Report: ML Morning Meeting

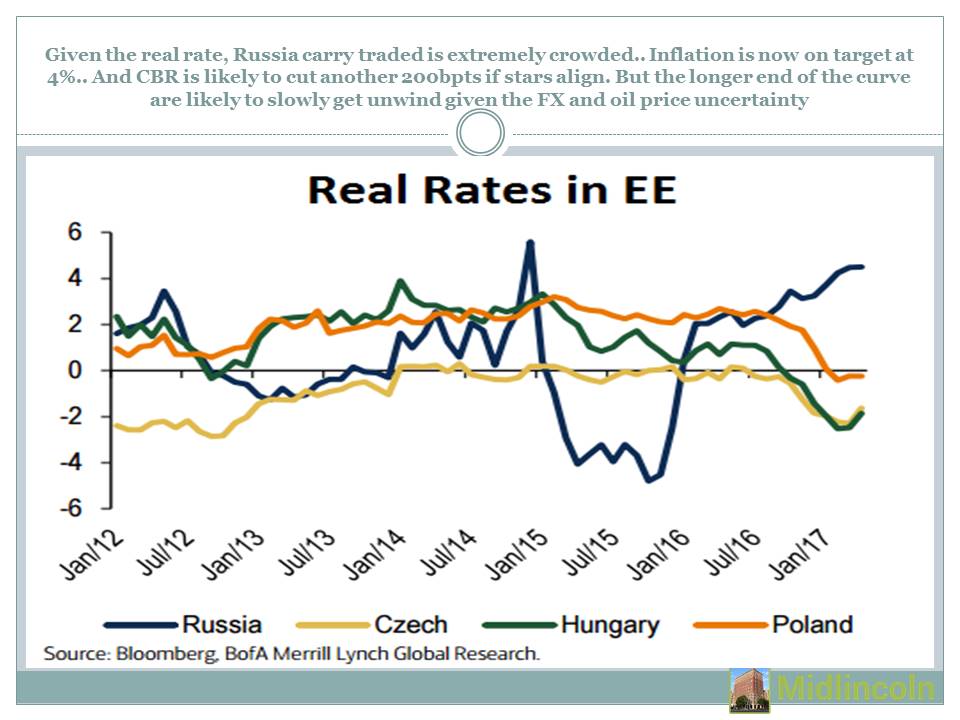

Given the real rate, Russia carry traded is extremely crowded.. Inflation is now on target at 4%.. And CBR is likely to cut another 200bpts if stars align. But the longer end of the curve are likely to slowly get unwind given the FX and oil price uncertainty

Source: ML, BAML

You will be able to download all slides in power point for this report

You will be able to download all slides in power point for this reportChart CEE Real Rates Given the real rate, Russia carry traded is extremely crowded.. Inflation is now on target at 4%.. And CBR is likely to cut another 200bpts if stars align. But the longer end of the curve are likely to slowly get unwind given the FX and oil price uncertainty Source: ML, BAML Download file in Power Point Comment Weekly performance is between 2017-05-16 and 2017-05-12 Best global markets last week EM LATIN AMERICA +1.61%, EUROPE +1.57%, EM (EMERGING MARKETS) +1.26%, While worst global markets last week FM (FRONTIER MARKETS) 0.10%, USA 0.41%, EFM ASIA 1.14%, U.S. Equities Hold Steady at S&P 500 Record as Phone Stocks Gain Gundlach: Ditch U.S. Equities for Emerging Markets Jupiter raises £90m for emerging markets trust Downgraded Countries: Top emerging-market performers last year. China stocks break 4-day winning streak, regulatory concerns linger China Stocks Jump, Led By Strong Earnings From Weibo, Sina Move over, US, the stampede is on for European equities What European equities cannot offer Has Global Oil Demand Really Surpassed Supply? Oil Prices Slip After U.S. API Reports Build In Crude Stocks Steel Price Forecast, April 2017: US Steel to Invest in Plants China AM: Ferrous futures move up amid steel price gains Today Gold Price: Track today gold rate latest trends and news Gold price: Find all the latest trends and news about Gold Best since the start of the week among various stock markets were AUSTRIA +5.34%, CZECH REPUBLIC +3.07%, BULGARIA +2.61%, ITALY +2.56%, NORWAY +2.32%, SPAIN +2.32%, RUSSIA +2.03%, BRAZIL +1.96%, FINLAND +1.94%, ROMANIA +1.85%, While worst since the start of the week among various stock markets were NIGERIA -2.65%, EGYPT -1.83%, TUNISIA -1.11%, MAURITIUS -1.08%, UNITED ARAB EMIRATES -1.06%, BANGLADESH -1.00%, KAZAKHSTAN -0.92%, INDONESIA -0.77%, PAKISTAN -0.72%, BAHRAIN -0.57%,