| Focus | Objective | Asset Class | Flow USD mn |

| Commodities | INDUSTRIAL METALS | Commodity | -16.01 |

| Commodities | PRECIOUS METAL SECTOR | Equity | 546.83 |

| Commodities | PRECIOUS METALS | Commodity | -1417.60 |

| Commodities | PRECIOUS METALS | Mixed Allocation | 1.24 |

| country | AUSTRALIA | Equity | -164.33 |

| country | AUSTRALIA | Fixed Income | -2.94 |

| country | AUSTRALIA | Mixed Allocation | 0.04 |

| country | BRAZIL | Equity | 41.98 |

| country | BRAZIL | Fixed Income | 27.67 |

| country | CHINA | Equity | -420.12 |

| country | CHINA | Fixed Income | -36.31 |

| Country | EGYPT | Equity | 0.49 |

| country | INDIA | Equity | -209.63 |

| country | INDIA | Fixed Income | 39.95 |

| country | ISRAEL | Equity | -4.44 |

| country | JAPAN | Equity | 297.65 |

| country | JAPAN | Fixed Income | -66.29 |

| country | JAPAN | Mixed Allocation | -2.13 |

| country | KOREA | Equity | -13.66 |

| country | POLAND | Equity | 0.18 |

| country | RUSSIA | Equity | -129.97 |

| country | RUSSIA | Fixed Income | -13.86 |

| country | SOUTH AFRICA | Equity | -18.40 |

| country | SPAIN | Equity | -9.76 |

| Country | TAIWAN | Equity | -77.84 |

| country | TURKEY | Equity | -17.97 |

| country | UNITED KINGDOM | Equity | -181.18 |

| industry | BASIC MATERIALS SECTOR | Equity | -766.18 |

| industry | COMMUNICATIONS SECTOR | Equity | -141.80 |

| industry | ENERGY SECTOR | Equity | -1212.31 |

| industry | ENERGY SECTOR | Mixed Allocation | -0.59 |

| industry | FINANCIAL SECTOR | Equity | -259.09 |

| industry | HEALTH CARE SECTOR | Equity | 1216.87 |

| industry | INDUSTRIAL SECTOR | Equity | -176.42 |

| industry | MULTIPLE SECTOR | Equity | -3.01 |

| industry | NATURAL RESOURCES SECTOR | Equity | -178.43 |

| industry | REAL ESTATE SECTOR | Alternative | -0.70 |

| industry | REAL ESTATE SECTOR | Equity | -910.56 |

| industry | TECHNOLOGY SECTOR | Equity | -472.11 |

| industry | UTILITIES SECTOR | Equity | -99.35 |

| region | AFRICAN REGION | Equity | -12.42 |

| region | AFRICAN REGION | Fixed Income | 0.07 |

| region | ASIAN PACIFIC REGION | Equity | -858.56 |

| region | ASIAN PACIFIC REGION | Fixed Income | -107.70 |

| region | ASIAN PACIFIC REGION | Mixed Allocation | -20.78 |

| region | ASIAN PACIFIC REGION EX JAPAN | Equity | -106.12 |

| region | ASIAN PACIFIC REGION EX JAPAN | Fixed Income | -95.94 |

| region | ASIAN PACIFIC REGION EX JAPAN | Mixed Allocation | -217.63 |

| region | EASTERN EUROPEAN REGION | Equity | -203.57 |

| region | EASTERN EUROPEAN REGION | Fixed Income | -22.03 |

| region | EASTERN EUROPEAN REGION | Mixed Allocation | -2.21 |

| region | EUROPEAN REGION | Equity | -2706.48 |

| region | EUROPEAN REGION | Fixed Income | -1626.39 |

| region | EUROPEAN REGION | Mixed Allocation | -3.23 |

| region | LATIN AMERICAN REGION | Equity | -302.35 |

| region | LATIN AMERICAN REGION | Fixed Income | -0.87 |

| region | MIDDLE EAST REGION | Equity | -30.84 |

| region | MIDDLE EAST REGION | Fixed Income | 0.16 |

| region | NORDIC REGION | Equity | -486.49 |

| region | NORTH AMERICAN REGION | Equity | -366.48 |

| region | NORTH AMERICAN REGION | Fixed Income | -21.66 |

| Risk | GOVERNMENT BOND | Alternative | 15.60 |

| Risk | GOVERNMENT BOND | Equity | -0.10 |

| Risk | GOVERNMENT BOND | Fixed Income | 138.05 |

| Risk | GOVERNMENT BOND | Mixed Allocation | 0.86 |

| Risk | INFLATION PROTECTED | Brazil | 2.20 |

| Risk | INFLATION PROTECTED | Fixed Income | 442.04 |

