 27.65 |

| CHINA UNIVERSAL CSI CONSUMER STAPLES INDEX ETF (159928) | -2.530581 | 4.791448 | 62.12493 | 45.06237 | 59.75475 | 26.77 |

| KB CHINA MAINLAND A SHARE LEVERAGE SEC FEEDER INVST TRUST-EQUITY-DERV FOF (3AF8926) | 3.890749 | 10.0566 | 62.88887 | 42.50567 | 48.91822 | 26.34 |

| UBS HANA AMBATOVY NICKEL OVERSEAS INVESTMENT COMPANY 1 (099340) | -0.2165909 | 5.294358 | 47.92831 | 44.9791 | 50.5658 | 25.16 |

| SIMPLEX CHINA BULL 2X H-SHARE ETF (1572) | 0.3437343 | 2.397334 | 57.05677 | 33.72586 | 61.80982 | 24.57 |

| CITIC-PRUDENTIAL CSI 800 FINANCIAL INDEX CLASSIFIED FUND (150158) | 2.401298 | 2.485756 | 43.62144 | 53.54375 | 39.52216 | 24.49 |

| CANADIAN LIFE COS SPLIT CORP (LFE) | 2.233211 | 5.609858 | 30.79006 | 44.62883 | 44.89993 | 24.34 |

| FIRST STATE GLOBAL UMBRELLA PLC - CHINA GROWTH FUND - I DIS (CRECHID) | 1.276309 | 7.594524 | 54.30062 | 32.97926 | 55.15495 | 24.25 |

| SIMPLEX CHINA BULL 2X H-SHARE ETF (9D31112C) | 2.876642 | 2.868255 | 62.28354 | 32.28155 | 58.41569 | 24.11 |

| CITIC-PRUDENTIAL CSI 800 NONFERROUS METAL INDEX FUND (150151) | -0.2292915 | -8.225395 | 63.23315 | 67.06021 | 37.14324 | 23.94 |

| CHINA UNIVERSAL CONSUMER SECTOR FUND (CNUNCSF) | 0.2689819 | 7.626855 | 54.33055 | 38.0832 | 48.24357 | 23.56 |

| FIDELITY JAPANESE VALUES PLC (FJV) | -0.3910125 | 7.046681 | 52.94247 | 36.24309 | 49.23232 | 23.03 |

| ASIAN TOTAL RETURN INVESTMENT CO PLC (ATR) | 1.208862 | 3.655842 | 57.17262 | 28.16602 | 58.66399 | 22.92 |

| CANADIAN BANC CORP (BK) | -0.1147185 | 2.436958 | 31.33448 | 29.31167 | 56.98788 | 22.16 |

| HANWHA CHINA MAINLAND SECURITIES FEEDER INVESTMENT TRUST H - EQUITY - C-F (3991497) | 2.756054 | 8.498883 | 56.98565 | 32.76079 | 44.24781 | 22.07 |

Top 20 Funds Shorts Based on Momentum

| Name | 1week | 1month | ytd | 6months | 1yr | Rank |

| VELOCITYSHARES 3X LONG NATURAL GAS ETN (UGAZ) | -7.421154 | -9.191079 | -78.37194 | -47.24868 | -58.57203 | -30.61 |

| KAYNE ANDERSON MLP INVESTMENT CO (KYN) | -6.470702 | -15.18229 | -16.36659 | -17.82403 | -16.32386 | -13.95 |

| PROSHARES ULTRASHORT MSCI BRAZIL CAPPED (BZQ) | 3.700094 | 25 | -41.54775 | -33.4375 | -48.27586 | -13.25 |

| DIREXION DAILY GOLD MINERS BULL 3X SHARES (NUGT) | -2.95197 | -17.49858 | -4.810209 | -14.7877 | -14.54172 | -12.44 |

| LYXOR ETF FTSE MIB DAILY DOUBLE SHORT XBEAR (XBRMIB) | 8.186762 | 0.5313833 | -27.17875 | -10.27337 | -47.82013 | -12.34 |

| CLEARBRIDGE ENERGY MLP FUND INC (CEM) | -6.9861 | -12.4914 | -12.65486 | -18.0596 | -7.937544 | -11.37 |

| KAYNE ANDERSON ENERGY TOTAL RETURN FUND INC (KYE) | -8.292686 | -14.4677 | -15.0554 | -13.79339 | -8.060979 | -11.15 |

| SIMPLEX CHINA BEAR 1X H-SHARE ETF (1573) | 0.2209145 | -1.993093 | -23.87745 | -15.99772 | -24.00986 | -10.44 |

| SIMPLEX CHINA BEAR 1X H-SHARE ETF (9D31212C) | -1.057478 | -1.990834 | -24.54683 | -15.00011 | -23.41423 | -10.37 |

| PRECIOUS METALS & MINING TRUST (MMP-U) | 0.9075125 | -14.72612 | -14.1588 | -8.035432 | -18.86194 | -10.18 |

| TORTOISE ENERGY INFRASTRUCTURE CORP (TYG) | -4.336638 | -8.794672 | -9.894691 | -20.42632 | -6.921244 | -10.12 |

| IPATH DOW JONES-UBS SUGAR SUBINDEX TOTAL RETURN ETN (SGG) | 3.149082 | 5.734893 | -29.03895 | -11.34466 | -36.1733 | -9.66 |

