Report: ML Weekly Fund FLows

Source: ML

You will be able to download all slides in power point for this report

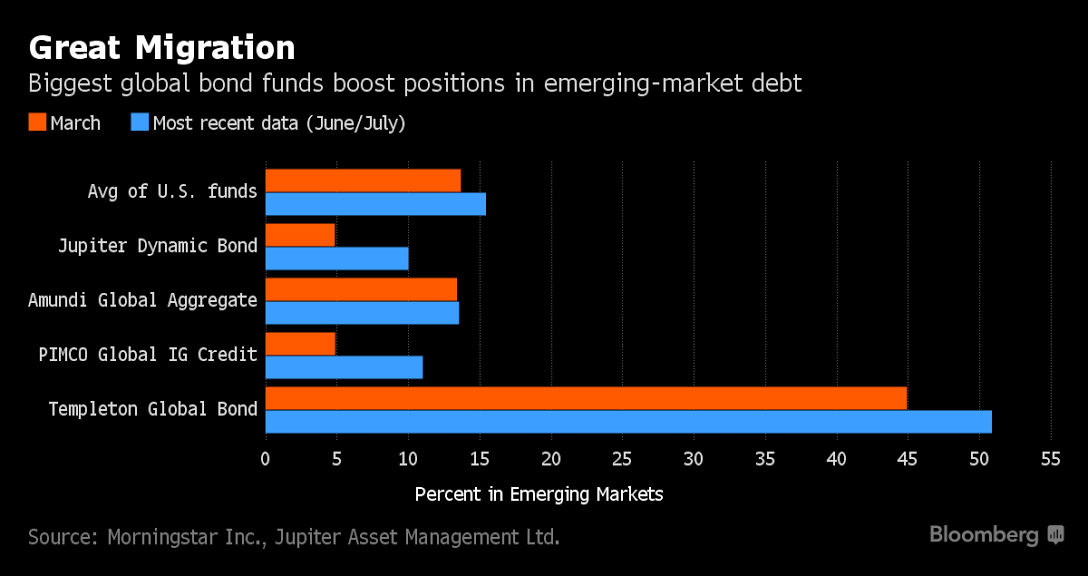

You will be able to download all slides in power point for this reportChart: Key DM Bond Fund Managers are Putting Money into Emerging Markets Bond Funds. The trend which is also highlighted in this weekly report Source: ML Emerging markets fund flow showed 703.2 USD mn of inflow. While Frontier Markets funds showed -0.2 USD mn of outflows. BRAZIL Equity funds showed -8.6 USD mn of outflow. BRAZIL Fixed Income funds showed 491.8 USD mn of inflow. CHINA Equity funds showed -1254.3 USD mn of outflow. CHINA Fixed Income funds showed 14.7 USD mn of inflow. INDIA Equity funds showed -117.6 USD mn of outflow. INDIA Fixed Income funds showed -4.9 USD mn of outflow. KOREA Equity funds showed -40.3 USD mn of outflow. RUSSIA Equity funds showed 9.7 USD mn of inflow. RUSSIA Fixed Income funds showed -0.9 USD mn of outflow. SOUTH AFRICA Equity funds showed 0.9 USD mn of inflow. TURKEY Equity funds showed -1.3 USD mn of outflow. COMMUNICATIONS SECTOR Equity funds showed 32.3 USD mn of inflow. ENERGY SECTOR Equity funds showed 93.9 USD mn of inflow. FINANCIAL SECTOR Equity funds showed -41.8 USD mn of outflow. REAL ESTATE SECTOR Alternative funds showed -0.1 USD mn of outflow. REAL ESTATE SECTOR Equity funds showed 68.5 USD mn of inflow. TECHNOLOGY SECTOR Equity funds showed -9.3 USD mn of outflow. UTILITIES SECTOR Equity funds showed 237.2 USD mn of inflow. LONG SHORT Alternative funds showed -169.6 USD mn of outflow. LONG SHORT Equity funds showed -9575.5 USD mn of outflow. LONG SHORT Fixed Income funds showed -2.8 USD mn of outflow. LONG SHORT Mixed Allocation funds showed 0.0 USD mn of inflow.