| Risk | INFLATION PROTECTED | Mixed Allocation | -3.82 |

| Risk | LONG SHORT | Alternative | -76.00 |

| Risk | LONG SHORT | Equity | -346.06 |

| Risk | LONG SHORT | Fixed Income | -23.33 |

| Risk | LONG SHORT | Mixed Allocation | -0.11 |

| Sector | AGRICULTURE | Commodity | -53.62 |

| Sector | AGRICULTURE | Equity | 0.00 |

| Sector | CONSUMER DISCRETIONARY | Equity | 371.57 |

| Sector | CONSUMER STAPLES | Equity | -347.60 |

| segment | BRIC | Equity | -124.54 |

| segment | BRIC | Fixed Income | 17.74 |

| segment | DEVELOPED MARKETS | Equity | -376.34 |

| segment | EMEA | Equity | 6.04 |

| segment | EMEA | Fixed Income | -5.84 |

| segment | EMERGING MARKETS | Equity | 442.11 |

| segment | GCC | Equity | -7.18 |

| segment | GCC | Fixed Income | -0.13 |

| segment | GCC | Mixed Allocation | 1.60 |

| segment | MENA | Equity | -5.80 |

| segment | MENA | Fixed Income | -7.14 |

| Size | LARGE-CAP | Equity | -808.15 |

| Size | MID-CAP | Commodity | -0.17 |

| Size | MID-CAP | Equity | 817.42 |

| Size | SMALL-CAP | Equity | -1235.51 |

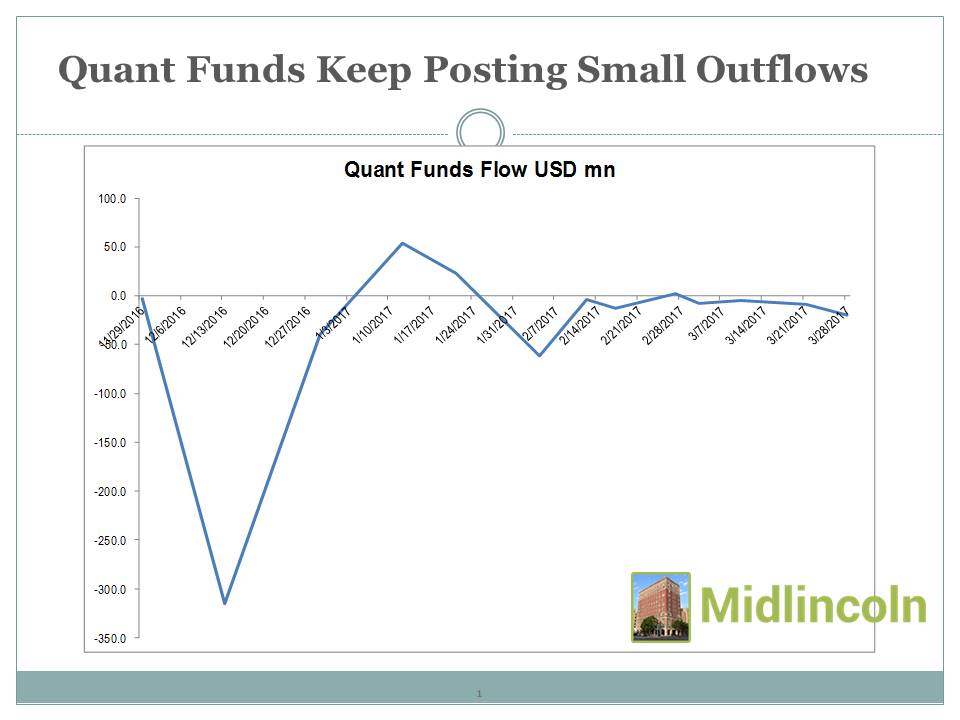

Chart: Quant Funds Keep Posting Small Outflows

Source: ML

Download file in Power PointEmerging markets fund flow showed 442.1 USD mn of inflow. While Frontier Markets funds showed -5.7 USD mn of outflows.

BRAZIL Equity funds showed 42.0 USD mn of inflow.

BRAZIL Fixed Income funds showed 27.7 USD mn of inflow.

CHINA Equity funds showed -420.1 USD mn of outflow.

CHINA Fixed Income funds showed -36.3 USD mn of outflow.

INDIA Equity funds showed -209.6 USD mn of outflow.

INDIA Fixed Income funds showed 40.0 USD mn of inflow.

KOREA Equity funds showed -13.7 USD mn of outflow.

RUSSIA Equity funds showed -130.0 USD mn of outflow.

RUSSIA Fixed Income funds showed -13.9 USD mn of outflow.

SOUTH AFRICA Equity funds showed -18.4 USD mn of outflow.

TURKEY Equity funds showed -18.0 USD mn of outflow.

COMMUNICATIONS SECTOR Equity funds showed -141.8 USD mn of outflow.

ENERGY SECTOR Equity funds showed -1212.3 USD mn of outflow.

ENERGY SECTOR Mixed Allocation funds showed -0.6 USD mn of outflow.

FINANCIAL SECTOR Equity funds showed -259.1 USD mn of outflow.

REAL ESTATE SECTOR Alternative funds showed -0.7 USD mn of outflow.

REAL ESTATE SECTOR Equity funds showed -910.6 USD mn of outflow.

TECHNOLOGY SECTOR Equity funds showed -472.1 USD mn of outflow.

UTILITIES SECTOR Equity funds showed -99.3 USD mn of outflow.

LONG SHORT Alternative funds showed -76.0 USD mn of outflow.

LONG SHORT Equity funds showed -346.1 USD mn of outflow.

LONG SHORT Fixed Income funds showed -23.3 USD mn of outflow.

LONG SHORT Mixed Allocation funds showed -0.1 USD mn of outflow.

Markets

Best global markets since the begining of the week USA +0.83%, EUROPE +0.20%, EM LATIN AMERICA-0.40%,

While worst global markets since the begining of the week FM (FRONTIER MARKETS) -1.27%, EM (EMERGING MARKETS) -1.11%, EFM ASIA -0.45%,

Best since the start of the week among various stock markets were PORTUGAL +6.18%, GREECE +4.84%, KENYA +2.21%, SAUDI ARABIA DOMESTIC +1.65%, BANGLADESH +1.60%, INDIA +1.53%, SINGAPORE +1.24%, SRI LANKA +1.15%, FRANCE +1.01%, COLOMBIA +0.94%,

While worst since the start of the week among various stock markets were BOTSWANA -10.50%, SOUTH AFRICA -8.68%, BULGARIA -7.24%, KUWAIT -4.07%, BAHRAIN -3.81%, MAURITIUS -3.75%, CROATIA -3.64%, POLAND -3.18%, SLOVENIA -2.99%, TRINIDAD AND TOBAGO -2.94%,