| IPATH DOW JONES-UBS COFFEE SUBINDEX TOTAL RETURN ETN (JO) | 1.934462 | -0.5487165 | -16.5138 | -7.636308 | -32.12843 | -9.59 |

| ETRACS ALERIAN MLP INFRASTRUCTURE INDEX ETN (MLPI) | -5.175297 | -6.721562 | -14.33771 | -13.69316 | -9.897605 | -8.87 |

| ETFS COFFEE (COFF) | 1.24357 | -0.08463559 | -14.5494 | -8.381837 | -28.21526 | -8.86 |

| ETFS DAILY SHORT COPPER (SCOP) | 0.6737089 | 1.673411 | -19.55478 | -17.91864 | -19.54307 | -8.78 |

| ALERIAN MLP ETF (AMLP) | -5.25107 | -6.776545 | -12.74469 | -12.36769 | -9.809936 | -8.55 |

| TORTOISE ENERGY INFRASTRUCTURE CORP (XTYGX) | -4.74893 | -7.380772 | -13.61292 | -13.75404 | -8.274383 | -8.54 |

| AUSTRALIA EQUITY INCOME FUND (DWAUEIP) | -2.492783 | -1.646618 | -17.10858 | -11.06159 | -18.49843 | -8.42 |

| MARKET VECTORS OIL SERVICE ETF (OIH) | -5.059869 | -1.954528 | -26.29685 | -10.0951 | -15.5796 | -8.17 |

Best Funds last Week

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| LYXOR ETF FTSE MIB DAILY DOUBLE SHORT XBEAR (XBRMIB) | 2.328257 | -27.17875 | 8.186762 | 0.5313833 | -10.27337 | -47.82013 | -12.34 |

| SPOTR BEAR OMXS30 (SPBEAOMX) | -0.346734 | -14.17335 | 8.171453 | -1.949105 | 2.109224 | -21.54624 | -3.30 |

| DB PHYSICAL RHODIUM ETC (XRH0) | 4.094265 | 76.38195 | 7.39081 | 19.46849 | 60.12483 | 71.59168 | 39.64 |

| ETFS WTI CRUDE OIL (CRUD) | -2.171919 | 15.20173 | 7.063942 | 8.223349 | 13.40425 | 15.20173 | 10.97 |

| YINHUA CONSUMPTION THEME FUND (150048) | -0.8488842 | 41.56953 | 6.555569 | 12.46291 | 35.27716 | 29.26601 | 20.89 |

| LYXOR ETF IBEX 35 DOBLE INVERSO DIARIO (2INVE) | 2.157938 | -13.28125 | 6.382534 | 3.37169 | 13.4389 | -28.82041 | -1.41 |

| JPMORGAN CHINESE INVESTMENT TRUST PLC (JMC) | 0.1378124 | 75.11398 | 5.526658 | 11.88762 | 44.97231 | 76.19755 | 34.65 |

| LYXOR ETF FTSE MIB DAILY SHORT BEAR (BERMIB) | 1.503945 | -9.784962 | 4.729681 | -0.243071 | -2.778644 | -23.98986 | -5.57 |

| TRACKER FUND OF HONG KONG LTD (TF5) | 3.739205 | 38.73778 | 4.455704 | 10.23933 | 19.24754 | 35.02299 | 17.24 |

| KB CHINA MAINLAND A SHARE LEVERAGE SEC MASTER INVST TRUST-EQUITY-DERV FOF (3AF8884) | 0.6649404 | 66.13433 | 3.943467 | 10.28797 | 44.10835 | 52.27083 | 27.65 |

| KB CHINA MAINLAND A SHARE LEVERAGE SEC FEEDER INVST TRUST-EQUITY-DERV FOF (3AF8926) | 0.6588898 | 62.88887 | 3.890749 | 10.0566 | 42.50567 | 48.91822 | 26.34 |

| LYXOR UCITS ETF IBEX 35 INVERSO DIARIO (INVEX) | 1.394524 | -1.093059 | 3.865729 | 1.395686 | 9.635687 | -11.12719 | 0.94 |

| GUGGENHEIM S&P 500 EQUAL WEIGHT CONSUMER STAPLES ETF (RHS) | 0.3595133 | 6.682409 | 3.835347 | 1.691899 | 0.8918353 | 9.958276 | 4.09 |

| PROSHARES ULTRASHORT MSCI BRAZIL CAPPED (BZQ) | 3.197671 | -41.54775 | 3.700094 | 25 | -33.4375 | -48.27586 | -13.25 |

| EAST CAPITAL LUX - RUSSIAN FUND (EC0A) | 0.8745482 | 17.48104 | 3.187479 | 1.017074 | 15.62599 | 34.94286 | 13.69 |

| FIRST TRUST CONSUMER STAPLES ALPHADEX FUND (FXG) | 0.1528731 | 1.185999 | 3.172105 | -0.3487563 | 0.7480772 | 5.12295 | 2.17 |

