Report: ML Fund Atlas Weekly Flows

Source: ML

You will be able to download all slides in power point for this report

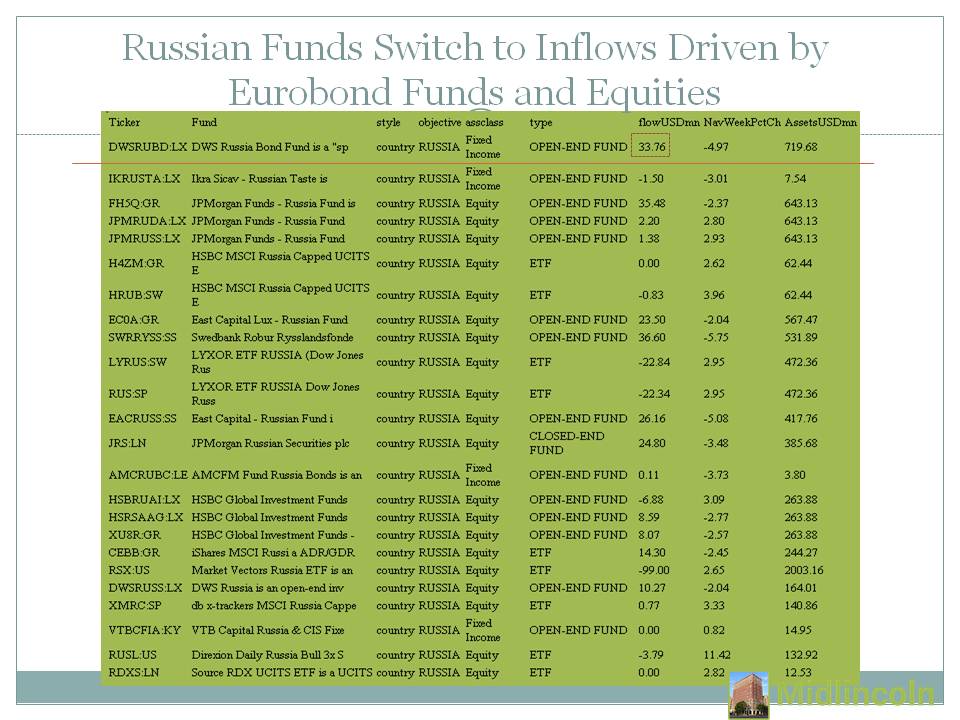

You will be able to download all slides in power point for this reportEmerging markets fund flow showed 208.8 USD mn of inflow. While Frontier Markets funds showed -2.1 USD mn of outflows. BRAZIL Equity funds showed -39.5 USD mn of outflow. BRAZIL Fixed Income funds showed 33.7 USD mn of inflow. CHINA Equity funds showed 705.2 USD mn of inflow. CHINA Fixed Income funds showed 77.9 USD mn of inflow. INDIA Equity funds showed 531.0 USD mn of inflow. INDIA Fixed Income funds showed 28.9 USD mn of inflow. KOREA Equity funds showed 14.1 USD mn of inflow. RUSSIA Equity funds showed 36.4 USD mn of inflow. RUSSIA Fixed Income funds showed 32.4 USD mn of inflow. SOUTH AFRICA Equity funds showed 20.4 USD mn of inflow. TURKEY Equity funds showed 24.2 USD mn of inflow. COMMUNICATIONS SECTOR Equity funds showed 354.1 USD mn of inflow. ENERGY SECTOR Equity funds showed -1383.5 USD mn of outflow. ENERGY SECTOR Mixed Allocation funds showed 0.8 USD mn of inflow. FINANCIAL SECTOR Equity funds showed 19.3 USD mn of inflow. REAL ESTATE SECTOR Alternative funds showed -0.4 USD mn of outflow. REAL ESTATE SECTOR Equity funds showed 820.8 USD mn of inflow. TECHNOLOGY SECTOR Equity funds showed 876.7 USD mn of inflow. UTILITIES SECTOR Equity funds showed 2.9 USD mn of inflow. LONG SHORT Alternative funds showed 0.8 USD mn of inflow. LONG SHORT Equity funds showed 606.1 USD mn of inflow. LONG SHORT Fixed Income funds showed 35.2 USD mn of inflow. LONG SHORT Mixed Allocation funds showed 1.7 USD mn of inflow.