Key Fund Flow Headlines

Top 20 Funds Longs Based on Momentum

| Name | 1week | 1month | ytd | 6months | 1yr | Rank |

| SANTANDER FIC FI VALE 3 ACOES (REALRIO) | 2.29 | -5.51 | 20.94 | 72.71 | 117.31 | 46.70 |

| SAFRA VALE DO RIO DOCE FIC FIA (SAFVRDA) | 2.08 | -5.71 | 20.25 | 71.04 | 114.44 | 45.46 |

| CANADIAN LIFE COS SPLIT CORP (LFE) | 0.80 | 1.45 | 14.50 | 84.31 | 90.12 | 44.17 |

| FIA MERLOT (MAXPOWR) | 3.54 | 1.03 | 3.98 | 27.16 | 81.26 | 28.25 |

| MAXWELL POWER (MAXPOWR) | 3.54 | 1.03 | 3.98 | 27.16 | 81.26 | 28.25 |

| DIREXION DAILY BRAZIL BULL 3X SHARES (BRZU) | 5.69 | -8.53 | 35.72 | 11.51 | 103.62 | 28.07 |

| DIREXION DAILY RUSSIA BULL 3X SHARES (RUSL) | 0.97 | 2.68 | -8.69 | 31.33 | 75.12 | 27.53 |

| NEUBERGER BERMAN MLP INCOME FUND INC (XNMLX) | 4.48 | -1.61 | 6.15 | 17.01 | 81.43 | 25.33 |

| DIREXION DAILY LATIN AMERICA BULL 3X SHARES (LBJ) | 8.77 | 0.91 | 48.77 | 24.38 | 58.66 | 23.18 |

| KAYNE ANDERSON ENERGY TOTAL RETURN FUND INC (XKYEX) | 4.14 | -0.82 | -0.82 | 8.38 | 79.57 | 22.82 |

| KAYNE ANDERSON ENERGY TOTAL RETURN FUND INC (KYE) | 4.31 | -2.25 | 6.60 | 13.15 | 75.43 | 22.66 |

| FIRST JANATA BANK MUTUAL FUND (1JANATA) | -4.37 | -1.75 | 7.61 | 35.50 | 58.28 | 21.92 |

| BB ACOES SIDERURGIA FICFI (BBACOSI) | -2.23 | -15.58 | 5.31 | 18.30 | 84.91 | 21.35 |

| LYXOR ETF IBEX 35 DOBLE APALANCADO DIARIO (IBEXA) | -0.89 | 12.54 | 24.40 | 34.00 | 37.41 | 20.77 |

| TORTOISE ENERGY INFRASTRUCTURE CORP (TYG) | 6.35 | 1.82 | 14.18 | 19.29 | 54.86 | 20.58 |

| NEUBERGER BERMAN MLP INCOME FUND INC (NML) | 3.91 | -2.44 | 9.35 | 14.65 | 63.90 | 20.01 |

| GLOBAL X FTSE ARGENTINA 20 ETF (GX0A) | 3.46 | 7.27 | 23.59 | 17.83 | 49.08 | 19.41 |

| SECURITY - FONDO DE INVERSION IFUND MSCI BRAZIL SMALL CAP INDEX (IFBRASC) | 0.94 | -2.89 | 21.10 | 15.23 | 64.20 | 19.37 |

| JOHN HANCOCK FINANCIAL OPPORTUNITIES FUND (XBTOX) | 2.97 | -3.79 | -0.74 | 28.26 | 49.07 | 19.13 |

| CANADIAN BANC CORP (BK) | -0.13 | -3.37 | 8.49 | 27.20 | 50.96 | 18.67 |

Top 20 Funds Shorts Based on Momentum

| Name | 1week | 1month | ytd | 6months | 1yr | Rank |

| LYXOR ETF IBEX 35 DOBLE INVERSO DIARIO (2INVE) | -3.10 | -10.12 | -19.49 | -35.87 | -49.11 | -24.55 |

| LYXOR ETF FTSE MIB DAILY DOUBLE SHORT XBEAR (XBRMIB) | -3.60 | -6.28 | -11.60 | -41.61 | -46.70 | -24.55 |

| PROSHARES ULTRASHORT MSCI BRAZIL CAPPED (BZQ) | -4.01 | 2.29 | -26.51 | -27.58 | -65.49 | -23.70 |

| SPOTR BEAR OMXS30 (SPBEAOMX) | -6.68 | -3.97 | -11.90 | -24.20 | -45.13 | -20.00 |

| LYXOR ETF FTSE MIB DAILY SHORT BEAR (BERMIB) | -2.72 | -2.69 | -5.37 | -25.03 | -27.61 | -14.51 |

| LYXOR UCITS ETF IBEX 35 INVERSO DIARIO (INVEX) | -1.54 | -4.39 | -14.72 | -26.25 | -25.82 | -14.50 |

| LYXOR UCITS ETF IBEX 35 INVERSO DIARIO (INVEX) | -2.30 | -4.56 | -9.60 | -21.51 | -29.46 | -14.46 |

| DB X-TRACKERS SHORTDAX DAILY UCITS ETF (XSDX) | -4.59 | -1.73 | -6.81 | -19.60 | -29.54 | -13.87 |

| COMSTAGE ETF CAC 40 SHORT GR UCITS ETF (CBCACSEU) | -3.68 | -1.79 | -5.11 | -17.79 | -26.63 | -12.47 |

| CHANGSHENG TELECOM INDUSTRY FUND (CHTEINF) | -2.86 | -2.94 | -3.87 | -14.30 | -26.57 | -11.67 |

| IPATH DOW JONES-UBS SUGAR SUBINDEX TOTAL RETURN ETN (SGG) | -5.17 | -14.70 | -14.65 | -30.18 | 5.71 | -11.08 |

| DIREXION DAILY GOLD MINERS BULL 3X SHARES (NUGT) | -3.99 | 9.57 | 23.04 | -26.64 | -21.42 | -10.62 |

| ETFS DAILY SHORT COPPER (SCOP) | -2.79 | 0.85 | -6.36 | -19.76 | -20.65 | -10.59 |

| VELOCITYSHARES 3X LONG NATURAL GAS ETN (UGAZ) | 1.56 | 25.36 | -56.66 | -51.42 | -15.83 | -10.08 |

| ETFS WHEAT (OD7S) | 0.85 | -7.64 | 2.59 | -1.91 | -22.62 | -7.83 |

| HARVEST DUOLI CLASSIFICATION BOND FUND (HARDCLB) | -0.14 | -7.19 | -6.61 | -10.69 | -10.26 | -7.07 |

| SIMPLEX CHINA BEAR 1X H-SHARE ETF (1573) | 1.62 | -1.45 | -8.58 | -5.08 | -21.06 | -6.49 |

| DB X-TRACKERS MSCI AC ASIA EX JAPAN TRN INDEX UCITS ETF (DXS5) | -1.54 | 1.28 | 1.42 | -4.54 | -18.68 | -5.87 |

| SIMPLEX CHINA BEAR 1X H-SHARE ETF (9D31212C) | 2.39 | -0.56 | -9.73 | -5.59 | -19.62 | -5.85 |

| ISHARES MSCI TURKEY ETF (ISVZ) | -1.86 | 1.07 | 9.13 | -5.24 | -16.15 | -5.55 |

Best Fundses last Week

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| NEXT NOTES NIKKEI TOCOM LEVERAGED CRUDE OIL ETN (2038) | 1.05 | -16.91 | 11.77 | -7.85 | 9.01 | 29.00 | 10.48 |