| MIRAE ASSET TIGER CHINA CONSUMER ETF (150460) | 0.2763709 | 30.74706 | 3.151868 | 15.94033 | 6.458709 | 25.52241 | 12.77 |

| IPATH DOW JONES-UBS SUGAR SUBINDEX TOTAL RETURN ETN (SGG) | -0.4204369 | -29.03895 | 3.149082 | 5.734893 | -11.34466 | -36.1733 | -9.66 |

| CONSUMER STAPLES SELECT SECTOR SPDR FUND (SD7I) | 1.471571 | 6.651801 | 2.962339 | -0.9128928 | 0.02160669 | 9.684117 | 2.94 |

| SIMPLEX CHINA BULL 2X H-SHARE ETF (9D31112C) | -0.5824816 | 62.28354 | 2.876642 | 2.868255 | 32.28155 | 58.41569 | 24.11 |

Worst Funds last Week

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| KAYNE ANDERSON ENERGY TOTAL RETURN FUND INC (KYE) | -2.691515 | -15.0554 | -8.292686 | -14.4677 | -13.79339 | -8.060979 | -11.15 |

| DIREXION DAILY LATIN AMERICA BULL 3X SHARES (LBJ) | -4.206565 | 43.44058 | -7.922419 | -24.49422 | 34.66346 | 49.53595 | 12.95 |

| VELOCITYSHARES 3X LONG NATURAL GAS ETN (UGAZ) | -6.50936 | -78.37194 | -7.421154 | -9.191079 | -47.24868 | -58.57203 | -30.61 |

| CLEARBRIDGE ENERGY MLP FUND INC (CEM) | -1.738793 | -12.65486 | -6.9861 | -12.4914 | -18.0596 | -7.937544 | -11.37 |

| DIREXION DAILY BRAZIL BULL 3X SHARES (BRZU) | -4.987601 | 11.11111 | -6.907717 | -32.68293 | 46.68367 | 20.30705 | 6.85 |

| H&Q LIFE SCIENCES INVESTORS (HQL) | -2.61658 | 17.51464 | -6.510937 | -13.87363 | -2.530729 | 8.780611 | -3.53 |

| KAYNE ANDERSON MLP INVESTMENT CO (KYN) | -1.395348 | -16.36659 | -6.470702 | -15.18229 | -17.82403 | -16.32386 | -13.95 |

| ETFS NICKEL (NICK) | -5.249184 | 14.23295 | -6.263893 | 1.777094 | 27.44505 | 2.837507 | 6.45 |

| PROSHARES ULTRA DJ-UBS CRUDE OIL (UCO) | -4.356057 | -13.5702 | -6.223871 | 15.04274 | 15.02049 | 19.50354 | 10.84 |

| SPOTR BULL OMXS30 (SPBULOMX) | 0.5720959 | 31.87908 | -5.718724 | -3.732076 | 5.920287 | 45.26717 | 10.43 |

| NEUBERGER BERMAN MLP INCOME FUND INC (NML) | -1.883944 | -5.650922 | -5.644875 | -10.67983 | -10.31863 | -0.4296287 | -6.77 |

| GLOBAL X FTSE ARGENTINA 20 ETF (GX0A) | -2.77419 | 34.61317 | -5.252838 | -3.059817 | 5.463441 | 40.61014 | 9.44 |

| ALERIAN MLP ETF (AMLP) | -1.032914 | -12.74469 | -5.25107 | -6.776545 | -12.36769 | -9.809936 | -8.55 |

| JOHN HANCOCK FINANCIAL OPPORTUNITIES FUND (BTO) | -0.06718531 | -1.324043 | -5.205963 | -7.200293 | 4.563385 | 10.79802 | 0.74 |

| ETRACS ALERIAN MLP INFRASTRUCTURE INDEX ETN (MLPI) | -1.331605 | -14.33771 | -5.175297 | -6.721562 | -13.69316 | -9.897605 | -8.87 |

| MARKET VECTORS OIL SERVICE ETF (OIH) | -2.884236 | -26.29685 | -5.059869 | -1.954528 | -10.0951 | -15.5796 | -8.17 |

| ALPINE GLOBAL PREMIER PROPERTIES FUND (AWP) | -0.3236728 | 31.04484 | -4.917052 | -8.698576 | 6.842152 | 37.95382 | 7.80 |

| JPMORGAN ALERIAN MLP INDEX ETN (AMJ) | -1.19708 | -12.37072 | -4.895965 | -6.146 | -11.55203 | -7.497695 | -7.52 |

| SPDR S&P OIL & GAS EXPLORATION & PRODUCTION ETF (XOP) | -2.703456 | -15.17022 | -4.733967 | 3.883925 | 1.096657 | -4.787415 | -1.14 |

| SPDR S&P METALS & MINING ETF (SSGG) | -1.716858 | -2.843508 | -4.571116 | -7.675482 | 6.596643 | 3.394331 | -0.56 |

Best Funds last Month

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| NEXT NOTES NIKKEI TOCOM LEVERAGED CRUDE OIL ETN (2038) | -0.6743378 | 5.884463 | -2.21047 | 26.5651 | 31.70621 | 72.04562 | 32.03 |

