Report: Midlincoln Index Atlas - Ideas for 2019

Source: ML

You will be able to download all slides in power point for this report

You will be able to download all slides in power point for this reportMidlincoln Index Atlas - Ideas for 2019

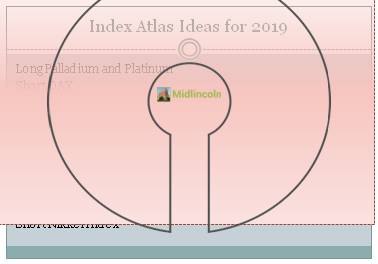

Liquidity of a short term end of the European and Japan Bond Curve Should be Bad as at least 234 bonds in 12 EU countries and Japan trade with negative yield..

Domestic investors in these countries are likely to chase short term bonds else where?

US Treasury Yields – a lot lower

Yields in the UK Are A Bit Tighter

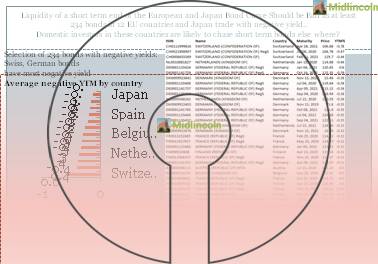

France Bonds have been negatively affected by Yellow Jackets

Emerging Market Bonds Should Be Better With Negative Yields in a lot of places..

Emerging Markets Bonds – Mostly Seen Yield Contraction with only a Few Exceptions

Lebanon bonds – move into high yield category

Nostrum Oil Eurobond Negatively Affects Kazakhstan average

Few Bonds Were Significantly Weaker in the last month of 2018

Venezuelan Eurobonds – Hot Topic

Italian Bonds – another popular topic

Local Sovereign Yields are a lot better – and with stable DXY – we might see few carry trades opportunities

Ukraine – in pre-election,

Is there a buying opportunity?

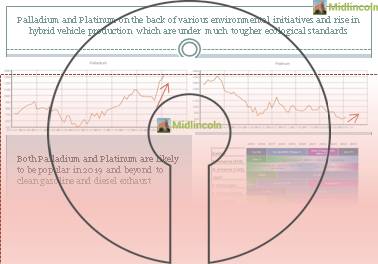

Long Palladium and Platinum

Short DAX

Long iBovespa

Short Greece and Turkey Index

Long Singapore SIBOR rate

Short Brent Oil Price Index

Positive on Long BRICs

Positive on 12m Libor rate in USD

Long Natural Gas in the US

Short Nikkei Index