Midlincoln Aggregates for funds

for week ending last Friday (inclusive)

| Focus | Objective | Asset Class | Flow USD mn | |

| Commodities | INDUSTRIAL METALS | Commodity | 0.03 | |

| Commodities | PRECIOUS METAL SECTOR | Equity | -2.30 | |

| Commodities | PRECIOUS METALS | Commodity | 5.91 | |

| country | BRAZIL | Equity | -16.17 | |

| country | CHINA | 0 | 0.90 | |

| country | CHINA | Equity | 51.83 | |

| country | CHINA | Fixed Income | -3.72 | |

| country | INDIA | Equity | 0.00 | |

| country | JAPAN | Equity | -2335.31 | |

| country | RUSSIA | Equity | -10.86 | |

| country | SPAIN | Equity | -7.81 | |

| country | UNITED KINGDOM | Equity | -14.05 | |

| industry | BASIC MATERIALS SECTOR | Equity | 17.78 | |

| industry | COMMUNICATIONS SECTOR | Equity | 0.00 | |

| industry | ENERGY SECTOR | Equity | 19.86 | |

| industry | HEALTH CARE SECTOR | Equity | 25.85 | |

| industry | INDUSTRIAL SECTOR | Equity | 0.22 | |

| industry | NATURAL RESOURCES SECTOR | Equity | -0.74 | |

| industry | REAL ESTATE SECTOR | Equity | 13.61 | |

| industry | TECHNOLOGY SECTOR | 0 | -0.91 | |

| industry | TECHNOLOGY SECTOR | Equity | 9.09 | |

| industry | UTILITIES SECTOR | Equity | 21.53 | |

| region | AFRICAN REGION | Equity | -0.31 | |

| region | ASIAN PACIFIC REGION | Equity | -1.08 | |

| region | ASIAN PACIFIC REGION EX JAPAN | Equity | -0.51 | |

| region | EASTERN EUROPEAN REGION | 0 | 0.00 | |

| region | EASTERN EUROPEAN REGION | Equity | 0.19 | |

| region | EUROPEAN REGION | Equity | -154.66 | |

| region | EUROPEAN REGION | Fixed Income | 23.33 | |

| region | LATIN AMERICAN REGION | 0 | 0.00 | |

| region | LATIN AMERICAN REGION | Equity | -0.08 | |

| region | NORTH AMERICAN REGION | Equity | 27.92 | |

| region | NORTH AMERICAN REGION | Fixed Income | -0.01 | |

| Risk | GOVERNMENT BOND | Fixed Income | 37.14 | |

| Risk | INFLATION PROTECTED | Fixed Income | 144.45 | |

| Risk | LONG SHORT | Alternative | -16.44 | |

| Risk | LONG SHORT | Equity | -17.76 | |

| Sector | AGRICULTURE | Commodity | -0.10 | |

| Sector | CONSUMER DISCRETIONARY | Equity | -0.29 | |

| Sector | CONSUMER STAPLES | Equity | 7.86 | |

| segment | BRIC | Equity | -0.05 | |

| segment | DEVELOPED MARKETS | Equity | -1.37 | |

| segment | EMERGING MARKETS | Equity | 25.72 | |

| segment | MENA | Equity | -1.82 | |

| segment | MENA | Fixed Income | -3.92 | |

| Size | LARGE-CAP | Equity | 1672.00 | |

| Size | MID-CAP | Equity | -16.05 | |

| Size | SMALL-CAP | Equity | 44.63 |

Source: Midlincoln Research

Fund Aggregates

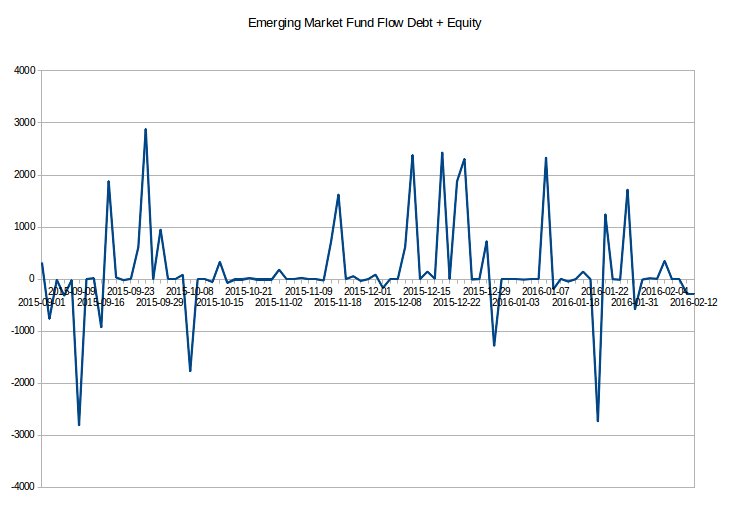

Chart: Emerging Markets Funds - Outflows Less

Emerging Markets Total Fund FLows still in negative zone, but equities show small inflow.

Source:

Emerging markets fund flow showed 25.7 USD mn of inflow. While Frontier Markets funds showed USD mn of inflows.

BRAZIL Equity funds showed -16.2 USD mn of outflow.

CHINA 0 funds showed 0.9 USD mn of inflow.

CHINA Equity funds showed 51.8 USD mn of inflow.

