Report: October Strategy

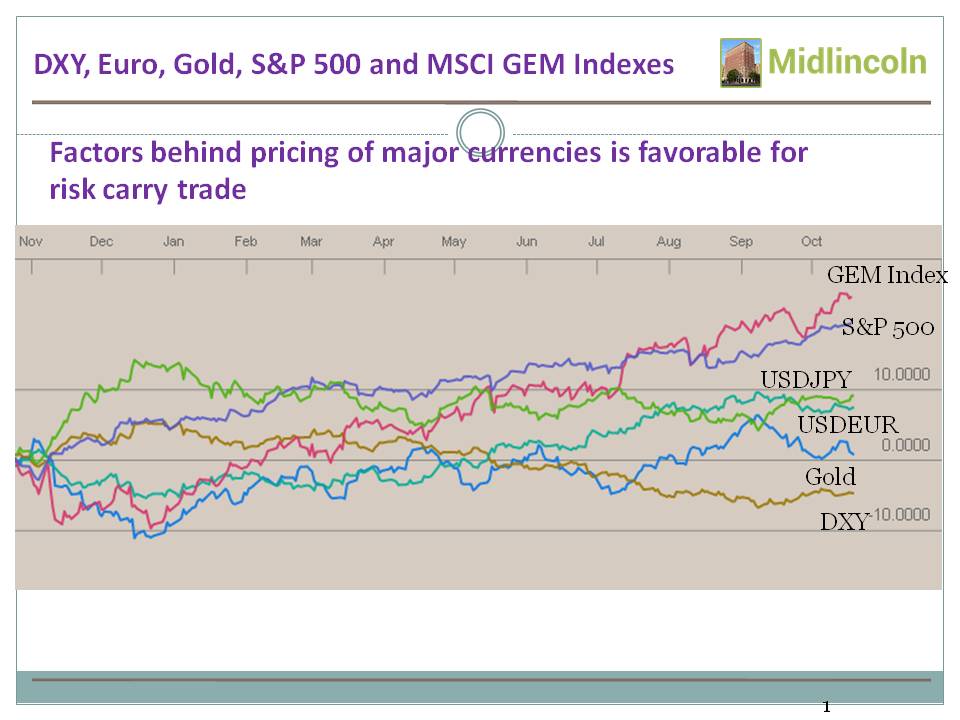

Factors behind pricing of major currencies is favorable for risk carry trade

You will be able to download all slides in power point for this report

You will be able to download all slides in power point for this report and all data is available excel

and all data is available excelStrategy Markets have been doing great this year. But it is tough anyway. North Korea escalation is hanging above the markets as a sledge hammer, ready to fall anytime as a guillotine and cut the roots of the risk appetite. Similar effect, albeit much less bloody is the rate hike priced in for the Fed’s December meeting. Regarding North Korea – its seems that Asian markets disregard that risk completely. China is up 36% YTD (to end of September) while Korea stocks are up 28% in the same time period. At first glance -the market performance in those countries implies that insiders in the region disregard the North Korean risk. On the other hand the rise in those markets can be a sign of investor’s blindness with regards to the NK risk event. China markets have been strong this year as a proxy for GEM risk appetite that was very robust, and because of the MSCI rebalancing next year that will increase the weight of China in MSCI GEM index to 37% from current 28% (http://midlincoln.com/viewchart.php?v=x573.jpg) while S Korean stocks could be stronger on the back of weaker bonds markets in the country. Markets are usually wrong, hopefully this year it is an exception....