| PROSHARES ULTRASHORT MSCI BRAZIL CAPPED (BZQ) | 3.197671 | -41.54775 | 3.700094 | 25 | -33.4375 | -48.27586 | -13.25 |

| DB PHYSICAL RHODIUM ETC (XRH0) | 4.094265 | 76.38195 | 7.39081 | 19.46849 | 60.12483 | 71.59168 | 39.64 |

| MIRAE ASSET TIGER CHINA CONSUMER ETF (150460) | 0.2763709 | 30.74706 | 3.151868 | 15.94033 | 6.458709 | 25.52241 | 12.77 |

| PROSHARES ULTRA DJ-UBS CRUDE OIL (UCO) | -4.356057 | -13.5702 | -6.223871 | 15.04274 | 15.02049 | 19.50354 | 10.84 |

| YINHUA CONSUMPTION THEME FUND (150048) | -0.8488842 | 41.56953 | 6.555569 | 12.46291 | 35.27716 | 29.26601 | 20.89 |

| JPMORGAN CHINESE INVESTMENT TRUST PLC (JMC) | 0.1378124 | 75.11398 | 5.526658 | 11.88762 | 44.97231 | 76.19755 | 34.65 |

| IPATH GOLDMAN SACHS CRUDE OIL TOTAL RETURN INDEX ETN (OIL) | -3.119867 | -6.714056 | -3.983737 | 10.37384 | 11.83712 | 12.26236 | 7.62 |

| KB CHINA MAINLAND A SHARE LEVERAGE SEC MASTER INVST TRUST-EQUITY-DERV FOF (3AF8884) | 0.6649404 | 66.13433 | 3.943467 | 10.28797 | 44.10835 | 52.27083 | 27.65 |

| WTI CRUDE OIL PRICE LINKED ETF (1671) | -0.1425488 | -3.500084 | -1.179662 | 10.28464 | 11.56423 | 16.65837 | 9.33 |

| TRACKER FUND OF HONG KONG LTD (TF5) | 3.739205 | 38.73778 | 4.455704 | 10.23933 | 19.24754 | 35.02299 | 17.24 |

| KB CHINA MAINLAND A SHARE LEVERAGE SEC FEEDER INVST TRUST-EQUITY-DERV FOF (3AF8926) | 0.6588898 | 62.88887 | 3.890749 | 10.0566 | 42.50567 | 48.91822 | 26.34 |

| CHINA SOUTHERN GRAIN & OIL COMMODITY FUND (CSG0CMD) | -1.300071 | 33.60456 | 2.81263 | 9.32196 | 29.90289 | 25.10043 | 16.78 |

| HANWHA CHINA MAINLAND SECURITIES FEEDER INVESTMENT TRUST H - EQUITY - C-F (3991497) | 0.9023456 | 56.98565 | 2.756054 | 8.498883 | 32.76079 | 44.24781 | 22.07 |

| ETFS WTI CRUDE OIL (CRUD) | -2.171919 | 15.20173 | 7.063942 | 8.223349 | 13.40425 | 15.20173 | 10.97 |

| UNITED STATES OIL FUND LP (U9N) | -2.124285 | -4.796694 | -2.891713 | 7.983743 | 8.553178 | 14.71194 | 7.09 |

| BAILLIE GIFFORD JAPAN TRUST PLC/THE (BGFD) | -0.579086 | 53.0816 | -0.3440534 | 7.908032 | 28.86714 | 50.33511 | 21.69 |

| JPMORGAN JAPAN SMALLER COMPANIES TRUST PLC (JPS) | 0.4278179 | 47.91523 | 1.011768 | 7.711944 | 26.96869 | 44.66736 | 20.09 |

| CHINA UNIVERSAL CONSUMER SECTOR FUND (CNUNCSF) | -1.690208 | 54.33055 | 0.2689819 | 7.626855 | 38.0832 | 48.24357 | 23.56 |

| FIRST STATE GLOBAL UMBRELLA PLC - CHINA GROWTH FUND - I DIS (CRECHID) | -1.001679 | 54.30062 | 1.276309 | 7.594524 | 32.97926 | 55.15495 | 24.25 |

Worst Funds last Month

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| NEXT NOTES NIKKEI TOCOM LEVERAGED CRUDE OIL ETN (2038) | -0.6743378 | 5.884463 | -2.21047 | 26.5651 | 31.70621 | 72.04562 | 32.03 |

| PROSHARES ULTRASHORT MSCI BRAZIL CAPPED (BZQ) | 3.197671 | -41.54775 | 3.700094 | 25 | -33.4375 | -48.27586 | -13.25 |

| DB PHYSICAL RHODIUM ETC (XRH0) | 4.094265 | 76.38195 | 7.39081 | 19.46849 | 60.12483 | 71.59168 | 39.64 |

| MIRAE ASSET TIGER CHINA CONSUMER ETF (150460) | 0.2763709 | 30.74706 | 3.151868 | 15.94033 | 6.458709 | 25.52241 | 12.77 |