CHINA Fixed Income funds showed -3.7 USD mn of outflow.

INDIA Equity funds showed 0.0 USD mn of inflow.

RUSSIA Equity funds showed -10.9 USD mn of outflow.

COMMUNICATIONS SECTOR Equity funds showed 0.0 USD mn of inflow.

ENERGY SECTOR Equity funds showed 19.9 USD mn of inflow.

REAL ESTATE SECTOR Equity funds showed 13.6 USD mn of inflow.

TECHNOLOGY SECTOR 0 funds showed -0.9 USD mn of outflow.

TECHNOLOGY SECTOR Equity funds showed 9.1 USD mn of inflow.

UTILITIES SECTOR Equity funds showed 21.5 USD mn of inflow.

LONG SHORT Alternative funds showed -16.4 USD mn of outflow.

LONG SHORT Equity funds showed -17.8 USD mn of outflow.

It is worth noting that MidLincoln data shows flow dynamics for last week ending last Friday where as EPFR data reports data only to last Wednesday, which makes ML data far more relevant

Top 5 fund winners and Top 5 losers by country by inflow

Russia Inflows

| assclass | profile | flow USD mln$ | |

| Equity | Direxion Daily Russia Bear 3x Shares is an | 4.04 | |

| Equity | LYXOR ETF RUSSIA Dow Jones Russia GDR - D | 0.88 | |

| Equity | World Investment Opportunities Funds - | 0.00 | |

| Equity | db x-trackers MSCI Russia Capped Index UCITS | 0.00 | |

| Equity | Direxion Daily Russia Bull 3x Shares is an | -15.77 |

Russia Outflows

| assclass | profile | flow USD mln$ | |

| Equity | Direxion Daily Russia Bull 3x Shares is an | -15.77 | |

| Equity | World Investment Opportunities Funds - | 0.00 | |

| Equity | db x-trackers MSCI Russia Capped Index UCITS | 0.00 | |

| Equity | LYXOR ETF RUSSIA Dow Jones Russia GDR - D | 0.88 | |

| Equity | Direxion Daily Russia Bear 3x Shares is an | 4.04 |

Source: MidLincoln Research

China Inflows

| assclass | profile | flow USD mln$ | |

| Equity | Hang Seng Investment Index Funds Series - | 38.18 | |

| Equity | Fubon SSE 180 Index ETF is an exchange-traded | 5.74 | |

| Equity | Fuh Hwa CSI 300 A Shares ETF is an exchange-traded | 4.66 | |

| Equity | Yuanta/P-shares SSE50 Securities Investment | 3.73 | |

| Equity | KB China Mainland A Shares Securities Feeder | 2.68 |

China Outflows

| assclass | profile | flow USD mln$ | |

| Equity | W.I.S.E. Yuanta/P-shares CSI 300 ETF is an | -4.01 | |

| Fixed Income | Deutsche Invest I China Bonds is an open-end | -1.27 | |

| Fixed Income | Deutsche Invest I China Bonds is an open-end | -1.27 | |

| Fixed Income | Deutsche Invest I China Bonds is an open-end | -1.19 | |

| Equity | KB China Mainland A Share Leverage Securities | -0.79 |

Source: MidLincoln Research

South Africa Inflows

South Africa Outflows

Source: MidLincoln Research

Korea Inflows

Korea Outflows

Source: MidLincoln Research

India Inflows

| assclass | profile | flow USD mln$ | |

| Equity | KB India Securities Investment Trust (Equity) | 0.05 | |

| Equity | KB India Securities Master Investment Trust | 0.02 | |

| Equity | KB India Representative Growth Securities | 0.00 | |

| Equity | The iShares MSCI India Small-Cap ETF is an | -0.06 |

India Outflows

| assclass | profile | flow USD mln$ | |

| Equity | The iShares MSCI India Small-Cap ETF is an | -0.06 | |

| Equity | KB India Representative Growth Securities | 0.00 | |

| Equity | KB India Securities Master Investment Trust | 0.02 | |

| Equity | KB India Securities Investment Trust (Equity) | 0.05 |

Source: MidLincoln Research

Turkey Inflows

Turkey Outflows

Source: MidLincoln Research

Brazil Inflows

| assclass | profile | flow USD mln$ | |

| Equity | KB Brazil Securities Feeder Investment | 0.15 | |

| Equity | KB Brazil Securities Master Investment | 0.07 | |

| Equity | NEXT FUNDS Ibovespa Linked Exchange Traded | 0.00 | |

| Equity | iShares MSCI Brazil UCITS ETF (Dist) is an | -16.40 |

Brazil Outflows

| assclass | profile | flow USD mln$ | |

| Equity | iShares MSCI Brazil UCITS ETF (Dist) is an | -16.40 | |

| Equity | NEXT FUNDS Ibovespa Linked Exchange Traded | 0.00 | |

| Equity | KB Brazil Securities Master Investment | 0.07 | |

| Equity | KB Brazil Securities Feeder Investment | 0.15 |

Source: MidLincoln Research

Australia Inflows

Australia Outflows

Source: MidLincoln Research

Canada Inflows

Canada Outflows

Source: MidLincoln Research

Good luck! And don’t stay out of the market for too long. As the policy of being too cautious is the greatest risk of all.

Ovanes Oganisyan