| PROSHARES ULTRA DJ-UBS CRUDE OIL (UCO) | -1.52 | -19.82 | 10.57 | -12.76 | -16.05 | 13.79 | -1.11 |

| DIREXION DAILY LATIN AMERICA BULL 3X SHARES (LBJ) | 2.20 | 48.77 | 8.77 | 0.91 | 24.38 | 58.66 | 23.18 |

| IPATH GOLDMAN SACHS CRUDE OIL TOTAL RETURN INDEX ETN (OIL) | -1.08 | -12.80 | 6.98 | -8.76 | -9.51 | 11.52 | 0.06 |

| WTI CRUDE OIL PRICE LINKED ETF (1671) | 0.70 | -9.91 | 6.56 | -4.79 | -4.17 | 10.05 | 1.91 |

| TORTOISE ENERGY INFRASTRUCTURE CORP (TYG) | -1.36 | 14.18 | 6.35 | 1.82 | 19.29 | 54.86 | 20.58 |

| DIREXION DAILY BRAZIL BULL 3X SHARES (BRZU) | 2.33 | 35.72 | 5.69 | -8.53 | 11.51 | 103.62 | 28.07 |

| UNITED STATES OIL FUND LP (U9N) | -0.43 | -9.76 | 5.66 | -6.34 | -6.84 | 11.83 | 1.08 |

| DB X-TRACKERS S&P/ASX 200 UCITS ETF (LF1) | 2.96 | 14.04 | 4.97 | 6.72 | 12.98 | 24.34 | 12.25 |

| KAYNE ANDERSON MLP INVESTMENT CO (KYN) | -1.24 | 8.91 | 4.64 | -4.03 | 7.70 | 41.32 | 12.41 |

| KAYNE ANDERSON ENERGY TOTAL RETURN FUND INC (KYE) | -0.32 | 6.60 | 4.31 | -2.25 | 13.15 | 75.43 | 22.66 |

| ABERDEEN GREATER CHINA FUND INC (GCH) | 0.19 | 20.71 | 4.27 | 11.01 | 15.07 | 28.49 | 14.71 |

| INDIA FUND INC/THE (IFN) | 0.69 | 19.56 | 4.26 | 9.11 | 8.69 | 20.46 | 10.63 |

| ASIA TIGERS FUND INC (GRR) | -0.35 | 23.91 | 4.17 | 12.26 | 11.82 | 26.08 | 13.58 |

| SPDR S&P OIL & GAS EXPLORATION & PRODUCTION ETF (XOP) | -1.16 | -10.48 | 4.07 | -2.07 | -5.21 | 24.94 | 5.43 |

| FAIRCOURT GOLD INCOME CORP (FGX) | 3.78 | 15.34 | 3.94 | 6.40 | 4.11 | 33.27 | 11.93 |

| GOLDMAN SACHS INDIA EQUITY PORTFOLIO (GS06) | 0.34 | 22.01 | 3.93 | 8.56 | 5.94 | 27.15 | 11.40 |

| NEUBERGER BERMAN MLP INCOME FUND INC (NML) | -0.30 | 9.35 | 3.91 | -2.44 | 14.65 | 63.90 | 20.01 |

| MARKET VECTORS OIL SERVICE ETF (OIH) | -0.62 | -8.19 | 3.90 | -4.40 | 4.63 | 19.78 | 5.98 |

| ABERDEEN LATIN AMERICA EQUITY FUND INC (LT4) | -0.36 | 20.23 | 3.51 | 8.33 | 11.16 | 31.63 | 13.66 |

Worst Funds last Week

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| ISHARES MSCI SOUTH AFRICA ETF (ISVW) | -1.17 | 4.03 | -7.74 | -0.37 | -0.06 | 9.20 | 0.26 |

