Report: MidLincoln Index Atlas

Source: ML, SeekingAlpha

You will be able to download all slides in power point for this report

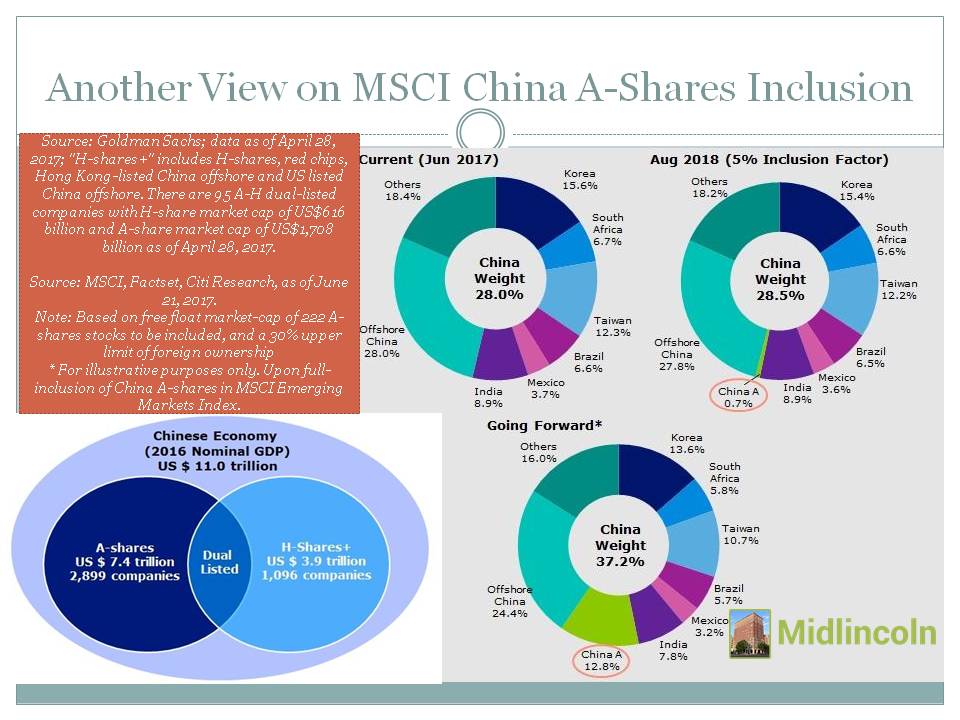

You will be able to download all slides in power point for this reportIndex Rebalancing News MSCI Technicals At the Forefront For iShares Edge MSCI Min Vol EAFE ... Why You Can't Afford To Miss European Small-Caps MSCI launches new Japan ESG indices Global fund managers betting big on A-shares Is China's Stock Market About To Go Gangbusters? MSCI To Add China A-Shares To Emerging Markets Index: What ... MSCI to add 222 China A shares in emerging-markets index After MSCI's Big China Decision, Wealth Managers Take Stock MSCI inclusion of China stocks – risks on the horizon Small and mid-cap stocks set to continue growth trend: MIDF Research Standard & Poor's Index FTSE ITV plc looks ridiculously cheap LONDON MARKETS: FTSE 100 Ends Higher As Commodity Stocks ... LONDON MARKET MIDDAY: ITV Leads Rising FTSE 100 As UK ... FTSE 100 ends higher as commodity stocks climb, factory ... FTSE Russell announces constituent changes to US indices A Commodity-led FTSE Is a Blinding Brexit Barometer Russell Index Rebalancing: The Small-Cap ETF Crowd Favorite What Russell index rebalancing means for the stock market Pound jumps above $1.29 after new poll shows Conservatives ... FTSE Russell CEO on Rebalancing, China Shares and Brexit Bloomberg Indices Swank Capital and Cushing Asset Management Announce ... From Brazil to India, Emerging Currencies to Endure Tapering Finding the Active in Low-Cost Passive Investing Mr. Fun and Poison Short-Sellers US Tech Stocks Rally; Dollar Gains, Bonds Slide: Markets Wrap Real estate gets a home of its own on S&P index MSCI To Add China A-Shares To Emerging Markets Index: What ... US Stocks Mixed With Dollar as Oil Stabilizes: Markets Wrap MSCI inclusion of China stocks – risks on the horizon Rebounding Tech, Energy Help US Stock ETFs Edge Higher Dow Jones How the Fed's big balance sheet unwind may affect markets Books Boost Retail; 2 Index Plays Put Apple, Top Techs In Reach Dow closes lower on General Electric's stock drop Investment Insights: Second-quarter 2017 investment review CSE announces changes in S&P Sri Lanka 20 index The Mexican Stock Exchange and S&P Dow Jones Indices ... Bullish Bias Continues For The Dow Jones Industrial Average Close Update: Dow, S&P Return Gains Ahead of Russell ... MARKET SNAPSHOT: Stock Market Edges Higher As Tech, Energy ... Market Awaits Telling Economic Data On Approach To Long Weekend STOXX European Dividend Growth Fund Announces Exchange Ratios European Dividend Growth Fund Closes Initial Public Offering Five Things You Need to Know to Start Your Day Stocks Flat, Metals Rise as Markets Await Earnings: Markets Wrap Oil is still in the $45-55 range – having failed to make a downside ... Pound Drops as UK Exit Poll Unnerves Investors: Markets Wrap European Dividend Growth Fund Files Final Prospectus Traders Are Following db x-trackers DJ STOXX 600 Technology ETF ... Solactive launches Europe multi-factor index Asia: Stocks rise on yen weakness, tech share gains