Report: ETFs On Moscow Exchange, Building New Asset Class

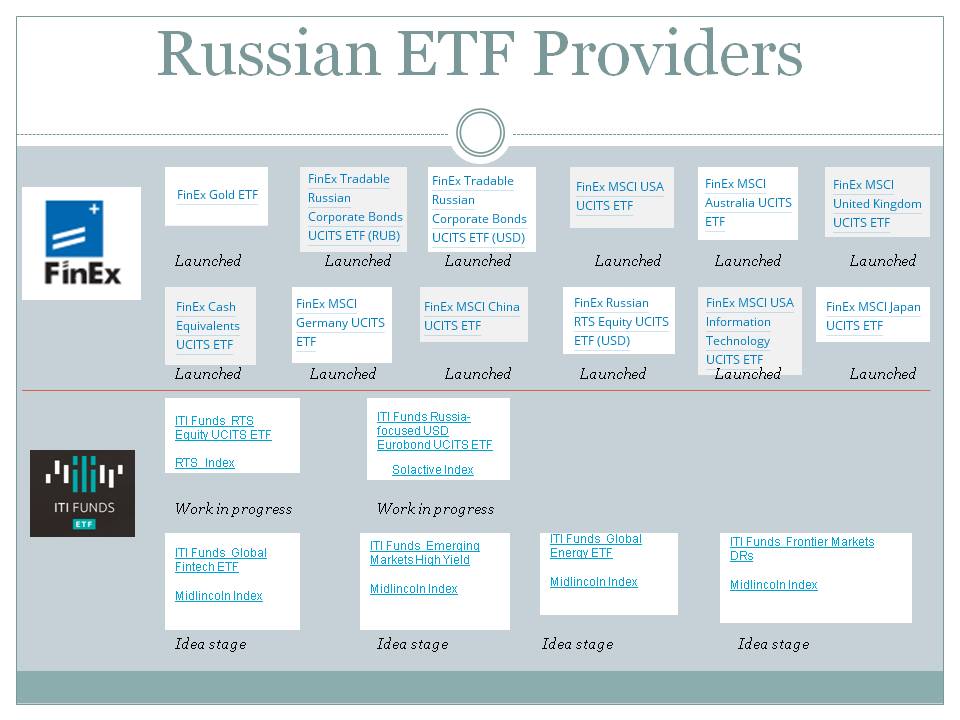

Finex launched 12 ETFs ITI Funds working on 2 and has a pipelines of 3 or 4 other ETFs so far in the idea stage Read our Russian ETFs recent report

Source: ML

You will be able to download all slides in power point for this report

You will be able to download all slides in power point for this reportRussian ETF business has been picking up recently. There are few ETFs trading on the Moex exchange. So far they are not really Russian products and registered in Ireland, but Moscow Exchange driven effort to increase liquidity and depth of the market in Russia has been supportive to accommodate these instruments onto trading floor. Moscow exchange has been probably the sole and most active driver for ETF development business in Russia. In the past few years it has been supportive of few domestic groups to launch ETF products and to list them on exchange. Finex was pioneer here, while ITI Funds is the next group which is working on the ETF product line and their listing on Moex. Moscow Exchange has also offered a few of the international ETF providers to cross list their products on its trading floor. This has not yet resulted in anybody actually listing ETFs on Moex although Moex still courting likes of Vanguard, State Street, Ishares , VanEck and Wisdomtree to cross list their ETFs on Moex. So far these ETFs of the international providers are made available to Russia investors by brokers as foreign stocks just like ADRs and GDRs from LSE on NYSE. But the transaction costs in these instruments are normally high for Russian investors. Moex has been active lobbyist with Russian regulator to accommodate legislature to allow internationally listed ETFs to cross list in Moscow. Moex as well as wider financials community in Russia have also been active in lobbying for legislature changes to support domestically registered ETFs (a legislature that was lacking still in the beginning 2018) and it has been lobbying that Russian pension managers be allowed to invest into ETFs. Moex was also accommodative of the investment community requests to initiate the changes in methodology of the RTS and Moex Indexes, Russian main benchmarks to make it more suitable for the ETF creation. It also revised its sectoral benchmark approach to make it more suitable for future domestic sectoral ETFs. In this study we explore the ETF market segment available for Russian domestic investors and also Russia focused ETFs available for internationals investors. We think that the efforts of the exchange, the regulator and the financial community will results in further growth of the ETF trading segment in Russia – which will affects investors risks and costs positively. In the not too distant future there will be more of the ET products on Moex coming both from domestic groups, with focus on Russian and international markets. At the same time we think that Moex will be successful in including some of the ET products of the major international providers into its trading lists.