| SPOTR BEAR OMXS30 (SPBEAOMX) | -0.37 | -11.90 | -6.68 | -3.97 | -24.20 | -45.13 | -20.00 |

| SPDR S&P EMERGING MIDDLE EAST & AFRICA ETF (SSGU) | -3.56 | 6.34 | -6.18 | -2.21 | 0.96 | 8.94 | 0.38 |

| ISHARES MSCI SOUTH AFRICA UCITS ETF (IRSA) | 0.11 | 5.28 | -5.83 | -1.44 | 0.34 | 10.03 | 0.77 |

| NEXT FUNDS FTSE/JSE AFRICA TOP40 LINKED NOMURA ETF (01313087) | -0.35 | 5.16 | -5.67 | -0.01 | 4.24 | 8.06 | 1.66 |

| HSBC MSCI SOUTH AFRICA UCITS ETF (HZAR) | 0.31 | 5.23 | -5.24 | -0.55 | 0.79 | 10.23 | 1.31 |

| IPATH DOW JONES-UBS SUGAR SUBINDEX TOTAL RETURN ETN (SGG) | 0.58 | -14.65 | -5.17 | -14.70 | -30.18 | 5.71 | -11.08 |

| MERCANTILE INVESTMENT CO LTD (21IA) | -1.37 | -5.58 | -4.77 | -3.91 | -3.95 | 15.48 | 0.71 |

| DB X-TRACKERS SHORTDAX DAILY UCITS ETF (XSDX) | -0.69 | -6.81 | -4.59 | -1.73 | -19.60 | -29.54 | -13.87 |

| JPMORGAN FUNDS - AFRICA EQUITY FUND - A$ (JYJL) | -2.06 | 1.53 | -4.48 | -0.09 | -1.16 | 1.61 | -1.03 |

| PROSHARES ULTRASHORT MSCI BRAZIL CAPPED (BZQ) | -1.47 | -26.51 | -4.01 | 2.29 | -27.58 | -65.49 | -23.70 |

| DIREXION DAILY GOLD MINERS BULL 3X SHARES (NUGT) | 4.51 | 23.04 | -3.99 | 9.57 | -26.64 | -21.42 | -10.62 |

| SIMPLEX CHINA BULL 2X H-SHARE ETF (9D31112C) | -2.03 | 20.57 | -3.87 | 1.07 | 8.68 | 31.28 | 9.29 |

| COMSTAGE ETF CAC 40 SHORT GR UCITS ETF (CBCACSEU) | -0.46 | -5.11 | -3.68 | -1.79 | -17.79 | -26.63 | -12.47 |

| LYXOR ETF FTSE MIB DAILY DOUBLE SHORT XBEAR (XBRMIB) | 1.49 | -11.60 | -3.60 | -6.28 | -41.61 | -46.70 | -24.55 |

| LYXOR ETF IBEX 35 DOBLE INVERSO DIARIO (2INVE) | 1.61 | -19.49 | -3.10 | -10.12 | -35.87 | -49.11 | -24.55 |

| BLACKROCK GLOBAL FUNDS - WORLD GOLD FUND - A2EUR HEDGED (H2ZG) | 0.40 | 10.55 | -3.05 | 6.74 | -6.91 | 9.13 | 1.48 |

| DWS INVEST - AFRICA - A2 USD ACC (HVJF) | -0.47 | 3.02 | -2.78 | -1.07 | -8.24 | -1.77 | -3.47 |

| DWS INVEST - AFRICA - DS1 GBP DIST (HVJG) | -0.41 | 2.13 | -2.76 | -2.07 | -8.67 | -1.63 | -3.78 |

| LYXOR ETF FTSE MIB DAILY SHORT BEAR (BERMIB) | 0.77 | -5.37 | -2.72 | -2.69 | -25.03 | -27.61 | -14.51 |

Best Funds last Month

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| VELOCITYSHARES 3X LONG NATURAL GAS ETN (UGAZ) | -3.52 | -56.66 | 1.56 | 25.36 | -51.42 | -15.83 | -10.08 |

| PROSHARES ULTRA MSCI MEXICO CAPPED IMI (UMX) | 2.48 | 37.09 | 1.19 | 16.33 | 3.54 | -11.76 | 2.32 |

| ASIA PACIFIC FUND INC/THE (APB) | -0.65 | 25.00 | 0.56 | 13.35 | 16.79 | 29.17 | 14.97 |

| LYXOR ETF IBEX 35 DOBLE APALANCADO DIARIO (IBEXA) | -2.35 | 24.40 | -0.89 | 12.54 | 34.00 | 37.41 | 20.77 |

| ASIA TIGERS FUND INC (GRR) | -0.35 | 23.91 | 4.17 | 12.26 | 11.82 | 26.08 | 13.58 |

| ZIF BREZA INVEST DD VARAZDIN (BRINRA) | -0.16 | 9.06 | -1.83 | 11.32 | 0.06 | 1.96 | 2.88 |

| ABERDEEN GREATER CHINA FUND INC (GCH) | 0.19 | 20.71 | 4.27 | 11.01 | 15.07 | 28.49 | 14.71 |

| DB PHYSICAL RHODIUM ETC (XRH0) | 2.29 | 23.61 | 0.37 | 10.52 | 37.03 | 23.61 | 17.88 |

| FIDELITY ASIAN VALUES PLC (FAS) | 0.10 | 15.54 | 2.65 | 10.33 | 16.11 | 38.26 | 16.84 |

| NEW INDIA INVESTMENT TRUST PLC (NIQ) | 1.05 | 19.83 | 2.87 | 10.22 | 9.59 | 23.32 | 11.50 |

| MIRAE ASSET TIGER CHINA CONSUMER ETF (150460) | 1.40 | 14.20 | 1.50 | 10.11 | -5.67 | -12.28 | -1.59 |

| ISHARES MSCI SPAIN CAPPED ETF (ISVS) | 0.18 | 16.61 | 0.65 | 9.97 | 17.19 | 17.16 | 11.24 |

| DIREXION DAILY GOLD MINERS BULL 3X SHARES (NUGT) | 4.51 | 23.04 | -3.99 | 9.57 | -26.64 | -21.42 | -10.62 |

| INDIA FUND INC/THE (IFN) | 0.69 | 19.56 | 4.26 | 9.11 | 8.69 | 20.46 | 10.63 |

| LYXOR ETF FTSE MIB DAILY LEVERAGED (LEVMI) | -1.49 | 12.04 | 0.56 | 8.83 | 43.92 | 19.87 | 18.30 |

| BARING KOREA FEEDER FUND (BRGKORI) | 0.65 | 15.50 | 0.51 | 8.78 | -1.45 | 6.12 | 3.49 |

| MORGAN STANLEY INDIA INVESTMENT FUND INC (IIF) | 0.13 | 23.19 | 3.37 | 8.68 | 11.15 | 31.09 | 13.57 |

| GOLDMAN SACHS INDIA EQUITY PORTFOLIO (GS06) | 0.34 | 22.01 | 3.93 | 8.56 | 5.94 | 27.15 | 11.40 |

| ABERDEEN GLOBAL - INDIAN EQUITY FUND - A2 (AEF2) | 0.66 | 18.61 | 2.17 | 8.47 | 4.92 | 16.80 | 8.09 |

| ABERDEEN LATIN AMERICA EQUITY FUND INC (LT4) | -0.36 | 20.23 | 3.51 | 8.33 | 11.16 | 31.63 | 13.66 |

Worst Funds last Month

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| VELOCITYSHARES 3X LONG NATURAL GAS ETN (UGAZ) | -3.52 | -56.66 | 1.56 | 25.36 | -51.42 | -15.83 | -10.08 |

