Report: ML Fund Atlas Weekly Flows

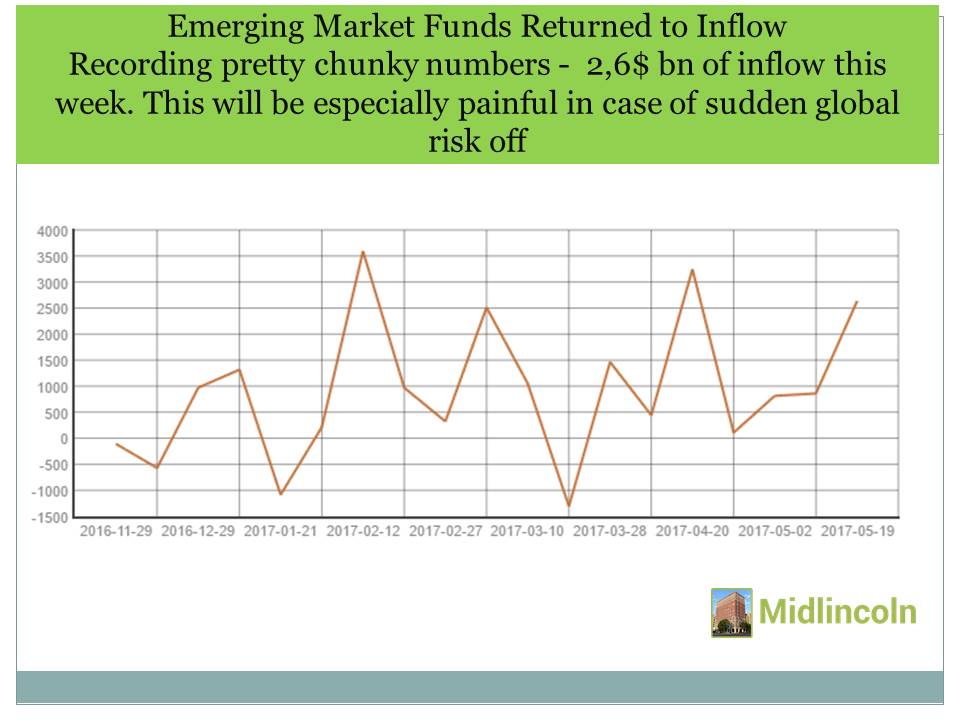

Recording pretty chunky numbers - 2,6$ bn of inflow this week. This will be especially painful in case of sudden global risk off

Source: ML

You will be able to download all slides in power point for this report

You will be able to download all slides in power point for this reportChart: Emerging Market Funds Returned to Inflow Recording pretty chunky numbers - 2,6$ bn of inflow this week. This will be especially painful in case of sudden global risk off Source: ML Download file in Power Point Emerging markets fund flow showed 2635.3 USD mn of inflow. While Frontier Markets funds showed -0.1 USD mn of outflows. BRAZIL Equity funds showed -48.6 USD mn of outflow. BRAZIL Fixed Income funds showed -720.3 USD mn of outflow. CHINA Equity funds showed 84.0 USD mn of inflow. CHINA Fixed Income funds showed 44.3 USD mn of inflow. INDIA Equity funds showed 332.5 USD mn of inflow. INDIA Fixed Income funds showed 13.7 USD mn of inflow. KOREA Equity funds showed -3.1 USD mn of outflow. RUSSIA Equity funds showed -103.9 USD mn of outflow. RUSSIA Fixed Income funds showed 47.3 USD mn of inflow. SOUTH AFRICA Equity funds showed 17.6 USD mn of inflow. TURKEY Equity funds showed 7.8 USD mn of inflow. COMMUNICATIONS SECTOR Equity funds showed 378.0 USD mn of inflow. ENERGY SECTOR Equity funds showed 407.3 USD mn of inflow. ENERGY SECTOR Mixed Allocation funds showed 0.7 USD mn of inflow. FINANCIAL SECTOR Equity funds showed 191.2 USD mn of inflow. REAL ESTATE SECTOR Alternative funds showed -1.9 USD mn of outflow. REAL ESTATE SECTOR Equity funds showed 274.5 USD mn of inflow. TECHNOLOGY SECTOR Equity funds showed 376.6 USD mn of inflow. UTILITIES SECTOR Equity funds showed 371.4 USD mn of inflow. LONG SHORT Alternative funds showed -100.0 USD mn of outflow. LONG SHORT Equity funds showed 231.3 USD mn of inflow. LONG SHORT Fixed Income funds showed 28.9 USD mn of inflow. LONG SHORT Mixed Allocation funds showed 0.9 USD mn of inflow. Markets Best global markets since the begining of the week EUROPE +0.22%, EFM ASIA-0.06%, FM (FRONTIER MARKETS)-0.62%, While worst global markets since the begining of the week EM LATIN AMERICA -9.45%, EM (EMERGING MARKETS) -1.40%, USA -1.05%, Best since the start of the week among various stock markets were ZIMBABWE +8.23%, AUSTRIA +4.85%, BULGARIA +3.71%, HUNGARY +3.16%, KENYA +2.10%, CZECH REPUBLIC +1.67%, KUWAIT +1.67%, SERBIA +1.62%, ROMANIA +1.49%, SLOVENIA +1.13%, While worst since the start of the week among various stock markets were BRAZIL -14.72%, ARGENTINA -3.52%, PAKISTAN -3.35%, PORTUGAL -2.91%, MEXICO -2.36%, JAMAICA -2.21%, CHILE -2.18%, ISRAEL -2.07%, KAZAKHSTAN -1.98%, LEBANON -1.96%, Key Fund Flow Headlines FUND FLOWS: Investors Pull Money From Developed Market Funds FUND FLOWS: French Election Turns Money Toward Developed ... Emerging Markets ETFs: Bulls vs Bears Foreign funds prepare for long slog to gain Iran foothold A Smart Beta Idea For Developed Markets Exposure The emerging markets boom is taking place in bonds, too FUND FLOWS: Investors Still See Opportunity In Emerging Equities Brazilian Meltdown Puts Emerging Market Funds In Focus FUND FLOWS: Emerging Markets Investors Favor Asia Emerging Market Equity Funds Attract Most Money Since 2006 FUND FLOWS: Fixed Income Funds Keep Taking In Fresh Money Fund Flows Surge To Near Record Last Week Fund Flows: “It's Back On” For Equities; FUND FLOWS: Fixed Income Funds Keep Taking In Fresh Money FUND FLOWS: Geopolitical News Helps Flows To US and Emerging ...