Report: Midlincoln Fund Atlas

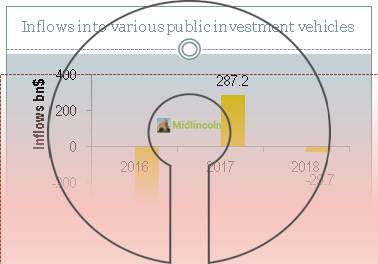

After stellar 2017 when new money generation was extreamly robust and net inflows into various public investment vehicles stood at 287$bn while MSCI World index was up 20.1% (data ex HF and FO) 2018 was a year when most of the things reversed direction vs. 2017

Source: ML

You will be able to download all slides in power point for this report

You will be able to download all slides in power point for this reportGlobal Growth Powers International Fund Flows Investors Sell PowerShares FTSE RAFI Developed Markets (PXF ... International ETFs ready for takeoff Investors pulled $5.8 billion out of emerging market stocks in February Fund flows into India to be healthy despite LTCG tax: John Praveen ... The rush to emerging markets "Epic" flows to tech funds as "buy-the-dip" rules -BAML Flow Traders US LLC Has $4.90 Million Position in Schwab ... Investors pulled $5.8 billion out of emerging market stocks in February Fund flows into India to be healthy despite LTCG tax: John Praveen ... "Epic" flows to tech funds as "buy-the-dip" rules -BAML Navigating Through Stiff Income Crosswinds: What Are Cash Flow ... Investors Warm Up to Bond ETFs US Fund-Flows Weekly Report: All 4 Fund Macro-Groups Take In ... New Year, Not-So-New Trends in Fund Flows