| PROSHARES ULTRA MSCI MEXICO CAPPED IMI (UMX) | 2.48 | 37.09 | 1.19 | 16.33 | 3.54 | -11.76 | 2.32 |

| ASIA PACIFIC FUND INC/THE (APB) | -0.65 | 25.00 | 0.56 | 13.35 | 16.79 | 29.17 | 14.97 |

| LYXOR ETF IBEX 35 DOBLE APALANCADO DIARIO (IBEXA) | -2.35 | 24.40 | -0.89 | 12.54 | 34.00 | 37.41 | 20.77 |

| ASIA TIGERS FUND INC (GRR) | -0.35 | 23.91 | 4.17 | 12.26 | 11.82 | 26.08 | 13.58 |

| ZIF BREZA INVEST DD VARAZDIN (BRINRA) | -0.16 | 9.06 | -1.83 | 11.32 | 0.06 | 1.96 | 2.88 |

| ABERDEEN GREATER CHINA FUND INC (GCH) | 0.19 | 20.71 | 4.27 | 11.01 | 15.07 | 28.49 | 14.71 |

| DB PHYSICAL RHODIUM ETC (XRH0) | 2.29 | 23.61 | 0.37 | 10.52 | 37.03 | 23.61 | 17.88 |

| FIDELITY ASIAN VALUES PLC (FAS) | 0.10 | 15.54 | 2.65 | 10.33 | 16.11 | 38.26 | 16.84 |

| NEW INDIA INVESTMENT TRUST PLC (NIQ) | 1.05 | 19.83 | 2.87 | 10.22 | 9.59 | 23.32 | 11.50 |

| MIRAE ASSET TIGER CHINA CONSUMER ETF (150460) | 1.40 | 14.20 | 1.50 | 10.11 | -5.67 | -12.28 | -1.59 |

| ISHARES MSCI SPAIN CAPPED ETF (ISVS) | 0.18 | 16.61 | 0.65 | 9.97 | 17.19 | 17.16 | 11.24 |

| DIREXION DAILY GOLD MINERS BULL 3X SHARES (NUGT) | 4.51 | 23.04 | -3.99 | 9.57 | -26.64 | -21.42 | -10.62 |

| INDIA FUND INC/THE (IFN) | 0.69 | 19.56 | 4.26 | 9.11 | 8.69 | 20.46 | 10.63 |

| LYXOR ETF FTSE MIB DAILY LEVERAGED (LEVMI) | -1.49 | 12.04 | 0.56 | 8.83 | 43.92 | 19.87 | 18.30 |

| BARING KOREA FEEDER FUND (BRGKORI) | 0.65 | 15.50 | 0.51 | 8.78 | -1.45 | 6.12 | 3.49 |

| MORGAN STANLEY INDIA INVESTMENT FUND INC (IIF) | 0.13 | 23.19 | 3.37 | 8.68 | 11.15 | 31.09 | 13.57 |

| GOLDMAN SACHS INDIA EQUITY PORTFOLIO (GS06) | 0.34 | 22.01 | 3.93 | 8.56 | 5.94 | 27.15 | 11.40 |

| ABERDEEN GLOBAL - INDIAN EQUITY FUND - A2 (AEF2) | 0.66 | 18.61 | 2.17 | 8.47 | 4.92 | 16.80 | 8.09 |

| ABERDEEN LATIN AMERICA EQUITY FUND INC (LT4) | -0.36 | 20.23 | 3.51 | 8.33 | 11.16 | 31.63 | 13.66 |

Best Funds YTD

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| DIREXION DAILY LATIN AMERICA BULL 3X SHARES (LBJ) | 2.20 | 48.77 | 8.77 | 0.91 | 24.38 | 58.66 | 23.18 |

| JPMORGAN INDIAN INVESTMENT TRUST PLC (3J8) | -0.49 | 38.65 | 1.55 | 7.31 | 4.23 | 20.92 | 8.50 |

| PROSHARES ULTRA MSCI MEXICO CAPPED IMI (UMX) | 2.48 | 37.09 | 1.19 | 16.33 | 3.54 | -11.76 | 2.32 |

| DIREXION DAILY BRAZIL BULL 3X SHARES (BRZU) | 2.33 | 35.72 | 5.69 | -8.53 | 11.51 | 103.62 | 28.07 |

| ASIA PACIFIC FUND INC/THE (APB) | -0.65 | 25.00 | 0.56 | 13.35 | 16.79 | 29.17 | 14.97 |

| LYXOR ETF IBEX 35 DOBLE APALANCADO DIARIO (IBEXA) | -2.35 | 24.40 | -0.89 | 12.54 | 34.00 | 37.41 | 20.77 |

| ASIA TIGERS FUND INC (GRR) | -0.35 | 23.91 | 4.17 | 12.26 | 11.82 | 26.08 | 13.58 |

| DB PHYSICAL RHODIUM ETC (XRH0) | 2.29 | 23.61 | 0.37 | 10.52 | 37.03 | 23.61 | 17.88 |

| GLOBAL X FTSE ARGENTINA 20 ETF (GX0A) | 0.37 | 23.59 | 3.46 | 7.27 | 17.83 | 49.08 | 19.41 |

| MORGAN STANLEY INDIA INVESTMENT FUND INC (IIF) | 0.13 | 23.19 | 3.37 | 8.68 | 11.15 | 31.09 | 13.57 |

| DIREXION DAILY GOLD MINERS BULL 3X SHARES (NUGT) | 4.51 | 23.04 | -3.99 | 9.57 | -26.64 | -21.42 | -10.62 |

| GOLDMAN SACHS INDIA EQUITY PORTFOLIO (GS06) | 0.34 | 22.01 | 3.93 | 8.56 | 5.94 | 27.15 | 11.40 |

| FONDUL PROPRIETATEA SA/FUND (FP) | 1.58 | 21.46 | 1.10 | 4.58 | 10.53 | 22.85 | 9.77 |

| ABERDEEN GREATER CHINA FUND INC (GCH) | 0.19 | 20.71 | 4.27 | 11.01 | 15.07 | 28.49 | 14.71 |

| WISDOMTREE INDIA EARNINGS FUND (EPI) | 0.66 | 20.63 | 2.06 | 6.87 | 10.24 | 26.19 | 11.34 |

| SIMPLEX CHINA BULL 2X H-SHARE ETF (9D31112C) | -2.03 | 20.57 | -3.87 | 1.07 | 8.68 | 31.28 | 9.29 |

| KOREA EQUITY FUND INC (KR6) | -0.12 | 20.31 | 1.22 | 6.90 | 7.95 | 13.66 | 7.43 |

| ABERDEEN LATIN AMERICA EQUITY FUND INC (LT4) | -0.36 | 20.23 | 3.51 | 8.33 | 11.16 | 31.63 | 13.66 |

| HSBC GLOBAL INVESTMENT FUNDS - INDIAN EQUITY (JHSC) | 0.35 | 20.12 | 3.14 | 7.52 | 9.56 | 28.15 | 12.09 |

| NEW INDIA INVESTMENT TRUST PLC (NIQ) | 1.05 | 19.83 | 2.87 | 10.22 | 9.59 | 23.32 | 11.50 |

Worst Funds YTD

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| VELOCITYSHARES 3X LONG NATURAL GAS ETN (UGAZ) | -3.52 | -56.66 | 1.56 | 25.36 | -51.42 | -15.83 | -10.08 |

