. | |||

Russia’s Unlucky July. This time its Yukos which will cost Russians 2.5% of GDP.

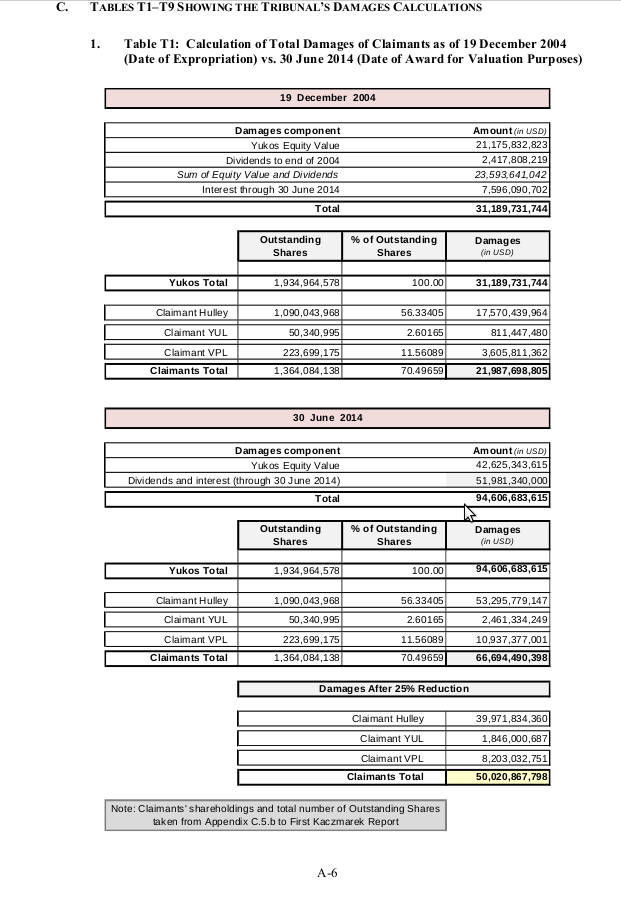

Permanent court of arbitration in Hague issued its final awards in 3 arbitrations between former shareholders of Yukos and the Russian Federation: Hulley Enterprises Limited (Cyprus), Yukos Universal Limited (Isle of Man) and Veteran Petroleum Limited (Cyprus) (“Claimants”). It ruled that Russia Federation had taken measures with the effect equivalent to an expropriation of Claimants’ investments in Yukos and thus had breached Article 13(1) of the Energy Charter Treaty. As a result, the Russian Federation was ordered to pay damages to compensate Claimants. At the same time, the arbitral tribunals found some contributory fault on behalf of Claimants, leading them to reduce the amount of damages awarded.

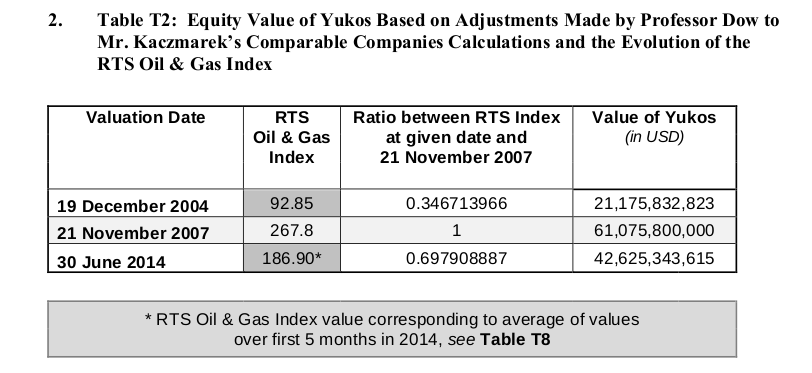

The amount is half less than 100 bn$ of damages that claimants had hoped to get and this is the only one of the positives in the whole thing. Of the awarded sum 39$bn goes to Hulley, 1.8 bn$ goes to Yukos Universal and 8.1$bn to Veteran Petroleum fund

We are not completely sure but it looks as if the ruling was made on July 18, and court was in its final stages sometimes earlier, so the parties involved could have formed their own clues of the court decision, and hence there was pretty strong expectations on the market that Russia had lost. Thats is why market reaction is likely to be limited, though it will takes bites of ruble, the bond yields and stock levels.

The decision is likely to be challenged by Russian Federation as ministry of foreign affairs has already mentioned.

Mikhail Khodorkovsky had alienated himself from claims as he surrendered his ownership in Yukos back in 2005 in favor of his partners.

Unfortunately it looks like nationalisation of Yukos went in favor of Putin’s state oligarchs who were primary beneficiaries of the whole process, While now the taxpayers are supposed to pay the state debt associated with Yukos.

After Hagues court decision, It does look that the whole issue of handling results of privatisation went wrong way.

And it looks that one off windfall profit tax on oligarchs and may be some dilutions towards the state could have been a wiser approach to tackle privatisation results who many think were unjust.

The siloviki faction around the president have suffered quite a blow. They are already cornered due to events unfolding in Ukraine where they have ceded control to separatists and are now basically hostages to the whole situation. Their further reaction could be emotional blasting the west both for Ukraine trouble and for Yukos loss, But it looks like they started from the wrong foot and continue to the wrong tune, and their position in Russia could be further exacerbated as well as the situation as a whole in the country.

Source: http://www.pca-cpa.org/showfile.asp?fil_id=2722

Good luck! And don’t stay out of the market for too long. As the policy of being too cautious is the greatest risk of all.

Ovanes Oganisyan