| PROSHARES ULTRA DJ-UBS CRUDE OIL (UCO) | -4.356057 | -13.5702 | -6.223871 | 15.04274 | 15.02049 | 19.50354 | 10.84 |

| YINHUA CONSUMPTION THEME FUND (150048) | -0.8488842 | 41.56953 | 6.555569 | 12.46291 | 35.27716 | 29.26601 | 20.89 |

| JPMORGAN CHINESE INVESTMENT TRUST PLC (JMC) | 0.1378124 | 75.11398 | 5.526658 | 11.88762 | 44.97231 | 76.19755 | 34.65 |

| IPATH GOLDMAN SACHS CRUDE OIL TOTAL RETURN INDEX ETN (OIL) | -3.119867 | -6.714056 | -3.983737 | 10.37384 | 11.83712 | 12.26236 | 7.62 |

| KB CHINA MAINLAND A SHARE LEVERAGE SEC MASTER INVST TRUST-EQUITY-DERV FOF (3AF8884) | 0.6649404 | 66.13433 | 3.943467 | 10.28797 | 44.10835 | 52.27083 | 27.65 |

| WTI CRUDE OIL PRICE LINKED ETF (1671) | -0.1425488 | -3.500084 | -1.179662 | 10.28464 | 11.56423 | 16.65837 | 9.33 |

| TRACKER FUND OF HONG KONG LTD (TF5) | 3.739205 | 38.73778 | 4.455704 | 10.23933 | 19.24754 | 35.02299 | 17.24 |

| KB CHINA MAINLAND A SHARE LEVERAGE SEC FEEDER INVST TRUST-EQUITY-DERV FOF (3AF8926) | 0.6588898 | 62.88887 | 3.890749 | 10.0566 | 42.50567 | 48.91822 | 26.34 |

| CHINA SOUTHERN GRAIN & OIL COMMODITY FUND (CSG0CMD) | -1.300071 | 33.60456 | 2.81263 | 9.32196 | 29.90289 | 25.10043 | 16.78 |

| HANWHA CHINA MAINLAND SECURITIES FEEDER INVESTMENT TRUST H - EQUITY - C-F (3991497) | 0.9023456 | 56.98565 | 2.756054 | 8.498883 | 32.76079 | 44.24781 | 22.07 |

| ETFS WTI CRUDE OIL (CRUD) | -2.171919 | 15.20173 | 7.063942 | 8.223349 | 13.40425 | 15.20173 | 10.97 |

| UNITED STATES OIL FUND LP (U9N) | -2.124285 | -4.796694 | -2.891713 | 7.983743 | 8.553178 | 14.71194 | 7.09 |

| BAILLIE GIFFORD JAPAN TRUST PLC/THE (BGFD) | -0.579086 | 53.0816 | -0.3440534 | 7.908032 | 28.86714 | 50.33511 | 21.69 |

| JPMORGAN JAPAN SMALLER COMPANIES TRUST PLC (JPS) | 0.4278179 | 47.91523 | 1.011768 | 7.711944 | 26.96869 | 44.66736 | 20.09 |

| CHINA UNIVERSAL CONSUMER SECTOR FUND (CNUNCSF) | -1.690208 | 54.33055 | 0.2689819 | 7.626855 | 38.0832 | 48.24357 | 23.56 |

| FIRST STATE GLOBAL UMBRELLA PLC - CHINA GROWTH FUND - I DIS (CRECHID) | -1.001679 | 54.30062 | 1.276309 | 7.594524 | 32.97926 | 55.15495 | 24.25 |

Best Funds YTD

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| DB PHYSICAL RHODIUM ETC (XRH0) | 4.094265 | 76.38195 | 7.39081 | 19.46849 | 60.12483 | 71.59168 | 39.64 |

| JPMORGAN CHINESE INVESTMENT TRUST PLC (JMC) | 0.1378124 | 75.11398 | 5.526658 | 11.88762 | 44.97231 | 76.19755 | 34.65 |

| DB X-TRACKERS CAC 40 UCITS ETF DR (DX2G) | 0.8745503 | 68.34305 | 1.28804 | 2.901082 | 53.10341 | 65.17947 | 30.62 |

| KB CHINA MAINLAND A SHARE LEVERAGE SEC MASTER INVST TRUST-EQUITY-DERV FOF (3AF8884) | 0.6649404 | 66.13433 | 3.943467 | 10.28797 | 44.10835 | 52.27083 | 27.65 |

| CITIC-PRUDENTIAL CSI 800 NONFERROUS METAL INDEX FUND (150151) | 0.1854778 | 63.23315 | -0.2292915 | -8.225395 | 67.06021 | 37.14324 | 23.94 |

| KB CHINA MAINLAND A SHARE LEVERAGE SEC FEEDER INVST TRUST-EQUITY-DERV FOF (3AF8926) | 0.6588898 | 62.88887 | 3.890749 | 10.0566 | 42.50567 | 48.91822 | 26.34 |

| SIMPLEX CHINA BULL 2X H-SHARE ETF (9D31112C) | -0.5824816 | 62.28354 | 2.876642 | 2.868255 | 32.28155 | 58.41569 | 24.11 |

| CHINA UNIVERSAL CSI CONSUMER STAPLES INDEX ETF (159928) | -1.296164 | 62.12493 | -2.530581 | 4.791448 | 45.06237 | 59.75475 | 26.77 |