| PROSHARES ULTRASHORT MSCI BRAZIL CAPPED (BZQ) | -1.47 | -26.51 | -4.01 | 2.29 | -27.58 | -65.49 | -23.70 |

| PROSHARES ULTRA DJ-UBS CRUDE OIL (UCO) | -1.52 | -19.82 | 10.57 | -12.76 | -16.05 | 13.79 | -1.11 |

| LYXOR ETF IBEX 35 DOBLE INVERSO DIARIO (2INVE) | 1.61 | -19.49 | -3.10 | -10.12 | -35.87 | -49.11 | -24.55 |

| NEXT NOTES NIKKEI TOCOM LEVERAGED CRUDE OIL ETN (2038) | 1.05 | -16.91 | 11.77 | -7.85 | 9.01 | 29.00 | 10.48 |

| IPATH DOW JONES-UBS SUGAR SUBINDEX TOTAL RETURN ETN (SGG) | 0.58 | -14.65 | -5.17 | -14.70 | -30.18 | 5.71 | -11.08 |

| IPATH GOLDMAN SACHS CRUDE OIL TOTAL RETURN INDEX ETN (OIL) | -1.08 | -12.80 | 6.98 | -8.76 | -9.51 | 11.52 | 0.06 |

| SPOTR BEAR OMXS30 (SPBEAOMX) | -0.37 | -11.90 | -6.68 | -3.97 | -24.20 | -45.13 | -20.00 |

| LYXOR ETF FTSE MIB DAILY DOUBLE SHORT XBEAR (XBRMIB) | 1.49 | -11.60 | -3.60 | -6.28 | -41.61 | -46.70 | -24.55 |

| SPDR S&P OIL & GAS EXPLORATION & PRODUCTION ETF (XOP) | -1.16 | -10.48 | 4.07 | -2.07 | -5.21 | 24.94 | 5.43 |

| WTI CRUDE OIL PRICE LINKED ETF (1671) | 0.70 | -9.91 | 6.56 | -4.79 | -4.17 | 10.05 | 1.91 |

| UNITED STATES OIL FUND LP (U9N) | -0.43 | -9.76 | 5.66 | -6.34 | -6.84 | 11.83 | 1.08 |

| SIMPLEX CHINA BEAR 1X H-SHARE ETF (9D31212C) | 0.16 | -9.73 | 2.39 | -0.56 | -5.59 | -19.62 | -5.85 |

| LYXOR UCITS ETF IBEX 35 INVERSO DIARIO (INVEX) | 0.80 | -9.60 | -2.30 | -4.56 | -21.51 | -29.46 | -14.46 |

| DIREXION DAILY RUSSIA BULL 3X SHARES (RUSL) | 2.47 | -8.69 | 0.97 | 2.68 | 31.33 | 75.12 | 27.53 |

| SIMPLEX CHINA BEAR 1X H-SHARE ETF (1573) | -0.67 | -8.58 | 1.62 | -1.45 | -5.08 | -21.06 | -6.49 |

| MARKET VECTORS OIL SERVICE ETF (OIH) | -0.62 | -8.19 | 3.90 | -4.40 | 4.63 | 19.78 | 5.98 |

| VANGUARD ENERGY ETF (VDE) | -0.76 | -7.75 | 2.27 | -2.55 | -1.05 | 16.40 | 3.77 |

| UBS HANA AMBATOVY NICKEL OVERSEAS INVESTMENT COMPANY 1 (2772642) | 0.87 | -7.44 | 0.05 | -7.49 | 16.94 | 40.14 | 12.41 |

| DB X-TRACKERS SHORTDAX DAILY UCITS ETF (XSDX) | -0.69 | -6.81 | -4.59 | -1.73 | -19.60 | -29.54 | -13.87 |

Best Funds 1yr

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| DIREXION DAILY BRAZIL BULL 3X SHARES (BRZU) | 2.33 | 35.72 | 5.69 | -8.53 | 11.51 | 103.62 | 28.07 |

