Report: ML Fixed Income Weekly

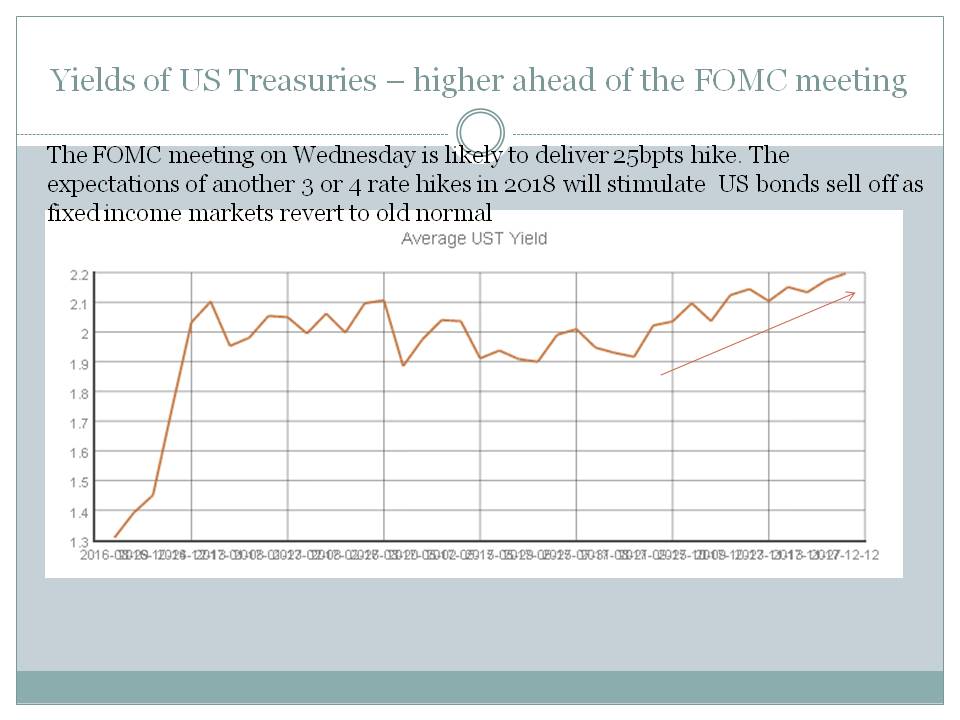

The FOMC meeting on Wednesday is likely to deliver 25bpts hike. The expectations of another 3 or 4 rate hikes in 2018 will stimulate US bonds sell off as fixed income markets revert to old normal

Source: ML

You will be able to download all slides in power point for this report

You will be able to download all slides in power point for this reportFOMC meeting to be the main event this week - BMO CM Only one thing matters at the next Fed meeting ECB to play up eurozone strength at steady-as-she-goes meeting EUR: ECB meeting largely a non-event - ING Haruhiko Kuroda says reappointment as Bank of Japan chief didn't ... DIARY-Top Economic Events to Jan. 30 Tuesday's Rome BOE meeting to be a farewell to 4 board members GBP/USD: Balance Of Risks Into EU Summit & BoE Meeting This ... China liquidity tool moves into focus as Fed rate decision awaited PBOC Seen Holding Rates Post Fed Hike Amid Stable Yuan, Bond ... China's Central Bank to be more active in fending off financial risks ... Chinese central bank injects liquidity into market Traders Checking in on Banco Do Brasil SA (OTCMKTS:BDORY) EMERGING MARKETS-LatAm currencies seesaw on mixed US jobs ... Why RBI may go against consensus and cut rates Has RBI consistently over-estimated inflation in its forecasts? Russia's Banking Sector Is on the Mend After a Catastrophic Summer IMF Staff Concludes Visit to Russia Central Bank of Turkey likely to hike rate in December - Barclays Turkish Lira Exchange Rates Today: More Upside In USD/TRY To ... S. Africa Holds Rate as Uncertainty Lifts Chance of Increase South Africa holds rates, but big test ahead for rand on debt ratings Surging Debt Will Make Asian Central Banks Cautious on Rates Bank of Korea Leads the Way in Asia With Interest-Rate Hike