Report: Midlincoln Chart Art

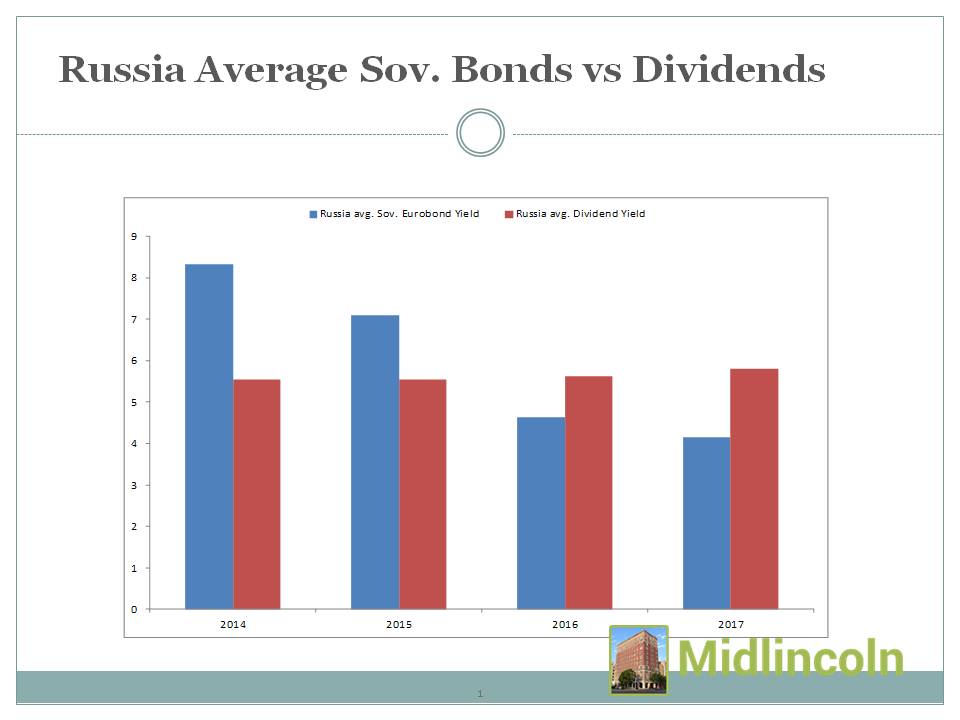

Bond Investing Has Been More Profitable for Russia Fixed Yield Investors In Crisis While Now Equities Shine..

Source: ML

You will be able to download all slides in power point for this report

You will be able to download all slides in power point for this reportGlobal Sectors - PE vs Growth Key Quant Indexes YTD Performance Quant Funds Outflows - Less Download file in Power Point Brent Oil price vs. USD Index (DXY). Dollar strength is the key to oil price dynamics Emerging Markets Funds Post inflows much more often then outflows recently Quant Funds Keep Posting Small Outflows Download file in Power Point Average Debt To MarketCap across Countries Worst 20 Markets Last Year Vs. Their YTD Perfromance.. Ukraine - unexpected winner this year Gold's heads and shoulders - rally to be short lived? Gold and Precious Metals Funds Show Outflows Canada Yield Spikes on US Rate hike Caracas Stocks Take off as Oil Plunges Global Sector YTD Performance Materials Lead � Energy Lags Historic Russia Average Sov. Bonds Yields vs Dividends Yields Key Russia Linked ETFs Russia RTS Sectors 12 month performance -"state owned regulated" Utilities lead while "free market" Consumers lag Some of the Key Russian Benchmarks (published ex-Russia) YTD Performance Russian RTS Index Subsectors Performance Some of the Best Performing Bond Fund Ideas YTD (% NAV Change YTD) Fund Flows into Key Commodities Funds Historic and Projected Revenue Growth By Sector Price of Aluminium on LME MidLincoln Comics: Key Performing Index Ideas YTD Weekly Fund Flows For Select GEM Countries Bonds vs. Equities Larger Set