| CANADIAN LIFE COS SPLIT CORP (LFE) | -2.45 | 14.50 | 0.80 | 1.45 | 84.31 | 90.12 | 44.17 |

| KAYNE ANDERSON ENERGY TOTAL RETURN FUND INC (KYE) | -0.32 | 6.60 | 4.31 | -2.25 | 13.15 | 75.43 | 22.66 |

| DIREXION DAILY RUSSIA BULL 3X SHARES (RUSL) | 2.47 | -8.69 | 0.97 | 2.68 | 31.33 | 75.12 | 27.53 |

| NEUBERGER BERMAN MLP INCOME FUND INC (NML) | -0.30 | 9.35 | 3.91 | -2.44 | 14.65 | 63.90 | 20.01 |

| DIREXION DAILY LATIN AMERICA BULL 3X SHARES (LBJ) | 2.20 | 48.77 | 8.77 | 0.91 | 24.38 | 58.66 | 23.18 |

| TORTOISE ENERGY INFRASTRUCTURE CORP (TYG) | -1.36 | 14.18 | 6.35 | 1.82 | 19.29 | 54.86 | 20.58 |

| SPDR S&P METALS & MINING ETF (SSGG) | -0.84 | -3.22 | 3.04 | -3.62 | 19.31 | 52.11 | 17.71 |

| CANADIAN BANC CORP (BK) | -1.75 | 8.49 | -0.13 | -3.37 | 27.20 | 50.96 | 18.67 |

| LYXOR ETF BRAZIL IBOVESPA USD (LYRIO) | 1.49 | 14.12 | 2.18 | -0.79 | 14.19 | 50.42 | 16.50 |

| BLACKROCK WORLD MINING TRUST PLC (BRWM) | -0.53 | 6.56 | 0.81 | -2.58 | 15.59 | 49.91 | 15.93 |

| GLOBAL X FTSE ARGENTINA 20 ETF (GX0A) | 0.37 | 23.59 | 3.46 | 7.27 | 17.83 | 49.08 | 19.41 |

| NEXT FUNDS IBOVESPA LINKED EXCHANGE TRADED FUND (1325) | -0.27 | 12.30 | 1.24 | -0.67 | 13.35 | 48.60 | 15.63 |

| DB X-TRACKERS MSCI BRAZIL INDEX UCITS ETF (XMBR) | 0.24 | 11.90 | 1.93 | 0.48 | 12.80 | 46.88 | 15.52 |

| BNY MELLON GLOBAL FUNDS PLC - BRAZIL EQUITY FUND (HZ5R) | -0.47 | 11.69 | 1.19 | -3.44 | 10.18 | 46.38 | 13.58 |

| STONE HARBOR EMERGING MARKETS INCOME FUND (EDF) | 0.88 | 12.87 | -0.19 | 2.03 | 7.19 | 44.46 | 13.37 |

| ISHARES MSCI BRAZIL UCITS ETF (INC) (IBZL) | 2.07 | 13.68 | 3.11 | -1.59 | 10.90 | 43.93 | 14.09 |

| ISHARES MSCI BRAZIL UCITS ETF (CSBR) | 1.36 | 12.27 | 2.48 | -1.10 | 10.33 | 43.34 | 13.76 |

| KAYNE ANDERSON MLP INVESTMENT CO (KYN) | -1.24 | 8.91 | 4.64 | -4.03 | 7.70 | 41.32 | 12.41 |

| POLAR CAPITAL TECHNOLOGY TRUST PLC (PCT) | -1.96 | 10.88 | 1.64 | 0.10 | 12.94 | 40.35 | 13.76 |

Worst Funds 1yr

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| PROSHARES ULTRASHORT MSCI BRAZIL CAPPED (BZQ) | -1.47 | -26.51 | -4.01 | 2.29 | -27.58 | -65.49 | -23.70 |

| LYXOR ETF IBEX 35 DOBLE INVERSO DIARIO (2INVE) | 1.61 | -19.49 | -3.10 | -10.12 | -35.87 | -49.11 | -24.55 |

| LYXOR ETF FTSE MIB DAILY DOUBLE SHORT XBEAR (XBRMIB) | 1.49 | -11.60 | -3.60 | -6.28 | -41.61 | -46.70 | -24.55 |

| SPOTR BEAR OMXS30 (SPBEAOMX) | -0.37 | -11.90 | -6.68 | -3.97 | -24.20 | -45.13 | -20.00 |

| DB X-TRACKERS SHORTDAX DAILY UCITS ETF (XSDX) | -0.69 | -6.81 | -4.59 | -1.73 | -19.60 | -29.54 | -13.87 |

| LYXOR UCITS ETF IBEX 35 INVERSO DIARIO (INVEX) | 0.80 | -9.60 | -2.30 | -4.56 | -21.51 | -29.46 | -14.46 |

| LYXOR ETF FTSE MIB DAILY SHORT BEAR (BERMIB) | 0.77 | -5.37 | -2.72 | -2.69 | -25.03 | -27.61 | -14.51 |

| COMSTAGE ETF CAC 40 SHORT GR UCITS ETF (CBCACSEU) | -0.46 | -5.11 | -3.68 | -1.79 | -17.79 | -26.63 | -12.47 |

| DIREXION DAILY GOLD MINERS BULL 3X SHARES (NUGT) | 4.51 | 23.04 | -3.99 | 9.57 | -26.64 | -21.42 | -10.62 |

| SIMPLEX CHINA BEAR 1X H-SHARE ETF (1573) | -0.67 | -8.58 | 1.62 | -1.45 | -5.08 | -21.06 | -6.49 |

| SIMPLEX CHINA BEAR 1X H-SHARE ETF (9D31212C) | 0.16 | -9.73 | 2.39 | -0.56 | -5.59 | -19.62 | -5.85 |

| DB X-TRACKERS II IBOXX GLOBAL INFLATION-LINKED UCITS ETF-GBP (X03E) | -0.22 | 4.82 | 0.68 | 2.59 | -0.80 | -16.98 | -3.63 |

| ISHARES MSCI TURKEY ETF (ISVZ) | -0.35 | 9.13 | -1.86 | 1.07 | -5.24 | -16.15 | -5.55 |

| HSBC MSCI TURKEY UCITS ETF (H4Z2) | 1.62 | 10.88 | -0.89 | 1.43 | -4.22 | -15.92 | -4.90 |

| ISHARES MSCI TURKEY UCITS ETF (IDTK) | 0.02 | 10.81 | -1.72 | 1.50 | -4.70 | -15.84 | -5.19 |

| VELOCITYSHARES 3X LONG NATURAL GAS ETN (UGAZ) | -3.52 | -56.66 | 1.56 | 25.36 | -51.42 | -15.83 | -10.08 |

| LYXOR ETF TURKEY EURO (TURU) | -0.52 | 10.03 | -2.59 | 0.83 | -4.06 | -15.49 | -5.33 |

| INVESCO KOREAN EQUITY FUND - A INC (IUVD) | 0.54 | 13.70 | 0.36 | 6.84 | -4.22 | -14.71 | -2.93 |

| MIRAE ASSET TIGER CHINA CONSUMER ETF (150460) | 1.40 | 14.20 | 1.50 | 10.11 | -5.67 | -12.28 | -1.59 |

| PROSHARES ULTRA MSCI MEXICO CAPPED IMI (UMX) | 2.48 | 37.09 | 1.19 | 16.33 | 3.54 | -11.76 | 2.32 |