| INVESCO GREATER CHINA EQUITY FUND - C EUR HEDGE (INVPGCH) | 0.3697293 | 57.3252 | 1.491394 | 1.860463 | 27.33788 | 51.75797 | 20.61 |

| ASIAN TOTAL RETURN INVESTMENT CO PLC (ATR) | 1.256743 | 57.17262 | 1.208862 | 3.655842 | 28.16602 | 58.66399 | 22.92 |

| SIMPLEX CHINA BULL 2X H-SHARE ETF (1572) | -0.06446564 | 57.05677 | 0.3437343 | 2.397334 | 33.72586 | 61.80982 | 24.57 |

| HANWHA CHINA MAINLAND SECURITIES FEEDER INVESTMENT TRUST H - EQUITY - C-F (3991497) | 0.9023456 | 56.98565 | 2.756054 | 8.498883 | 32.76079 | 44.24781 | 22.07 |

| DB X-TRACKERS MSCI AC ASIA EX JAPAN TRN INDEX UCITS ETF (DXS5) | 0.8745453 | 56.5619 | 1.571259 | -0.5242333 | 13.06969 | 53.61972 | 16.93 |

| COMSTAGE ETF DAX TR UCITS ETF (CBDAX) | 0.874553 | 55.97844 | 1.547485 | 6.688268 | 11.17345 | 53.04722 | 18.11 |

| JPMORGAN INDIAN INVESTMENT TRUST PLC (3J8) | 0.451925 | 55.20494 | -4.371739 | -1.071252 | 5.540313 | 24.81583 | 6.23 |

| FRANKLIN TEMPLETON INVESTMENT FUNDS - TEMPLETON BRIC FUND (F7RH) | 0.7105364 | 54.60435 | 1.397491 | 1.210306 | 28.27695 | 53.707 | 21.15 |

| CHINA UNIVERSAL CONSUMER SECTOR FUND (CNUNCSF) | -1.690208 | 54.33055 | 0.2689819 | 7.626855 | 38.0832 | 48.24357 | 23.56 |

| FIRST STATE GLOBAL UMBRELLA PLC - CHINA GROWTH FUND - I DIS (CRECHID) | -1.001679 | 54.30062 | 1.276309 | 7.594524 | 32.97926 | 55.15495 | 24.25 |

| BAILLIE GIFFORD JAPAN TRUST PLC/THE (BGFD) | -0.579086 | 53.0816 | -0.3440534 | 7.908032 | 28.86714 | 50.33511 | 21.69 |

| FIDELITY JAPANESE VALUES PLC (FJV) | 0.09913418 | 52.94247 | -0.3910125 | 7.046681 | 36.24309 | 49.23232 | 23.03 |

Worst Funds YTD

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| VELOCITYSHARES 3X LONG NATURAL GAS ETN (UGAZ) | -6.50936 | -78.37194 | -7.421154 | -9.191079 | -47.24868 | -58.57203 | -30.61 |

| PROSHARES ULTRASHORT MSCI BRAZIL CAPPED (BZQ) | 3.197671 | -41.54775 | 3.700094 | 25 | -33.4375 | -48.27586 | -13.25 |

| IPATH DOW JONES-UBS SUGAR SUBINDEX TOTAL RETURN ETN (SGG) | -0.4204369 | -29.03895 | 3.149082 | 5.734893 | -11.34466 | -36.1733 | -9.66 |

| LYXOR ETF FTSE MIB DAILY DOUBLE SHORT XBEAR (XBRMIB) | 2.328257 | -27.17875 | 8.186762 | 0.5313833 | -10.27337 | -47.82013 | -12.34 |

| MARKET VECTORS OIL SERVICE ETF (OIH) | -2.884236 | -26.29685 | -5.059869 | -1.954528 | -10.0951 | -15.5796 | -8.17 |

| SIMPLEX CHINA BEAR 1X H-SHARE ETF (9D31212C) | 0.4722087 | -24.54683 | -1.057478 | -1.990834 | -15.00011 | -23.41423 | -10.37 |

| SIMPLEX CHINA BEAR 1X H-SHARE ETF (1573) | 1.257836 | -23.87745 | 0.2209145 | -1.993093 | -15.99772 | -24.00986 | -10.44 |

| ETFS DAILY SHORT COPPER (SCOP) | 1.898269 | -19.55478 | 0.6737089 | 1.673411 | -17.91864 | -19.54307 | -8.78 |

| ISHARES US TELECOMMUNICATIONS ETF (ISQC) | -0.3127129 | -16.9843 | -1.283988 | -9.939377 | -10.83421 | -6.22716 | -7.07 |

| IPATH DOW JONES-UBS COFFEE SUBINDEX TOTAL RETURN ETN (JO) | -0.4881125 | -16.5138 | 1.934462 | -0.5487165 | -7.636308 | -32.12843 | -9.59 |

| KAYNE ANDERSON MLP INVESTMENT CO (KYN) | -1.395348 | -16.36659 | -6.470702 | -15.18229 | -17.82403 | -16.32386 | -13.95 |

