Report: Midlincoln March Strategy

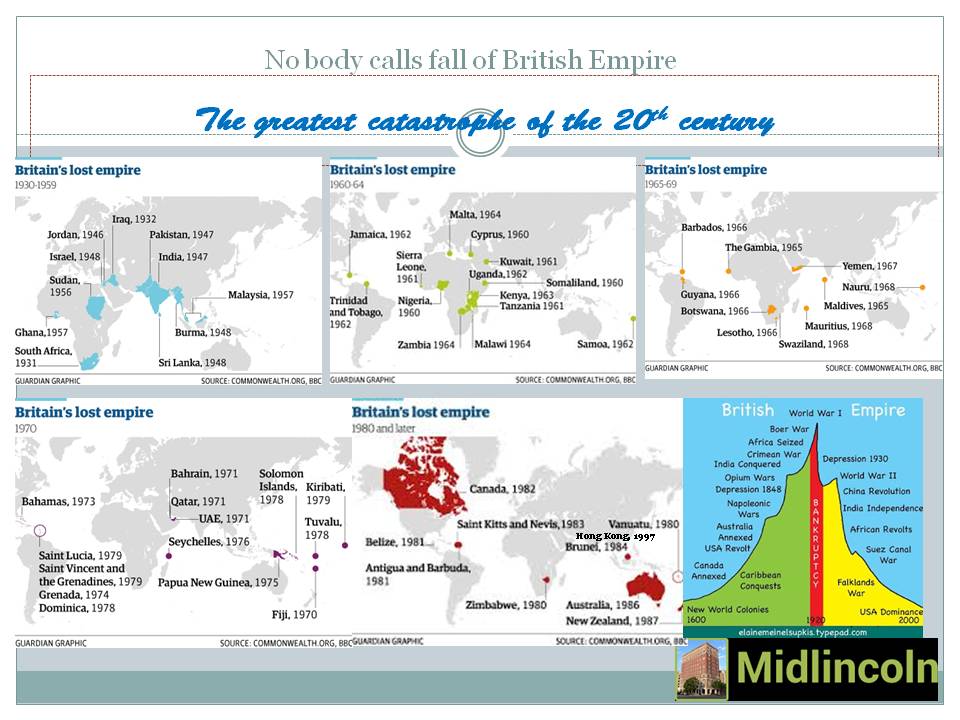

The greatest catastrophe of the 20th century

You will be able to download all slides in power point for this report

You will be able to download all slides in power point for this report and all data is available excel

and all data is available excelWhat is in common between Kazakhstan and Botswana? They were among 12 markets that remained in the positive territory in February. Kazkhstan equities added 6.5% in February while Botswana +1.06%. The remaining 10 markets were TUNISIA 3.88, JORDAN 3.11, FINLAND 2.35, THAILAND 2.06, BAHRAIN 1.80, KENYA 1.46, KUWAIT 1.15, TRINIDAD AND TOBAGO 1.14, RUSSIA 0.93, ROMANIA 0.19. The rest of the 44 markets out of 56 that Midlincoln tracks ended up in red for the month. As you see there is no great pattern among the markets that sustained February volatility and most likely this markets were able to hold on to gains because they are off radar of most investors. Are they?

Kazakhstan is not off radars. This market is investors focus for the last couple of years. Kazakhstan mostly is the oil producer. The volume of oil production in Kazakhstan in 2017 amounted to 86.2 million tonnes (an increase of 10.5% from 2016). Most of the increase came from Kashagan oil field which produced 8.35 million tonnes of oil and 5.1 billion cubic metres of gas in 2017 and is on the plan to produce 11mn tones in 2018.

Kashagan now producers roughly 300Kboe per day and this will go up to 400Kboe in the next couple of years. This is roughly equal to a cut in oil production that Russia pledged to make under OPEC agreement. Hopefully this does not offend Putin too much.