| SPDR S&P OIL & GAS EXPLORATION & PRODUCTION ETF (XOP) | -2.703456 | -15.17022 | -4.733967 | 3.883925 | 1.096657 | -4.787415 | -1.14 |

| KAYNE ANDERSON ENERGY TOTAL RETURN FUND INC (KYE) | -2.691515 | -15.0554 | -8.292686 | -14.4677 | -13.79339 | -8.060979 | -11.15 |

| ETFS COFFEE (COFF) | -1.378444 | -14.5494 | 1.24357 | -0.08463559 | -8.381837 | -28.21526 | -8.86 |

| ETRACS ALERIAN MLP INFRASTRUCTURE INDEX ETN (MLPI) | -1.331605 | -14.33771 | -5.175297 | -6.721562 | -13.69316 | -9.897605 | -8.87 |

| VANGUARD TELECOMMUNICATION SERVICES ETF (VOX) | -0.8389012 | -14.24748 | -1.573428 | -8.561661 | -7.471325 | -3.723654 | -5.33 |

| SPOTR BEAR OMXS30 (SPBEAOMX) | -0.346734 | -14.17335 | 8.171453 | -1.949105 | 2.109224 | -21.54624 | -3.30 |

| PRECIOUS METALS & MINING TRUST (MMP-U) | -0.5623083 | -14.1588 | 0.9075125 | -14.72612 | -8.035432 | -18.86194 | -10.18 |

| PROSHARES ULTRA DJ-UBS CRUDE OIL (UCO) | -4.356057 | -13.5702 | -6.223871 | 15.04274 | 15.02049 | 19.50354 | 10.84 |

| LYXOR ETF IBEX 35 DOBLE INVERSO DIARIO (2INVE) | 2.157938 | -13.28125 | 6.382534 | 3.37169 | 13.4389 | -28.82041 | -1.41 |

Best Funds 1yr

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| LYXOR ETF FTSE MIB DAILY LEVERAGED (LEVMI) | 1.115876 | 52.10779 | -4.309479 | -1.464898 | 18.99232 | 98.96245 | 28.05 |

| JPMORGAN CHINESE INVESTMENT TRUST PLC (JMC) | 0.1378124 | 75.11398 | 5.526658 | 11.88762 | 44.97231 | 76.19755 | 34.65 |

| NEXT NOTES NIKKEI TOCOM LEVERAGED CRUDE OIL ETN (2038) | -0.6743378 | 5.884463 | -2.21047 | 26.5651 | 31.70621 | 72.04562 | 32.03 |

| DB PHYSICAL RHODIUM ETC (XRH0) | 4.094265 | 76.38195 | 7.39081 | 19.46849 | 60.12483 | 71.59168 | 39.64 |

| DB X-TRACKERS CAC 40 UCITS ETF DR (DX2G) | 0.8745503 | 68.34305 | 1.28804 | 2.901082 | 53.10341 | 65.17947 | 30.62 |

| SIMPLEX CHINA BULL 2X H-SHARE ETF (1572) | -0.06446564 | 57.05677 | 0.3437343 | 2.397334 | 33.72586 | 61.80982 | 24.57 |

| ISHARES MSCI POLAND UCITS ETF (IPOL) | 0.5415941 | 48.94095 | -1.17121 | -2.673797 | 14.91891 | 60.53269 | 17.90 |

| LYXOR ETF WIG20 (ETFW20L) | -0.2260846 | 47.32153 | -1.83413 | -4.063146 | 13.64893 | 59.83516 | 16.90 |

| CHINA UNIVERSAL CSI CONSUMER STAPLES INDEX ETF (159928) | -1.296164 | 62.12493 | -2.530581 | 4.791448 | 45.06237 | 59.75475 | 26.77 |

| ASIAN TOTAL RETURN INVESTMENT CO PLC (ATR) | 1.256743 | 57.17262 | 1.208862 | 3.655842 | 28.16602 | 58.66399 | 22.92 |

| DIREXION DAILY RUSSIA BULL 3X SHARES (RUSL) | -3.776115 | -0.6138641 | -3.629035 | -7.856092 | 24.20193 | 58.63486 | 17.84 |

| SIMPLEX CHINA BULL 2X H-SHARE ETF (9D31112C) | -0.5824816 | 62.28354 | 2.876642 | 2.868255 | 32.28155 | 58.41569 | 24.11 |

| CANADIAN BANC CORP (BK) | 3.087014 | 31.33448 | -0.1147185 | 2.436958 | 29.31167 | 56.98788 | 22.16 |

| FIRST STATE GLOBAL UMBRELLA PLC - CHINA GROWTH FUND - I DIS (CRECHID) | -1.001679 | 54.30062 | 1.276309 | 7.594524 | 32.97926 | 55.15495 | 24.25 |

| FRANKLIN TEMPLETON INVESTMENT FUNDS - TEMPLETON BRIC FUND (F7RH) | 0.7105364 | 54.60435 | 1.397491 | 1.210306 | 28.27695 | 53.707 | 21.15 |

| DB X-TRACKERS MSCI AC ASIA EX JAPAN TRN INDEX UCITS ETF (DXS5) | 0.8745453 | 56.5619 | 1.571259 | -0.5242333 | 13.06969 | 53.61972 | 16.93 |

| COMSTAGE ETF DAX TR UCITS ETF (CBDAX) | 0.874553 | 55.97844 | 1.547485 | 6.688268 | 11.17345 | 53.04722 | 18.11 |

| POLAR CAPITAL TECHNOLOGY TRUST PLC (PCT) | -0.5028366 | 45.84434 | -1.915938 | 3.72707 | 20.98897 | 52.94361 | 18.94 |

| AMUNDI ETF MSCI EASTERN EUROPE EX RUSSIA UCITS ETF - EUR (CE9U) | 0.3176239 | 43.61787 | -1.231695 | -2.699714 | 14.746 | 52.84203 | 15.91 |

| LYXOR ETF EASTERN EUROPE CECE EUR (CEC) | 1.418342 | 44.67986 | 0.0953216 | -1.644902 | 15.94977 | 52.42915 | 16.71 |

Worst Funds 1yr

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| VELOCITYSHARES 3X LONG NATURAL GAS ETN (UGAZ) | -6.50936 | -78.37194 | -7.421154 | -9.191079 | -47.24868 | -58.57203 | -30.61 |

| PROSHARES ULTRASHORT MSCI BRAZIL CAPPED (BZQ) | 3.197671 | -41.54775 | 3.700094 | 25 | -33.4375 | -48.27586 | -13.25 |

| LYXOR ETF FTSE MIB DAILY DOUBLE SHORT XBEAR (XBRMIB) | 2.328257 | -27.17875 | 8.186762 | 0.5313833 | -10.27337 | -47.82013 | -12.34 |

| IPATH DOW JONES-UBS SUGAR SUBINDEX TOTAL RETURN ETN (SGG) | -0.4204369 | -29.03895 | 3.149082 | 5.734893 | -11.34466 | -36.1733 | -9.66 |

| IPATH DOW JONES-UBS COFFEE SUBINDEX TOTAL RETURN ETN (JO) | -0.4881125 | -16.5138 | 1.934462 | -0.5487165 | -7.636308 | -32.12843 | -9.59 |

| LYXOR ETF IBEX 35 DOBLE INVERSO DIARIO (2INVE) | 2.157938 | -13.28125 | 6.382534 | 3.37169 | 13.4389 | -28.82041 | -1.41 |

| ETFS COFFEE (COFF) | -1.378444 | -14.5494 | 1.24357 | -0.08463559 | -8.381837 | -28.21526 | -8.86 |

| SIMPLEX CHINA BEAR 1X H-SHARE ETF (1573) | 1.257836 | -23.87745 | 0.2209145 | -1.993093 | -15.99772 | -24.00986 | -10.44 |

| LYXOR ETF FTSE MIB DAILY SHORT BEAR (BERMIB) | 1.503945 | -9.784962 | 4.729681 | -0.243071 | -2.778644 | -23.98986 | -5.57 |

| SIMPLEX CHINA BEAR 1X H-SHARE ETF (9D31212C) | 0.4722087 | -24.54683 | -1.057478 | -1.990834 | -15.00011 | -23.41423 | -10.37 |

| SPOTR BEAR OMXS30 (SPBEAOMX) | -0.346734 | -14.17335 | 8.171453 | -1.949105 | 2.109224 | -21.54624 | -3.30 |

| ETFS DAILY SHORT COPPER (SCOP) | 1.898269 | -19.55478 | 0.6737089 | 1.673411 | -17.91864 | -19.54307 | -8.78 |

| PRECIOUS METALS & MINING TRUST (MMP-U) | -0.5623083 | -14.1588 | 0.9075125 | -14.72612 | -8.035432 | -18.86194 | -10.18 |

| UBS HANA AMBATOVY NICKEL OVERSEAS INVESTMENT COMPANY 1 (2772642) | -0.5465631 | -5.479802 | -3.493472 | 7.563981 | 11.09761 | -16.36642 | -0.30 |

| KAYNE ANDERSON MLP INVESTMENT CO (KYN) | -1.395348 | -16.36659 | -6.470702 | -15.18229 | -17.82403 | -16.32386 | -13.95 |

| MARKET VECTORS OIL SERVICE ETF (OIH) | -2.884236 | -26.29685 | -5.059869 | -1.954528 | -10.0951 | -15.5796 | -8.17 |

| LYXOR UCITS ETF IBEX 35 INVERSO DIARIO (INVEX) | 0.8745452 | -6.203012 | 1.571259 | -0.5242335 | 5.743294 | -15.43512 | -2.16 |

| DIREXION DAILY GOLD MINERS BULL 3X SHARES (NUGT) | 0.6226224 | -4.810209 | -2.95197 | -17.49858 | -14.7877 | -14.54172 | -12.44 |

| ETFS AGRICULTURE DJ-UBSCI (AIGA) | -0.9098585 | -11.05413 | -1.119086 | -1.72088 | -6.620138 | -13.21671 | -5.67 |

| SPDR S&P RETAIL ETF (XRT) | -0.4408022 | -9.22378 | 1.358971 | -1.175003 | -2.602977 | -11.32348 | -3.44 |